Dan Kitwood

Deutsche Bank’s (NYSE:DB) near 30% year-to-date capitulation embodies the cyclical risk embedded in today’s financial markets. The economic outlook remains uncertain; however, Deutsche’s fortunes could be set to change after the bank’s third-quarter earnings report revealed an illustrious 14.2% year-over-year top-line growth trend.

We assessed Deutsche’s latest earnings report and phased in leading variables to conclude that the stock’s likely undervalued. Thus, we place a buy rating on the stock with a six-month horizon in mind.

Let’s do a deeper dive into what we discovered about Deutsche Bank.

Deutsche Bank Operational Analysis

Earnings Review

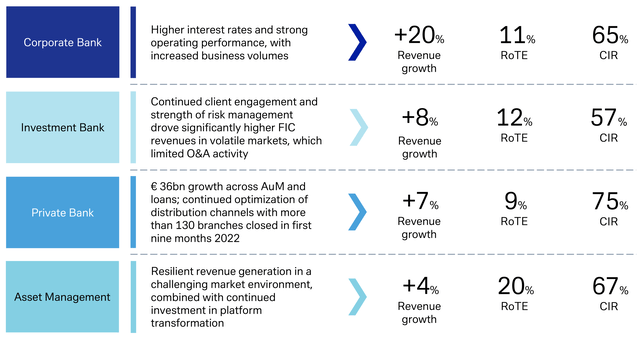

Deutsche Bank achieved broad-based growth in its third quarter, led by a rise in corporate banking activities. As with most banks, Deutsche benefitted from rising interest rates, which supported its credit activities. Rising interest rates don’t only allow banks to charge higher spreads on loans but also tend to taper inflation, subsequently minimizing the erosion of debt portfolios.

Surprisingly Deutsche Bank extended its investment banking unit’s top-line revenue versus the same time last year. Much of the segment’s revenue surge was due to successful trading execution, with emerging market exposure playing a big hand in building successful investment portfolios. In addition, Deutsche’s financing revenues were bolstered by executing pipeline projects.

Despite the bank’s investment banking positives, systemic risk has likely played its hand, as Deutsche’s equity origination and advisory was significantly lower than at the same time last year. In our opinion, this can’t be assigned to the bank itself; instead, we believe the tame IPO market to be the primary influencing variable.

Furthermore, Deutsche’s private banking activities were a mixed bag. The segment grew during the quarter. However, much of its growth was due to FX translations that benefitted both top-line and bottom-line figures. On the plus side, Deutsche captured approximately $8 billion in client assets under management inflows. We find this relatively surprising given 2022’s bear market and rising global inflation.

Lastly, the firm’s asset management division remained relatively stagnant as the company is in a restructuring process with aggressive capital deployment on key hires and platform development. Despite its underwhelming growth, the division’s 20% ROTE (return on tangible equity) reveals it’s worthwhile to expand on proceedings. In practice, companies look at various inter-segmental return measures to determine CapEx allocation. And the asset management leg’s impressive ROTE means it’s trivial to re-invest in the division.

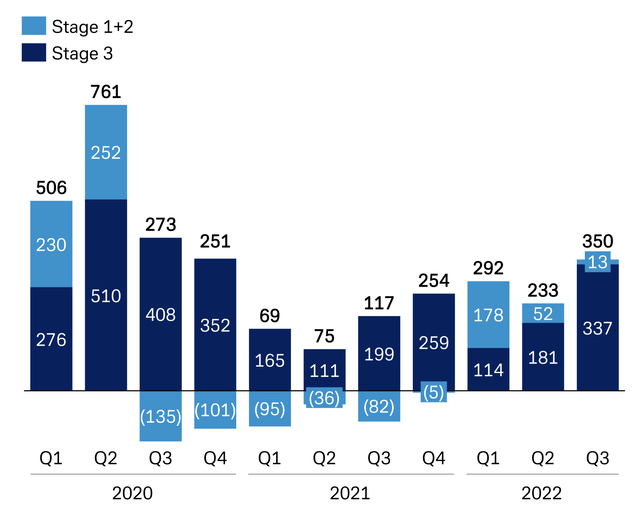

A concerning feature of the bank’s latest earnings report is its increased provisions for loan losses, indicating that it anticipates higher counter-party risk. Deutsche’s provisions have grown exponentially since the turn of 2021, conveying possible fault lines in today’s economy.

Provision for Credit Losses (Deutsche Bank)

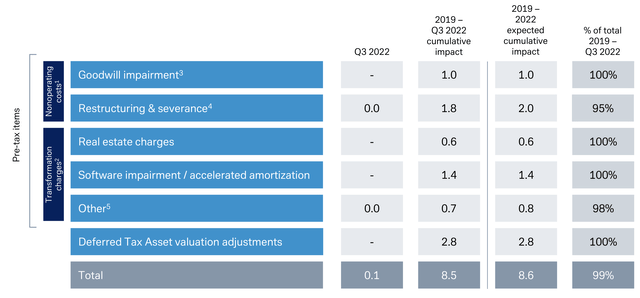

Furthermore, Deutsche’s sitting on $8.6 billion of transformation-related liabilities that could dent future earnings reports. These are usually considered non-core items and get backed out of a stock’s valuation. Nonetheless, we’re worried about the bank’s deferred tax liability, especially during a period of high recession risk.

Restructuring charges and intangible asset impairments such as software development costs aren’t an issue to us, as they’re part of a fundamental shift in the business’s growth trajectory. Additionally, goodwill impairment can’t be reversed under GAAP or IFRS accounting standards; however, goodwill impairments are regular occurrences; thus, we don’t see this as a threat to Deutsche Bank’s stock price.

Macroeconomic Influence

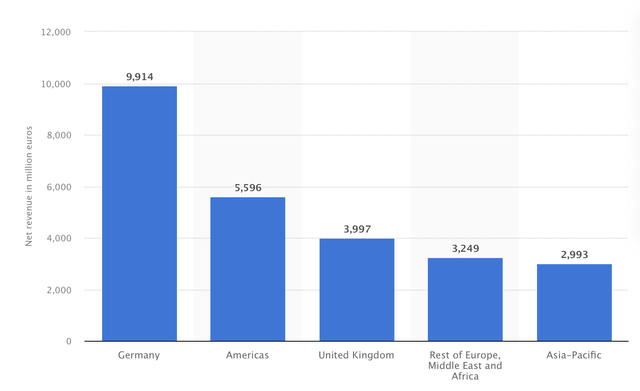

A key consideration should be Deutsche Bank’s exposure to Germany, a country with alarming recession risk amid the Russia-Ukraine war. Russia supplied much of Germany’s upstream utilities, and a pivot towards alternative sources could wane the nation’s economy. Therefore, we’re wary of the potential slowing economic growth attached to the country and the influence it could have on Deutsche.

Revenue by Region – 2021 (Statista)

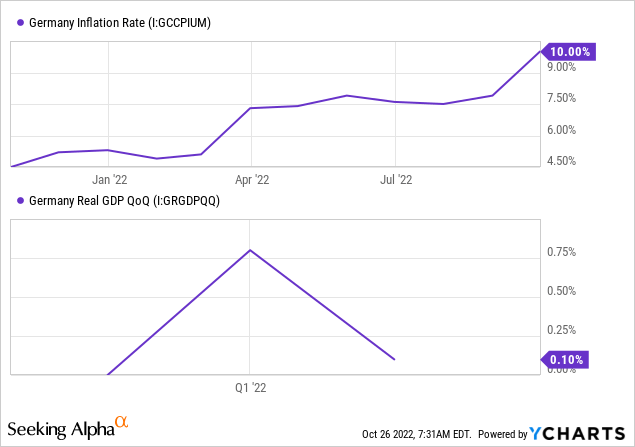

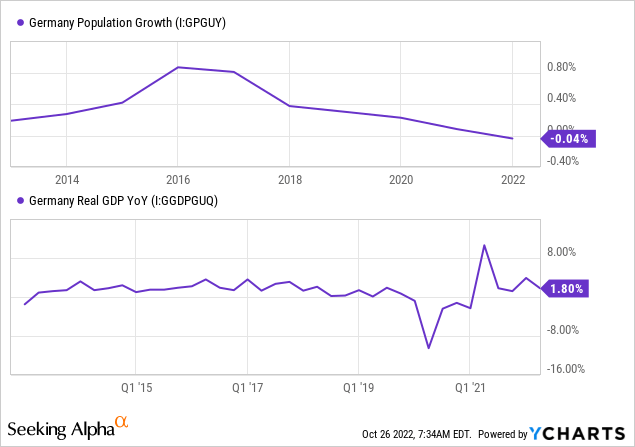

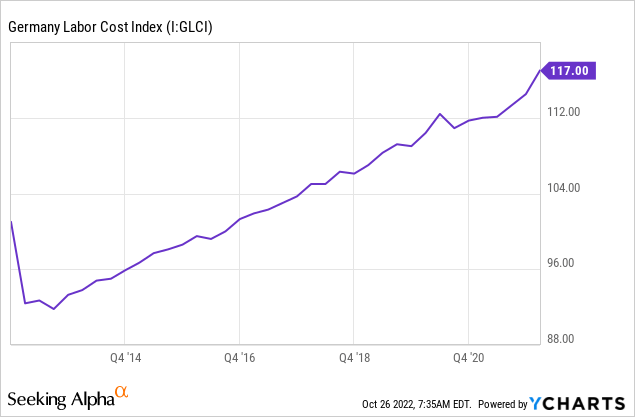

Moreover, Germany and the Eurozone are generally faced with a long-term slowing economic trajectory. For example, notice (in the diagram below) how Germany’s population growth is slowing and its GDP is flatlining. These are both indicators of economic growth, and they’re unfavorable in Germany’s case. In addition, witness (in the diagram below) the exponential rise in Germany’s labor cost index over the past decade, which signals higher general input costs and potential diminishing profitability of the nation’s private sector (including banks).

DB Stock Valuation

Our biggest short-term draw to Deutsche is its valuation metrics. At a price-to-book value of merely 0.27, the stock seems undervalued on a relative basis. To add more substance, the stock’s PE Ratio is accommodated by a PEG of only 0.20, implying the stock’s earnings-per-share growth is potentially underscored by the market.

| Price-to-Book | 0.27 |

| Price-to-Earnings | 7.42 |

| PEG | 0.20 |

Source: Seeking Alpha

Relative valuation metrics should ideally be looked at in collaboration with other variables. Nonetheless, Deutsche’s valuation ratios paint a bullish picture.

Final Word On Deutsche Bank’s Stock

Our bullish argument centers itself from a short-to-medium-term vantage point. We firmly believe Deutsche Bank’s stock is oversold, undervalued, and primed for recovery. The bank’s most recent earnings report conveys its ability to yield returns in bear markets while leveraging a rising interest rate environment. Moreover, Deutsche’s asset management division’s restructuring could pay dividends amid high returns on capital.

Despite various macroeconomic woes, increased counter-party risk, and a stagnant IPO market, we see short-term upside for Deutsche and will revise our stance in due course.

Be the first to comment