pegasophoto

Dear readers,

It’s time for an update on National grid (NYSE:NYSE:NGG), one of the few somewhat UK-based companies I currently invest in. I’ve been investing in utilities for some time, with this being a relatively recent addition, all things considered. While things are expected to decline somewhat, I don’t expect that this will have a material, further impact on overall valuation, but expect we’ll see a bounce-back upwards based on 2023-2024E numbers.

Here is my reasoning why.

National Grid – Revisiting the thesis

The outlook for National Grid as a business continues to be a positive one, on the back of excellent fundamentals. A company like NGG is seeing improvements in profit for electricity transmission and distribution, as well as gas. While the company’s US operations are posting somewhat lukewarm results in terms of overall profit, the company’s balance sheet remains exceedingly strong with 64% fixed rate debt and an interest coverage ratio of 4.7X, well above Moody’s FFO interest cover of 4.5X.

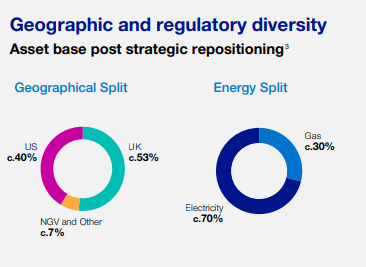

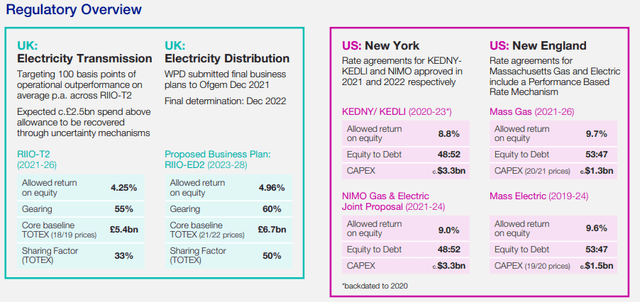

Like any utility, the flow of NGG’s business is determined by the rate cases and increases allowed by relevant regulators. Because the company is partially US-based and partially UK-based, the company is under the scrutiny of several regulators, with a business split looking something like this.

NGG IR (NGG IR)

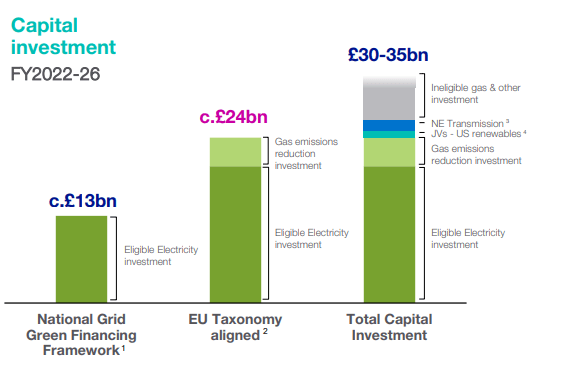

The company’s case is also based on its expansion and corresponding CapEx. Until 2026E, the company’s plans are to invest upward of £35B, mixed in electricity transmission, US regulated, distribution, and New ventures. This in turn will cause asset growth of 6-8% CAGR, and EPS growth at 5-7% CAGR. The company yields over 5%, and is expected to grow that dividend in line with CPIH.

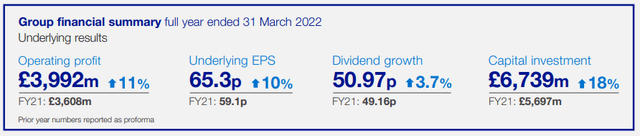

The company has a fiscal year ending in March, and results for 2022A were excellent.

Some headwinds that are company-specific. The company still has a 4.7x coverage ratio, with the current rating threshold from Moody’s being >4.5x. This is despite the company not reaching its gearing target. The reason for this being that proceeds for some of the company’s asset sales haven’t been realized. Once this is realized, the company’s gearing is expected to settle around the 70% mark, which is in line with overall expectations.

Overall, the company is exposed to a number of regulators in the USA and England, with different targets. The company’s accepted returns are very different in the US versus England.

NGG is one of the world’s publicly listed utilities – and it’s facing one of the largest energy transition challenges out there, especially with the exposure to the UK. The company’s investment plans are aligned with the overall EU Taxonomy. By 2030, it means to reduce emissions by 80%, 90% by 2040, and net zero by 2050.

A large part of the company’s investments is going into “Green Capex”.

NGG IR (NGG IR)

The fact is, NGG is a bit of a perfect inflation hedge – it has been for a long time. I see the company’s 7% CAGR upward EPS target as conservative – and I would expect closer to possibly 8-9%, especially with double digits expected for the 2024E fiscal. There’s something wrong with the considered equation of limited EPS growth but a significantly growing dividend due to CPIH-indexed inflation while managing aggressive CapEx over a 5-year period.

I consider the company’s prospects to be more solid than this, because of its indexed inflation clauses, its CapEx plans, and the various company plans to integrate operations, its ongoing divestment of NECO and NGG as well as a 50% stake in a JV in order to re-allocate capital and capture further synergies.

There’s more to NGG’s near-term future than this conservative guidance would suggest – and it’s important to remember that NGG’s attractiveness is exactly because of that protected dividend and its recession-resistant cash flows.

It’s my view that NGG offers one of the best “hybrid” profiles in terms of investments, with a mix of floating-bond type investments while remaining exposed to the equity market.

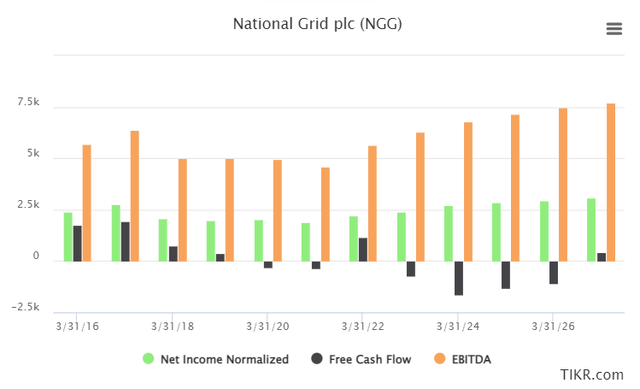

NGG continues to drop in valuation. The company’s bears argue that NGG FCF does not cover the dividend – I argue that this is based on a fundamental misunderstanding of the application of FCF as a metric. Both FCF and EBITDA are used to measure earnings before interest, tax, and D&A – and both of them measure the earnings a business generates. The key difference is that FCF is what we would consider “unencumbered” – we get FCF by adding back D&A and adjusting for WC and CapEx. EBITDA on the other hand doesn’t account for CapEx and looks at earnings before the usual essential expenses.

Using FCF to analyze utilities is flawed, for a few reasons. The main reason though is that utilities are businesses requiring a substantial amount of investment CapEx in high-value assets that both stay on the books for very long times, but more importantly, have very long payback periods.

It is counter-intuitive to use FCF as a basis to compare this, because EBITDA not only offers a fairer comparison by not accounting for such expenses but being a better comparison to peers in the same industry.

EBITDA also offers a better comparison in the cases of M&A, or in cases where firms use debt financing or so-called leverage to fund expansion. You’ll notice that NGG does this almost exclusively. Again, when using FCF as a basis for comparison, this might not provide the best picture – because EBITDA gives us a better picture of the company’s capacity to pay debt interest.

While there is less fudging FCF – but as long as you understand EBITDA, it’s really not a problem. Problems arise through lack of understanding or companies inflating its own EBITDA through not accounting for certain expenses that do need to be accounted for – some companies caught in scandals categorize everyday expenses as CapEx, and can, as such, inflate their EBITDA.

NGG does not, to my knowledge or from what I have seen, do this.

Therefore I view EBITDA or earnings as the fair comparison here, not FCF. Take a look at EBITDA, FCF and net income on a normalized basis for the company expected going forward, and you will see what I mean.

NGG Metrics (TIKR.com/S&P Global)

I know that some bears look at FCF – but the above is why I do not and don’t consider it a fair metric for either Telcos or Utilities, or any other asset-heavy, long-payback company.

Let’s move on to valuation.

National Grid – The valuation

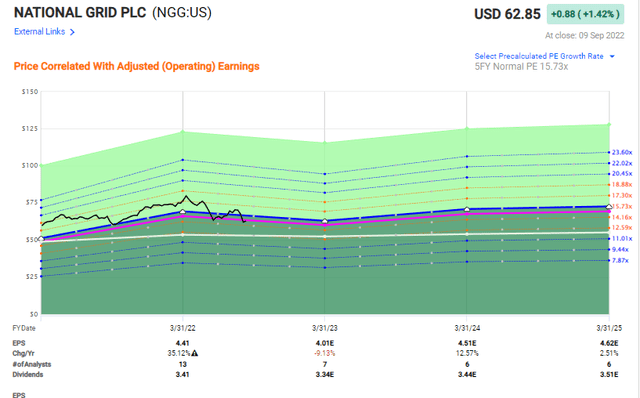

The picture for NGG’s valuation continues to be a strong one. Take a look at current forward expectations for this company.

Even a conservative multiple calling only for a 15-16x forward P/E would still result in a double-digit upside with a 5%+ yield. I don’t hide the fact that this is exactly what I am looking for in this climate.

I’m looking for Safe, BBB, or above-rated yields at 5% or above, with double-digit upside and what I consider to be conservative safety. I believe they can act as a staple of a very resistant portfolio.

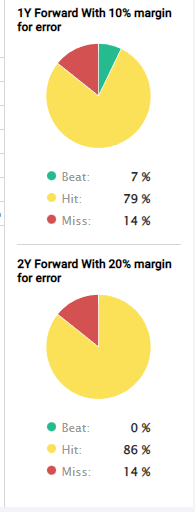

The forecast accuracy for this company is very convincing. Analysts don’t often miss negatively here, with a hit ratio of over 85% including the positive beats.

NGG Forecast accuracy (FactSet)

Consider and remember for a moment that you’re really talking about essentially a hybrid bond proxy.

These are utilities and transmissions to millions of customers across New England, NYC, and the UK – these are incredibly stable operations with indexation for inflation. That’s exactly what we want to hear in the current environment – that we are, in fact, indexed and protected against what inflation may come.

Is it the “best upside” ever? No – of course not. NGG has never been, nor will it likely ever be about the market-beating best upside ever.

That’s not why I am writing this article about NGG. I’m writing because this is a BBB+ rated safe utility investment and perhaps one of the best of its kind, with proven stability over a long period of time.

For the best upsides in utilities, I would direct your attention to companies like Enel (OTCPK:ENLAY) or Fortum (OTCPK:FOJCF), both of which I am long, and even longer than NGG in some cases. However, none of these currently offer the safety or stability that NGG does. Bond proxies are, in part, after all about that “stability” we want to see – and NGG gives us this.

Current targets for this supposed bond proxy come to $70 on an average level, which gives us an upside of about 7-10% depending on what share price and day you’re looking at. I consider this to be an accurate level/accurate target for the company.

We can look at peers or other ways to value the company, as I do with some of my other articles, but this does not give us materially different results. Looking at various ways to value NGG, we see that the company’s book value implies a massive undervaluation of the company’s assets. Yield, P/E and NAV are somewhat more modestly discounted and only imply a single-digit upside (still valid), but it is book value that we find some of the more interesting comps. The company is valued cheaper in terms of its book value than most of its closest peers, except perhaps Fortum – but again, there are reasons for Fortum’s current valuation.

The undervaluation is there – it’s just around 10%. If you want more, you may have to wait, and if we don’t get there, you’ll have missed that opportunity to pick up NGG at a 5.1% yield.

I still consider the company a “BUY”, with a price target of $70/share. I haven’t changed my PT since my last piece, and I still view it to be very fair.

Thesis

The current thesis for National Grid is:

- While an excellent company with an appealing portfolio, NGG is about to take on copious amounts of leverage to improve its assets while doing very little to its dividend – though inflation will now do something to offset that.

- With an improved valuation, I now consider NGG to be a “BUY”.

- I would now be interested in buying the company, and I’m bumping my price target up to $70/share.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- The company is currently cheap

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment