ehrlif

Almost a year ago, I recommended purchasing DTE Energy Company (NYSE:NYSE:DTE) for its attractive dividend yield back then, its promising growth prospects, and its reasonable valuation. Since then, the stock has outperformed the market by a wide margin, as it has rallied 22% whereas the S&P 500 has declined 7%. However, due to its rally, DTE Energy is currently trading at a 10-year high price-to-earnings ratio of 22.5 and is offering a 10-year low dividend yield of 2.6%. While this high-quality utility has provided a safe haven in the ongoing bear market, investors should wait for a lower entry point.

Business overview

Until last year, DTE Energy had a major difference from a typical utility. It had a non-regulated, midstream segment, which used to generate a significant portion of the total earnings of the company. That segment helped the company grow faster than a typical utility, but it also imparted much higher volatility in earnings. As a result, DTE Energy spun off its midstream business last year, and thus it has now become a nearly pure regulated utility.

As a utility, DTE Energy is essentially immune to recessions. The defensive character of the stock is especially important in the current investing landscape, as inflation has skyrocketed to a 40-year high and the Fed is raising interest rates aggressively in order to lead inflation back to its normal range. As higher interest rates take their toll on economic growth, the risk of an upcoming recession has greatly increased. Therefore, investors should make sure that their stocks can endure a recession. This is certainly the case for DTE Energy, as consumers do not reduce their consumption of electricity and gas even under the most adverse economic conditions. To be sure, in 2020, when the pandemic caused a fierce recession, DTE Energy posted all-time high earnings per share of $7.19.

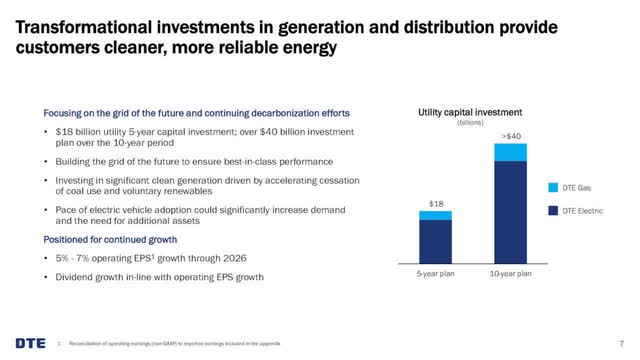

Moreover, DTE Energy has promising growth prospects ahead. It has grown its earnings per share by 5.0% per year on average over the last decade, from $3.67 in 2011 to $5.99 in 2021. Furthermore, the company has an immense 5-year investment plan of $18 billion in place. This plan aims to enhance the portion of clean energy in the energy mix and increase the efficiency of the network of the utility.

DTE Energy Growth Prospects (Investor Presentation)

As the amount of the investment plan is 69% of the market capitalization of the stock, it is obvious that the company is heavily investing in its future growth. Management has repeatedly provided guidance for 5%-7% annual growth of earnings per share until at least 2026.

Such a growth rate may seem lackluster to some investors, but it is important to realize the merits of the defensive nature of the stock. When the 5%-7% growth rate of DTE Energy is combined with its resilience to recessions and the reliability of its growth trajectory, the stock is an attractive candidate for conservative investors, particularly in the ongoing bear market.

Moreover, DTE Energy enjoys positive business momentum this year. In the second quarter, its adjusted earnings per share decreased 28% over the prior year’s quarter, primarily due to increased fuel costs in the electricity division. However, the utility exceeded its own expectations, and thus, it improved its guidance for its earnings per share in 2022 from $5.80-$6.00 to $5.90-$6.10.

Analysts seem to agree with the outlook of management, as they expect DTE Energy to post earnings per share of $6.03 this year and grow its earnings per share by 4%-7% per year over the next four years. It is also worth noting that DTE Energy has exceeded the analysts’ estimates by a wide margin in 7 of the last 9 quarters. Overall, one can reasonably expect the company to earn approximately $6.03 per share this year and grow its bottom line in the upcoming years as per its guidance, i.e., by 5%-7% per year on average.

Valuation

DTE Energy has rallied 17% off its bottom about three months ago. Consequently, the stock is currently trading at a forward price-to-earnings ratio of 22.5, which is a 10-year-high valuation level, much higher than the 10-year average of 17.6 of the stock. The price-to-earnings ratio of DTE Energy, which is 11% higher than the median price-to-earnings ratio of 20.3 of the utility sector, is undoubtedly high for a utility stock.

On the bright side, the short-term technical picture of DTE Energy is bullish, as the stock seems ready to break to new all-time highs. Nevertheless, given its 10-year-high earnings multiple, the stock is not attractively valued. It is also worth noting that the stock is trading at 17.8 times its expected earnings in 2026. In other words, the market has already priced a material portion of future growth in the stock.

Dividend

DTE Energy has raised its dividend for 12 consecutive years. In addition, the stock has a solid payout ratio of 58%. Management has repeatedly stated that it expects to grow the dividend by 5%-7% per year on average until at least 2026. Given also its reliable growth trajectory and its resilience to recessions, the company is likely to continue raising its dividend for many more years.

On the other hand, the aforementioned rally of the stock towards its all-time highs has resulted in a 10-year low dividend yield of 2.6%. This yield, which is lower than the median dividend yield of 3.1% of the utility sector, is not attractive for a utility stock, especially in the highly inflationary environment prevailing right now.

Final thoughts

DTE Energy has provided a safe haven to its shareholders so far in the ongoing bear market, as the stock has outperformed the S&P 500 by an impressive margin in the last 12 months. In fact, many utilities have attracted the interest of investors this year, as their above-average yields and the reliable growth of their dividends are viewed favorably in the highly inflationary environment, especially given the risk of an upcoming recession.

However, thanks to its defensive character, DTE Energy has rallied close to its all-time highs and is now trading at a 10-year high price-to-earnings ratio while it is offering a 10-year low dividend yield. In the short run, the positive momentum of the stock of DTE Energy is likely to remain in place. On the other hand, whenever the economy recovers from its current headwinds, DTE Energy is likely to underperform the S&P 500 by a wide margin due to its rich valuation. Therefore, investors should wait for a lower entry point, probably close to the technical support around $120.

Be the first to comment