Hung_Chung_Chih/iStock via Getty Images

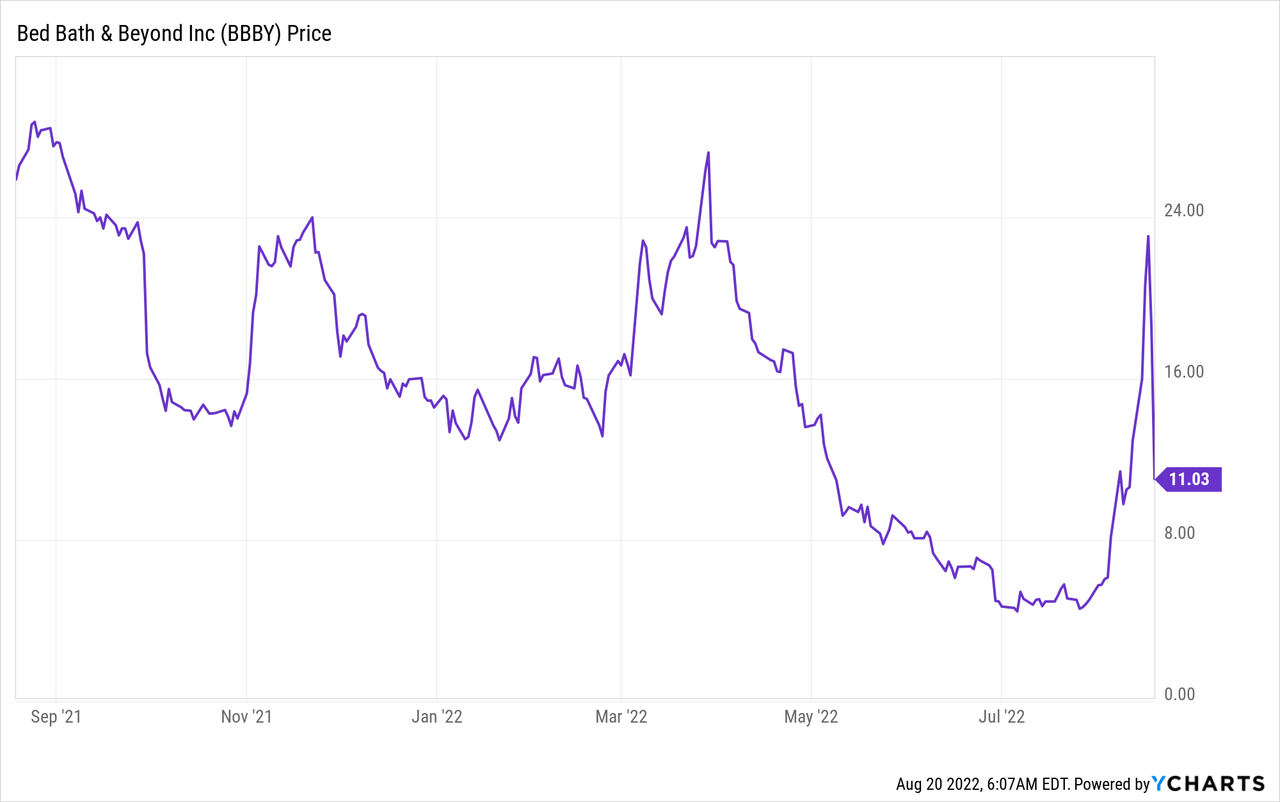

Investors were probably struck with a serious case of Deja Vu as Bed Bath & Beyond’s common shares ripped higher and its self-proclaimed apes dominated the financial news cycle over the last few weeks. Apes, retail traders who are incredibly bullish on heavily shorted stocks, came to characterise the later era of the pandemic trading boom in early 2021. In those days when SPACs were all the rage and meme stocks had taken over Wall Street, companies like Bed Bath & Beyond (NASDAQ:BBBY), AMC Entertainment (AMC), and GameStop (GME) saw significant daily trading volume as the battle between the apes and shorts was spectacularly played out publicly.

The apes were an unexpected phenomenon that followed the onset of the pandemic as the unique conditions of these years combined to mint new retail traders en masse. In this, many households locked in suddenly found themselves with more free time and excess capital on hand. This would see shares of Bed Bath & Beyond surge to just above $35 as its meme stock peers also saw significant gains. The shorts were squeezed and as more apes piled into the already crowded trade, Bed Bath & Beyond’s common shares went parabolic.

The party came to an end on the back of the risk-off sentiment which came about from rising inflation, a more hawkish FED, and an inverting yield curve. Bed Bath and Beyond fell to lows of $4.38 but has rocketed higher in recent weeks with euphoria returning on the back of inflation fears abating. The current run-up just like the last one seems to have no fundamentals to stand on. Bed Bath & Beyond, the New Jersey-based brick-and-mortar chain for domestic merchandise including kitchenware and bedding, is fast losing cash as revenue and cash burn move in the wrong direction.

Material Liquidity Gap Has Reduced Runway

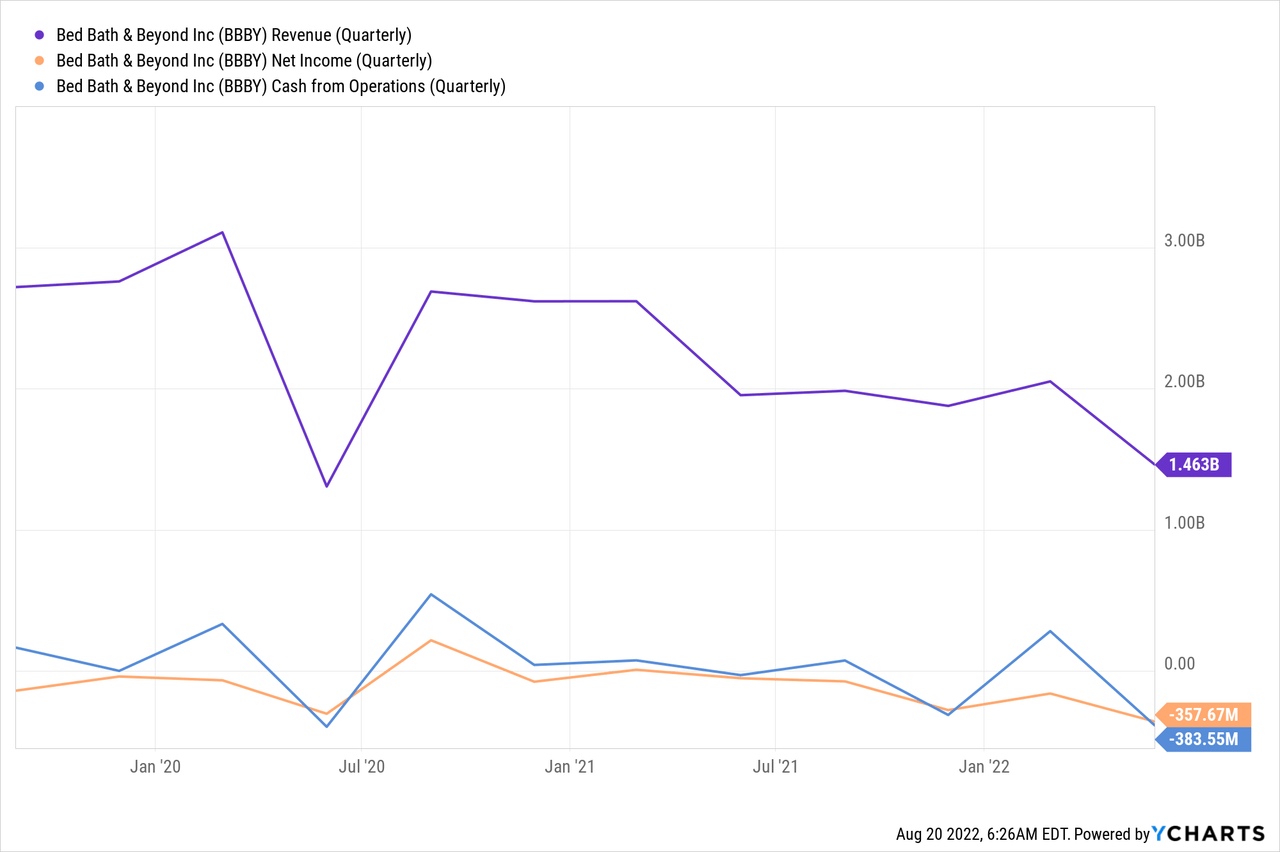

The company last reported earnings for its fiscal 2022 first quarter which ended on the 28th of May. The quarter saw revenue come in at $1.46 billion, a decrease of 25% from the year-ago quarter and a miss of $46.37 million on consensus estimates. Management pointed to a shift in consumer spending patterns and a fall in overall demand in the home sector as reasons for the fall. Indeed, with new home sales down and real wages falling, spending on domestic merchandise has slowed.

Whilst the weakening economic backdrop poses a danger to the whole market it’s especially acute for Bed Bath & Beyond due to a weak liquidity position and high debt burden.

The company generated a gross profit of $350 million with margins of 23.95%, down from 34.85% in the year-ago quarter. Net loss of $357.67 million worsened sequentially from a loss of $159 million in the preceding quarter. This was also a year-over-year increase of 603% and meant cash burn from operations came in at $383.6 million, up from a year-ago burn of $28.7 million.

To summarise, revenue and gross profit are down while net loss and cash burn have rocketed higher. Hence, it is difficult to see what exactly the apes are bullish on. The apes would rightly say that the near 42% short interest and the potential for a short squeeze continue to be driving factors for their behaviour. The financials don’t matter, they never have.

But the current context is significantly worse than it was in the early days of 2021. The company is at serious risk of no longer being a going concern and current diamond-handed apes are in serious danger. Bed Bath & Beyond held cash and equivalents of $107.5 million against $5.17 billion in total liabilities as of the end of its last reported quarter. This included $1.38 billion in long-term debt and $1.50 billion in capital leases. To put this simply, I believe that at the current rate of burn and current debt burden, Bed Bath and Beyond has a couple of months of runway left on a best-case scenario.

The company has already hired a corporate restructuring firm to help advise on its debt and has tapped financial advisors on pathways to raise money. Taking on more debt is likely out of the picture, so fundraising efforts would likely coalesce around an equity offering.

However, a key risk to bears is when Bed Bath & Beyond provides the market with certainty around its liquidity gap. If the company announces strong cost-saving efforts and is able to raise cash through a mix of a partly dilutive equity raise and a sale-leaseback on some fixed assets, then common shares will rocket higher. This could build on upward momentum to cause a short squeeze like that the apes have been in pursuit of.

Apes Together Strong

The revival of vivid hopes for a short squeeze seems extremely odd when set against a financial backdrop characterized by a huge liquidity gap unlikely to be filled without pain.

More retail traders in the market is a great thing. It broadly contributes to a healthier economy and means the machinery of capitalism and wealth creation is democratized. However, the type of trading championed by the apes is very risky especially when conducted on companies that are losing a lot of money and are struggling to plug any such liquidity gap. Piling into a stock not on fundamentals but on momentum and hype is simply not prudent. Current investors are likely betting on offloading their stakes at a higher price to other investors and someone is going to be left holding the bag when the music stops. I’d advise investors to avoid shares.

Be the first to comment