SteveMcsweeny/iStock via Getty Images

The hawks talk. The U.S. Federal Reserve is set to convene its latest annual Economic Symposium in Jackson Hole, Wyoming later this week. The August 25-27 central banking event according to the Federal Reserve Bank of Kansas City “brings together economists, financial market participants, academics, U.S. government representatives and news media to discuss long-term policy issues of mutual concern”. Topping the list of “mutual concern” this year will almost certainly be the blistering hot inflation that has been plaguing the global economy for the last year. The stock market summer serenity may soon be in for a rude awakening.

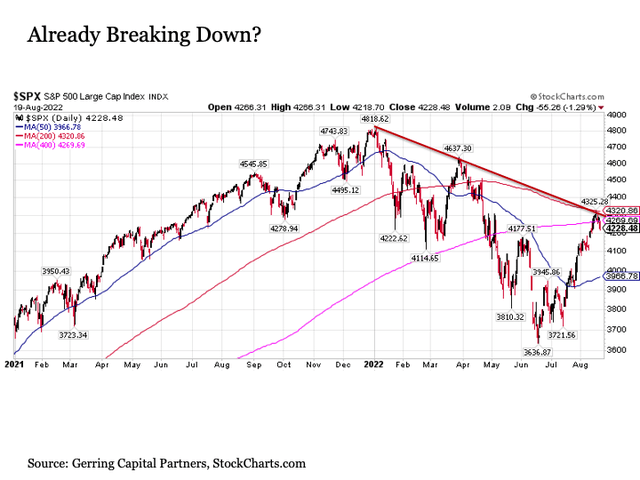

Beep, beep, beep. The wakeup call for stocks heading into the Jackson Hole meeting may have already sounded, as the set up for stocks heading into the trading week is tenuous. After having rallied for more than a month since mid-July, U.S. stocks as measured by the S&P 500 ran headfirst into two major resistance levels last Tuesday– the 200-day moving average and the downward sloping trendline dating back to the early January highs both at around 4325.

The S&P 500 subsequently turned back at this dual resistance and has since retreated by 100 points, falling back below its ultra-long-term 400-day moving average in the process. Whether stocks continue their recent descent into the new trading week remains to be seen, but S&P 500 futures are marginally lower heading into the overnight into Monday’s trading.

Hawks take flight. A supposed primary driver of the stock market bounce this summer has been the notion, wildly misguided in my view, that the U.S. Federal Reserve would soon not only back off on its aggressive monetary tightening stance due to fading inflationary pressures, but would also start easing monetary policy in response to an economy increasingly weakening toward recession. Expect the Fed to put a giant-sized fork into this idea this upcoming week.

Here’s the thing. The Fed has a Jackson Hole credibility issue that they need to address. And given that the folks at the Fed put their pants on one leg at a time like the rest of us, they are likely to overcompensate for what now look like some glaring missteps at their last two annual Symposia.

Back during the remote event in 2020 in the midst of the COVID crisis, the Fed stole the headlines with the declaration that they were willing to tolerate inflation overshooting its 2% goal for an extended period in keeping interest rates low for many years. Turns out they completely nailed this one, although I’m guessing they weren’t gunning for over 9% annual inflation in the process. Um, whoops.

Speaking of tolerating that inflation overshoot, by the time the 2021 event rolled around, the annual inflation rate had recently spiked above its 2% target up toward 4%. The Fed worked to dismiss these pricing pressures at temporary, declaring that tightening monetary policy could be particularly harmful. Turns out, maintaining easy monetary policy amid inflation that subsequently surged to its highest levels since the 1970s can also be particularly harmful too.

Such is the set up going into the 2022 Jackson Hole gathering. The Fed spent the last two meetings coming off as way to easy peasy lemon squeezy about letting monetary policy runway too loose for way too long regardless of the inflation threat as it eventually turned out. They’ve not only got some ‘splaining to do about their past Jackson Hole policy proclamations, but they need to demonstrate they have seen the light on inflation and flaunt their price stability fighting bona fides in the process.

Putting this altogether, expect the Fed to spend the Jackson Hole gathering talking consistently tough on how they plan on getting inflationary pressures under control, even if it is at the expense of the U.S. economy falling into recession. Unfortunately for recent stock market optimists, the mention of easing monetary policy or even backing off on rate hikes anytime soon will likely nowhere be found in their discussions. Instead, the focus will likely center on how aggressively the Fed will continue to hike rates and for how long. For just as Fed Chair Paul Volcker taught the begrudging world a few decades ago, a central banker has to fully slay the inflationary beast before they can turn to fight for economic growth. Today is no exception.

The dirty work is already being done. While many market participants may need to hear the hawkish words directly from the Fed Chair’s mouth later this week, the reality is that the Fed is moving increasingly aggressively to tighten monetary policy on many fronts.

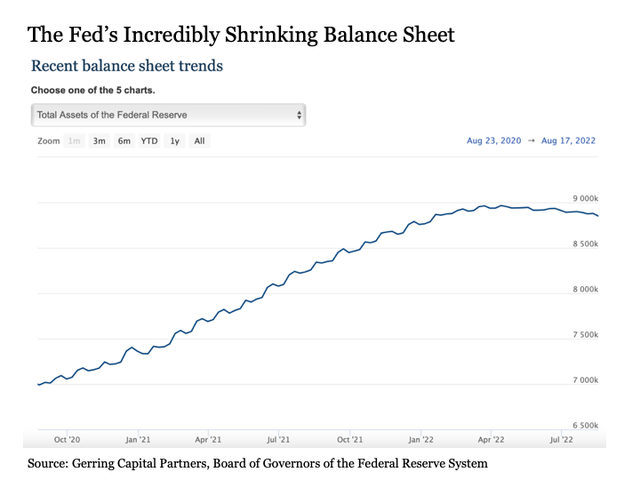

Consider the Fed’s balance sheet. From the Fed’s virtual Jackson Hole event two years ago up through mid-April of this year, the Fed’s balance sheet was steadily expanding. But since mid-April, their balance sheet has since contracted by $116 billion. Notably, $46 billion of this balance sheet reduction, or roughly 40%, has taken place in the past month.

Board of Governors of the Federal Reserve System

This confirms the notion already stated by the Fed that they plan on picking up the pace of their balance sheet reduction going forward, certainly not slow it down or start expanding it again. And given that Fed balance sheet expansion through the daily purchase of U.S. Treasury securities in particular was a major driving force that pushed U.S. stocks higher for so many years in the wake of the Great Financial Crisis, we as investors should not be surprised if the subsequent Fed balance sheet reduction through the redemption of maturing Treasury securities places commensurate downside pressure on the same U.S. stocks going forward.

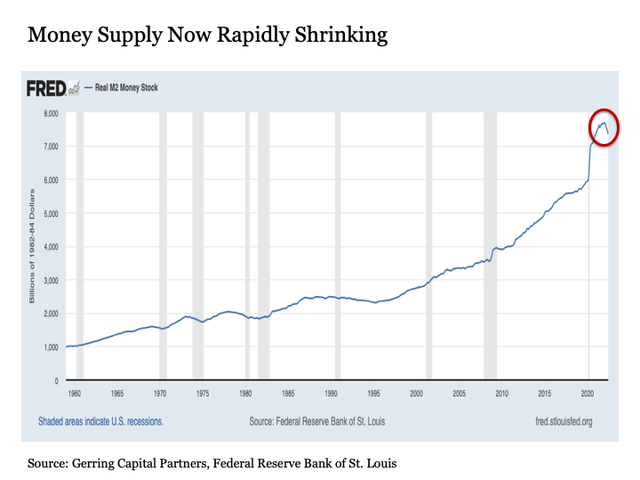

Next consider the Real M2 Money Stock. For what exploded in breathtaking fashion amid the onset of the COVID – an increase of $1 trillion, or 17% of the total money supply, in just four months – and continued to expand higher for another $700 billion through January of this year has suddenly reversed course. For in the five months since through June, the Real M2 Money Stock has shrunk by $340 billion, nearly 5% of the total money supply, and it is almost certain that the money supply will have continued to assertively decline further when the July and August data are officially available.

Federal Reserve Bank of St. Louis

The only time in recent history we have seen anything remotely similar to this pace of contraction was from June 1973 to January 1975 (20 months) and from February 1978 to May 1980 (28 months) when the real money supply shrank by roughly 9% in both instances. In both past instances, the stock market fell measurably on an inflation adjusted basis (31% and 7%, respectively), and the U.S. economy fell into recession.

Today, the money supply is shrinking much more rapidly versus these past two examples, the U.S. stock market has already fallen -25% peak-to-trough, and we’ve already booked two consecutive quarters of negative GDP growth. Thus, the fact that this money supply contraction is likely to continue for the foreseeable future is anything but a cause for optimism for stock investors.

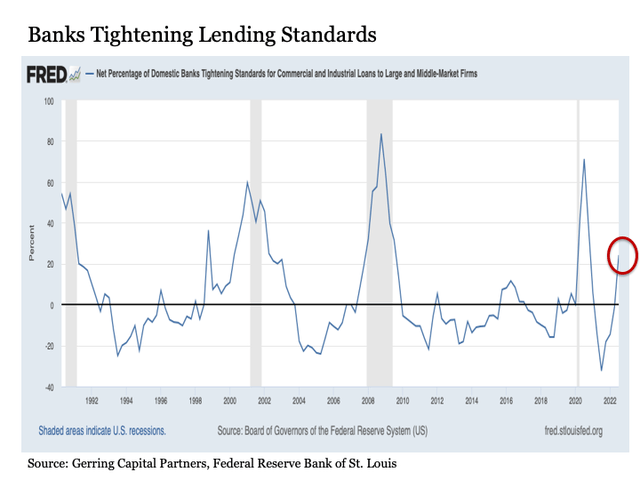

Now consider bank lending activity. After the Federal Reserve fully opened the monetary policy firehose in the wake of the COVID crisis, domestic banks reached recent records in the net percentage that were easing lending standards for commercial and industrial loans to large and middle-market firms, or more simply the companies that are the primary engines of U.S. economic growth. But as 2022 has progressed, bank lending standards have shifted markedly toward tightening. In 2022 Q3, the net percentage of domestic banks tightening lending standards reached nearly 25%.

Federal Reserve Bank of St. Louis

In each of the past four instances where this net percentage was this percentage or higher, the U.S. economy eventually fell into recession and stocks dropped by at least -15% if not much more. And the fact that U.S. banks are being compelled by regulators to raise capital suggests that an even net percentage of banks will be tightening lending standards in the coming quarters, particularly if the economy cools and falls into recession.

Get ready. The U.S. stock market has been remarkably resilient this summer in the face of higher short-term interest rates and corporate earnings that came in well below expectations coming into the quarter. But while inflationary pressures may continue to come down in the coming months, the Fed is likely to use it’s time back in the valleys of Wyoming later this week to make sure everyone knows it has the monetary policy long guns out for inflation, the economic and stock market consequences be damned.

As a result, risk averse investors that have not already reduced their target weighting to stocks earlier this year within their diversified asset allocation strategy may wish to consider making marginal adjustments in the week ahead and reallocating the sale proceeds either to investment grade ultra-short-term bonds or possibly to long-term U.S. Treasuries and/or gold for those that may be underweight these allocations within their portfolio strategy.

Less diplomatically, if you are still up to your eyeballs in tech stocks, you may want to take the opportunity after a strong summer rally to raise some cash before the Fed starts jawboning later this week.

Be the first to comment