gorodenkoff/iStock via Getty Images

Investment Thesis

Array Technologies, Inc. (NASDAQ:ARRY) manufactures and supplies solar tracking systems and related products in the United States and internationally. The stock has been on an upward trajectory this year, outperforming the market with a margin of about 50% YTD.

Currently, the stock is trading at $20.95, near its 52-week high of $23.61. I attribute the outstanding performance to the growing demand for green energy in the US and the world. The influence of renewable energies is growing as a result of technical developments. As the global energy demand continues to rise, more and more nations are developing innovative methods of creating and storing renewable energy.

The US government is supporting its green energy sector. Among the things the government has done are Biden’s tariff moratorium and the inflation reduction act of 2022. The two regulations are directly impacting the green energy sector positively. These regulations and the growing demand for green energy support my bullish case on ARRY.

Array

Source: Array

The regulatory environment

There has been long-standing discontent with government regulation from many corners of the economic world. Companies and their representatives frequently criticize government regulations as unreasonable roadblocks to economic growth, productivity, and job creation. Many corporations have used loopholes, transferred operations overseas, and violated antitrust rules to avoid regulations. In essence, the increasing number of laws and the complexity of the tax system have positively and negatively affected American firms. Therefore, the government’s relationship with businesses might take two forms: cooperative and antagonistic. In light of this, I am curious to speculate on where the most recent government regulation may lead American corporations, particularly ARRY.

1. Biden’s Tariff Moratorium

In response to concerns raised by the American solar industry, the Biden administration has revealed its intention to loosen limitations on solar panel imports from Southeast Asia. The United States government announced a 24-month tariff moratorium on solar panels made in Cambodia, Malaysia, Thailand, and Vietnam on June 6. The suspension is in response to complaints from the US solar industry about the consequences of a Department of Commerce (‘DOC’) inquiry on whether solar panels imported from these nations originated in China and would be subject to 250 % retroactive tariffs. The moratorium exempts US corporations from retroactive taxes. The government also declared its intention to increase domestic production of solar energy components and decrease dependency on imported solar panels by invoking the Defense Production Act.

About 80% of the crystalline-silicon modules used in the US solar business come from Southeast Asia; therefore, the DOC inquiry disrupted their supply chain. As planned, the DOC inquiry had unexpected implications that have hampered the ability of US solar companies to create new projects. Consequently, the solar industry has reported a high rate of delays and cancellations of new solar installations scheduled for 2021 and 2022. The tariff moratorium came when Biden’s government was progressing toward a 2024 goal of tripling domestic solar production capacity. Since President Biden took office, domestic solar manufacturing capacity has grown by 15 gigawatts. This output would total 22.5 gigawatts by the end of his first term, enough to power more than 3.3 million homes annually. This further shows how the US government is committed to supporting the solar sector in the country.

The obvious question that any potential investor would ask is, besides the impacts this regulation would have on the industry, how will ARRY benefit as a company? To answer them, I refer them to the company’s Q2 2022 transcript call, where the CEO of the company says that Biden’s executive order welcomes relief and a window of certainty for their customers. He further states that they have set start dates on several of the $240 million in projects they had previously flagged as at risk during their first quarter call, and as a result, they now expect these projects to proceed. The support the US government is according to this sector is colossal and investors should expect nothing short of a boom for this company and the industry in my view.

2. Inflation Reduction Act of 2022 on Renewable Energy Tax Credits

President Biden ratified the Inflation Reduction Act of 2022 (‘ACT’) on August 16, 2022. Health care, business taxation, energy policy, and legal issues are all covered under the Act. A new base credit amount is available under the Act’s modified tax credit program for selected renewable energy projects that enter service after December 31, 2021. Solar would be eligible for a PTC base credit level of 0.3 cents per kWh(adjusted for inflation). A new 6% ITC base credit would be available for solar energy, fuel cell, waste energy recovery properties, energy storage technology, eligible biogas properties, and microgrid controllers built before December 31, 2024. The Act, in its totality, favors the green energy industry, and the solar industry is taking a central role as far as the benefits are concerned. The benefits ARRY will draw from this Act are of great interest to me and the investors in this article. Referring to the company’s Q2 2022 transcript call, the company has elaborated on the benefits of the inflation act of 2022.

Kevin Hostetler, ”While details of many of the provisions still need to be clarified, what is clear is this legislation will provide long-term certainty on incentives for both deployment and manufacturing related to solar energy.”

The CEO further gave details of their initial analysis of the Act. According to him, their initial analysis of the impact on their company is as follows;

To begin with, it’s a significant boost for the solar industry. Initial estimates suggest extending the investment tax credit will add 40% more installations between 2023 and 2027. These installations would add 46 gigawatts of solar over five years.

Secondly, enterprises that produce and source in the US benefit from the 10% domestic content adder. Irrespective of the direct beneficiary, these credits help the industry. In perspective, the current credits of $0.87 per kilogram of the torque tube and $2.28 per kilogram of fasteners translate to $0.015-$0.017 per kilowatt, which is very significant in terms of revenues.

Leveraging on the strong demand for solar energy

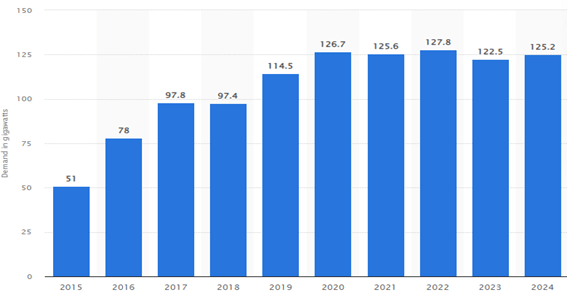

Before 2005, just around 5 GW of solar PV had been installed worldwide, with only about 0.5 GW in the United States. By 2020, global solar PV reached 710 GW, up 900% in 10 years. Solar PV grew 1,300% in the US in 10 years to 73.8 GW. As solar power gains popularity, experts predict that the industry will expand by 20.5% between 2019 and 2026. Data from Statista show that the demand for solar energy has been growing yearly since 2015, as shown below.

Statista

Looking at the company’s Q2 of 2022, the firm is capitalizing on this growing demand, and I am convinced that the company will excel both in the short and long run. In the transcript call, they reported that their year-over-year growth and $1.9 billion order book show robust demand for their products and services. Based on the present demand distribution throughout their order book, they are estimating deliveries of $600 million to $800 million for the rest of this year. These figures imply they are sure of $1.0 to $1.2 billion in 2023 income even before the year begins. The Inflation Reduction Act’s potential impact will be a positive addition to this promising start. Because of these figures, I almost guarantee investors will see strong quarters in the coming years. To support my proposition further, By 2026, global renewable power capacity is expected to expand 60% from 2020 to over 4,800 GW, equal to fossil fuels and nuclear combined. Solar PV will provide more than half of the worldwide power capacity expansion until 2026.

Conclusion

Two critical pieces of legislation passed by the United States government are surefire ways to increase the firm’s success in my view. The government is not only supplying help against severe challenges that are slowing down progress but also offering incentives in terms of tax credits and easing the effects of inflation. The current demand for renewable energy, particularly solar, ensures a lucrative future for the company and a constant growth rate. The company’s share price should continue rising, and its revenue and profitability will likely increase dramatically, thanks to its promising future and the supportive legislative climate. For these reasons, I rate the company a strong buy.

Be the first to comment