Sundry Photography/iStock Editorial via Getty Images

Cloudflare (NYSE:NET) is uniquely positioned to benefit from the catalyzed growth in the zero trust security market, enhanced through its recent partnership with cyber security firm CrowdStrike (CRWD). Although NET is not yet profitable, it is still a buy as it has significant potential to boost its revenues as more corporations and government agencies adapt to this new security standard. NET will also have additional potential revenue streams available to it when the company makes the shift towards workers on its product development roadmap.

Industry analysis

As a quick primer on zero trust security, the Biden administration issued the executive order 14028 that mandates federal agencies adhere to NIST 800-207 security standards. This means that all agencies must adhere to the following principles: continuous verification, limit the “blast radius,” and automate context collection and response. More importantly, these principles have become the de facto standard for NET’s retail and corporate customers as they represent the best-in-class security for zero trust environments.

The adoption of zero trust security is currently being catalyzed from several strong forces. Cyber attacks, particularly ransomware attacks directed towards government agencies and corporations, are on the rise. According to a report by SonicWall, ransomware attacks have increased 151% since 2020, which affected 37% of all industries. Ransomware is a two-part problem involving code execution and identity compromise. In a zero trust environment, the attack surface is much smaller as less identities are discoverable on the internet. Zero trust environments also inspect all traffic moving throughout its network, which makes malicious code execution considerably more difficult for cyber criminals.

The uncertainty of future COVID waves and future variants are another catalyst forcing the adoption of zero trust environments. More employees than ever are working from home in potentially unsecure environments on unmanaged devices, and working from home appears to becoming a permanent shift, which will further spur appropriate security measures.

Then there’s also the issue of transitioning towards zero trust security, which can also be considered a catalyst for companies like Cloudflare to make transitioning fast and flexible. 76% of companies are struggling to change to this model due to complex user access needs according to a study released by Forrester Consulting. Of course, often when there are problems to be fixed there are also opportunities, and I feel Cloudflare’s suite of zero trust products which I’ll touch on later help bridge this gap for its potential clients.

The zero trust market is also growing fast. According to Grand View Research Inc, the zero trust security market will grow at a CAGR of 15.2%, reaching 59.43 billion by 2028. The report states that the most amount of growth will come from SMEs due to the heightened awareness of cyber attacks.

With these catalysts considered, it’s likely that zero trust security will only become more important as time goes on, and NET has the right product mix and competitiveness to take advantage of them.

Cloudflare’s Zero Trust Solutions

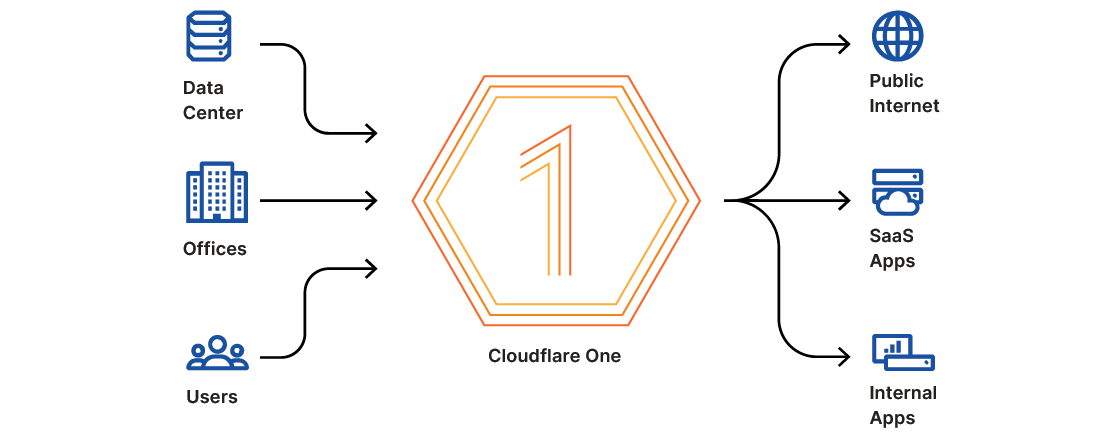

Two of NET’s services include Zero Trust Network Access (ZTNA) and Cloudflare One. ZTNA was recently integrated into Cloudflare’s suite of products to enable information sharing to bolster the security of each of the company’s respective networks.

Cloudflare One helps businesses shift from the “castle and moat” security model where insiders are automatically trusted, to one that verifies all activity on the network. A large reason for why the castle and moat models fail to secure networks is that there are an increasing number of workloads that run outside of the organization’s perimeter, such as cloud and SaaS applications.

Cloudflare Blog

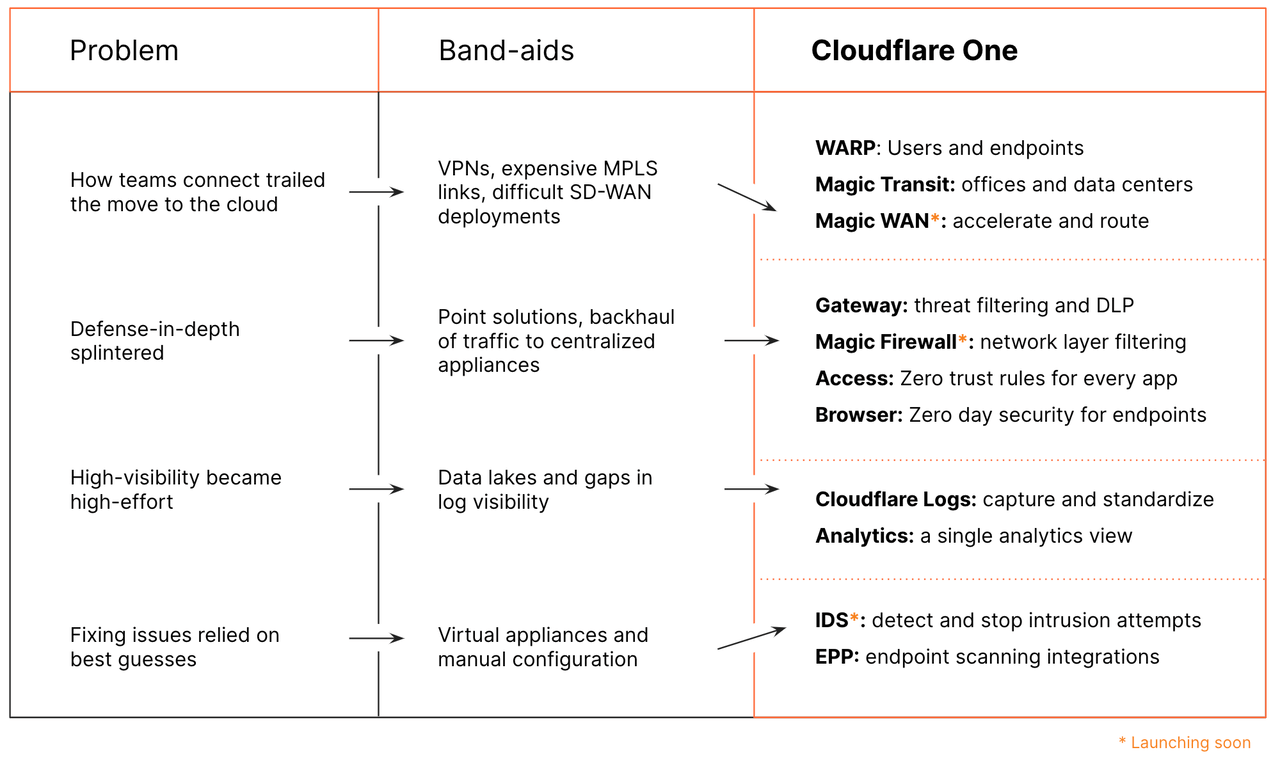

Crucially, Cloudflare One also aims to be an inclusive solution that can replace many commonly-used solutions to bolster access control and security. It replaces products like VPNs, virtual appliances, and point solutions. Companies can therefore get a comprehensive stack of products from one provider instead of relying on different vendors.

Cloudflare Blog

ZTNA is another product that takes advantage of the zero trust trend in relation to securing a company’s network perimeter. It is deployed as zero trust-as-a-service and quickly allows firms to authenticate employees and third party users. Other key features include the ability to lock down sensitive infrastructure such as web apps and SSH access and can effectively replace the function of VPNs for limiting access to privileged data.

Cloudflare Blog

In closing, due to the rising risks of cybercrime and the remote working habits forming for a lot of companies, I feel that zero trust security will become a standard in the security industry similar to some newly-adopted standards such as forcing strong passwords and 2FA, thus leading to an enormous scope for future growth.

Financials

In the Q4 2021 earnings call, Cloudflare CEO Matthew Prince stated that zero trust security is the area the company is focused on and is experiencing the most amount of growth from, naming it the second stage of growth of the company as it pivots its focus towards providing services towards larger commercial enterprises. Another detail in the earnings call was that the company was onboarding a greater number of companies paying between $500,000 and $1 million per year, with a 70% and 75% year-over-year increase respectively. In my view, larger businesses are the ideal prospects for selling NET’s widening array of zero trust security products due to their larger deal sizes and strong recurring revenues, so this is a good sign for the company to help it achieve its goal of breakeven profitability.

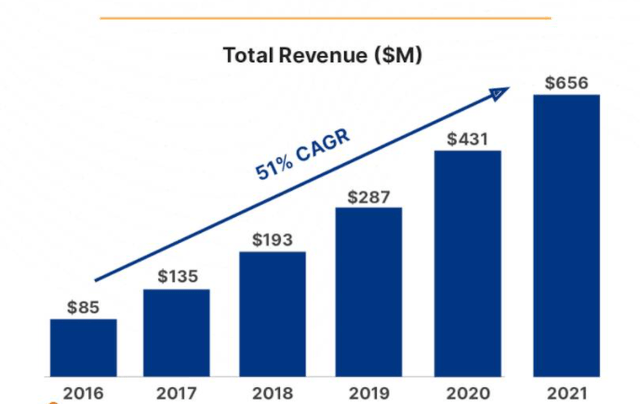

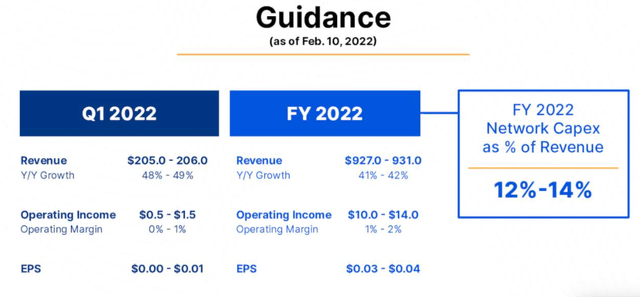

Despite widening EBITDA losses for the four last consecutive financial years, NET is showing some promising signs that it will soon enter into breakeven territory to provide investors with a positive EPS. If the company’s guidance for this year is accurate, it could happen as soon as later this year. Some promising signs include NET increasing its revenues since 2016 with a CAGR of 51%.

Cloudflare Earnings Call Q4 2021 Slides

NET also has a healthy cash and short-term investment balance sheet to help buy the company some runway in its pursuit of profitability. Cash and short-term investments grew 76.36% between 2020 to 2021 and 296.46% from 2018 to 2019.

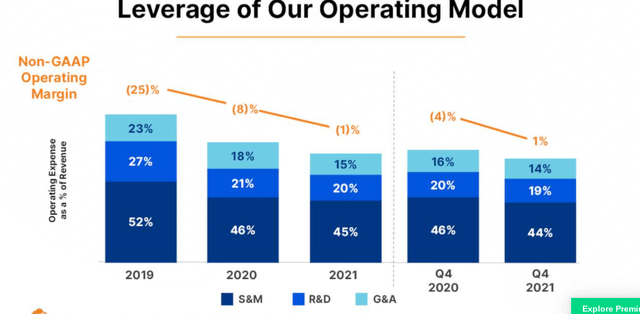

Another positive sign comes in the form of the NET becoming more efficient and reducing its expenses over the last three financial years. The company managed to reduce S&M, R&D, and G&A expenses from 2019 to 2021 as it leans up its company operations.

Cloudflare Q4 2021 Earnings Call Slide

Finally, NET released a guidance in the Q4 earnings call showing a projected EPS of $0.03 to $0.04 and a significantly increased operating income and revenue. Even if these numbers are optimistic at best, I think it’s safe to say that NET will soon enter profitable territory if that’s near the end of 2022 or somewhere between now and 2025. The company has built up a large amount of momentum in growing revenue from companies spending $500,000 or more and this is not yet showing trends of slowing down. Also, its zero trust security products are currently leading the charge and I believe this is something that’s only going to become necessary for large corporations to adapt to in the future judging by the amount of growth in the industry.

Cloudflare Q4 2021 Earnings Call Slide

Competitive Analysis

In this section I’ll cover how NET’s zero trust product suite compares to its competitors and what differentiators the company has to help it secure market share.

One stated advantage Cloudflare has over other vendors is the sheer number of applications it can support. These include network, zero trust, and application services that companies around the world depend on. Since the majority of applications can run on one network, these can be controlled through a centralized control panel to help speed up deployment and makes the maintenance and access control of these assets easier.

Cloudflare Blog

As a broader whole, NET also has several competitive advantages that allow it to stand out from its competitors. One way it does this is through shared intelligence, which helps to identify cybersecurity threats before they can cause damage to clients on its network. NET also powers one of the fastest networks on the planet and claims to be able to reach 95% of the world’s population in under 50 ms.

Cloudflare Q4 2021 Earnings Call Slide

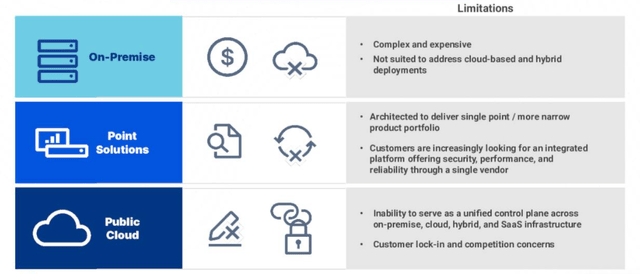

NET also stacks up comparatively well when looking at the alternatives customers have when looking for a cloud-based solution and sometimes comes as a logical choice. According to the below table supplied by NET, on-premise solutions for instance comes with the risk of being replaced by cloud and hybrid solutions as companies move to virtual solutions thanks to COVID-19, while public clouds lack the ability to create zero trust environments and don’t have a universal control panel to easily manage access control and other features that makes NET competitive.

Cloudflare Q4 2021 Earnings Call Slide

Valuation

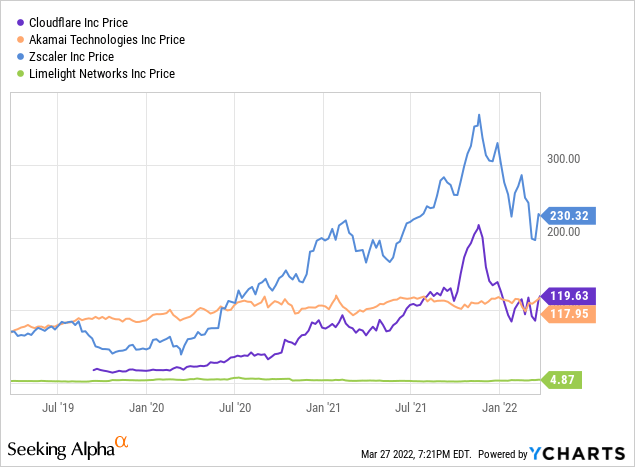

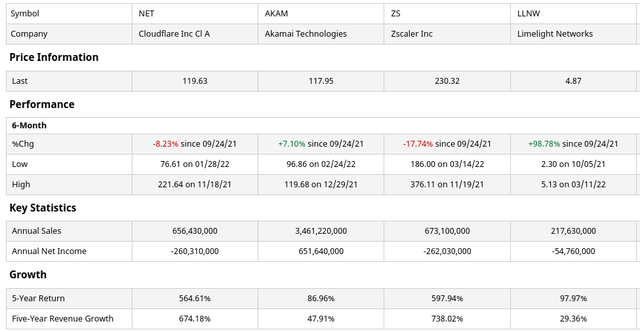

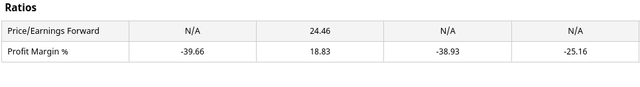

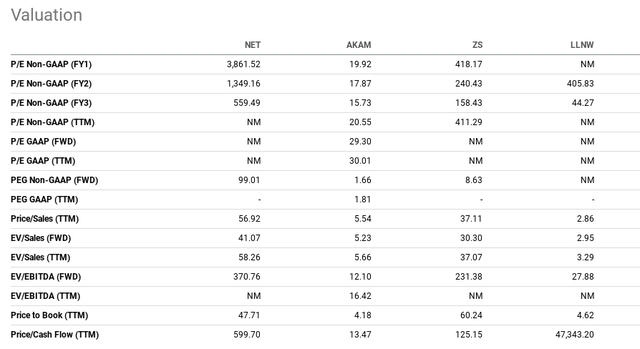

In this section I’ll talk about the contentious issue of NET’s valuation, which I’ll use a handful of its peer companies to create a comps benchmark. The companies I used in this comparison include Akamai Technologies (AKAM), Zscaler Inc (ZS), and Limelight Networks Inc (LLNW).

There is no denying that NET is expensive, as it currently trades at a forward EV/EBITDA of 370.76. This is considerably more than what I consider to be one its main competitors in the zero trust space, ZS, that trades at 231.38 EV/EBITDA. I think it’s important to keep in mind that NET continues to grow its revenues YoY and in my opinion has a long way to go before the company reaches a saturation point where it cannot grow any larger. For these reasons I am not concerned about the company’s expensive valuation as it has avenues available to it for growing its revenues further such as landing more enterprise clients and continuing to roll out new products.

When comparing NET’s price with others it’s clear to see that NET is not the most expensive company on a per-share basis. Zscaler came out as the most expensive company when comparing each firm’s share price side by side, and was also apparently hit by the sector rotation out of technology stocks along with NET.

Digging a little deeper into the financials of the companies reveals that the only profitable company is AKAM, while the rest have a negative net income. ZS is also struggling with the same problems that NET has in terms of a strong growing revenue stream while also having a negative profit margin.

Barchart.com Comparison Barchart.com Comparison

So while NET is certainly struggling to turn a profit, this appears to be the norm for companies in this space by examining its peers. Keep in mind also that NET has qualitative advantages (such as its brand) and strategic advantages that I covered earlier that I believe will catalyze its future growth prospects further.

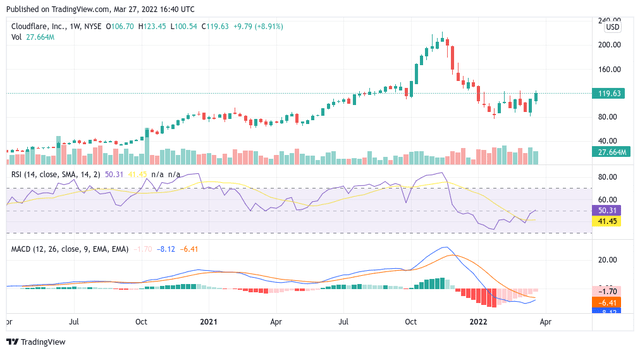

Lastly, let’s talk about the timing for this investment, which we can use technical analysis for. On the weekly charts, NET has recovered from its recent sell-off and its momentum has begun to swing in the positive direction. Both the RSI and the MACD are showing that it’s headed to the upside, but it is more apparent to see this on the MACD and histogram where there is close to being a crossover between the two moving averages. Volume has also picked up over the last few weeks, which helps gives conviction to these price and momentum movements. For these reasons I’m confident that an entry into NET will reap rewards later, especially considering that the company is nicely positioned to turn cashflow positive with higher revenues in the not so distant future.

Risks

There are several risks of investing in NET from my point of view. The first is that the company has a limited runway for reaching profitability. Although the company has a healthy cash balance, if management is not prudent they could burn through the firm’s cash account before ever reaching its ultimate goal. The other risk is that the longer the company takes to attain this goal more impatient its investors become, which could see the stock price of NET moving to lower levels.

The second risk is that intense amount of competition and rivalry the company faces in the marketplace which may work to erode market share and drive down profits. NET suffers from the fact that there are many alternatives customers have when choosing a cloud, zero trust, and security product to meet their needs with a low amount of differentiation between vendors.

The last risk is that the market could consider NET overvalued from its current standings. With a negative net income, NET has a long road ahead of it to justify its current price per share, which will need to come in the form of significantly increased revenues and reduced expenses.

Conclusion

Although there is significant uncertainty around NET that may dissuade investors with less tolerance, the company has strong fundamentals in terms of revenue growth, a recognizable brand, and attractive projects in the pipeline to help bolster its competitive and financial positions. Zero trust security is looking to be a de facto security practice used by both corporations and SMEs due to the rising risks of cyber attacks and the proclivities of workers doing business from home due to COVID. For these reasons, I anticipate that zero trust security to be a major tailwind to help the company reach and maintain profitability. Therefore, I am going long on NET and may accumulate more in the future.

Be the first to comment