AleksandarGeorgiev/E+ via Getty Images

In this economic environment, many of the companies that I cover that are involved in the packaging space have performed quite well. They have proven successful in passing on much of their costs onto their customers. But unfortunately, not every packaging company is the same. One great example of an exception to this rule can be seen by looking at Ranpak Holdings (NYSE:PACK). This enterprise focuses on providing the paper filling used to fill empty spaces in secondary packages. It also provides cushioning products like crumpled paper that’s turned into cushioning pads with the purpose of trapping air between layers in order to protect objects within boxes from external shocks and vibrations.

The company also creates wrapping systems that are used for protecting fragile items that need to be transported. But what is most interesting to me about the company though are the automation devices that it makes available to e-commerce customers who want to do their own automated packaging. Recently, financial performance achieved by the company has been rather disappointing. Sales, profits, and cash flows are all weakening. The company has also gone from looking rather cheap, it’s looking more or less fairly valued at this time. Normally, this would prompt me to downgrade the enterprise. But given how far shares have fallen, and the long-term outlook of the company, I would make the case that the upside moving forward might very well still be worth it.

Tough times

In early July of this year, I wrote an article that looked at Ranpak Holdings from a bullish perspective. In that article, I talked about the company’s historical financial performance and how impressive that had been. Given how things were going, I felt as though this year would be no exception, even though the company had experienced a rather disappointing first quarter. On top of this, I felt as though shares looked cheap enough that the company was certainly worth consideration by value-oriented investors. As a result of all of these factors, I ended up rating the company a ‘buy’ to reflect my view that it should generate performance that would more or less outperform the broader market moving forward. So far, that call has not proven to be so solid. While the S&P 500 is up by 6.2%, shares of Ranpak Holdings are down 17.1%.

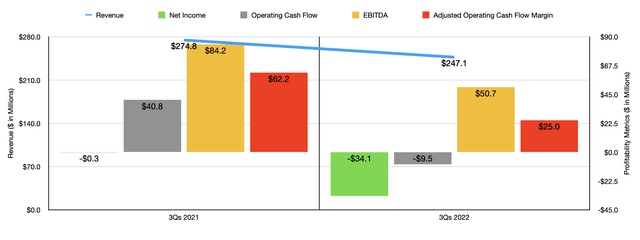

To see why the company is performing this way, we need to only look at financial results covering its 2022 fiscal year so far. For the first nine months of the year as a whole, sales came in at $247.1 million. That’s 10.1% lower than the $274.8 million generated the same time last year. Paper revenue for the company during this time declined by 13.3% while machine lease revenue actually managed to grow by 4%. Other revenue that accounts for only 4.7% of the company’s revenue managed to increase year over year as well, rising by 13.6%. When it comes to these specific types of offerings the company has, the biggest decline from a dollar perspective involved the void-fill machines the company produces. Sales here dropped by 10.9%, falling from $109.3 million to $97.4 million. According to management, the company was negatively impacted by currency headwinds, decreases in cushioning, void filling, and wrapping activities, and more. This, in turn, management attributed to lower economic activity and lower e-commerce use because of the opening up of economies following the pandemic. Inflationary pressures and the impact they ultimately have had on consumer demand have also played a role.

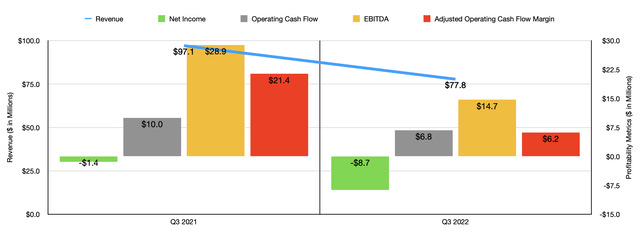

Due to these issues, the company has also seen its net loss grow from $0.3 million to $34.1 million. Operating cash flow went from $40.8 million to negative $9.5 million. Even if we adjust for changes in working capital, that picture would look bad, with the metric plunging from $62.2 million to $25 million. And finally, EBITDA also took a hit, declining from $84.2 million to $50.7 million. The biggest chunk of this pain seems to have come in the third quarter. Sales of $77.8 million are down 19.9% compared to the $97.1 million reported the same time last year. The same key drivers for the nine months as a whole were instrumental in pushing down these results for the company. Though it is worth mentioning that if we were talking about constant currency, the drop in sales would have been a more modest but still painful 12%. Profits have also followed this trajectory. The company went from generating a net loss of $1.4 million to a net loss of $8.7 million this year. Operating cash flow declined from $10 million to $6.8 million, while the adjusted figure for this declined from $21.4 million to $6.2 million. And finally, EBITDA is also down, having fallen from $28.9 million to $14.7 million.

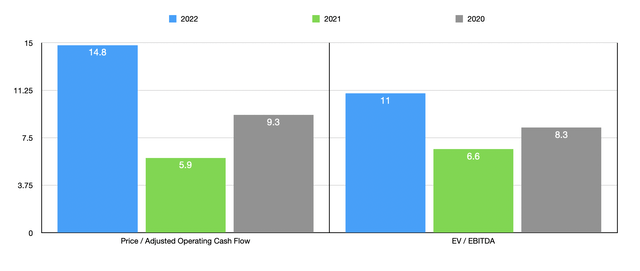

For shareholders, all of this has proven rather painful. And what makes things more complicated is that we don’t really know what to expect moving forward. If we simply annualize results experienced so far, then we should anticipate adjusted operating cash flow of $31.3 million and EBITDA of $70.9 million. This would translate to a forward price to adjusted operating cash flow multiple for the company of 14.8 and a forward EV to EBITDA multiple of 11. These numbers are considerably higher, as you can see from the chart above, than what we would get if we used data from 2020 or 2021. Because of the nature of the enterprise, I don’t believe that there are any really great companies to compare it to. If we just compare it to simple packaging businesses, as shown in the table below, the stock does look more expensive than its peers. But instead of relying on a comparative analysis, investors should ponder about the company’s potential to revert back to the level of profitability experienced prior to this recent downturn. Given the company’s track record for growth, I would make the case that an eventual recovery in the economy will result in stronger demand for its own services. Of course, this could be a rather painful and long road.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Ranpak Holdings | 14.8 | 11.0 |

| Pactiv Evergreen (PTVE) | 6.7 | 5.5 |

| Sonoco Products (SON) | 15.1 | 9.6 |

| Graphic Packaging Holding Company (GPK) | 9.2 | 9.6 |

| Sealed Air Corp. (SEE) | 11.9 | 9.6 |

| Packaging Corporation of America (PKG) | 8.5 | 7.2 |

Takeaway

At this point in time, I understand why some investors may be skittish about Ranpak Holdings and its prospects. Sales are falling and profits and cash flows are falling with it. What’s more, the picture seems to be worsening as time goes on, and it’s likely that this trend will continue so long as economic conditions worsen. For those who want less volatility in their portfolio, now would be an excellent time to consider cashing out. But considering that the company should eventually revert back to the levels of profitability experienced in the past, and considering how cheap shares would look at that point then, I do think it is still a sensible ‘buy’ opportunity for those who don’t mind extreme volatility on the road to success.

Be the first to comment