Smederevac/iStock via Getty Images

Investment Thesis

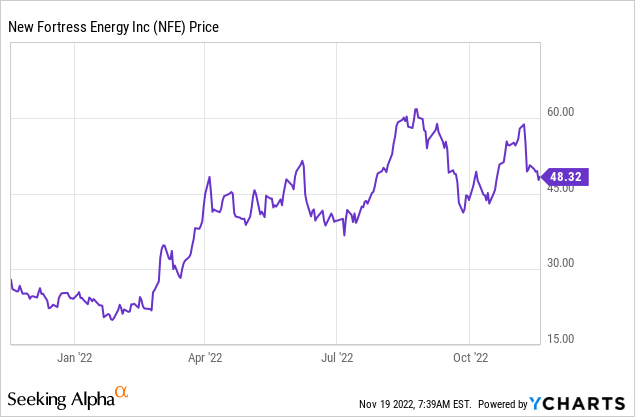

New Fortress Energy Inc. (NASDAQ:NFE) is a gas-to-power infrastructure corporation that serves global end-users. It runs a storage and re-gasification facility for LNG. The company has performed incredibly well, outpacing the industry by a factor of more than 90% and achieving a share price increase of 73.07%, culminating in an upward trajectory over the past year.

The company’s revenue has increased by more than 200% year-over-year and more than 154% on a compound annual growth rate basis over the past three years, mirroring the surge witnessed in the share price. New Fortress Energy has also strengthened its balance sheet by decreasing its debt and raising its liquidity MRQ.

This outstanding achievement is solely attributable to the lucrative FLNG industry, characterized by high demand, limited supply, and high prices. I am both short- and long-term optimistic about the company, as the market is expected to be profitable for the next 20 years.

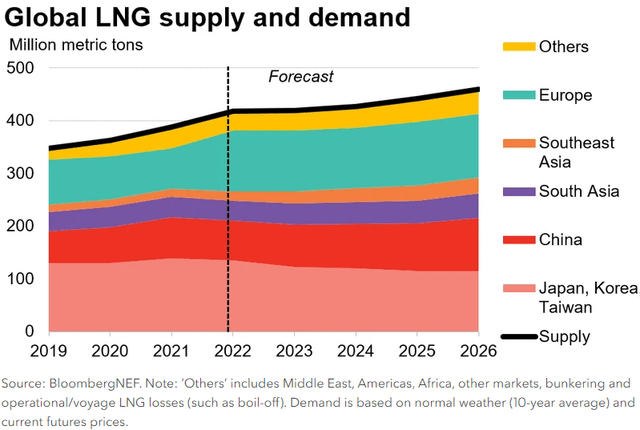

Global LNG Outlook

As a result of Europe’s efforts to lessen its reliance on Russian gas, the global LNG market is predicted to be tight in 2022–2026. Since the European market is willing to pay a higher price for flexible LNG than China and emerging Asia, this will slow gas demand growth in those regions. In the next five years, supply is forecast to be low; therefore, prices will likely stay above long-term norms in 2017–19, before the advent of Covid-19.

With the start of new supply projects, especially in the U.S., the global supply is expected to rise by 19% from 2021 to 460 million tons. Between 2021 and 2026, LNG supply is likely to limit demand growth, which is expected to be 18%. However, imports into Europe are expected to go up during this time.

LNG producers may expand flexible supply and spot volume in anticipation of high pricing. Investments in liquefaction plants may accelerate, but most won’t add supply before 2026 due to construction lead times. LNG projects with shorter start-up times could boost supply, while delays and penalties could restrict it.

NFE Leverages Industry Outlook

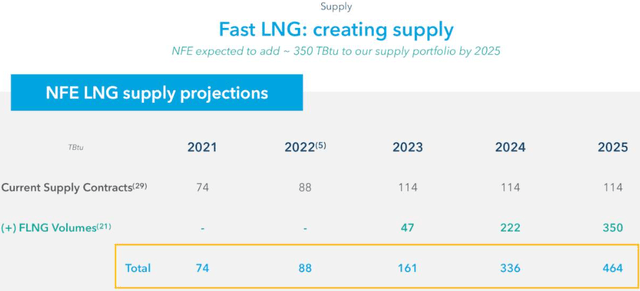

Following the long-term optimistic view for the LNG business, NFE is making every effort to seize the opportunity. The company is raising output by expanding production and signing new contracts to guarantee a steady product stream. I’ll detail the firm’s initiatives to capitalize on the current supply shortage.

First off, the amount of natural gas covered by existing contracts at NFE increased from 74 TBtu in 2020 to 88 TBTu in 2021, 114 TBTu in 2022, and 114 TBTu in 2023–2025. The addition of FLNG volumes gives them an extra 350 TbTu or about seven metric tons per year.

Second, NFE has made significant headway in deployment choices, including acquiring permissions for its numerous locations. For instance, they legally committed to stationing up to three troops in the Altamira region. The Sur de Tuxpan pipeline would bring feed gas molecules from the United States into Mexican waters, enabling the two countries to implement the deal. In addition, they applied for a MARAD permit to build two FLNG assets at the West Delta 38 location. To do so, they would reverse the gas flow from the onshore to their offshore unit, reusing the already-built pipelines.

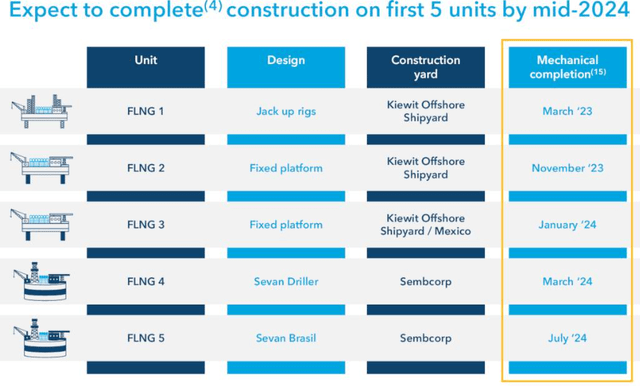

Finally, the company has built more additional units to increase production levels to make the most of the robust demand amidst limited supply. The first five units are expected to be finished by mid-2024, two years earlier than the anticipated time for almost balanced supplies. The company will gain significantly from being ahead of the curve.

An Improved Balance sheet: Sustainable Development

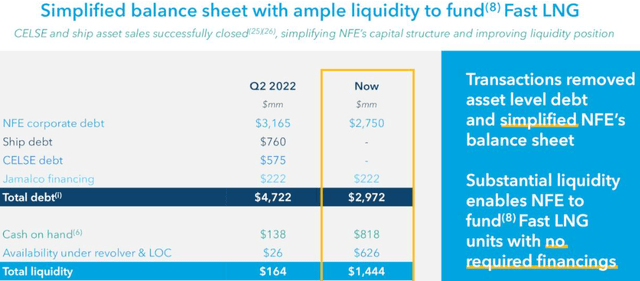

The Q3 conference call transcript highlighted several key points, including the company’s strengthened balance sheet. As of the end of Q3, the company has paid down its debt by $1.75 billion from $4.72 billion at the end of Q2. The current balance is 0.29X its market cap of $9.95B, indicating the company’s deleveraging effectiveness.

Alongside the company’s deleveraging initiative was its improved liquidity from a cash balance of 0.16B in Q2 to a cash balance of $1.44B in Q3. The current balance is 9X the previous one, a clear testimony of how the company’s liquidity improved in the MRQ.

With this strong liquidity, its developments can easily be funded without further financing. The company’s ability to improve its liquidity in the future can be backed up by improving cash flows from operations from $84.8M in Q2 to $315.6M in Q3.

During the Q3 conference call, NFE management mentioned the options it’s considering to use its liquidity for, which I find very beneficial to investors.

“So a significant amount of liquidity, and the question is then what do you do with that? The three obvious choices are in the box down below. So number one, you can obviously make additional investments. Number two, you can return capital to shareholders, either by deleveraging the company and then issue dividends, deleveraging the company and buying back stock or some combination of all of those things.

Considering the foregoing alternatives, it is clear that management is dedicated to its shareholders, which should encourage new investors to join the bandwagon.

The Top and Bottom Lines

NFE’s revenue and profit have remained highly appealing in the wake of a booming LNG market. The company has a 3-year CAGR of 154% and a YoY revenue growth of more than 200%.

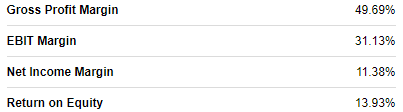

Seeking Alpha

The company has what I would consider excellent profit margins, with a gross profit margin of 49.69%, an EBIT margin of 31.13%, a net income margin of 11.38%, and a return on equity margin of 13.93%. High-profit margins, I believe, are due to an increase in revenue courtesy of the lucrative LNG sector.

Seeking Alpha

Additionally, the profit margins are not only appealing but also growing. NFE’s EBITDA margin increased from $8.14B in 2021 to $12.50B in 2021, much exceeding the company’s projection of $2.5B. Given the company’s momentum, I anticipate that these margins will continue to expand across the board as the company moves farther along the path to profitability.

Although the company’s profit margins are very healthy, it needs to improve on its efficiency, given its low asset turnover ratio of 0.35% compared to the industry median of 0.63%. Concerned shareholders need not worry too much about the company’s -30.85% levered FCF margin compared to the industry median of 6.47%. This disparity is likely due to a significant outflow used to pay down debt. Given the rising revenues and better operating cash flow, I expect this margin to expand over time.

Conclusion

New Fortress Energy Inc. has had a fantastic year, as seen by its high-profit margins, rapidly expanding sales [up more than 200% year-over-year], and rising share price [up more than 73%]. The MRQ’s strengthened balance sheet bodes well for the organization’s long-term health. I am optimistic about New Fortress Energy Inc. and give it a strong buy rating because of the bright future of the FLNG gas market and the steps the company is taking to cash in on that trend.

Be the first to comment