ohmygouche/iStock via Getty Images

As 2022 dawned, I authored a piece on dividend-bearing stocks that I believed would outperform the market. My criteria included a relatively high yield, low payout ratios, and a fairly robust 5-year dividend growth rate.

When the article debuted, the average yield for the five stocks was 2.66%, the average 5-year dividend growth rate was 8.64%, and four of the five companies had payout ratios below 38%.

So how have my picks performed relative to the S&P 500, which is down nearly 14% year-to-date?

Not as well as I had hoped. Two of the three have underperformed the market, but I take some solace in the fact that two of the outperformers have a positive return for the year. Had I invested an equal sum in each ticker, with dividends included, the five stocks would have outperformed the S&P 500 by roughly 10%.

As of the last trading day of July, Lowe’s (LOW) is the worst of the lot, down a hair over 25%, year-to-date.

Discover Financial (DFS) also underperformed the S&P 500. That ticker is down 14.87% in 2022; however, if you add in dividend payments, the stock is very close to break-even in relation to the market.

Pfizer (PFE) also lost share value, although it outperformed the market by a wide margin. PFE is down 10.84%, and the total return to date is closer to minus 9%.

Gaming and Leisure Properties (GLPI) is up 7.20% since the first of January. If you were to add in dividend payments, you would be nearing a double-digit gain year-to-date.

The best performer of the bunch is Nexstar Media Group (NXST). Capital appreciation on the media giant’s stock is nearing 23%.

For the Latter Half Of 2022, My Top Pick Is…

Taiwan Semiconductor Manufacturing Company Limited (TSM) dominates its industry. Even so, the stock is down by nearly a third year-to-date. This even though the company posted strong results for the first two quarters and management guiding for sustained annual sales growth of 15%-20%.

Semiconductor manufacturers operate in a cyclical industry. With macroeconomic headwinds and a cooling market for PCs, it appears investors are wary of the company’s prospects.

However, I believe the market underestimates the lead TSM has over the competition. The company is the largest and most advanced contract chipmaker. The only rival of any note is Samsung (OTCPK:SSNLF, OTCPK:SSNNF).

While I acknowledge the cyclical nature of TSM’s business, I also note the company has not recorded an annual earnings decline of more than 20% in the past 10 years. Moreover, the stock is now trading for a bit over $88 a share, a hefty discount from its 52 week high of $145.00.

TSM is also trading for a forward P/E of around 14x, a significant discount to its 5 year average P/E ratio of around 22x. This is the lowest P/E the stock has traded for in the last five years, including a period marked by low demand for semiconductors. The stock also sports a 5 year PEG of 0.58x, nearly a full point below the sector’s median PEG.

TSM’s debt is rated AA- by S&P and Aa3 by Moody’s.

I rate the stock as a Strong Buy. I initiated a position in TSM in the middle of July. I view this as a very safe investment over the long term, and I will be unfazed should the shares fall further.

With a yield of 2.09%, a 5 year dividend growth rate of 10.83%, and a payout ratio of just over 7%, TSM is a welcome addition to my dividend growth portfolio.

I am constructing an in-depth article on TSM that should debut soon.

My Second Choice

Comcast Corporation (CMCSA) possesses a number of characteristics I seek in my investments. It is a member of a duopoly, it has a firm financial foundation (debt ratings are on the lowest A rung, well within investment grade), CMCSA pays a safe, rapidly growing dividend, and the stock is trading with a margin of safety.

Of course, Comcast has wrestled with the loss of cable TV subscribers for years; however, the addition of broadband internet and mobile customers was outpacing the loss of video subscribers. That trend lost steam last quarter.

A few days ago, Comcast reported Q2 earnings that showed for the first time, the company failed to add broadband users. Even so, CMCSA beat on the top and bottom lines. Furthermore, during the earnings call, management provided an upbeat assessment:

Our financial results in the second quarter were very strong across the board, with Cable, NBCUniversal, and Sky each delivering solid growth in adjusted EBITDA, resulting in a double-digit increase in adjusted earnings per share and healthy free cash flow generation.”

Brian Roberts, CEO

Even so, J.P. Morgan downgraded the stock, and the shares dropped by over 12% following the earnings report.

Comcast’s churn has been quite low, and I note that the company is entering a period in which growth is unlikely in a now-mature business. I contend that the focus should be on the very strong growth in free cash flow, up 9% to $16.6 billion in Q122, rather than the lack of new broadband subs.

I see the drop in share price as a buying opportunity. CMCSA has forward P/E of 11.87x, well below the stock’s 5 year average P/E of 17.25x, and the 5 year PEG ratio of 0.96x is also well below the 5 year average PEG of 1.30x.

Investors can harvest a yield of 2.88%. With a payout ratio of less than 30%, and a 5 year dividend growth rate of 12%, CMCSA provides dividend growth investors with a solid buy.

I added to my position during the middle of July.

Still A Buy Despite Soundly Beating The Market

Merck & Co., Inc. (MRK) outperformed the S&P by a wide margin this year. Like Comcast, the company just provided Q2 earnings, and it too beat on the top and bottom line.

Keytruda recorded a 23% increase in sales, Gardasil sales were up 59%, and Bridion Lynparza, Lenvima, and Rotateq all registered double digit sales growth.

Keytruda is the leader in the immuno-oncology market, with strong efficacy in several cancer types, the drug has been approved for over 20 oncology uses in the U.S. By some estimates, sales of Keytruda will be double that of any other drug by 2026.

Merck is the fourth largest pharmaceutical company on the globe and boasts the 3rd largest R&D budget.

MRK has a forward P/E of 14.49X, more than 5 points below the stock’s average P/E ratio over the last five years. The 5 year PEG ratio of 1.11x is also well below the company’s average PEG for the last 5 years of 1.83x.

With a yield of 3.09%, a payout ratio of under 36%, and a 5 year dividend growth rate of 8.81%, shares of Merck should be a welcome addition to a dividend growth investor’s portfolio.

Capitalizing On Supply Chain Woes

Prologis, Inc. (PLD) does not provide the discounted valuation profile of my first three picks. However, I would posit that short of an extreme market swoon, we may never find PLD shares at true bargain basement levels. Nonetheless, Prologis is trading well below its 52 week high.

Furthermore, unlike my previous three picks, each of which possesses a wide moat, the nature of PLD’s business means it has no enduring competitive advantage. After all, warehouses can be built nearly anywhere. This year alone, 350 million square feet of warehouse space is expected to be added in the US, the highest increase in construction ever recorded.

However, Prologis does possess a portfolio of prime properties. PLD’s warehouses are strategically located in markets with dense populations, near key transportation hubs, and with properties that represent high barriers to entry. Prologis’ recently announced the acquisition of Duke Realty. Once that deal is closed, the addition of Duke will give PLD unrivaled scale in the industry.

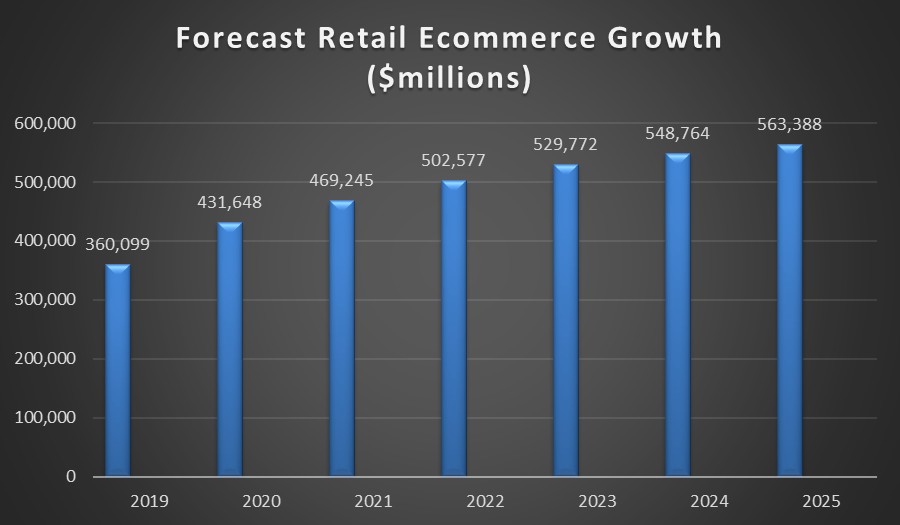

The growth of ecommerce sales presents an enduring tailwind for PLD, as every $1 billion increase in online sales results in an additional demand for 1 million square feet of distribution space.

The following chart details the projected growth in US ecommerce sales.

Author/ Statista

Where PLD aligns with my first three picks is in terms of its A- investment grade credit rating, and its safe, rapidly growing dividend.

Management targets a 60% AFFO payout ratio, well below average for REITs. With a current yield of 2.38%, and a 5 year dividend growth rate of 10.53%, Prologis provides another rapidly growing addition to a DGI portfolio.

Last, But Not Least

My final pick is Simon Property Group, Inc. (SPG). As a mall centered REIT, I acknowledge that Simon is more sensitive to the macroeconomic headwinds we are experiencing. Even so, I think the current share valuation has priced in the negatives.

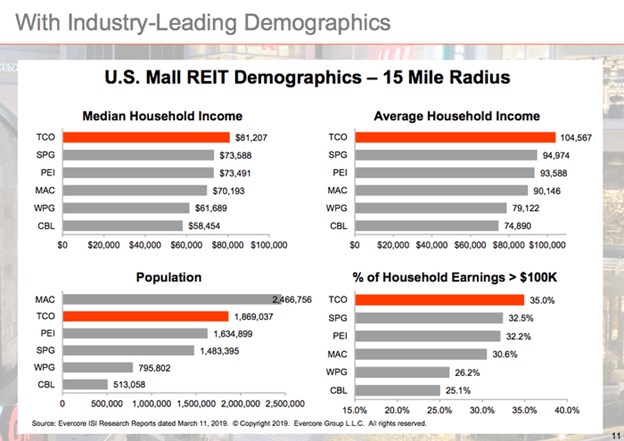

SPG is the largest mall REIT in the U.S. The following chart highlights the fact that the company’s malls are located in areas with high population densities and high household incomes. (Note SPG has since acquired the properties of TCO.)

Seeking Alpha

Simon derives over three fourths of net operating income (NOI) from its class A malls and nearly 90% of NOI from malls that are rated as B+ or better.

During the Q1 earnings call, management reported a company-record $734 in sales per square foot. This is significantly higher than the $693 in sales per square foot reported in the fourth quarter of 2019.

Bears believe ecommerce will eventually shutter Simon’s properties. However, while conducting research for my recent article on SPG, I uncovered studies indicating ecommerce could actually benefit the higher end malls.

SPG has an A- debt rating from S&P. Simon’s dividend is well covered with a forward AFFO dividend payout ratio just below 63%. The current yield is 6.26%, and the 5 year dividend growth rate is 3.63%.

Now trading for $108.60, the shares are well below the 52 week high of $171.12. Simon’s price/AFFO is 9.85x, well below the REIT’s historic price/AFFO of roughly 15x.

Summation

A similarity that most of my chosen companies share is a yield above 2%, a low payout ratio, and a 5-year dividend growth rate of roughly 10%.

My five picks for the latter part of this year have fatter yields (an average of 3.32%) and faster growing dividends (average five-year growth of 9.13%) than my earlier picks.

I rarely invest in companies that do not hold investment grade debt ratings. The sole exception to that rule among the ten listed companies is NXST. However, I note that S&P recently upgraded Nexstar, and the company now has debt ratings that are on the border of investment grade.

Of the five stocks I highlighted in my earlier article, I continue to rate Pfizer, Nexstar, and Lowe’s as buys.

Discover and GLPI stand in a gray area regarding my rating the companies as a buy or hold. As I view them as more sensitive to the prevailing macroeconomic environment, I will err on the side of caution and rate both as a hold.

Be the first to comment