Chris James/iStock via Getty Images

The barber down the street kept a mini pig as a pet. The mini pig was clearly an intelligent animal – which I say because this pig had learned to run errands. From time to time, you could see the pig trotting up a side street in Bairro Alto wearing his little vest with pockets. Then you’d watch him wander into one of the many local convenience stores to fetch packs of cigarettes, a beer, or whatever other order his owner had previously called in to the shop. The order would then go into one of the piggy’s vest pockets, and then the pig would trot purposefully back to the barbershop. We used to call him the “delivery pig.”

There’s a common saying in Portugal – “es um pouco mais complicado.” It’s a little more complicated. The problem is that Bairro Alto is the all-night party center of Lisbon. Every night is Mardi Gras in Bairro Alto, and all those late-night revelers tend to leave their plastic cups of half-consumed caipirinhas and mojitos all over the sidewalk. Most of the said plastic cups are brimming with generous helpings of fresh, liquor-soaked limes and the occasional sprig of mint. And let us not overlook the obvious fact that the delivery pig was, after all, a pig. So instead of returning dutifully to the barber shop, he’d go off and frolic and detour, snuffling and rooting around the gutters and near the trash containers, irresponsibly gobbling down all of the alcohol-permeated limes that he could find. And then after more than a few-too-many limes, the delivery pig would literally fall down on the job, lollygagging and basking in the sunshine and occasionally sullying his delivery vest (and presumably all of the contents therein) in the various puddles and questionable detritus that one finds on the streets of Bairro Alto after a particularly wild night of partying the night before.

Maybe it comes as no surprise that I haven’t seen the delivery pig in a long while. Elon Musk would certainly never have tolerated this sort of insufficiently “hard core” job performance from his new employees, so why would anyone else? And so we must regretfully conclude that the delivery pig – model employee that he was – has most likely been fired and moved on to pursue “other opportunities” and unknown “future endeavors.”

Meanwhile, on the more gentrified side of historic Lisbon, the other day I noticed a long line of people waiting for half an hour to be let in to a Louis Vuitton (OTCPK:LVMUY) boutique on Avenida Liberdade. The fact that it was dumping rain had done nothing to deter customers from patiently waiting to be let inside the boutique, where they’d probably spend a couple of thousand Euros or more on a handbag that I am certain cost nowhere NEAR that amount to manufacture.

My reaction? Naturally, it was “sure looks like an investment opportunity to me!”

So I checked my cell phone and saw that according to my Seeking Alpha app, LVMH currently has a PE ratio of just over 24.5 and five-year average earnings per share growth of over 32 percent. That’s a PE/G ratio of .77 which is not too shabby! In my worldview, any PE/G ratio of less than 2 is a bargain. A little more digging and I see that S&P Global rates the company’s credit at A+ which is more than enough to satisfy me that bankruptcy risk is low and that the company has ample room to fund acquisitions with reasonably-priced debt. Since I already own shares of LVMUY, I got curious and decided to waste half an hour of my time standing in line while my shoes got soaked. Once they let me inside, I wandered around the store picking up different bags, wallets, some belts. Not my style or price range, but the quality? Absolutely impeccable.

Was it an ironic coincidence that my stylish accessory that day happened to be a broken umbrella and recyclable grocery bag that I’d bought for 15 cents three years ago?

Being dressed the way I typically dress, it must have been more than abundantly clear that I wasn’t exactly in the market for a multi-thousand Euro handbag, but do you know what? That didn’t matter! The staff was friendly and helpful regardless. The guy who offered to show me around the store was actually excited to show me a bunch of lady’s purses for over 20 minutes. And that’s when it suddenly dawned on me. This employee was simply proud of his company’s products and wanted to showcase the quality and design to anyone willing to wait in line in the rain.

Enthusiastic employees who take pride in the company’s products

Not your typical security selection metric, but perhaps it’s no coincidence that every time I invest in a business with highly motivated employees who are enthusiastic about the company products, I make money. Sometimes a lot of it.

I think I probably told you the story of when I first bought shares of Apple (AAPL). They’d just invented the iPhone and I wanted to see what one looked like. The guy at the Apple store who showed me how the iPhone worked couldn’t say enough about it. “This thing is magic! I love it!” He was so enthusiastic about the product that instead of buying the iPhone, I went home and bought a large number of shares of stock that I still hold to this day.

And do you know why I bought shares of Goldman Sachs (GS) a little while after they first went public? Simple: I was sick and tired of listening to my friends subtly gloating and tactfully boasting about getting jobs at Goldman. One acquaintance of mine couldn’t wait to tell me when he’d finally landed a job at Goldman – and it was only AFTER he shared that proud news that he even bothered to mention that he and his wife also just had their first baby. That stock climbed from $68 to $379 per share and all those dividends over the years have more than made up for the many times someone shook my hand slightly too hard and for slightly too long as they casually mentioned “oh, I’m at Goldman” or “back when I was at Goldman.…”

What I like best about the “enthusiastic employee” investment criteria is that there really is no way that a trading algorithm can figure it out. Wall Street analysts don’t necessarily have a huge leg up on retail investors when it comes to discerning whether a company is staffed by a lot of people who are genuinely proud to be working there. Maybe it’s just a classic Peter Lynch type of investment analysis where an average investor can have an edge – provided said investor is willing to go visit some stores, check out some products and talk to the people who work there. And that’s exactly what I recommend to anyone looking to identify some high-quality businesses to own for the long term.

However, let me hasten to add, let us not forget that the Bairro Alto delivery pig was a very, VERY content employee back in his heyday (particularly when dozing in an inebriated stupor on his way back to the office). What a business owner wants is both enthusiastic and productive staff, which is why I’d strongly prefer investing in a company like AAPL where the net income per employee clocks in at $608,550 according to Seeking Alpha, as opposed to a company like Coinbase Global (COIN), with net income per employee of negative $329,150. Employee enthusiasm isn’t a standalone investment criterion so much as some valuable context for an objective numerical figure such as net income per employee.

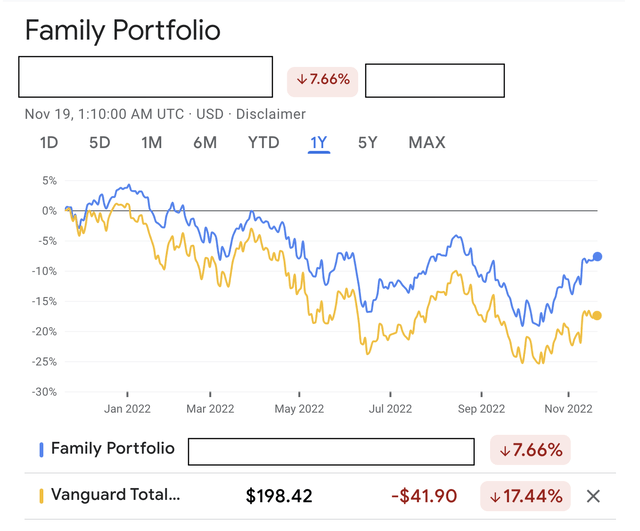

This month, I’ll buy some more shares of LVMUY when I reinvest dividends. I will also look at adding more shares to my positions in Public Storage (PSA) and Home Depot (HD). I can’t be alone when I say that this isn’t a year that I will particularly miss – at least not from an investment standpoint. Our portfolio is down 7.66% over the past year (or about negative 5% if you add back the dividends) compared to a 17.44% loss for the Vanguard Total US Stock Market Index according to Google Finance. If nothing else, bear markets are a test of stamina and determination to just keep reinvesting dividends into more and more shares of the best companies one can identify at the best prices then available.

Our Portfolio Performance (Google Finance)

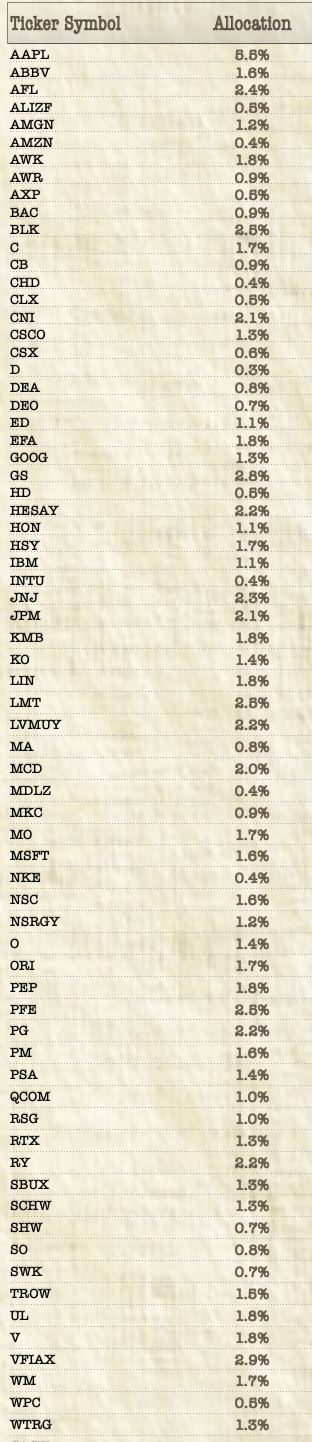

Our current portfolio composition:

Our current portfolio (Author’s spreadsheet)

Be the first to comment