Marina_Skoropadskaya

The Agreement

On July 8, Nano Dimension (NASDAQ:NNDM) announced that it had reached an agreement to acquire Formatec Holding, which includes its two subsidiaries, Admatec Europe B.V. (“Admatec”) and Formatec Technical Ceramics B.V. (“Formatec”). Formatec was purchased for $12.9 million (net of cash held by the company) and will be in addition to previous acquisitions Nano has made during 2021.

Formatec Holding

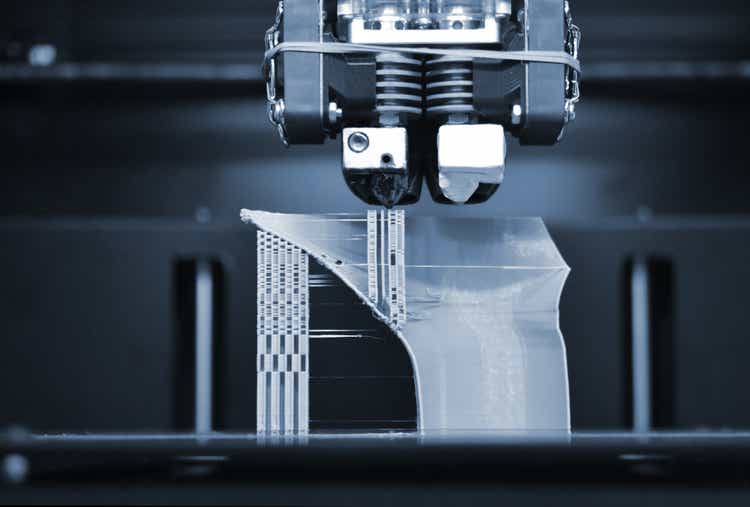

Formatec Holding is described in the release by Nano Dimension as: “a leader in the development and production of additive manufacturing and 3D printing systems for ceramic and metal parts for end users. Formatec Holding’s systems are industrial-grade – powered by digital light processing technology – and use materials with superior mechanical, electrical, thermal, biological and chemical properties to produce a range of parts for medical, jewellery, industrial and investment casting use.”

Yoav Stern, president and CEO of Nano Dimension, said: “Admatec/Formatec’s products and services expand Nano Dimension’s Fabrica Division, adding volume manufacturing capabilities to the high precision micro-mechanical Fabrica 2.0 systems.”

Nano Dimension’s previous acquisitions

In 2021, the company was very active on the acquisition side. As a result, three major companies were acquired:

- DeepCube: DeepCube is a machine learning company. The core of DeepCube’s proprietary technology is a set of deep learning algorithms that the company uses to improve data analysis and implement complex artificial intelligence systems. DeepCube’s framework can be implemented on any hardware in both data centres and edge devices, with benefits such as improved speed and reduced memory usage. Nano Dimension paid $40 million to DeepCube shareholders and a further $30 million in American Depositary Shares (ADSs). The ADSs will stand still for varying periods of up to three years.

- Nano Fabrica: Nano Fabrica (now renamed Fabrica group) is a company that produces 3D additive manufacturing systems. The main product is Fabrica 2.0, used by original equipment manufacturers (OEMs) in all industries who want to create small or large parts with micron-level accuracy. Nano Fabrica’s technology can produce highly accurate parts with ultra-fine detail to the standards required by many industries, such as aerospace, electronics, automotive, and medical. Nano Dimension paid Nano Fabrica shareholders between $54.9 million and $59.4 million, including $23 million to $27.5 million in cash, depending on whether Nano Fabrica achieves specific performance targets.

- Global Inkjet Systems: Global Inkjet Systems is a developer of application software, drive electronics, and ink system components that support a wide range of industrial inkjet printheads. This is all managed by very sophisticated software called Atlas, which delivers the inks accurately. Unlike what it may seem at first glance, this is not a materials company. It is a company that worked with Nano Dimension many years before its acquisition and has over 130 customers worldwide. Nano Dimension has paid Global Inkjet Systems shareholders $18.1 million in cash and $1.3 to $10.7 million more if it achieves specific performance targets.

The Financial Impact

For the acquisition of Formatec Holding, Nano Dimension paid $12.9 million. In 2021, the company had revenues of $5.3 million with a gross margin of 56%, in line with Nano Dimension’s gross margin. Analysts’ estimates of Nano Dimension’s revenue in 2022 were 30 million (the company said in its last quarterly report that it expects growth of about 300% over 2021, so about 40 million in revenue). Suppose we assume (in the bearish case) that Formatec does not grow its revenue during 2022. In that case, the acquisition could increase the analysts’ estimated revenue by 17% (or 13% in case the company succeeds in meeting the growth targets the company predicted in its last quarterly report). In the long term, it must be considered that the acquisition will have positive synergies with other companies within Nano Dimension, such as Nano Fabrica and its Fabrica 2.0 model.

The acquisition will not adversely affect Nano Dimension’s rock-solid balance sheet, which can rely on more than 1.2 billion in cash and short-term investments. Debt is virtually nonexistent, and the company, while not profitable, is not losing money at an alarming level. In addition, the company, in May 2022, announced a buyback of 100 million. Since the announcement of the acquisition, the company’s price has remained essentially flat.

Conclusions

Nano Dimension, at this time, appears to be an exciting company. Its balance sheet is perfect, and its future growth prospects are excellent. However, it is a company that has never been profitable; it loses money, and to grow to the levels projected in 2022 by analysts, it has had to make many acquisitions. So, the doubts I expressed in my previous article on Nano Dimension regarding the market in which it operates remain, although the choices made by the company’s management seem positive and on the right track.

Be the first to comment