Mat Hayward

Investment Thesis

NetEase (NASDAQ:NTES) had an outstanding quarter in 2022Q3, beating EPS estimates by around 50%. Combined with historically low enterprise value to sales (EV/Sales) and PEG ratios, NetEase seems like a strong buy. However, we think the market is pricing weakness in the Chinese games market, where NetEase derives the majority of its revenue. Game license approvals, needed by game companies to market games in China, have fallen off a cliff. Additionally, NetEase will lose some revenue due to the expiration of current licensing agreements with Activision Blizzard (ATVI). Therefore, we rate NetEase as a hold.

Financial Analysis

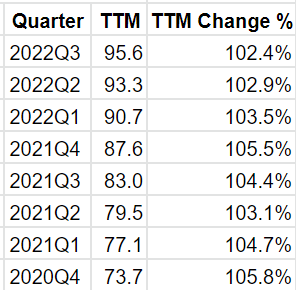

In 2022Q3, NetEase’s revenue continued to trend upward, both on a TTM and quarterly basis. Diving deeper, we see that revenue also grew in all 4 subcategories, including games, Cloud music, Youdao, and others. Gross and operating margins did not significantly deviate from trend and remained healthy at 56% and 19%, respectively.

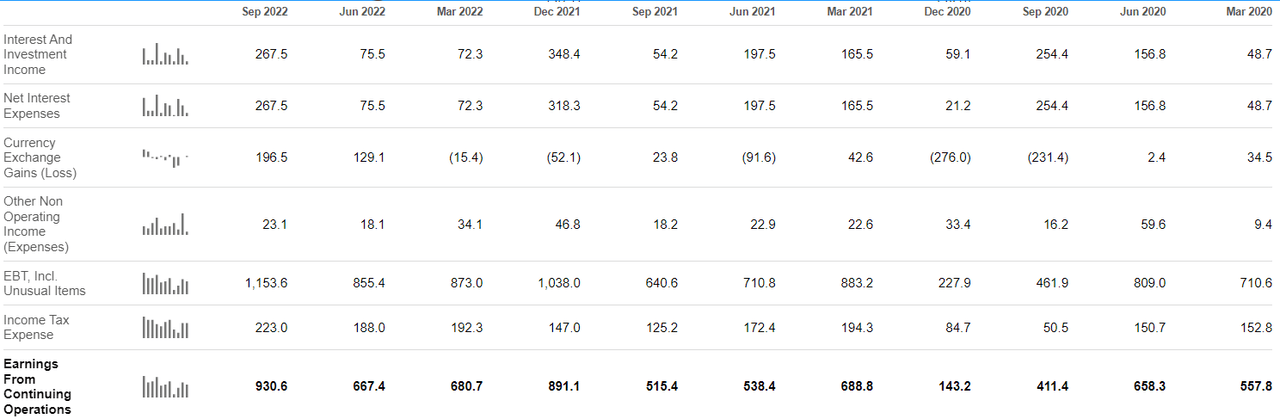

Net profit margin reached a 3 year high of 27%, which combined with the repurchase of 2.3 million ADS, resulted in a big EPS beat of $0.53 (consensus $1.05). However, it should be noted that this quarter’s strong net profit margin was primarily driven by interest and investment income and currency exchange gains. These 2 sources of income might be one-off and should not be expected to repeat in the future. In fact, removing interest and investment income and currency exchange gains results in a modest net profit margin of just 13.6%.

Seekingalpha.com

Some revenue is certain to be lost in the future due to the expiration of current licensing agreements with Activision Blizzard. Games such as World of Warcraft, Hearthstone, and Overwatch were licensed to NetEase and will not be available to players in China after the license expires. In the transcript, CFO Charles Yang states that:

Net revenues and net income contribution from these licensed Blizzard games represented low single digits of our total net revenue and net income in 2021 and in the first 9 months of 2022. The expiration of such licenses will have no material impact on our financial results.

The China Investor

By our own calculations, a low single digit decrease in yearly revenue would be sufficient to eliminate revenue growth for the entire year. For example, a 4% decrease in yearly revenue would result in a slight contraction in 2022Q3 revenue on a TTM basis. Therefore, it would be reasonable to expect some revenue impact from the expiry of licensed Blizzard games in 2023Q1.

The China Investor

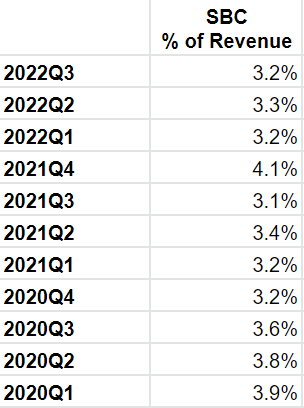

Moving on to the cash flow statement, we can see that free cash flows have grown steadily and share based compensation is a modest single digit percentage of revenue. This means that dilution to shareholders is minimal. Healthy cash flows have contributed to NetEase’s sizable cash and short term reserves, which combined with its low debt, have resulted in an enterprise value of USD $30B.

Valuation

Koyfin

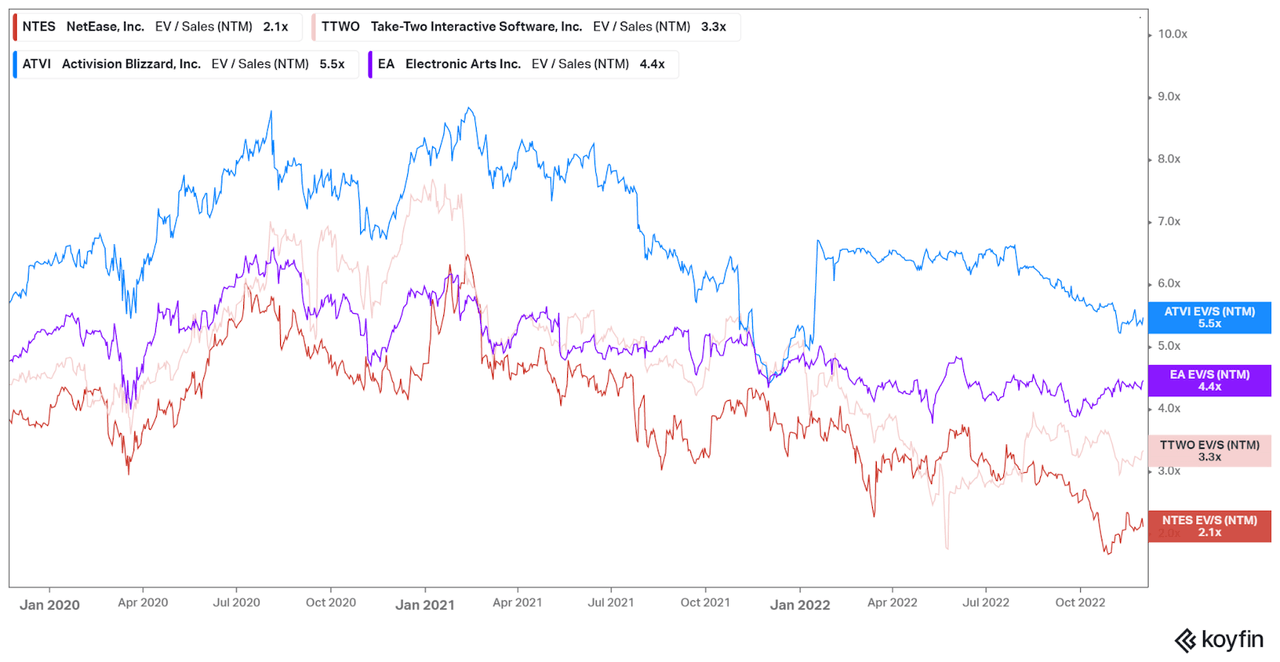

To get a feel for NetEase’s value, we compare it to similar sized companies in the gaming industry. Electronic Arts (EA), Activision Blizzard, and Take Two Interactive (TTWO) are all valued above USD $10B and generate more than USD $1B in revenue, with the majority of it derived from gaming. Looking at the enterprise value to sales NTM (next twelve months) ratio, we can see that NetEase is valued quite cheaply compared to its peers. NetEase’s EV/S (NTM) ratio is presently at 2.2, whereas the ratio ranges from 3.2 to 5.4 for its peers.

Koyfin

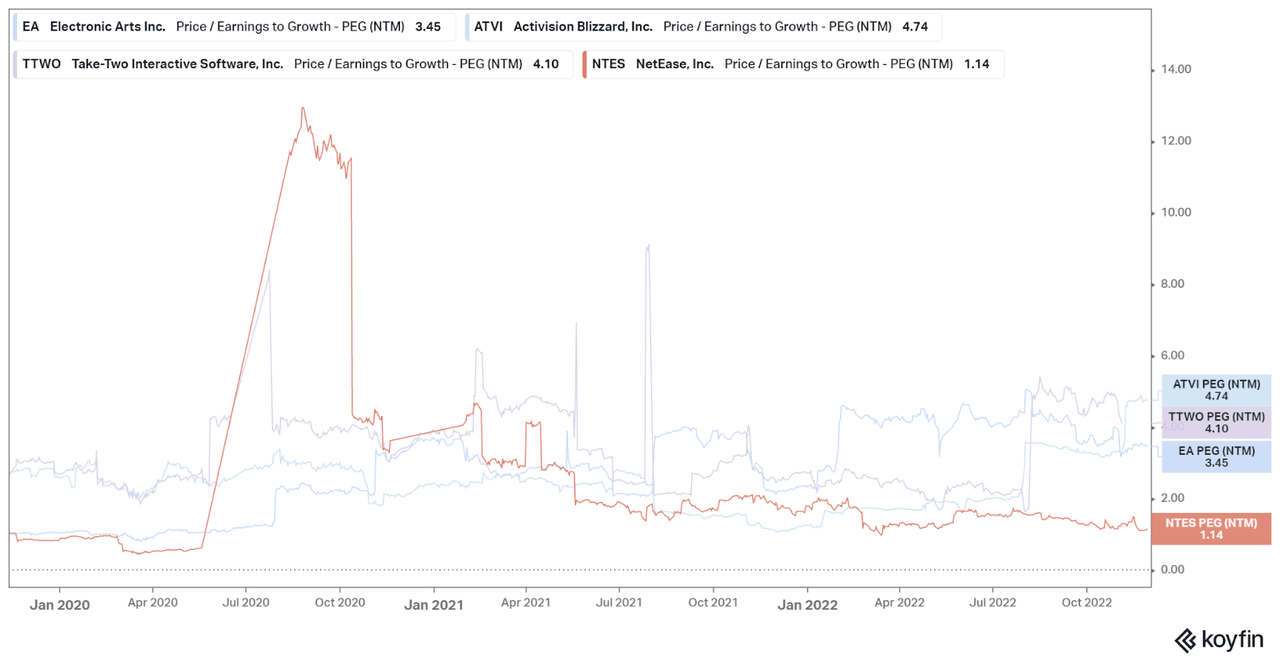

It is a similar story when we look at the PEG ratio. NetEase’s PEG ratio is just 1.14, much lower compared to its peers, whose PEG ratios range from 3.45 to 4.74. Taken together, NetEase’s low PEG and EV/Sales ratios suggest that it is undervalued. However, we think that its cheapness reflects the market pricing in NetEase’s uncertain future.

Outlook

Despite diversification efforts, China remains NetEase’s largest source of revenue, accounting for about 90% of gaming revenue. In 2022H1, game revenue in China dropped by 1.8% YOY, the first such contraction since 2008. This was largely due to a dramatic fall in game license approvals, which plunged more than 90% from 2017 to 2021. The dearth of game license approvals coincided with a change of stance in government policy in 2018. The changes included

-

the setting up of the National Press and Publication Administration (NPPA), a regulatory body tasked with licensing games,

-

limiting the amount of time minors could spend playing online games and implementing an age-rating system,

-

implementing spending limits within games, and

-

setting curfews for gamers younger than 18.

The nail in the coffin, however, was an article comparing games to the digital form of opium. Given the role opium played in China’s decline in the 19th and 20th centuries, it was clear that the games industry had fallen out of favor with the central government. Tencent and NetEase shares fell more than 8% in a single day.

As a result, Chinese game companies scrambled to diversify their income streams outside of China. Tencent and NetEase, China’s 2 largest game companies, announced that they would aim for 50% of revenue to originate from outside of China. To that end, Tencent has aggressively invested in or acquired numerous international game companies, including FromSoftware, Ubisoft, and Funcom. However, Tencent’s international revenue growth remains in the single digits. It is reasonable then, to expect that the benefits from NetEase’s recent investments and acquisitions will take many years to show. Until then, NetEase will have to grapple with challenging conditions in the domestic game industry.

There is a possibility that conditions in the domestic game industry may improve though, following a recent article published by the People’s Daily. The article lauded the contributions of the game industry in developing new technologies such as 5G, AI, and chips. The tone and stance of the article marked a complete change from years ago, when games were compared to digital opium.

A more accommodative approach to the games industry would be consistent with the central government’s actions in other parts of the economy. A slew of measures including the lifting of a ban on equity refinancing, sent Chinese property developers’ shares soaring. China’s LPR has been falling slightly while other major economies have been raising interest rates. Restrictive zero COVID policies, which have been blamed for supply chain disruptions and a slump in demand, may be lifted soon.

If the central government does change its approach to the games industry, the number of game license approvals should increase. The drought of game licenses have led to widespread bankruptcy in the gaming sector. Many less well capitalized firms have perished, and more than 14000 gaming firms were deregistered in 2021. In this scenario, NetEase is likely to benefit from the decreased competition, and may enjoy higher revenues in the future.

Conclusion

NetEase’s revenue continues to grow at a healthy pace, although that pace has slowed in recent years due to challenging industry conditions. NetEase’s margins remained healthy this quarter, but net margins were mainly bolstered by interest and investment income and currency exchange gains. Due to the expiration of current licensing agreements with Activision Blizzard, NetEase is likely to lose a few percentage points of revenue, which is equivalent to a year’s worth of growth on a TTM basis.

NetEase is valued quite favorably compared to similar sized game companies such as Activision Blizzard, Electronic Arts, and Take Two Interactive. NetEase’s enterprise value to sales ratio (NTM) and PEG ratio are both much lower than those of its peers. This could be due to markets pricing in the unique challenges NetEase faces as a Chinese company.

Unless game license approvals are increased, the Chinese game industry will continue to be under pressure. Game license approvals have fallen more than 90% since 2018, leaving local game companies such as NetEase with substantially reduced opportunities to grow. NetEase has committed to derive at least 50% of game revenue internationally, by acquiring and investing in international game companies. However, the benefits from these acquisitions and investments may take years to manifest, as in the case of Tencent. Therefore, we assign a hold rating to NetEase.

Be the first to comment