akinbostanci/iStock via Getty Images

Investment Thesis

Since our last article on Upstart Holdings, Inc. (NASDAQ:UPST), the company had further declined by -25.55%, from $139.38 on 18 February 2022 to $103.77 on 25 March 2022. We think it could be partly attributed to the Feds raising the benchmark interest rates for the first time ever since 2018, due to inflation. In addition, the ongoing Ukraine war had many investors selling off bonds, pushing Treasury yields beyond their 10-year highs. Consecutively, it led many notable companies, such as Tesla (TSLA), Affirm (AFRM), and World Omni Financial, an auto-financing company, to postpone their planned bond sales indefinitely.

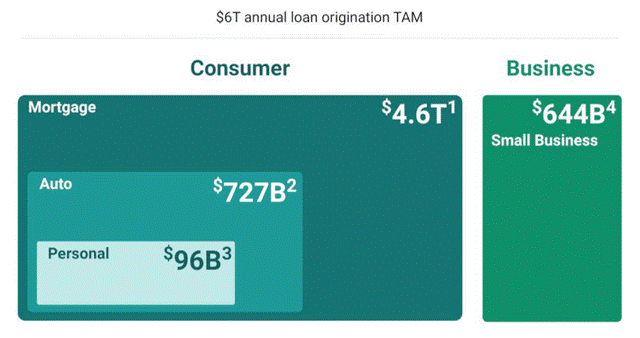

Nonetheless, in our opinion, the volatile market condition only created an even more attractive entry point for potential UPST investors, given its massive potential in the AI lending industry and Total Addressable Market (TAM) in Small Businesses and Mortgage financing.

In the meantime, we encourage you to read our previous article on UPST, which would help you better understand its position and market opportunities in the AI financing segment.

Auto Lending Will Juice UPST’s Recovery

UPST Total Addressable Market Size (Seeking Alpha)

UPST’s auto-financing dreams were announced in 2020 and further solidified with the acquisition of Prodigy Software in 2021, a leader in e-commerce platforms for car dealerships. It was the natural progression for UPST, given how it had penetrated the personal loans segment and aimed to grow its TAM to $6T annual loans, including the auto, mortgage, and small businesses segments.

Given that Prodigy also provided a direct linkage to car dealerships nationwide, UPST was able to directly monetize the multi-channel auto purchase experience for online and in-store auto shopping. Combined with UPST’s AI lending software and Prodigy’s auto credit application for final checkout transactions, we expect robust adoption ahead, given that over 61% of Americans prefer to buy from auto dealerships.

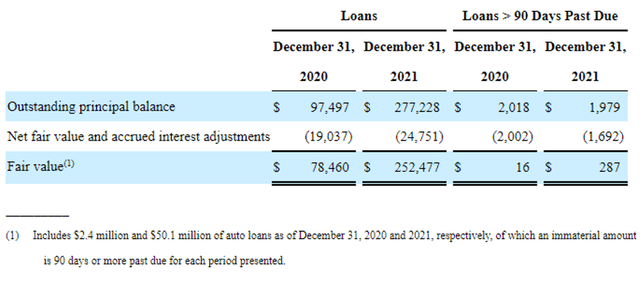

UPST Loan Value As Of FQ4’21 (Seeking Alpha)

As of FQ4’21, UPST’s existing auto loans are at $50.1M, accounting for 19.8% of its total loans. Seeing that UPST guided for a $1.5B loan for the new auto segment in FY2022, it is evident that the company expected exponential growth in loan value and consecutively, revenue moving forward. It is also important to note that UPST achieved these loans’ value prior to the release of its Upstart Auto Retail mobile platform on 9 March 2022. Given that two-thirds of UPST’s traffic originated from mobile devices, we expect the enhanced user experience to potentially drive the adoption of its AI-based lending moving forward. Michia Rohrssen, GM of Upstart Auto Retail, said:

Buying a new car is not always a linear process, so we designed the new, mobile-first, online platform not only to adapt to the mobile usage of customers, but also to give the dealer more options to customize for each type of shopper and the pace of purchase. (UPST)

In addition, UPST recently announced on 10 March 2022, that Volkswagen (OTCPK:VWAGY) has also chosen to adopt its Upstart Auto Retail software, building upon its existing partnership with other automakers such as Toyota, Lexus, Subaru, Mitsubishi, and Kia. It is important to note that Volkswagen is the largest carmaker in Europe with a decent market share of 2.4% in the US. Given that Volkswagen reported revenues of $51.5B in FY2021 for its North America segment, we expect many of Volkswagen’s future transactions to also include UPST’s AI-lending services moving forward.

Assuming an international expansion in the future, UPST could be looking at a massive auto market globally as well, with Volkswagen reporting revenues of $253.2B from its passenger cars, light commercial, and commercial vehicles segments in FY2021. Michia Rohrssen, GM of Upstart Auto Retail, said:

Online shopping and purchase behaviors have redefined the consumer experience so much that it’s now become an expectation across other industries, including auto. There’s a huge appetite on both sides-consumers wanting to browse, shop, and build deals online at their own pace, and manufacturers and dealers eager to embrace and extend their digital retail solutions. Volkswagen has consistently been at the forefront of innovation, and we are excited to power their digital retail expansion and initiatives now and in the future. (UPST)

In addition, UPST reported that many US franchise dealers selling other auto brands, such as Ford, Honda, and BMW, have also partnered with UPST for its auto-financing program. Almost $4B worth of vehicles is also transacted through the UPST’s AI-lending platform in 2021. As a result, it is evident that UPST’s AI-lending software is helping many Americans to own their dream cars through affordable and fuss-free financing.

Furthermore, UPST announced its partnership with Subaru on 21 March 2022, for the latter’s new “Build and Price” category. Given the current semiconductor shortage surrounding global supply chain issues, the new program will allow Subaru’s consumers to custom build and order their vehicles a year in advance, while also utilizing UPST’s AI-powered digital platform.

As a result, there is massive potential for UPST’s automotive AI-lending segment, given its closely-knit relationship with auto dealerships nationwide and multiple partnerships with market-leading automakers. Given that these two partnerships were announced in March, we expect to see the positive impacts only from FQ2’22 onwards. Nonetheless, given the YoY declining auto sales from the COVID-19 highs, we may expect a certain moderation for UPST’s revenue in the automotive segment in FQ1’22. In addition, given that both Russia and Ukraine are the main suppliers of the key materials for the manufacturing of semiconductor chips, we expect the volume of auto sales to be somewhat affected, at least for the next few months.

So, Is UPST Stock A Buy, Sell, or Hold?

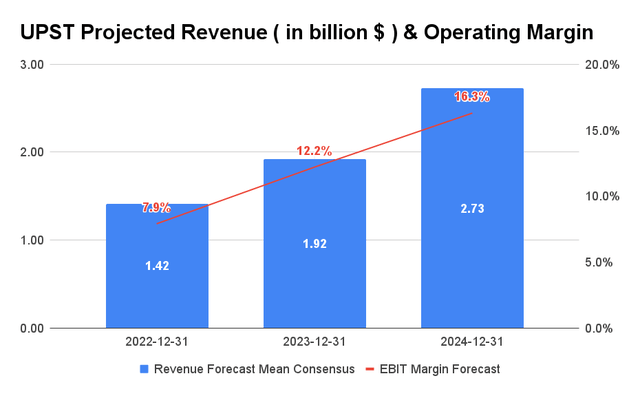

UPST Projected Revenue and Operating Margin (S&P Capital IQ)

Since our last article, the consensus has revised their estimates upwards by 2.1%, with UPST expected to report revenues of $1.42B in FY2022. It represents a potential increase of 77.2% YoY. In addition, UPST is expected to report revenue growth at a CAGR of 50.49% over the next two years. Despite the apparent deceleration of revenue growth compared to the historical CAGR of 98.92% over the past four years, the company is expected to report excellent growth in operating margins from 7.89% in FY2022 to 16.3% in FY2024, directly translating to steady increases in net income moving forward.

UPST is currently trading at an EV/NTM Revenue of 6.03x, lower than its 3Y mean of 15.53x. UPST’s massive TAM in auto and in future, small businesses, and mortgage financing also make its stock attractive, given its current undervaluation. As a result, we encourage interested investors to chance upon this dip to load up more.

Therefore, we will still rate UPST stock as a Buy.

Be the first to comment