David Taljat

Shipping is undergoing a significant transformation. Up until a couple of years ago, the industry was seen as a highly speculative, highly cyclical space that is run by bozos that casually dilute shareholders while they enjoy growing management fees. The PTSD that arose after a nightmarish decade is hard for many to bypass. However, things appear to be changing dramatically lately.

The industry is enjoying a favorable trading environment (especially containerships and dry bulks to a lesser but notable extent) that has led to record profit generation. However, along with great bottom line numbers, we see a change in the industry’s overall investment prospects. Corporations (and even MLPs) have become increasingly shareholder-friendly in many aspects, including capital returns (dividends, buybacks), transparent reporting & planning, prudent balance sheet management, and long-term sustainability.

Amongst shipping stocks, we are particularly interested in containerships due to industry rates remaining at record levels against declining share prices. We recently covered Danaos (DAC) along with ZIM Integrated Shipping Services Ltd. (ZIM), going over why the former, along with help from the latter, could reward investors with massive returns in the near future.

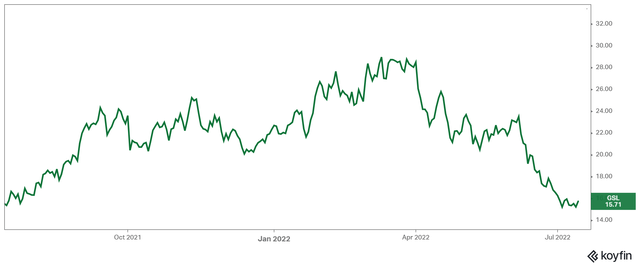

In this article, we are looking at another containership lessor, Global Ship Lease, Inc. (NYSE:GSL), whose 9.5% yield I have been buying hand over first as its share price has been plummeting lately. Despite the company creating fantastic shareholder value over the past few quarters, shares are trading at the same levels they did a year ago.

Global Ship Lease Stock Price (Koyfin)

The reason we are more confident in companies like Global Ship Lease and Danaos is that vessel lessors are subject to reduced operating risk. Further, these companies enjoy phenomenal cash flow visibility due to taking advantage of the recent market dynamics to secure multiyear leases at record rates. We believe that the market is short-sighted in that regard, failing to recognize the amount of money that is about to be generated in the coming years.

GSL’s Multiyear Contract Cover Is Astonishing

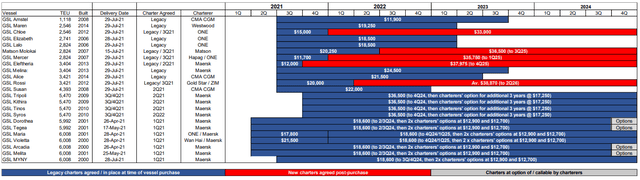

GSL’s fleet underwent a massive transformation last year. The company went on to acquire 23 vessels, growing its total fleet to 65 vessels. Besides the vessels being immediately accretive to earnings, the acquisitions took place just in time for the company to extend their legacy charters at remarkably higher rates than their existing ones.

GSL’s 2021-Acquired Vessel Employment (Q1 Investor Presentation)

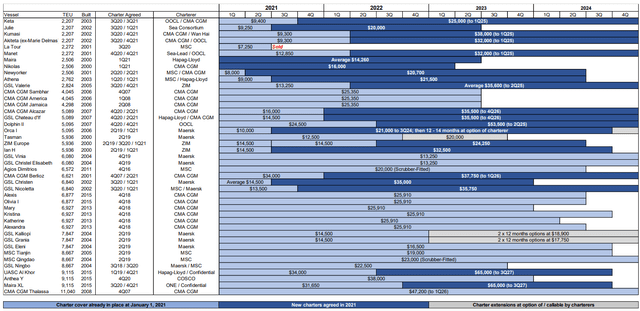

Take a look at the company’s core fleet, whose new multi-year charters are also multiple times over their previous rates.

GSL’s Core Feet Employment (Q1 Investor Presentation)

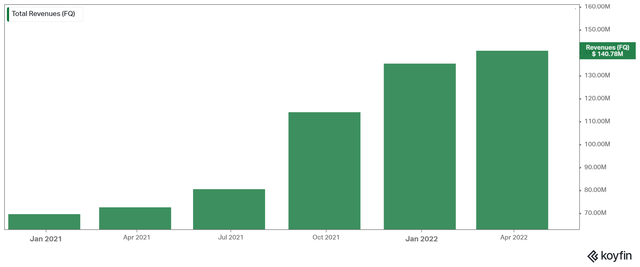

As you can see, the company’s revenues jumped following last year’s acquisitions, and they have been gradually expanding as more legacy charters expire, and new ones kick in.

GSL’s quarterly revenues (Koyfin)

Things get interesting here since we already know how these charters will evolve moving forward. Similar to how new charters have been taking over their legacy ones in the previous quarters, several of them will be kicking in over the next few quarters. Specifically:

- Five charters were renewed in Q2 (whose effects we will see in the upcoming earnings report),

- Three charters will be renewed in Q3, and

- One charter will be renewed in Q4 (and one more at the charterer’s option.)

The new rates on these charters are anywhere from 50% to 320% higher than their previous rates. Some of the company’s renewed charters also run as far as Q3 of 2027!

Growing Revenues & Margins To Drive Profits Higher For Global Ship Lease

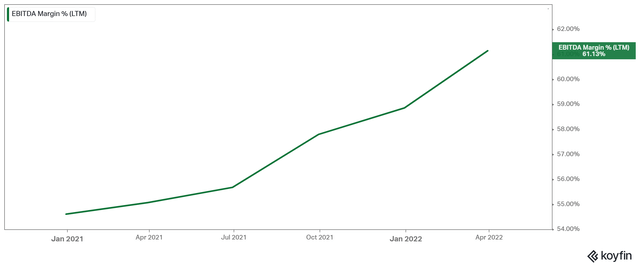

Basically, we already know that the company will grow its revenues sequentially over the next three quarters. However, besides the predetermined top-line growth, the bottom line should grow at an ever faster pace. With growing revenues against a disproportionate increase in operating expenses, EBITDA margins have been on the rise.

Profitability is also set to improve further as a result of the company getting rid of its expensive liabilities. For instance, in late March, GSL announced the partial redemption of its 8.00% Senior Notes due 2024 (NYSE:GSLD). In late June, the company announced the redemption of the remaining $89.02M aggregate principal senior notes, which will consequently cease trading on the NYSE.

Through the full $117.5 million redemption, the company will be saving $9.4 million in annual interest expenses on top of building its common equity value.

And while net income is set to grow through expanding operating margins and declining financial expenses, earnings per share enjoy another tailwind, namely GSL’s stock buybacks. Specifically, the BoD authorized a $40.0 million program for opportunistic share repurchases. Subsequent to the quarter (during April 2022), the company repurchased $4.9 million worth of common stock at an average price of $26.66 per share. During the Q1 earnings call, when asked about the pace of buybacks, CEO Mr. Ian Webber mentioned:

…So, cash becomes more available to us towards the end of 2022 through into 2023. So it’s — given the other potential demands on capital and the dynamic approach that we have which we review with the Board every quarter, I’m afraid it’s just not possible to say, well, we’ve done $5 million in this quarter, so expect $5 million a quarter for the next few quarters.

This is important as there is often uncertainty regarding whether companies actually make use of their stock buyback programs or whether they act as a cheap way to attract shareholder attention. Clearly, the latter is not the case based on the repurchases that have occurred so far and management’s comments. The stock has declined further since, so we wouldn’t be surprised if the rate of buybacks were to accelerate moving forward. In any case, the $40 million corresponds to around 6.3% of the company’s present market cap, which makes for a great “buyback yield”. Combined with the near double-digit dividend yield, GSL’s capital returns are becoming truly massive.

GSL Stock’s Dividend & Valuation

GSL has been building shareholder value all across the board. The fleet has expanded, earnings have reached record levels (and will keep growing), long-term liabilities are on the decline, and capital returns are on the rise. What else could investors be asking for?

Besides the initiation of buybacks, which we mentioned above, GSL’s latest dividend increase boosted its annualized rate to $1.50, implying a yield of around 9.5% at the stock’s current levels. It’s important to feel assured that the dividend is sustainable and well-covered. With the company generating EPS of $1.93 during Q1, the total annual dividend is currently covered amply by a single quarter’s earnings. In fact, driven by the EPS growth catalysts we mentioned earlier, the quarterly EPS rate should easily surpass $2.00 in the coming quarters. Thus, the payout ratio stands below 20%. Even if the company were to close additional charters in the future at lower rates, the dividend is more than likely to remain well-covered.

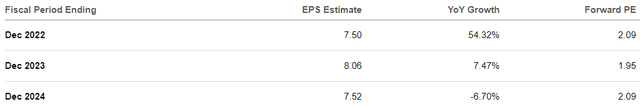

It’s also worth noting that the company is expected to deliver $7.50 for the year. This is rather unreasonable. Assuming the company’s $1.93 quarterly EPS rate were to be sustained, the annual EPS should come out to $7.72. Again, we know that EPS should be actually rather higher in Q2, Q3, and Q4 as charter renewals are gradually kicking in.

GSL Consensus EPS Estimates (Seeking Alpha )

Whether it’s at or above $8.00 per annum, however, the company is basically set to generate EPS higher than the current stock price over the next two years. Combined with the overall cash flow visibility that the company’s medium-term charters provide, we would argue that GSL is substantially underpriced.

Further, the common equity value on the balance sheet appears to be $791 million, implying that shares are currently trading at a 21% discount to book. However, this reflects the historical value of the vessels subject to depreciation and amortization. If we adjust for the increased value of vessels in the current trading environment, we estimate that GSL’s NAV/share should be somewhere between $35 and $40. Thus, shares are likely trading below 50% of their NAV.

Finally, back in September of 2021, GSL’s Executive Chairman George Youroukos increased his shareholding in the company to 6.4% at the time. He paid $19.17 per share, and the company’s financial position has significantly improved since. If he thought the stock was undervalued at $19.17 in September, we are not having a hard time feeling convinced the stock is substantially undervalued at $15.71 today.

Takeaway

GSL is a capital allocation play at this point, and in my view, management is well aware of its options and executes with consideration. Along with the fantastic cash flow visibility provided by its multi-year charters, and dead-cheap valuation, we believe that GSL’s investment case appears both very fruitful and with a notable margin of safety. While we expect (and hope) the stock to follow a course towards its (adjusted) NAV, we are getting paid the hefty 9.5%, which few to no equities offer at this point with such ample coverage. Still, we remind that investors must be well aware of the risks attached to the shipping industry and perform their due diligence before taking any action.

Be the first to comment