Nordroden

Just over two months ago, I wrote on Hecla (NYSE:HL), noting that while it had another solid quarter in Q2, inflationary pressures had overshadowed the strong performance (3.65 million ounces of silver, ~45,700 ounces of gold) and impacted margins. For this reason, I didn’t see any reason to pay up for the stock above $4.30. The stock suffered a 20% drawdown shortly after but managed to hold its July lows and has recovered all of its lost ground since then, outperforming the Gold Miners Index (GDX).

This strong recovery can be attributed to another quarter of solid operational performance, highlighted by record throughput at Greens Creek, a record year for throughput at Lucky Friday, and a record monthly throughput in September at Casa Berardi. While this won’t lead to record results due to lower metal prices, Hecla is set up for new records in 2024 as Keno Hill ramps up to commercial production, assuming metal prices cooperate. So, with Hecla boasting industry-leading margins and benefiting from having Tier-1 operations at a time when this is more important than ever, I would view any dips below US$3.85 as buying opportunities.

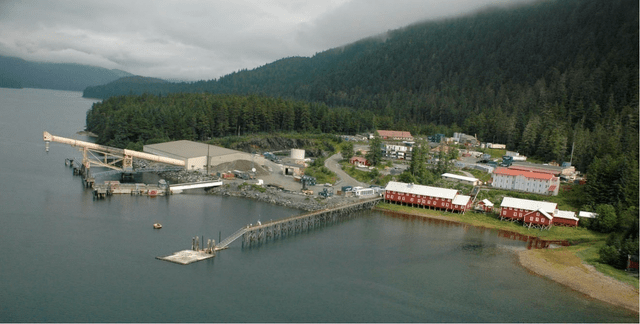

Greens Creek Operations (Company Presentation)

Q3 Results

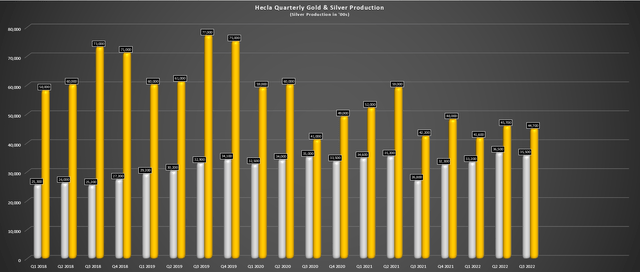

Hecla released its preliminary Q3 results earlier this month, reporting quarterly production of ~3.55 million ounces of silver and ~44,700 ounces of gold. This translated to a 3% decline in silver production vs. the year-ago period and a 2% decline in gold production, which might not seem all that impressive from a headline standpoint. However, on a year-to-date basis (first nine months), Hecla’s silver production is 9% higher at ~10.5 million ounces, and gold production is flat year-over-year after adjusting for ~20,200 ounces from its Nevada operations, which are now under care and maintenance. Given the challenges sector-wide from a labor standpoint, this performance is commendable.

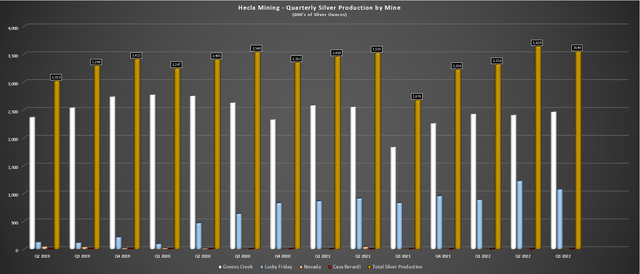

Hecla Mining – Quarterly Silver Production by Mine (Company Filings, Author’s Chart)

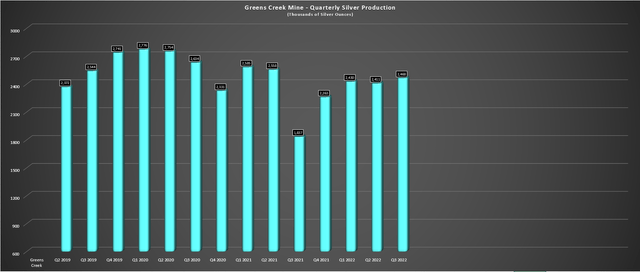

Looking at the chart above, we can see that Greens Creek was the star performer, producing ~2.47 million ounces of silver and ~11,4000 ounces of gold, translating to a 2% increase and 4% decline year-over-year, respectively. This was largely due to lower gold, lead, and zinc grades due to mine sequencing. On the positive side, the mill operated at a record throughput rate of 2,500 tons per day, which is quite encouraging given that Greens Creek has an industry-leading mine life (15+ years) to support higher production rates if sustainable. Given the solid Q3 performance, guidance has been increased to 9.3 to 9.6 million ounces of silver and 44,000 to 46,000 ounces of gold for the year at the Alaskan operation.

Greens Creek Quarterly Silver Production (Company Filings, Author’s Chart)

Moving to Lucky Friday, the mine produced ~1.07 million ounces of silver, a 12% decline from the year-ago period. However, the lower production was related to lower milled grades and mined tons as new equipment is commissioned, and projects are underway intending to increase future throughput. The highlight was that the mill operated at 986 tons per day in Q3, well ahead of the 860 tons per day in the year-ago period. The result is Lucky Friday is on track for a record year for throughput and is also expected to achieve its annual guidance.

Hecla – Quarterly Metals Production (Company Filings, Author’s Chart)

Finally, Casa Berardi had a decent quarter, producing ~33,300 ounces of gold, which was flat from the year-ago period. On a year-to-date basis, production is also flat, sitting at ~97,000 ounces of gold production and on track to meet annual guidance of 125,000 to 132,000 ounces. The positive development here in the quarter was that, like its other two operations, Casa Berardi also saw strong throughput, reporting a record monthly throughput of 4,856 tons per day in September. The key for this asset will be cost performance, though.

For those unfamiliar, the mine has struggled from a cost standpoint year-to-date (Q2 AISC: $1,641/oz) due to not benefiting from by-product credits like Hecla’s other operations and being a higher-volume operation. So, with gold prices below $1,700/oz currently, this asset has razor-thin margins from an all-in sustaining cost standpoint and is losing money from an all-in cost standpoint, assuming costs remain above $1,550/oz.

Recent Developments

As discussed in my July article, Hecla made a smart move in the lower portion of the cycle, scooping up Alexco Resources for less than 0.75x P/NAV, adding a fourth mining operation, and sticking to its core strategy. This strategy has been to operate the highest-grade mines in safe jurisdictions, and with an average north of 800 grams per tonne of silver and a mine in the Yukon Territories, Alexco certainly met this criterion. Hecla noted in its preliminary Q3 results that pre-production development work is now 20% complete following the closing of the acquisition, and the company is aiming for consistent mill production in 2023.

Keno Hill Mineralization (Company Presentation)

Hecla’s most recent presentation highlighted that it focuses on development and drilling in the 8-million-ounce Bear Zone and on development and drilling in the Upper Lightning Zone to supplement Bermingham ore. In a better case scenario than the 400-ton-per-day goal that Alexco’s team failed to reach, this is a mine capable of producing over a million ounces per annum of silver in concentrate at a 500+ tonne per day throughput rate. Under a more experienced team that excels at underground mining at its current operations, this might be achievable and would make the price paid even more attractive.

Keno Hill Operations (Company Technical Report)

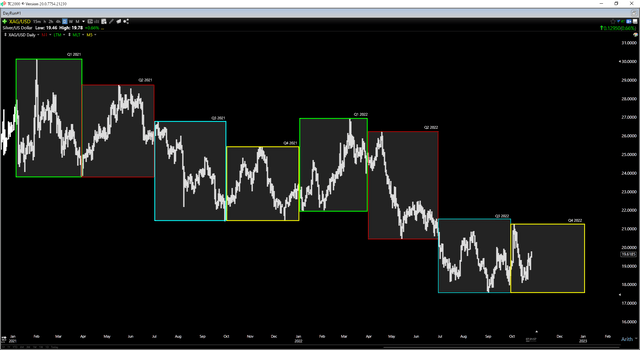

Unfortunately, this timely acquisition and Hecla’s strong operating performance have been overshadowed by much weaker metals prices, with gold continuing to hang out below $1,700/oz and silver losing the psychological $20.00/oz level. As the chart below shows, silver averaged below $19.80/oz in Q3 and looks like it could see a similar average price in Q4 2022, setting up very difficult comparable results as silver producers lap $24.00/oz silver prices in the year-ago period. The result is that even if silver producers see similar sales volumes, revenue will be down over 15% year-over-year and operating cash flow will drop even further, impacted by inflationary pressures.

The good news? These difficult year-over-year comps are now in the rearview mirror, and with the market being forward-looking, silver producers are now set up for much easier comps in 2023, meaning they could see outsized moves if silver regains heads back above $24.00/oz. Let’s take a look at Hecla’s valuation:

Silver Futures Price (TC2000.com)

Valuation & Technical Picture

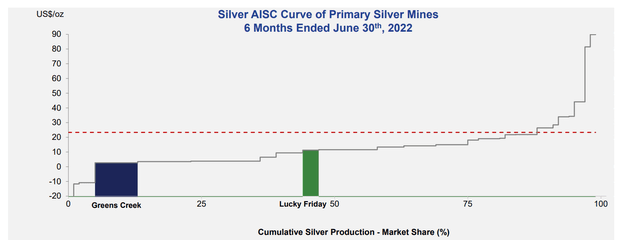

Based on an estimated year-end share count of ~609 million shares and a share price of $4.80, Hecla trades at a market cap of ~$2.92 billion, making it one of the highest capitalization silver producers in the sector. If we compare this figure to an estimated net asset value of $2.27 billion, this leaves Hecla trading at a 1.28x P/NAV, a steep discount to lower-quality names like First Majestic (AG), but a large premium to some of the largest producers sector-wide. In my view, much of this premium is justified, given that Hecla now owns four Tier-1 jurisdiction operations, benefits from industry-leading costs, and is one of the few silver producers that could weather a major bear market in gold/silver due to its attractive cost profile.

Silver AISC Curve of Primary Silver Mines vs. Hecla’s Greens Creek/Lucky Friday Mines (Company Presentation)

Based on what I believe to be a fair multiple of 1.60x P/NAV, this translates to a fair value for Hecla at $5.95, pointing to a 25% upside from current levels. While this is an attractive upside case, I prefer to buy at a minimum 35% discount to fair value, suggesting the ideal buy zone for the stock is $3.85. From a cash flow standpoint, this corroborates the view that HL is inching toward the upper portion of its valuation range after its recent rally, with it currently trading at ~12.6x FY23 cash flow estimates ($0.38), with a fair value for the stock of $6.08 even if we assume a slight premium to its historical multiple (16.0x cash flow vs. 15.0x).

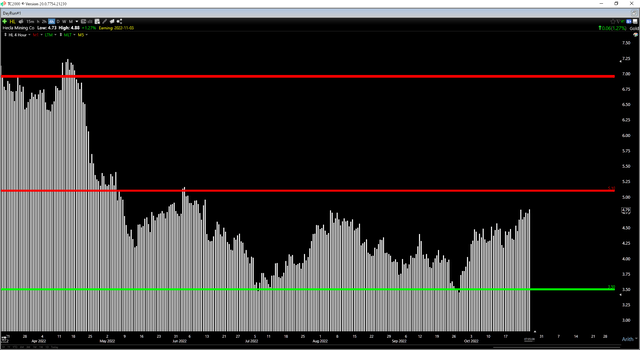

Finally, if we look at the technical picture, HL is now trading in the upper portion of its support/resistance zone, sitting $0.30 shy of potential resistance ($5.10) and $1.30 from support at ($3.50). While it’s certainly possible that the stock could break through resistance here, I prefer only to buy at a minimum 6 to 1 reward/risk ratio, and Hecla’s reward/risk ratio currently comes in at 0.23 to 1.0. Hence, from a technical standpoint as well, I don’t see this as a low-risk buy point for the stock above $4.80.

Summary

For investors looking for exposure to the precious metals sector, Hecla is certainly one of the better names, and this is a major statement given that the silver space typically has much lower quality operators (higher costs, lower reserve lives, spotty track records). That said, I’ve never found much value in investing in precious metals names at a 25% plus premium to net asset value, and Hecla sits near a 30% premium to its net asset value. This does not mean HL can’t head higher, but I prefer to go where the extreme valuation disconnects are, and I see better relative value elsewhere in the sector.

Two names with clear valuation disconnects are Karora (OTCQX:KRRGF) at 0.40x P/NAV in a Tier-1 jurisdiction and i-80 Gold (IAUX) at 0.35x P/NAV and boasting the best organic growth profile in the sector (potential to be a 550,000-ounce producer by 2029).

Be the first to comment