Dan Kitwood

In today’s article, we bring you the latest update in our recurring series based on analyzing 13F filings and the latest moves of some of the world’s most renowned funds. Our original article and the main thesis on the subject can be accessed through this link.

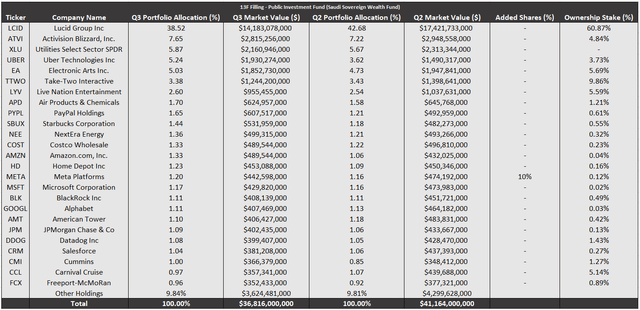

PIF Investment Map (Public Investment Fund)

Fund Overview

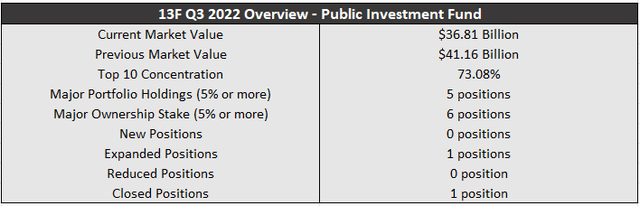

In stark contrast to their actions during the second quarter, as well as the past couple of years, the Saudi Wealth Fund went on a prolonged hiatus, making only two moves in terms of their US-based equity holdings in the third quarter of the year. As we recall from our previous analyses, PIF has been an adamant buyer throughout the last quarter, opening positions in companies such as Alphabet (GOOG) (GOOGL), Costco (COST), Zoom (ZM), BlackRock (BLK), Microsoft (MSFT), while expanding their stakes in stocks such as Electronic Arts (EA), PayPal Holdings (PYPL), Air Products and Chemicals (APD), and others. The fund established 17 new positions and added to 4 existing positions during Q2, many of them focused on “oversold” areas like the technology sector. After another couple of difficult months in the markets, the Sovereign Wealth Funds US-based assets under management further shrunk to $36.81 billion from the $41.16 billion they reported last quarter. This is almost half of the peak AUM they reported in Q4 of 2021, when the figure reached $55.89 billion.

While there have not been many moves made this quarter, the volatility of some of their top holdings has led to some interesting changes in terms of their portfolio concentration. The sovereign wealth fund’s concentration has been notorious for a long-time, as their top 10 holdings take up almost 73.08% of the AUM. Their position in Lucid Group (LCID) takes up 38.52% of the fund’s portfolio, meaning it decreased QoQ by 4.16% due to price movements. As a reminder, the fund owns a 60.87% controlling stake in the EV maker. Currently, the second largest holding is still Activision Blizzard (ATVI), which takes up 7.65% of the portfolio, while the third largest holding is the Utilities Select Sector SPDR fund (XLU), taking up 5.87% of the portfolio. Besides the majority ownership stake in Lucid, PIF holds large ownership stakes in Take-Two Interactive (TTWO), MultiPlan Corporation (MPLN), Electronic Arts, Live Nation Entertainment (LYV), and Carnival Corporation (CCL). The Saudi Sovereign Wealth Fund is notorious for holding major ownership stakes in its main investments.

PIF Overview Q3 2022 (Author Spreadsheet 13F Data)

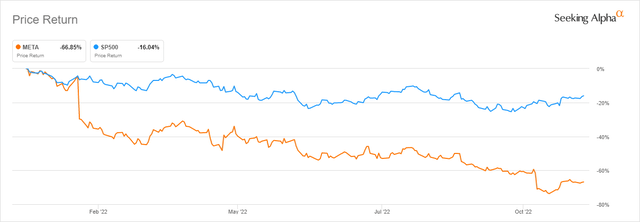

Expanded Positions

Meta Platforms (META): this is the only position that was expanded in the PIF portfolio during the third quarter of the year. Mark Zuckerberg’s social media empire has seen more than $600 billion of its market cap erased from the markets in a little less than a year. Meta’s rapid decline began earlier in the year when the company released what many consider a disastrous earnings report that brought to light several unknown and not yet recognized weaknesses in the company’s business model; mainly associated with expected growth and perceived depth of the moat the company carried. This is exactly when the Saudi Wealth Fund first opened its Meta stake, having bought 410,000 shares in Q1 of 2022 between prices of $186 and $337. The challenges Meta had to face only increased from that point on. The company seems to have hit a high ceiling in terms of the maximum reach of its main social platforms such as Facebook or Instagram, as it fails to report impressive MAU and DAU growth numbers. The social media giant is also expected to be hit significantly by the slowdown in advertising spending which the market is actively pricing in. All of this is not helped by pouring tens of billions of dollars into the “Metaverse” project, which many investors see as a form of reckless capital destruction.

As a result, the stock has been hammered in the markets and is underperforming the S&P 500 (SPY) by a large margin, having generated a negative 68.85% year-to-date return. After the pullback, META is currently selling for an NTM EV/EBITDA of 6.05x, NTM P/E of 15.55x, and an NTM P/FCF of 42.81x. Seeking Alpha Authors remain largely bullish about the prospects of META, even after the decline, assigning it a “Buy” rating with an average score of 3.85/5.00. Wall Street Analysts share the sentiment and rate the stock as a “Buy” with an average rating of 4.05/5.00. The position was expanded by 10% this quarter, as the fund bought another 320,00 shares for the price of $134-$183 per share. Very few investors remain on the fence when it comes to discussing Meta Platforms, but either see a tremendous investment opportunity or a crumbling social media giant. The Public Investment Fund made its position clear in this regard during the last three quarters. Meta quickly rose to represent Saudi Wealth Fund’s 15th largest holding and currently takes up 1.20% of the portfolio. The Public Investment Fund owns 3.26 million shares of Meta. The stock is currently selling for $114 per share.

Meta vs S&P500 YTD Results (Seeking Alpha)

Closed Positions

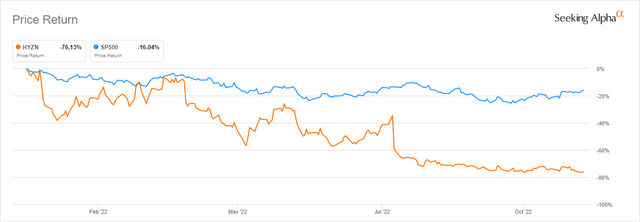

Hyzon Motors Inc. (HYZN) represents the only reduced or closed position for the quarter. It has been a stake with a rather disastrous performance, generating a negative year-to-date return of 76.13% and a negative one-year return of 78.84%. The company has been hit hard by a short seller’s report, which borderline called Hyzon out for being a scam. Blue Orca Capital called them out for reporting “fake customers”, which was later rebutted by the company in an official statement. The fund first acquired a stake in HYZN in Q3 of 2021 when the stock traded between $6 and $11, meaning its realized losses were extremely high as the stock now trades for less than $2 per share. The Public Investment Fund used to own 8.04 million shares of Hyzon, which was a relatively small position within its portfolio, they closed the position this quarter.

HYZN vs S&P500 YTD Returns (Seeking Alpha)

Final Overview

PIF Holdings Q3 2022 (Author Spreadsheet 13F Data)

We can conclude that the Saudi Sovereign Wealth Fund, at least as far as their US-based equity positions are concerned, went on a prolonged hiatus, perhaps speaking volumes on their market outlook for the upcoming year. This is the same fund that spent more than $7 billion on a buying spree mostly focused on beaten-down, high-end tech stocks. Some outlets have also mistakenly reported that the fund had added 4.03 million shares to their Alphabet position, however, this is only the effect of the 20-1 split that translated to the latest 13F filing. The latest filing shows that they have increased their position to 4.26 million shares, but in actuality, they have not bought any new shares. Even during this quiet period, Public Investment Fund managed to find time to expand on its Meta position, which quickly rose to become one of the more prominent positions in its portfolio. This is the third consecutive quarter in which the fund has increased their stake in Meta, what can be considered a huge vote of confidence in Zuckerberg’s social media empire.

Be the first to comment