Pgiam/iStock via Getty Images

Investment Thesis

ACCO Brands (NYSE:ACCO) should benefit from a strong back-to-school season and a return-to-office trend, which along with the pricing action taken on July 1 is expected to support the growth in 2H FY22. This growth should be partially offset by a volume decline in the PowerA brand, which sells gaming accessories. The gaming industry is experiencing a shortage in semiconductor chips and a reset in demand levels due to the reopening of the economy post-COVID. The stock is trading at a discount to its historical levels and while its high debt levels increases risks, it can be a speculative buy at the current levels.

ACCO’s Q2 FY22 Earnings

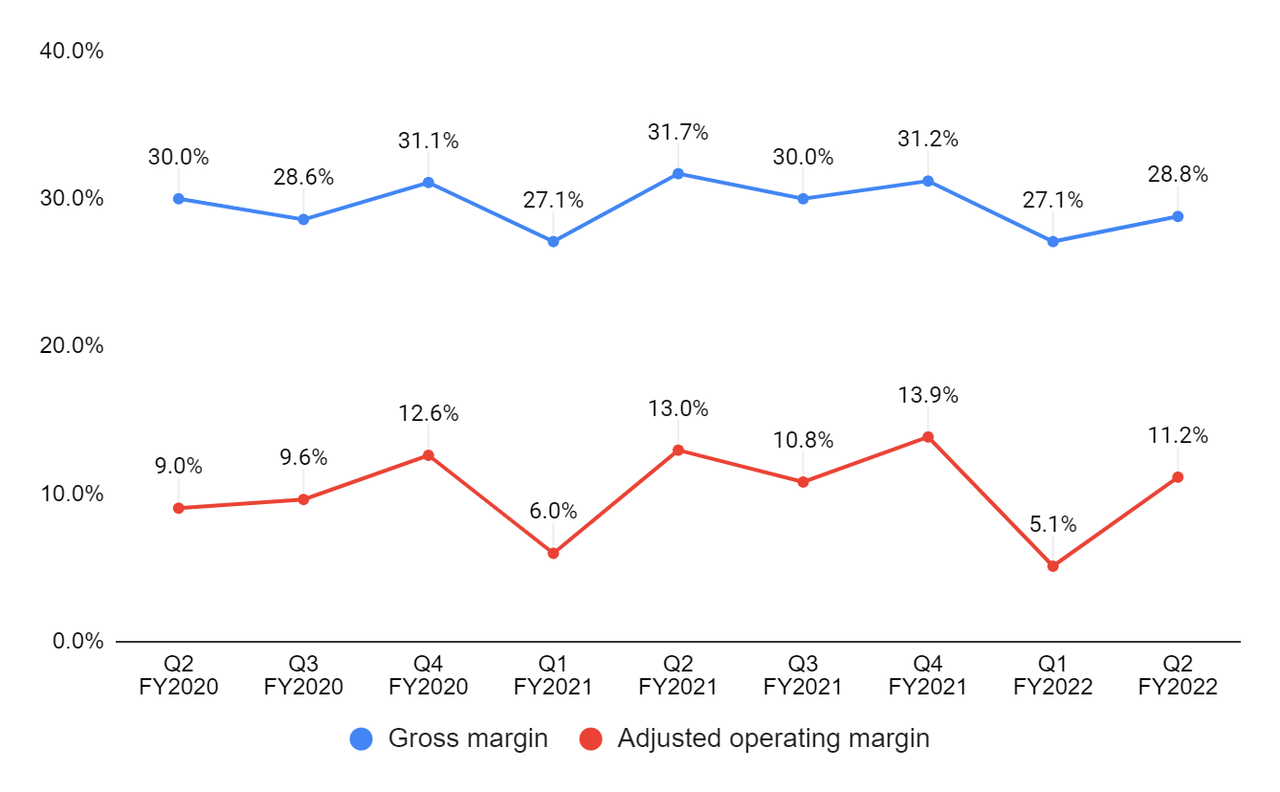

Last month, ACCO Brands reported lower-than-expected second quarter FY22 financial results. The revenue in the quarter was up 0.6% Y/Y to $521 mn (vs. the consensus estimate of $538.57 mn). The adjusted EPS was down 14% Y/Y to $0.37 (vs. the consensus estimate of $0.42). The revenue growth in the quarter was driven by higher pricing (8% Y/Y), partially offset by lower volume (-3% Y/Y) and a negative impact of 4.6% from unfavorable currency translation. The adjusted operating margin in the quarter declined 180 bps Y/Y to 11.2% Y/Y due to the impact of inflationary cost pressures in materials and freight, resulting in a 14% Y/Y decline in adjusted EPS in the quarter.

Revenue Outlook

The Comparable sales in Q2 FY22 were up 5% Y/Y driven by improved pricing, great back-to-school sell-in in North America, strong post-COVID recovery in Latin America, and return to office momentum in the market. Comparable sales represent net sales excluding the impact of acquisitions and foreign currency translation. Excluding the sales of gaming accessories, comparable sales were up 9% in the quarter. The sales of the PowerA brand, which sells gaming accessories, were down due to the reset in demand in the gaming industry and semiconductor chip shortages.

In North America, comparable sales increased 4% Y/Y due to higher pricing and increased volume in the majority of the products, partially offset by volume declines in gaming accessories. The demand for school and business products, and computer accessories remained strong. For back-to-school selling season, retailers pulled forward some of the orders to ensure they have inventory levels to tackle the supply chain issues. In the EMEA region, comparable sales were flat Y/Y driven by price increases, partially offset by volume declines. Volumes in the segment were negatively impacted by high inflation in the region and a demand reduction. Comparable sales in the International segment rose 20% Y/Y driven equally by higher pricing and higher volumes. The volume growth was due to the improved demand in Latin America, especially for note-taking products at schools and the opening of businesses for in-person work.

In December 2020, ACCO acquired PowerA, which is a leading provider of third-party video-gaming controllers, power charging solutions, and headsets. PowerA has a strong history of double-digit sales growth, and the company (PowerA) was able to deliver 22% sales growth in FY21 post-acquisition. However, for FY22, ACCO Brands has reduced the year-over-year sales growth guidance range for PowerA from +5% to +10% previously to negative 10% to negative 15% due to the weak 1H FY22 results driven by softening in demand for gaming accessories and semiconductor chip shortages. During the COVID years, the demand for the gaming industry shot up as people were spending more time at home. However, with the reopening of the economy, people are more inclined to travel and do other things, which are resulting in a decrease in demand. This is also experienced by companies such as NVIDIA (NVDA), Turtle Beach, and Corsair. However, over the medium term, the demand for the gaming industry is expected to normalize and reach pre-COVID levels by the end of 2023 after which it can resume its long-term growth trajectory.

The long-term prospects for the gaming industry look strong with an increasing number of people gaming all over the world, and the industry is expected to grow in the mid-to-high single digits. The company’s underrepresented presence in EMEA and Asia gives it the opportunity to gain market share and grow in the low double-digits.

ACCO reduced the mid-point of its comparable sales growth guidance and reduce the range from 3.5% to 8.5%, previously to 4% to 6%, primarily due to the headwinds in the gaming industry. There are also some concerns due to the current macro situation and fed rate hikes. However, so far, benefits from the economy reopening have offset the macro concerns with strong replenishment activity for back-to-school products and return to office trends driving growth and I expect this trend to continue. The office occupancy rate has been increasing as per the Kastle office occupancy barometer, but it is still below the pre-COVID occupancy rate. The pricing action taken by the company on July 1 to offset the inflationary cost pressures should also offset any volume headwinds.

ACCO Margins

The company’s margin in Q2 FY22 was impacted by the cumulative price cost gap despite numerous price increases. To offset this, the company took another price hike in July, which is expected to benefit in 2H FY22. The adjusted operating margin in the North America segment declined 160 bps Y/Y to 18.7% due to higher commodity materials, including paper, and increased freight costs. The adjusted operating margin in the EMEA segment declined by 730 bps Y/Y as previous price hikes were not able to fully offset inflation and the cost increases in locally sourced raw materials and energy costs. The adjusted operating margin in the International segment improved 390 bps Y/Y to 11.2%, driven by higher sales, stronger product mix, and cost control.

ACCO’s gross margin and adjusted operating margin (Company Data, GS Analytics Research)

Looking forward, the adjusted margin of the company across all three segments should improve in 2H FY22 as the pricing action taken by the company flows through P&L along with the moderation in higher input costs.

ACCO Brands Valuation & Conclusion

The stock is currently trading at ~3.66x FY22 consensus EPS estimate of $1.40 and ~3.11x FY23 consensus EPS estimate of $1.65, which is lower than its five-year average forward P/E of 7.89x. The low P/E is likely due to the company’s high debt levels – the company has net debt of $1.192 bn which is ~4.75x its trailing twelve months EBITDA of $250.7 mn. On an EV/EBITDA basis, the stock is trading at 5.90x forward estimates which is also a discount to its 5-year average of 6.66x.

In the near term, the company’s revenue and margin should improve, driven by the pricing actions taken and a strong back-to-school season. As the demand in the gaming industry stabilizes and supply chain constraints ease, the company’s revenue should improve in the long term.

While there are some risks associated with high debt levels, I believe the stock is too attractive to ignore especially given the upcoming tailwinds like EBITDA growth prospects as the economy reopens. Hence, I think a small speculative position can be taken in ACCO stock and, hence, I rate the stock a buy.

Be the first to comment