Paul Morigi/Getty Images Entertainment

As Warren Buffett’s writings heavily influenced me, insurance became my favorite industry quite early. But it took surprisingly long to form my insurance portfolio. The list of six stocks that I am holding now and will present today is non-traditional, to put it mildly.

On the SA site, insurance is not particularly popular. Aside from Lemonade (LMND) and Berkshire Hathaway (BRK.A) (BRK.B), one can hardly notice a trace of this huge industry on the front page. And this is good for insurance investors. One can expect better returns by staying away from hot stocks and high-yielders that get the lion’s share of site readers’ attention.

I am running a fairly concentrated portfolio with a low turnover that is heavily exposed to insurance. Besides the six in this post, my portfolio includes Berkshire Hathaway (mostly an insurance stock), Apollo Global (APO) (half an insurance stock due to Athene (ATH) as a part of it), and Brookfield Asset Management (BAM) (soon to be an important insurance player due to the growth of Brookfield Reinsurance (BAMR)).

My Top Six

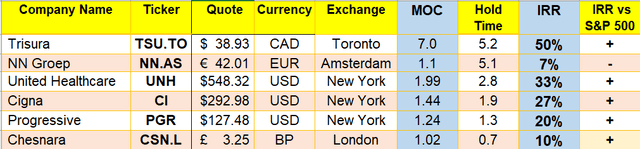

I will start with a table that lists my pure insurance holdings today.

My six insurance picks (Author)

Please note that actual returns are better than the ones listed in the table because of two reasons. First, the MOC (Multiple Of Capital) column does not account for dividends, otherwise, MOC would be higher (the IRR column accounts for dividends). Secondly, IRRs are indicated in USD. European currencies are at historical lows against the USD now and it negatively affects British Chesnara (OTC:CSNRF) (CSN in London) and Dutch NN Groep (OTCPK:NNGPF) (NN in Amsterdam). My actual returns for these stocks (especially for Chesnara) are much better than IRRs in the table because I often hedge my currency exposure. For example, upon purchasing Chesnara late in 2021, I kept holding a low-cost short position in the British pound until it dropped against the USD in 2022. Only at that point, I covered my short.

Do not miss the column that compares stock returns to the S&P 500 index performance. When I buy a stock, I always measure its long-term return vs. the index (including dividends for both) and consider it meaningful after one year of holding time. 5 out of 6 stocks have beaten the index and several of them by a wide margin. NN Groep has delivered less than the index (but not by much) only because of the currently low Euro. On the Seeking Alpha site, surprisingly few articles are devoted to seeking alpha.

It is time to ask the author whether he has introduced the so-called “survivorship bias” by deleting insurance picks sold. The answer is yes: I was holding decently performing Markel (MKL) and Travelers (TRV) for a long time but sold them a couple of years ago because concluded they were not likely to beat the index in the long run. I covered both of them in posts that can be found on my author’s page.

This performance of the stocks in the table is rather remarkable against the backdrop of historically low interest rates. Since insurance companies hold big fixed income portfolios, higher interest rates present an important tailwind that has not been fully factored in yet.

The list is rather diverse with half of the companies being foreign and split between 3 major groups of insurers – Property & Casualty, Life, and Medical. We will review the companies following these subindustries.

Property And Casualty

Trisura (OTCPK:TRRSF) (TSU:CA) is the best multi-year performer in my total portfolio including non-insurance stocks. I covered it twice on SA and these posts did not attract a big audience – who would be interested in a tiny Canadian insurer?

Due to its stunning growth, the stock is not so tiny any longer – its current market cap is close to CAD 2B. But despite its dazzling performance, it is not prohibitively expensive if at all: its P/E ratio is 20.4 on a TTM basis vs. GPW (gross premiums written) growth of 77% in the last quarter. In my opinion, Trisura is more likely than not to keep beating the index.

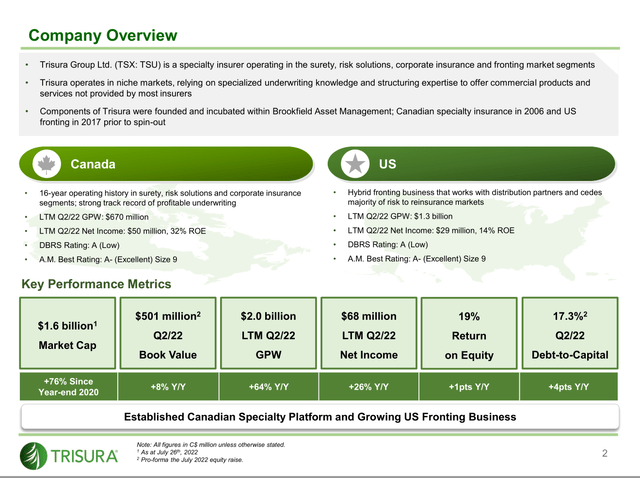

The company consists of 2 segments. In Canada, it is a specialty insurer while in the US it is a fronting insurer. It means that it cedes almost all (around 90%) of its premiums to reinsurers in return for a fronting fee. The slide below from the company’s August presentation provides a short description of its business. Please refer to my old publications for a deeper analysis (Making Money With Brookfield: Trisura Group and With 60%+ IRR Compounded Over 3.5 Years, Trisura Is Still Promising.)

Trisura overview (Company’s presentation)

My second P&C pick is rather traditional – Progressive Corporation (PGR), but it took me a while to buy this name because it is very expensive. It is the only big US P&C insurer that I am aware of that is trading noticeably above the sum of its equity and float. For comparison, Berkshire is always trading as the sum of equity and float with every other insurer being less expensive.

Progressive is a household name in the US as it has been the #3 auto insurance stock for many years. I have not seen the latest data but estimate that it should have overtaken Geico to become #2. The question about Progressive is whether its profitability and growth justify its valuations. I posted twice on Progressive ( The Progressive Corporation – An Outstanding Compan… and The Progress Of Progressive: Massive Insurer With G…) and limit myself to only several points here.

It was Mr. Buffett who convinced me to buy PGR. Over the last several years, PGR has beaten Geico, and Mr. Buffett publicly acknowledged it at recent Berkshire shareholders’ meetings. This investment hint was hard to ignore. PGR has been persistently increasing its market share in mandatory auto insurance at the expense of both #1 State Farm and smaller insurance players but still has a lot of room to grow. The growth has been always profitable with combined ratios superior to the industry. Over the last 10 years, PGR has delivered positive returns every year, and only twice it was less than 10%.

PGR’s investment portfolio includes ~$50B of bonds and a 1% increase in interest rates should add $500M to its net investment income. Since annual NPE (net premium earned) is about $45B, this $500M is roughly equivalent to a 1% improvement in the combined ratio which is a big deal for a big insurer.

PGR has found two new ways to grow. It is in commercial auto and property (primarily, homeowners). Commercial auto is already highly profitable and PGR is #1 in the business. Homeowners insurance is not profitable yet but is scaling up rather quickly and should become a contributor in 2-3 years.

Life Insurers

The industry is typically less attractive to investors than P&C because earnings are accounting-driven and accounting itself is mind-bogglingly complex. Some inconspicuous changes in regulations can cause a revolution in reported results. However, recently this industry has drawn more attention. Due to expected higher interest rates, major alternative asset managers (think of Brookfield, Blackstone (BX), KKR (KKR), and the like) want to become insurance players and disruptors.

My first pick here is a tiny British company Chesnara that I covered in Chesnara: The Land Of High Dividends – 8% And Growing (I suggest buying it in London as opposed to its ADR available OTC in the US). It is specialized in run-off portfolios of life policies. I built the position in December-January for 270-280 pp and considered it a yield play with secure dividends and good chances to beat the index. I also considered it a possible target by one of the asset managers. So far, it has performed significantly above my expectations delivering 16% in appreciation (in British pounds) plus dividends. The appreciation should be partially attributed to one of the British asset managers taking a big position in the stock. The annual bump in dividends should be coming shortly. Please keep in mind, that the UK does not have a withholding tax on dividends and the pound is very cheap now.

NN Groep (again, I suggest buying it in Amsterdam vs. the US with eyes on cheap Euro) was a value stock when I bought it and, probably, still is. Famous hedge fund Elliott took an activist position in NN Groep in 2020 and called for changes in the interest of shareholders. NN pays a fairly high and growing dividend with a current yield of 5.6% and is buying back stock at a low P/B ratio of ~ 0.6 (intangibles constitute only about 7% of shareholders’ equity). While the Netherlands imposes a 15% withholding tax on dividends there is a way around it. NN offers to either pay dividends in cash withholding 15% for US residents or in stock without withholdings. Of course, one can sell the newly distributed shares upon receiving them avoiding withholdings.

Medical Insurers

There are only 5 big health insurers in the US and my list includes two of them. I bought them due to different reasons but both, so far, have delivered extraordinary returns.

United Healthcare (UNH) is the biggest and better-diversified company compared to its peers. At the same time, it is very profitable, grows quickly, and increases its dividends at a stunning rate – 18% on average over the last 5 years. But it is very expensive now and with P/E~ 28, I would not buy it at its current price.

Cigna (CI) is smaller, more volatile, pays a decent dividend, and buys back its shares at an enviable rate. It is not surprising because Cigna is cheaper than its peers (P/E~17 with free cash flow higher than net income). Despite its recent appreciation, it is still moderately attractive. Better still, Cigna is quite volatile and armed with patience, investors can scoop it with time relatively inexpensively.

Within the scope of this post, it is impossible to analyze such a complicated beast as a medical insurer. I would refer my readers to my old post about Cigna (Unpopular Cigna May Become Very Rewarding) which I still consider pretty much on the point. However, for medical insurers, it is rather easy to grasp the big picture.

Healthcare expenses are destined to grow in the US and worldwide. It is due partially to increased longevity and partially to the ever-expanding arsenal of cures including diagnostics and pharmaceuticals. As long as private medical insurance is accepted by society on a significant scale and the industry is not too fragmented, big insurers are very likely to grow profitably. The industry underwriting profit can be considered as a toll on healthcare expenses. This core income helps to originate several other related cash inflows.

The fact that the industry is universally hated helps a lot: sometimes the stocks are available at depressed valuations. Quite a few Americans are confident they have an inferior medical system with medical insurers being the main culprit. Perhaps, it is so because many of these Americans have not experienced other medical systems when they were seriously sick. As long as one is relatively healthy, high costs of medical insurance in the US cause justified ire.

By far, the main (if not the only) risk for the industry is Medicare-for-all or some other single-payer system. In my post on Cigna, I crudely estimated this risk as fairly remote in the US and invested. I wish I had done it earlier. There is one thing about medical insurers that I fail to grasp though: why is Warren Buffett not invested today? The industry appears to fit his criteria and he was an investor 15-20 years ago.

Conclusion

As I already mentioned, growing interest rates represent a compelling reason to take a closer look at the insurance industry. Berkshire Hathaway has not missed the opportunity and recently added Alleghany (Y) to its stable of insurers (The Acquisition Logic: Berkshire Acquires Alleghany). It was Buffett’s first big acquisition after a long dry spell. Growing insurance operations against the favorable interest rates backdrop make Berkshire itself quite attractive.

Admittedly, my list of six insurers is non-conventional. Some of the names mentioned are more expensive now than they used to be and doubtless, many other names deserve close attention. Still, Warren Buffett’s example is encouraging: outstanding compounders and dividend payers can be found within the industry, outside of the buzz of Seeking Alpha’s front page.

Be the first to comment