Artur/iStock via Getty Images

2020 was a year to forget as the COVID-19 outbreak led to an unprecedented scale of lockdowns. 2021 was supposed to be the recovery year but the Delta and Omicron variants emerged in the fall and winter and derailed the path toward a return to normalcy. I was looking forward to a cheery 2022 but the investment climate soured before the year began.

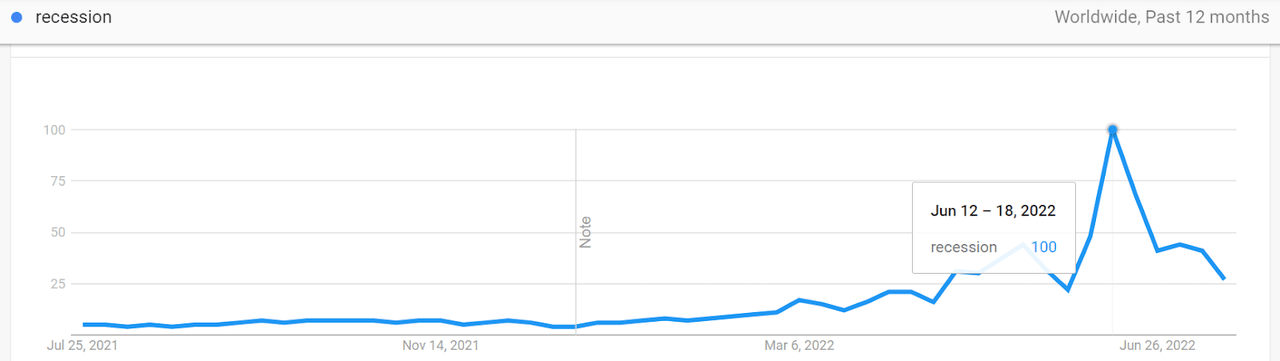

Russia’s invasion of Ukraine, inflationary pressures, rising interest rates, and recession became the buzzwords hogging the headlines. According to Google Trends, the search frequency for the keyword ‘recession’ globally has come off from the peak in mid-June but remains elevated relative to the first few months of this year.

Google Trends

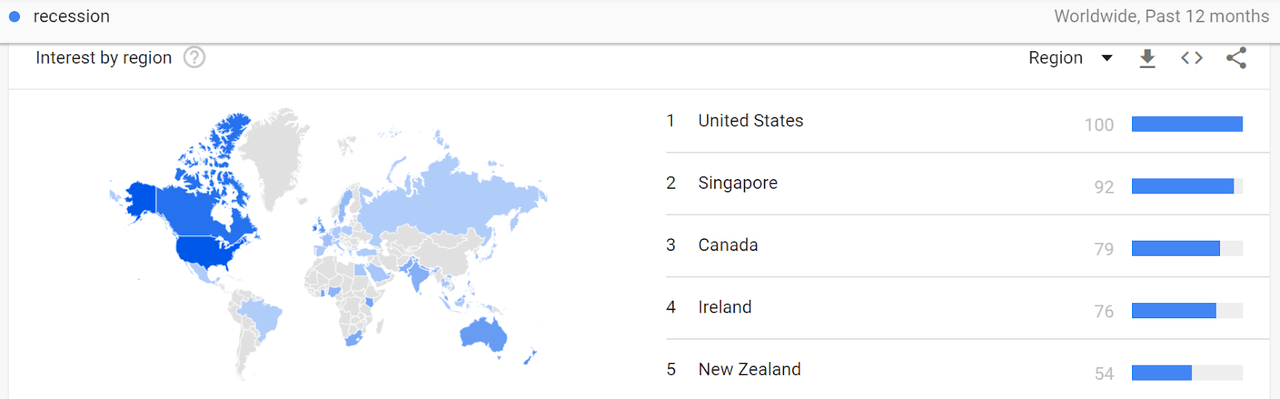

By region, the search interest for the keyword ‘recession’ was the highest in the United States, while Canada took the third spot. This indicates continued high concern among Americans regarding a looming economic slowdown.

Google Trends

Amazon.com Inc. (NASDAQ:AMZN) has been touted to be a beneficiary of an inflationary environment. Its e-commerce unit would see higher sales from consumers moving away from premium products to seeking value-for-money alternatives. The pressure to work harder and longer hours to avoid being part of the layoff exercise or the need to take on additional jobs to supplement one’s income would mean switching from physically shopping at the supermarket aisles to online shopping for convenience and time savings.

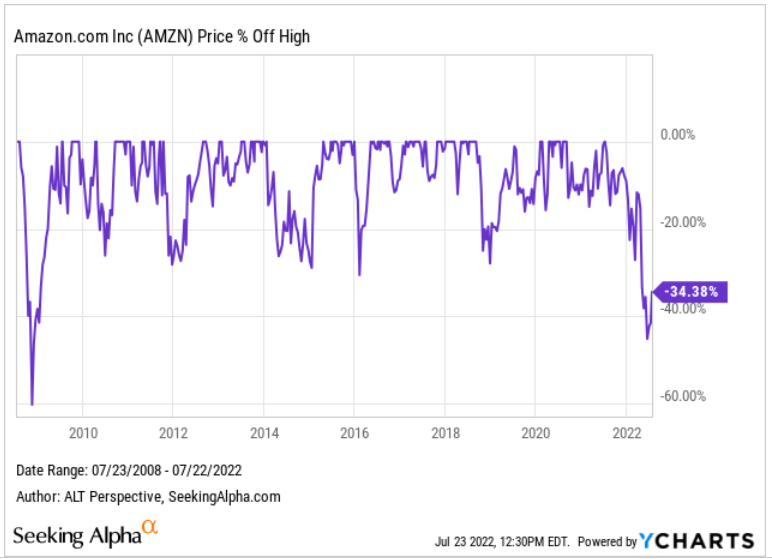

AWS, its profitable cloud unit, would benefit from businesses looking to lower their operating expenses by moving their in-house cloud infrastructure to third-party cloud providers like Amazon, the argument goes. Despite such seemingly logical bullish drivers, AMZN stock was down over 40% off its high before a broad market relief rally narrowed the gap to 34%. Even with the rebound, the share price of Amazon is down the most off its high in over a decade. The last time AMZN stock dropped more was during the financial crisis in 2008 when it was 60% off its high.

YCharts

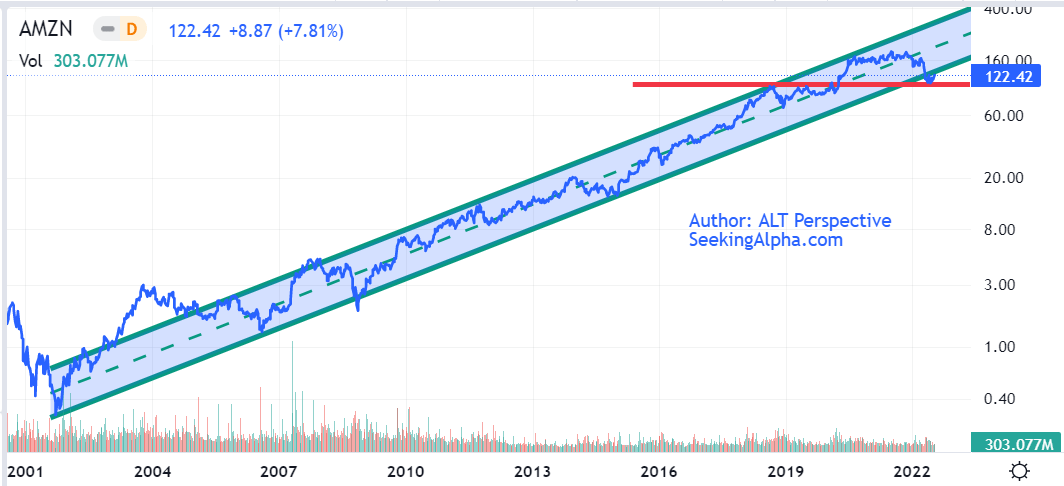

Yet, plotting the share price chart of AMZN stock from 2001 to the present, we see that even the 2008 plunge was just a brief aberration during the 21-year uptrend. The strong bull run has resulted in many market players calling the e-commerce and cloud titan a “no-brainer” investment to get in at any price. However, the mini-crash (or dip, if you prefer) this year has seen AMZN stock ominously falling out of the multi-year price channel.

ALT Perspective (drawn using SA advanced charting tool)

Fortunately for shareholders, AMZN stock is holding up (albeit precariously to some) at the four-year support line (around $105) and it appears to have formed a bottom. Should the bulls be correct about Amazon as an inflation beneficiary, its share price may enjoy further recovery. However, if the company misses on its second-quarter 2022 earnings scheduled for Thursday, 28 July 2022, and issues weak guidance for the next reporting period, shareholders would have to brace for a steep correction amid jittery investor sentiment. Which scenario is more likely? Let’s discuss this in the following sections.

AMZN Stock Key Metrics

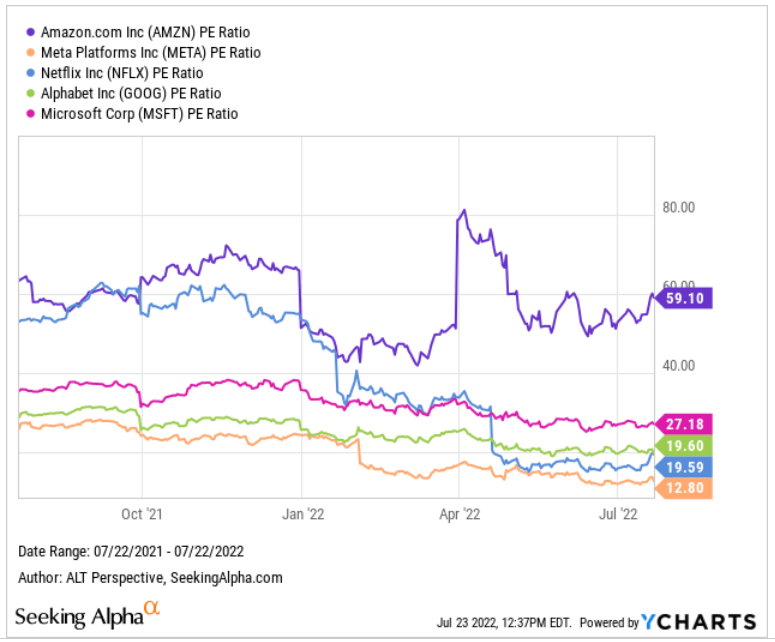

Among the MAMAN (or formerly FANGM), Amazon stock used to trade at a similar price-to-earnings ratio as Netflix Inc. (NFLX). However, after a sharp selldown in NFLX stock, AMZN now stands aloof alone, with a PE ratio of 59 times, while the remaining quad, comprised of Meta Platforms Inc. (META), Alphabet Inc. (GOOG)(GOOGL), and Microsoft Corporation (MSFT), trades at 13-27 times.

YCharts

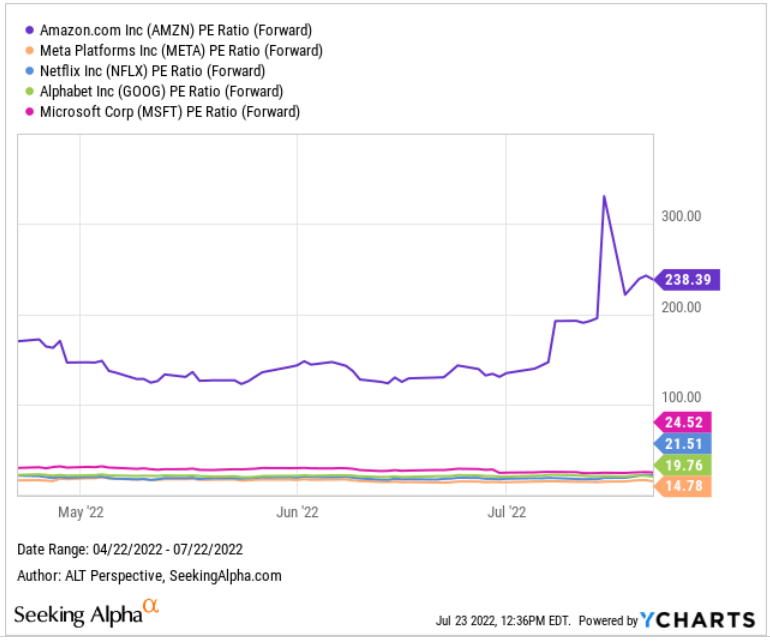

On a forward basis, AMZN stock is standing out even starker. Its PE ratio (forward) has risen to 238 times. The remaining quad? A mere 15-25 times. It’s often argued that the PE ratio is an irrelevant stock metric to judge Amazon because of its two disparate core businesses – e-commerce and cloud computing. However, a study conducted by investment firm AllianceBernstein (AB) showed that there is a high level of retail ownership of Amazon stock – 40%. This compares with a mere 21% for Genuine Parts (GPC) and 29% for Chevron (CVX).

How many retail investors are sophisticated enough to consider other metrics? Note that AMZN has long been touted as one of the “no-brainer” stocks, which means shareholders may not have performed much due diligence or evaluated the company beyond simple metrics if any at all. With that in mind, it is not difficult to see why the realization of a big increase in PE ratio and the widening gap with the other mega-cap names could trigger heightened shareholder cautiousness in a market permeated with fear.

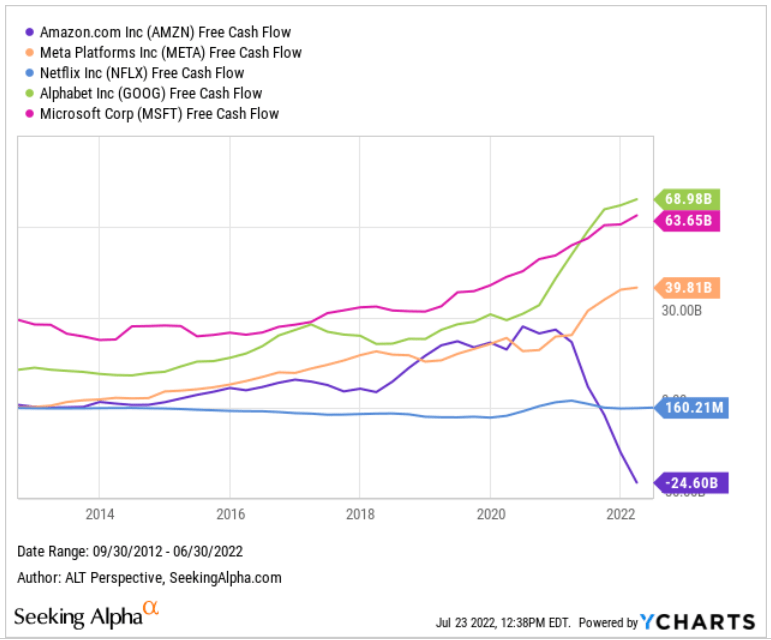

YCharts

Again, unlike the Quad in comparison, Amazon is seeing its free cash flow [FCF] moving in the opposite direction as the rest since last year, and starkly so. Amazon’s FCF has fallen off a cliff to -$24.6 billion, down from around $25 billion in 2020. The beleaguered video-streaming giant Netflix has managed to eke out a small positive in its FCF ($160 million) while Microsoft and the parent of Google are oozing FCF at $64.7 billion and $69.0 billion respectively.

YCharts

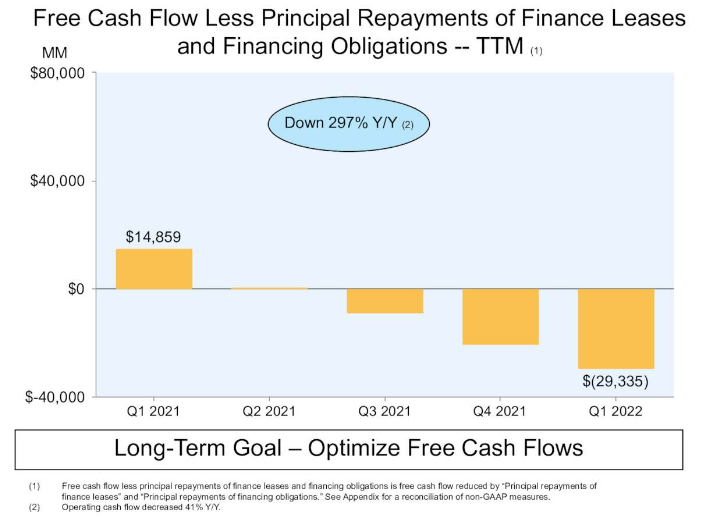

To the credit of Amazon’s management, they are upfront about the deteriorating FCF, with charts representing the quarterly changes in FCF in the earnings deck. However, the capital expenditure is expected to remain high this year. During the Q1 2022 earnings conference call, Brian Olsavsky, Amazon’s chief financial officer, said for the full year of 2022, the executives “expect infrastructure spend to grow year-over-year, in large part, to support the rapid growth in innovation we’re seeing within AWS.”

In the consumer business, Olsavsky acknowledged that there is “some excess capacity in the network” but “many of the build decisions were made 18 to 24 months ago, so there are limitations on what we can adjust midyear.” This meant that surplus capacity may continue to exacerbate at the expense of Amazon’s FCF.

Amazon Q1 2022 earnings slide deck

Is Amazon Stock A Good Recession Pick?

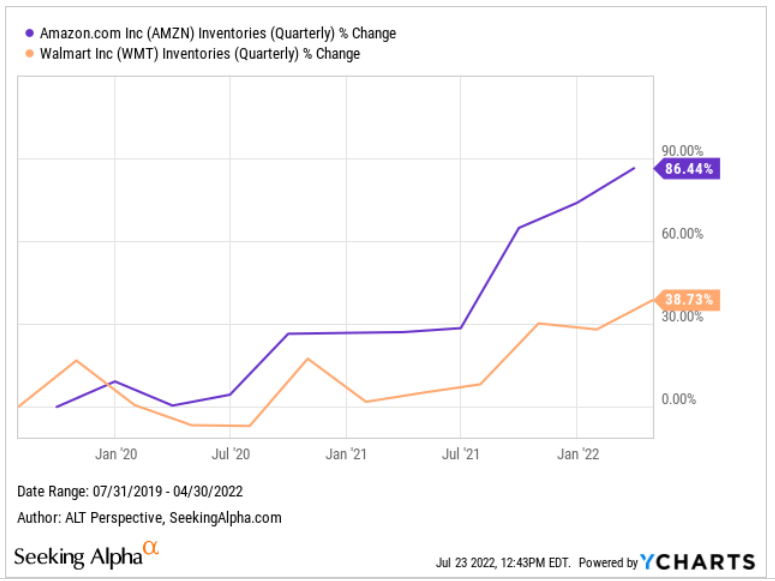

In mid-May, Target Corporation (TGT) blamed its oversized inventory, and even worse, the wrong mix, for its disastrous first-quarter fiscal year 2023 results. TGT sank nearly 25% following the results release, the steepest drop for the stock since 1987. Naturally, AMZN shareholders may be worried about the rising inventory level at the e-commerce giant, which has escalated in the past year. In contrast, Walmart Inc. (WMT) has seen its inventories rise at less than half the pace of Amazon.

YCharts

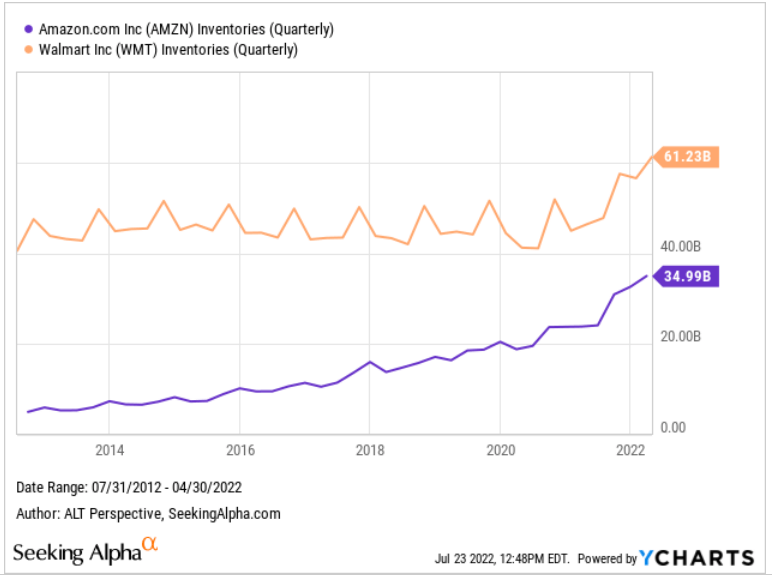

Looking back to 2012, Amazon’s inventory climb can be regarded as in line with its business growth. On the other hand, the off-trend inventory jump in Walmart appears more concerning.

YCharts

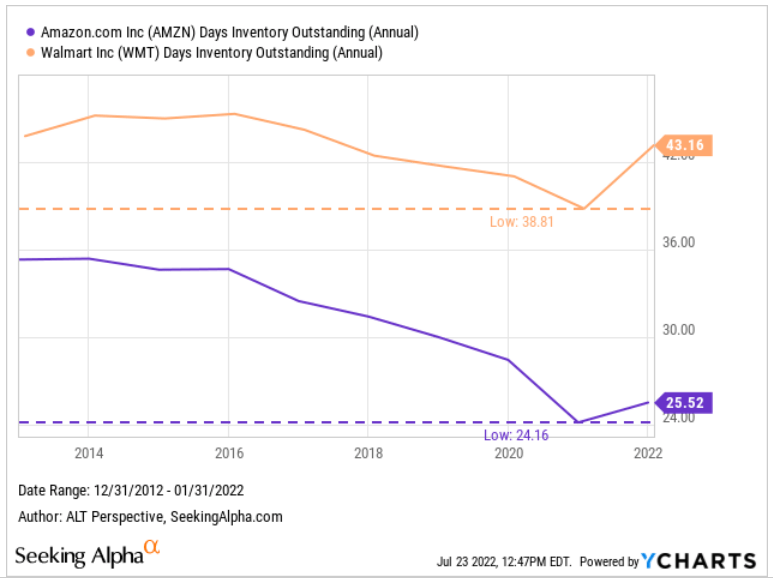

Nonetheless, the duo’s Days Inventory Outstanding [DIO] are below their historical highs. Amazon’s present DIO is just over a day more than its 2020’s trough of 24.2 days. Thus, it is far from a concerning level and Olsavsky believed that having inventory and SKU selection in some cases back to where it was pre-pandemic would help restore the service levels that Amazon achieved pre-pandemic.

YCharts

The expanded inventory must have played a key role in enabling Amazon Prime Day 2022 to become the single biggest Prime Day event in its history, with members purchasing more than 300 million items worldwide. The strong showing goes some way to prove the bulls correct that the leading e-commerce platform is a beneficiary of a trade-down behavior amid the inflationary environment and economic slowdown we are in.

On AWS, it seems to be a fallacy that Amazon’s cloud business would be an obvious gainer from a recession. According to a June 15 article on Business Insider, spending on AWS, Microsoft Azure, and Google Cloud declined in April from the first quarter. While large enterprises are primarily locked into long-term contracts, smaller customers typically pay based on their usage. Hence, with the renewed pressure to cut costs due to the intensified investor scrutiny on the bottom line as well as reduced cloud requirements in line with the slowing business, cloud spending inevitably decelerated.

For the large customers, they are looking to “take their IT infrastructure in-house, rather than letting a cloud provider like AWS manage it,” warned Martin Casado, a general partner at venture capital giant Andreessen Horowitz. “Big companies are taking this very, very seriously and doing very aggressive things internally,” he added.

An article published July 7 on Insider Intelligence reaffirmed this phenomenon with cloud customers “getting slapped with astronomical bills” from the top three providers—Amazon, Microsoft, and Google. Amazon, which has the lion’s share of the cloud market at 38.9%, dominated complaints on bill shocks. If users made good on their promises to build their own infrastructure or shop around for better cloud deals, AWS would suffer from market share and revenue losses.

Nevertheless, in my opinion, Amazon can benefit from the market swoon on recessionary concerns given the lowered valuation of many potential acquisition candidates for the behemoth. Take, for instance, the announcement last week where Amazon agreed to acquire One Medical (ONEM), an operator of a membership-based primary care platform for $18 per share in an all-cash transaction valuing it at approximately $3.9 billion, including net debt. ONEM stock closed at $10.18 the day before news of the deal broke. While the acquisition price represents a 77% premium over the pre-news price, it is a substantial bargain considering the share price nearly hit $60 on 16 February 2021.

Amazon is a whale in e-commerce and cloud, but from a sectoral perspective, it is more of an octopus. Hence, it can acquire more companies in various industries to supplement its Prime program and not attract regulatory condemnation. The stock market weakness in the past months provides Amazon with the bargain deals it can make to buy growth and entrench its competitive strengths over its rivals.

Is AMZN Stock A Buy, Sell, or Hold?

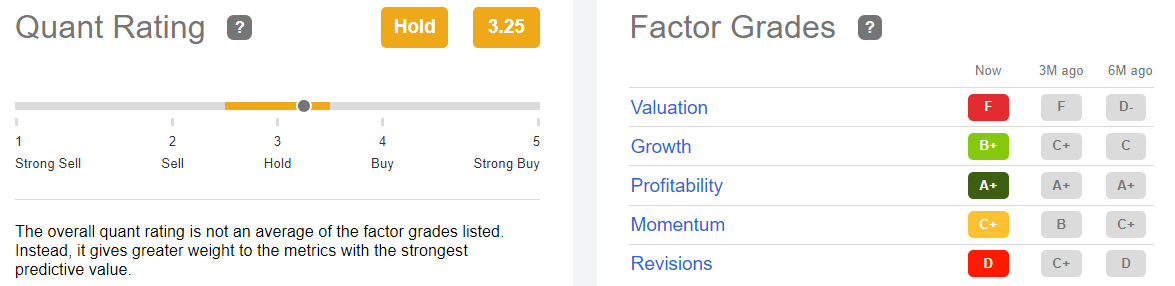

Amazon’s current Quant rating is a Hold with a score of 3.25. Its Quant ranking is unattractive, putting it at 170th out of 531 in the Consumer Discretionary sector and 7th out of 61 in the Internet and Direct Marketing Retail industry. Its Factor Grades are a mixed bag. Valuation deteriorated from six months ago to F, Growth improved to B+, Profitability remained A+, Momentum remained unchanged at C+ from six months ago but deteriorated from three months ago, and Revisions similarly remained unchanged at D from six months ago but deteriorated from three months ago.

Seeking Alpha Premium

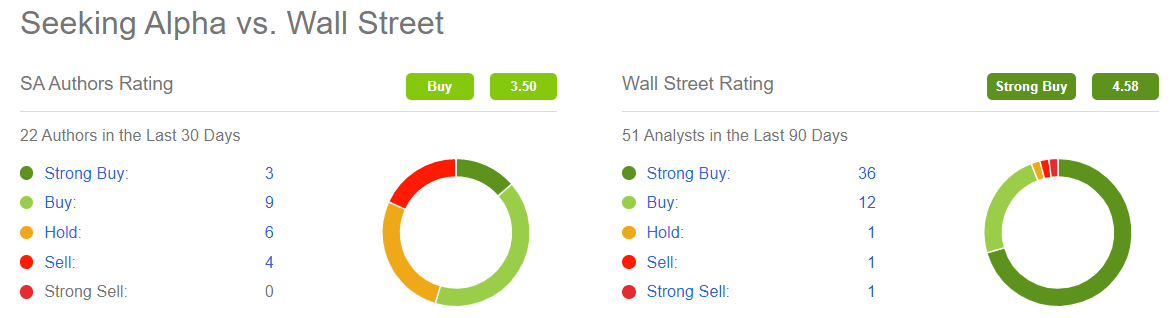

Ahead of its earnings release on Thursday, authors on Seeking Alpha have AMZN stock at Buy with a score of 3.50 while the consensus rating on Wall Street is Strong Buy with a score of 4.58. Thus, it appears that Wall Street analysts are much more bullish on Amazon than SA authors.

Seeking Alpha Premium

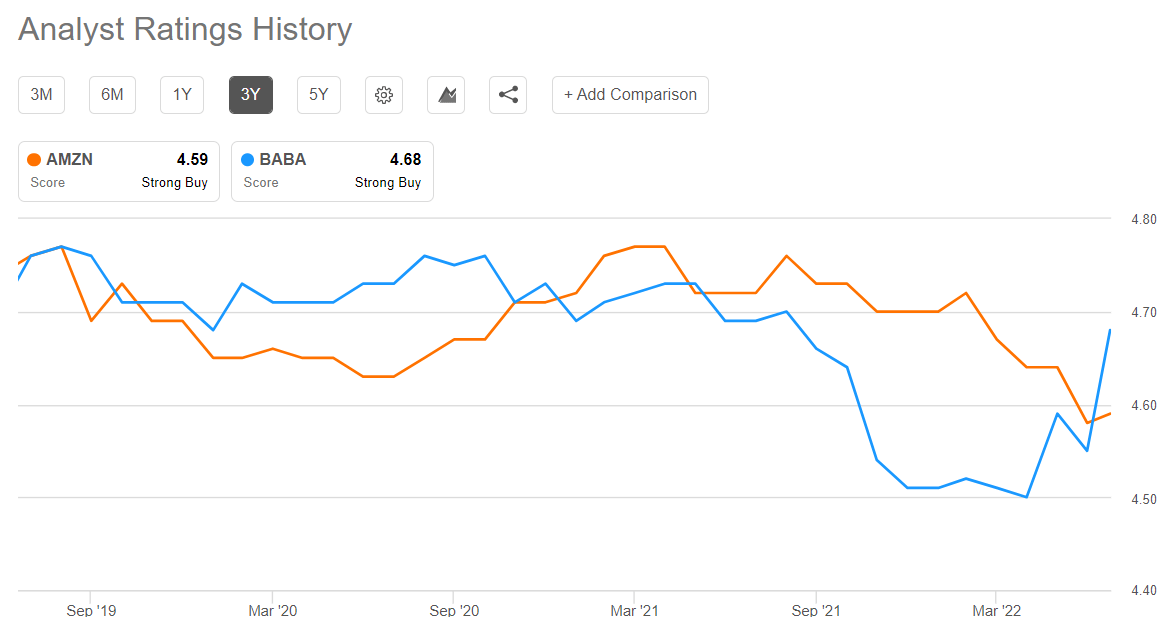

However, looking at the analyst ratings history chart, it becomes apparent that Wall Street has turned less bullish on AMZN stock since February this year. The score has declined from 4.72 in February to 4.59 presently. In the same period, the score for Alibaba Group (BABA), affectionately labeled the Amazon of China, has risen from 4.50 in March to 4.68 presently.

Seeking Alpha Premium

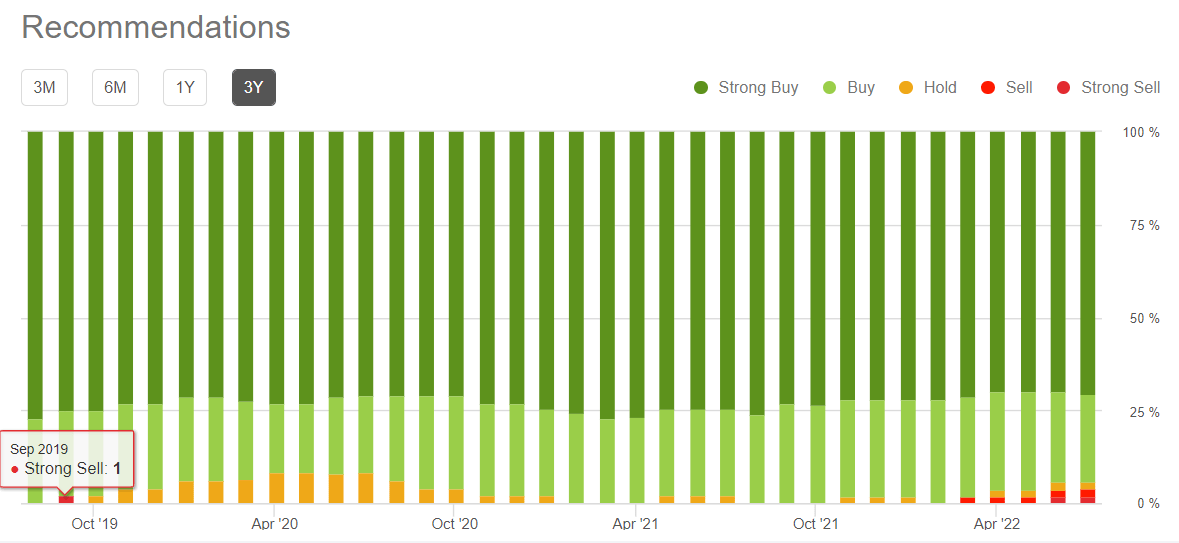

Amazon stock has even attracted its first Strong Sell since September 2019. This is noteworthy considering that Wall Street analysts typically shy away from issuing Sell calls to avoid antagonizing their clients or prevented from new businesses from the target companies.

Seeking Alpha Premium

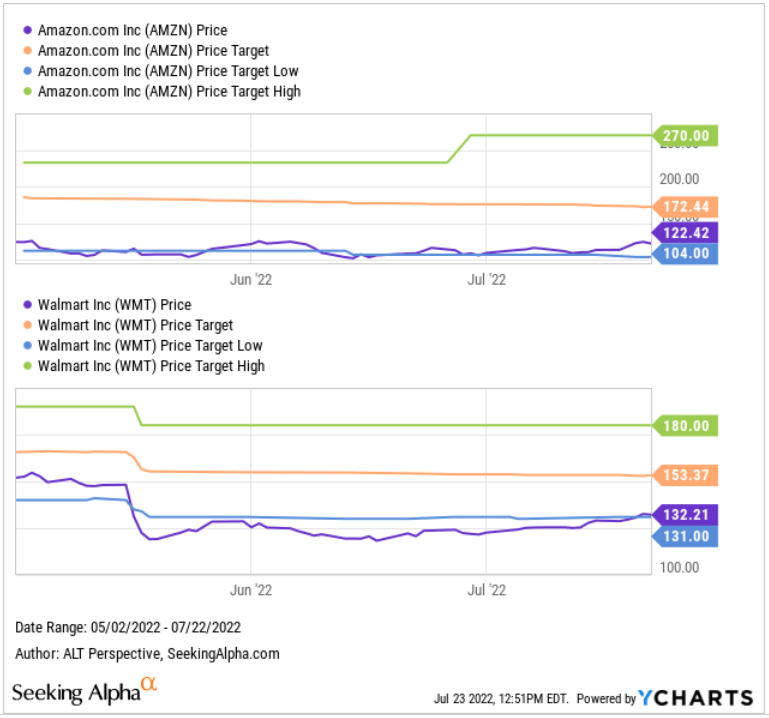

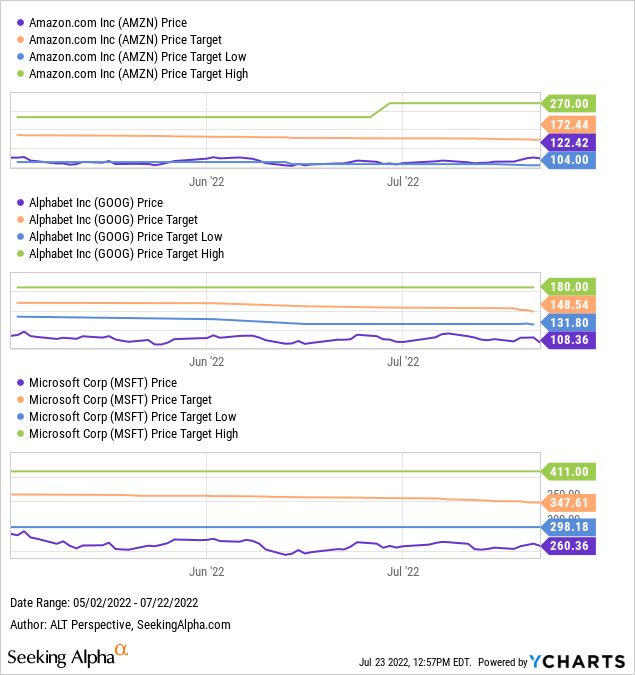

Nonetheless, the consensus price target on AMZN stock indicates an attractive 41% upside and the last closing price at $122.42 is 18% higher than the low end of its price target range. In contrast, retail giant Walmart is a mere $1.21 above the low end of its price target range.

YCharts

The share prices of Alphabet and Microsoft, Amazon’s main cloud rivals, are even trading below the low end of their respective target price ranges. This suggests that analysts may still be overly optimistic about Amazon versus Alphabet and Microsoft. The latter two companies report earnings on Tuesday, July 26.

Meanwhile, regulatory risks are escalating. Shareholders have long shrugged off taunts on Amazon from regulators around the world, believing that the usually thinly staffed regulatory bodies would be no match for the robust legal team at the e-commerce and cloud behemoth. However, judging by the increasing news flow on the regulatory front recently and potential consumer backlash from exposes into Amazon’s practices, there are reasons for concern.

For instance, Amazon admitted to Massachusetts Senator Ed Markey that it had provided footage from Ring doorbells to law enforcement without permission as many as 11 times. If the admission was made by a Chinese company in China, there would have been immediate widespread media coverage highlighting the pervasive surveillance of the Chinese population. The outcry over the privacy invasion enabled by Ring seemed to have died down pretty quickly in the U.S. but if politicians want to score favors with the voters, such controversies can be played up to the detriment of tech companies like Amazon.

In conclusion, considering the relative optimism on Amazon over its tech peers, higher valuation premium, and heightened regulatory scrutiny which combined to give greater downside risks that offset the potential recovery upside, I rate AMZN stock a Hold over the next six months.

Be the first to comment