hh5800

One of the most intriguing companies on the market today is a fairly small company that goes by the name Nano Dimension (NASDAQ:NNDM). These days, the firm operates as a provider of additive manufacturing, also known as 3-D printing technologies. Unlike many of the other players in this space though, its emphasis is on providing machines and materials that can print electronic devices such as the circuit board. Like many other companies on the market more broadly, shares have not exactly responded well during the recent downturn. However, I do believe that the downside the company has experienced is severely unwarranted. If anything, shares now look drastically undervalued, with the only major complaint being some of the decisions management has made in recent months. All things considered, I have decided to increase my rating on the company from a ‘buy’ to a ‘strong buy’ to reflect my belief that it should significantly outperform the broader market moving forward.

A unique situation

Back in late March of this year, I wrote my first article on Nano Dimension, discussing what investors should anticipate when the company reported results for the final quarter of its 2021 fiscal year. In that article, I talked about the work management had put in to position the company in a very particular and potentially valuable niche. But due to the fact that the firm was generating very little revenue and was incurring significant cash outflows, I concluded that it was a race against its own cash burn to see whether the company can gain significant traction. But given just how lopsided the valuation looked, I ended up rating the company a ‘buy’. In the months that followed, things have not gone exactly as planned. While the S&P 500 is down by 15.9%, shares of Nano Dimension have plunged by 34.3%.

Author – SEC EDGAR Data

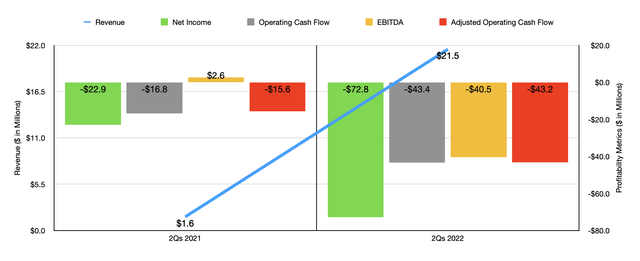

Normally, I wouldn’t bother with a company like Nano Dimension. In addition to operating in a space that I believe has been overhyped over the past several years, the company also has a problem when it comes to profits and cash flows. At the same time, however, revenue for the company is expanding rapidly. To see what I mean, we need only to discuss the most recent financial data for the business. During the first two quarters of the 2022 fiscal year, sales came in at $21.53 million. Though this may not seem like much for a company with a market capitalization of $641 million, it represents a significant improvement over the $1.62 million in revenue generated the same two quarters one year earlier. Unfortunately, management has not offered a great deal of information. At the end of the day though, they said that most of this sales increase came from additional revenue from its core operations. Although the company is not going to release financial results covering the third quarter of its 2022 fiscal year until early December, they did give preliminary sales figures of $10 million. That’s 646% higher than what the company generated in the third quarter of 2021. That should bring sales for the first nine months of the year up to $31.5 million, a 963% increase over what the company experienced at the same time one year ago.

While it’s great to see revenue surging, the dark side is that the company generates significant net losses and cash outflows. During the same six months of the 2022 fiscal year, the company generated a loss of $72.83 million. That compares to the $22.92 million loss the company incurred in the first half of the 2021 fiscal year. But this was not the only profitability metric to show weakness. Operating cash flow went from negative $16.80 million to negative $43.48 million. Even if we adjust for changes in working capital, it would have gone from negative $15.61 million to $43.22 million. Even worse was the trend seen by EBITDA, a metric that went from a positive $2.64 million to a negative $40.47 million.

I love seeing growth. But it’s rare that any amount of growth is enough to make up for such significant losses and cash outflows. What really impresses me about the company though is the fact that it actually has a negative enterprise value. In all my years of investing, I have only seen this kind of circumstance a handful of times. Based on the estimates for the third quarter, the company has cash and cash equivalents in excess of debt totaling almost $1.19 billion. Actual debt on a gross basis is actually less than $1 million according to the second quarter earnings release. By comparison, the market capitalization of the company comes out to $641 million. That implies an enterprise value that is negative to the tune of $546 million.

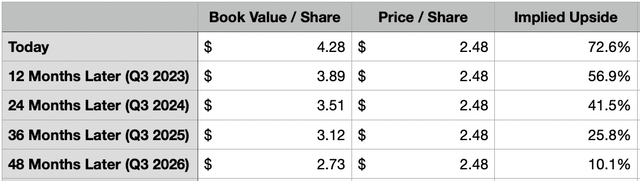

Author

After stripping out intangible assets from the equation, I ended up getting a book value per share for the company of $4.28. And most of that is in the form of cash. By comparison, shares today are $2.48. Based on data from the first half of the 2022 fiscal year, the company is losing nearly $90 million per year in cash. If we increase that to $100 million per year, the company would still have a book value per share one year out from now of $3.89. In fact, following that trend, the book value per share out in 2026 would be $2.73, implying a 10.1% upside over where shares are priced today. It’s not unthinkable that as revenue continues to increase, cash outflows might increase as well. But this does go to illustrate just how much cash the company has that it can burn through before facing real financial trouble. And when you consider how fast sales are growing, it’s not unreasonable to think that financial performance will improve before this occurs.

It’s also worth noting that management is focused on more than just organic growth. Some of these decisions might end up being wise. For instance, in July of this year, management acquired Formatec Holding, a leading developer and manufacturer of additive manufacturing printing systems for ceramic and metal end-user parts and a business that uses specialized materials to produce an array of parts across multiple industries. That particular firm brought in $5.3 million in revenue during the 2021 fiscal year and cost shareholders only $12.9 million on a net basis. Later that same month, the company announced that it had acquired a 12.12% ownership interest in Stratasys (SSYS), a leader in the smart and connected 3D printers space. As of this writing, that ownership stake is worth around $115.85 million. This is not to say that I approve of every decision management has made. In May of this year, for instance, the company did announce a $100 million share buyback program. In normal circumstances, with the company trading so cheap, I would say that this is a no-brainer. But as a value-oriented investor, I tend to prioritize a conservative approach to business. And as such, I believe a better use of funds would involve investing them into further growth and achieving positive cash flow. Fortunately, this buyback program does not require the company to repurchase shares. And we have no evidence right now that they have acquired any. But if they do, I would find that disconcerting.

Takeaway

When I look at Nano Dimension, I see a case of contradictions. Revenue is growing rapidly but shares are cheap. Cash flows are significantly negative, but I find the company fundamentally attractive. Despite the cash flow problems the company has, management is making interesting investments and pondering share buybacks. The list goes on. But with this company that violates so many rules of common sense for investing, I also see tremendous promise. The overall risk to shareholders right now looks very limited. I still think that the company is in a race against its cash burn. But the progress that has been seen recently is definitely encouraging enough to lead me to rate it a ‘strong buy’.

Be the first to comment