bjdlzx

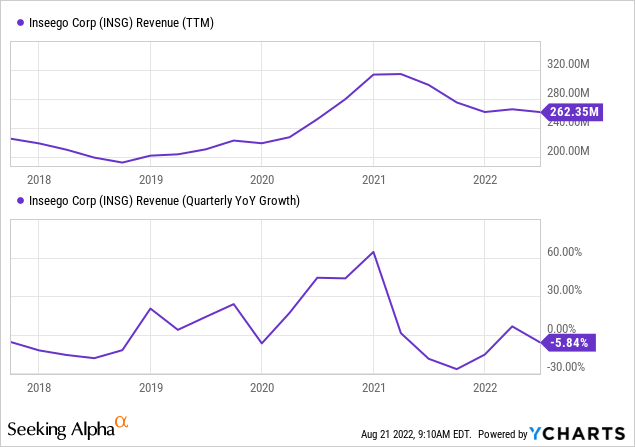

Inseego (NASDAQ:INSG) has been a big disappointment. After the 4G-based work from home/pandemic boom that lasted until early 2021 we expected this to quickly turn on other growth motors that had the additional benefit of increasing gross margins:

- 5G carrier market

- FWA (fixed-wireless access) enterprise market, a new market for the company and 3x the size of the carrier market

- SaaS solutions that come on top of FWA enterprise deployments

All three of these carry higher gross margins, the SaaS most notably so, of course. What happened was that these things are indeed happening, but a lot slower than we expected, and apparently also management, from the Q2CC:

While it has taken longer than we would like, we are finally starting to see that promise become a reality.

The downturn in 2021 is accentuated by the divestiture of their Ctrack South Africa business:

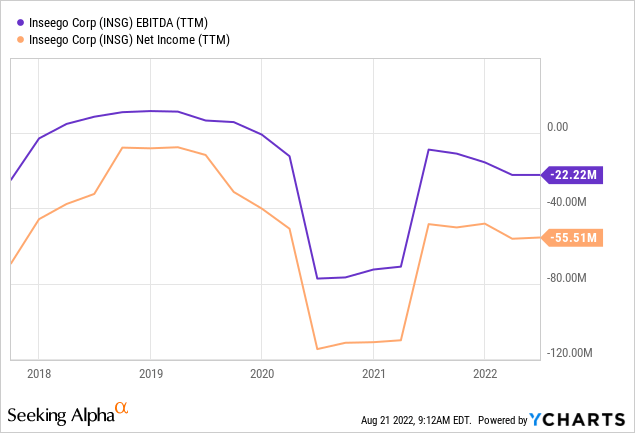

The financial results in the meantime were pretty awful:

But this looks set to change.

FWA or Fixed Wireless Access

But there seems to be light at the end of the tunnel and the FWA/enterprise market seems set for a multi-year upturn in H2 on the back of the mid-band carrier networks that are ideally suited for these, providing an ideal combination of range, penetration and speed, and new cost-effective data plans for business, from the (Q2CC, our emphasis):

we started to see several enterprise customers convert 5G pilots into full-fledged large multi-location deployments… the size of the pipeline is like triple, quadruple since we last spoke

And that pipeline is changing into trials and real deployments as well. The company has three different ways to sell this:

- Their stock business is where a carrier buys routers like the FX2000 and delivers them to customers. Activity has accelerated since last November at T-Mobile and management expects significant restocking from them in H2.

- Joint sales, already to over 400 customers alongside T-Mobile’s sales force. The advantage here is significantly higher margins and much higher software attach rates.

- The VAR channel, working with the top VARs from AT&T and Verizon and they have a large pipeline of enterprise customers, according to management.

SaaS

What we are particularly enthusiastic about is their SaaS suite for managing enterprise WANs (Wide Area Networks). They added another important component to the suite in the form of their 5G SD EDGE solution (Q2CC):

This expands our software capabilities beyond cloud management to complete corporate IT management. With Inseego’s 5G SD EDGE, enterprises now have the tools to secure, automate and orchestrate the management of their wireless wide area networks, much like they do with their wired WANs… We believe this solution will offer a much more simplified approach to enhance security and network policy management compared to traditional on-premise WAN management solutions. We are already in pilots with multiple customers, and we expect our first launch customers this quarter.

This boosts their SaaS package and another element is that they are subsuming their asset tracking software Ctrack under this enterprise umbrella as well which would open up additional use cases and demand.

They are also introducing their third generation 5G hotspot, the MiFi X Pro, with carriers like Telstra of Australia and a US Tier 1 carrier already signed up as customers.

Finances

Revenue growth (pro forma, after factoring in the divestiture of Ctrack South Africa) was up 6%. Growth is still modest as 4G sales have a long but declining tail. The finances are still pretty ugly as we showed above but as 4G tapers off and 5G and FWA enterprise gathers pace we now have a real prospect of:

- Accelerating revenue growth

- Gross margin expansion (which is already happening, as 5G, enterprise and especially SaaS carry higher or much higher margins than 4G).

- Operational leverage and cash flow production.

Gross margin increased 220bp to 29.5% and management argues that they will not need a lot of additional OpEx supporting the growth going forward, also with major product certifications in the rearview mirror.

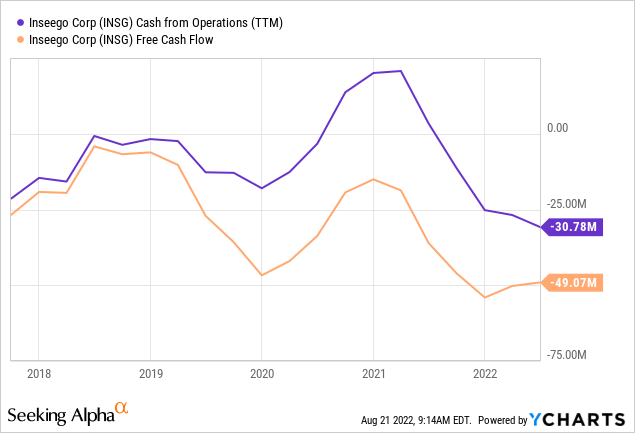

Still, non-GAAP net loss was $9.5M even if AEBITDA loss was only $1M. Cash flow is still negative but at least it’s moving in the right direction, although Q2 seems to have delivered a considerable retreat.

The main H1 items with regards to cash flow were the net loss ($37.6M), inventories (an increase of $10.1M) and receivables (a decrease by $5.2M), and an increase in accounts payable ($6.2M) so they’re not out of the woods in terms of cash flow, but management promises to be cash flow breakeven by the end of the year.

Other positives are that the company isn’t likely to suffer a great deal should the economy end in recession as these networks are pretty strategic for companies and they offer a much more economical WAN solution. They also don’t have any supply chain issues.

The company has $21M of cash left and although management argues that cash burn will greatly ease in H2, that is a little low for comfort, so they entered into a $50M credit facility of which $4.5M was drawn already. They also have $157.7M in notes outstanding.

Valuation

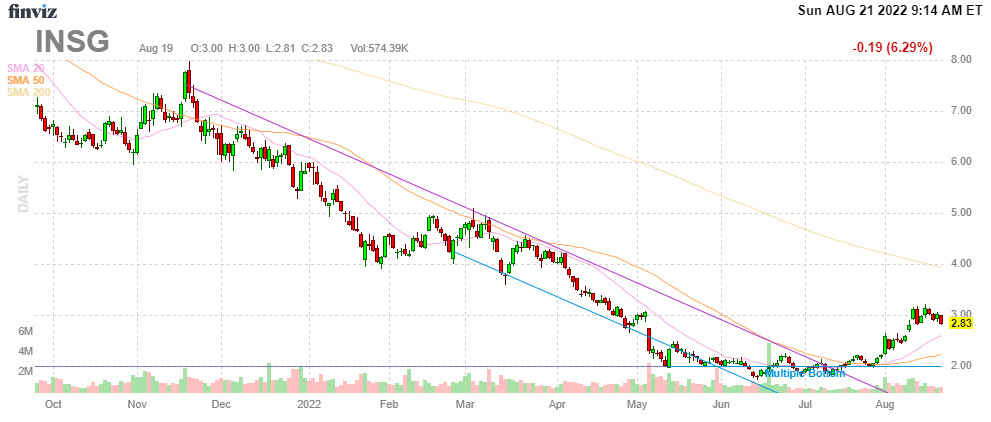

FinViz

Some relevant data:

- 107.6M shares outstanding, 5.2M options, 2.5M warrants and 1.4M RSUs

- Market cap 116.7×3.1= $361.7M

- Net debt $140M

- EV = $500M

- FY22 Revenue $258M

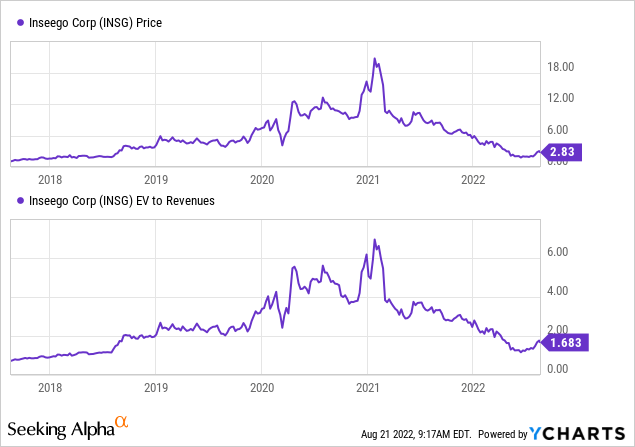

So the shares are selling at 2x EV/S. (The chart below for curious reasons doesn’t display without the top part):

But it shows that the shares are at the cheapest valuation for quite some time, which is an interesting observation to keep in mind.

Conclusion

There is a lot to like:

- The company went from one product with one carrier Verizon in 4G a couple of years ago to many products with many carriers in 5G.

- The company has added the fixed-wireless enterprise market to that, 3x the size of the carrier market and higher margins.

- The company added its own, recently expanded, SaaS software platform, producing high-margin recurring revenues. This is a distinguishing competitive feature and increases customer stickiness as well.

- Revenues are set to accelerate with declining 4G sales an ever-smaller part of revenue and FWA enterprise sales about to take off as the C-band frequencies and data plans are now in place.

- Given the strategic nature of these enterprise WANs the company isn’t likely to suffer all that much, if any, from a possible recession.

- While the company is better placed than ever for significant growth and margin expansion, the shares are, despite a 60%+ rally from the low earlier this year, still cheap on a historic basis.

- So while financial improvement will only be gradual, it will be lasting and we think there is considerable room for valuation multiple expansion.

Be the first to comment