lyash01/iStock via Getty Images

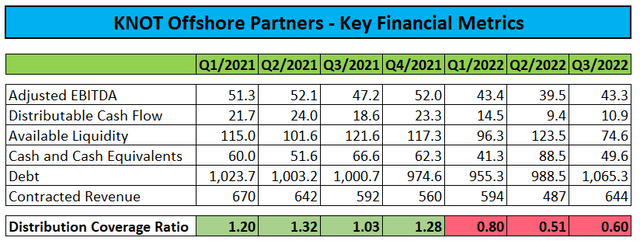

On Tuesday, leading shuttle tanker operator KNOT Offshore Partners (NYSE:NYSE:KNOP) reported another set of weak quarterly results with Q3 representing the third consecutive quarter with a distribution coverage ratio of well below 1.00:

Company Press Releases

Results continue to be pressured by an elevated number of scheduled drydockings with additional impact expected in the current quarter and also for next year with another five vessels due for their respective special surveys in 2023.

In addition, Q4 results will be negatively impacted by a host of issues:

The Partnership’s earnings for the fourth quarter of 2022 will be affected by preparatory costs related to the scheduled ten-year special survey drydocking of the Carmen Knutsen which is due to take place in January 2023, off hire and costs above deductible amounts related to a minor repair carried out on the Windsor Knutsen and time spent by the vessel without employment in the quarter, the anticipated redelivery of the Ingrid Knutsen on or around December 7, 2022, the anticipated redelivery of the Torill Knutsen on or around December 17, 2022, and the short-term time charters of the Bodil Knutsen and Hilda Knutsen to Knutsen NYK that are at a reduced charter rate. The Tove Knutsen was offhire for 11 days in October 2022 to repair a minor problem with the vessel’s port crane, and the Synnøve Knutsen was offhire in October 2022 for 18 days due to a malfunction on the vessel’s controllable pitch propeller.

Considering all of the above, Q4 results might be very similar to Q3 or perhaps even weaker.

Available liquidity as of the end of Q3 was down to $74.6 million, the lowest number in recent history.

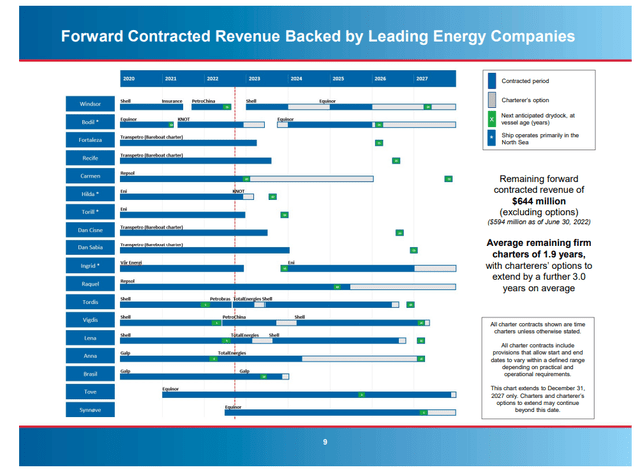

In addition, the company’s North Sea exposure remains a major cause for concern as the entire four-vessel fleet will soon be either idle or employed on short-term charters with sponsor Knutsen NYK Offshore Tankers (“Knutsen NYK”) at reduced rates.

Company Presentation

Please note the fact that customer Eni (E) continues to redeliver older units to the partnership while at the same time taking delivery of additional newbuilds from its parent:

On November 17, 2022, the charterer of the Torill Knutsen, Eni, notified the Partnership of its intention to redeliver the vessel and, as a consequence, the vessel is currently expected to be returned to the Partnership on or around December 17, 2022. The Partnership is now marketing the vessel for new time charter employment.

Moreover, despite vastly increased newbuilding prices, the company’s sponsor recently ordered two additional shuttle tankers for work offshore Brazil with delivery expected in 2024 and 2025. In addition, competitor Tsakos Energy Navigation (TNP) also ordered a pair of new shuttle tankers that will be chartered by TotalEnergies (TTE).

The pick-up in newbuild activity is concerning as leading operators are clearly looking to contract modern, more environmental-friendly vessels. On the flip side, activity offshore Brazil is expected to pick up quite meaningfully over the next couple of years so the partnership should still manage to find additional work for its vessels.

With the North Sea market likely to remain weak well into next year, the company is considering trading some of its vessels in the currently red hot conventional tanker market but warned investors of potentially insufficient returns (emphasis added by author):

As we are concerned that this North Sea situation may continue in 2023, we are also considering opportunities for our North Sea-based vessels in the conventional tanker market as a potential alternate source of income and employment. However, in practice, and despite strong headline rates, the all-in returns from conventional tanker employment may be insufficient once utilization and fuel costs are considered. If we are unable to employ our North Sea vessels in the near term at acceptable rates, either on third party charters or in the conventional tanker market, we are likely to experience a material adverse effect on our distributable cash flow.

On the conference call, management made abundantly clear that a near-term distribution cut is on the table:

We’re working every angle to support our short term cash flows across our North Sea vessels to find opportunities to reinforce our balance sheet. But if we’re not able to do that and soon then the board will need to consider how this impacts on our distributable cash flow.

Investors clearly got the message telegraphed by management as evidenced by the 20% selloff on Wednesday, but a distribution cut similar to the one conducted by Hoegh LNG Partners last year would likely cause the common units to drop well into the single digits.

With the longer-term outlook for the shuttle tanker market increasingly positive, parent and sponsor Knutsen NYK might very well decide to make use of the blueprint recently provided by Hoegh LNG and take the partnership private considerably below current unit price levels.

But even if KNOT Offshore Partners remains a public company, investors would likely face many quarters or even years of nominal distributions with the partnership expected to focus on rebuilding liquidity and bringing down debt levels.

Bottom Line

KNOT Offshore Partners investors are heading for the exit in anticipation of a near-term distribution cut and I certainly can’t blame them given the rather bold warnings issued in the press release and on the conference call.

At this point, I would expect the partnership to reduce the payout for Q4 to a nominal amount and announce a new focus on increasing liquidity and debt reduction early next year.

Based on improved long-term shuttle tanker market fundamentals, parent and sponsor Knutsen NYK might consider taking advantage of the company’s short-term issues by acquiring KNOT Offshore Partners at a substantial discount to the current unit price subsequent to the anticipated distribution cut.

Given the ugly near-term prospects, investors should consider selling existing positions and moving on.

Be the first to comment