firebrandphotography/iStock via Getty Images

“Even as a solid rock is unshaken by the wind, so are the wise unshaken by praise or blame.”― Dhammapada

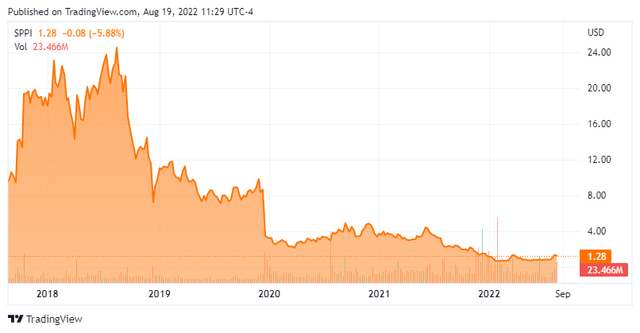

We last posted an article on Spectrum Pharmaceuticals (NASDAQ:SPPI) back in March of 2021. At that time, we declined any investment recommendation on the shares but did promise to circle back on this name as its story developed. The company reported second-quarter results earlier this month and I have gotten a question or two from Seeking Alpha followers recently. Therefore, we will revisit this small biopharma company via the analysis below.

Company Overview:

Spectrum Pharmaceuticals focuses on developing and commercializing novel and targeted drug products with a primary focus in oncology. The company is headquartered just outside of Las Vegas. The stock currently trades around $1.25 a share and sports an approximate market capitalization of $250 million.

Recent Developments:

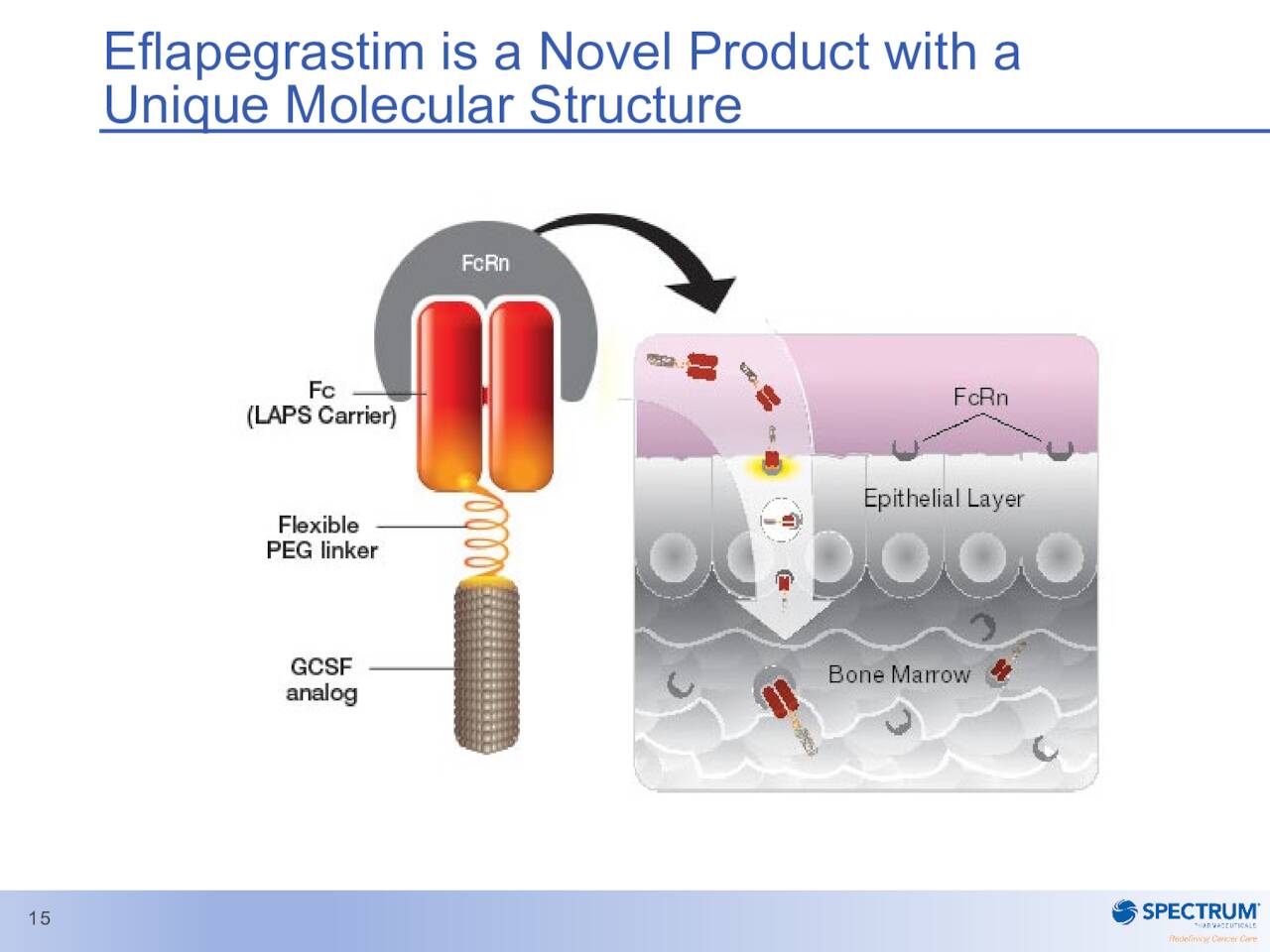

The company has been a non-stop soap opera since we last looked in on it. Its primary asset is ROLONTIS (eflapegrastim). Spectrum had submitted a marketing application on it for the treatment of neutropenia in patients receiving myelosuppressive anti-cancer drugs. This candidate has had a rocky ride, to say the least, towards FDA approval. First, the inspection of the manufacturing facility where ROLONTIS was to be made in South Korea by partner Hanmi was delayed thanks to the pandemic.

March Company Presentation

Then in August of 2021, the FDA slapped Spectrum’s Biologics License Application or BLA with a Complete Response Letter or CRL. The CRL cited deficiencies related to manufacturing and indicated that a re-inspection will be necessary. Then in December of last year, the company announced its CEO was retiring which was followed by resignation of its CFO in February of this year. In between those management losses, Spectrum announced a restructuring that resulted in approximately 30% of its workforce being let go. The company also halted development of early-stage drug candidates to focus solely on pushing poziotinib and ROLONTIS across the finish line. These measures were projected to reduce annual cash burn by 20% to 25% and push the company’s ‘cash runway‘ into 2023. The company did resubmit its BLA for ROLONTIS in April and the FDA is scheduled to make a decision on its application on September 9th.

January 2021 Company Presentation

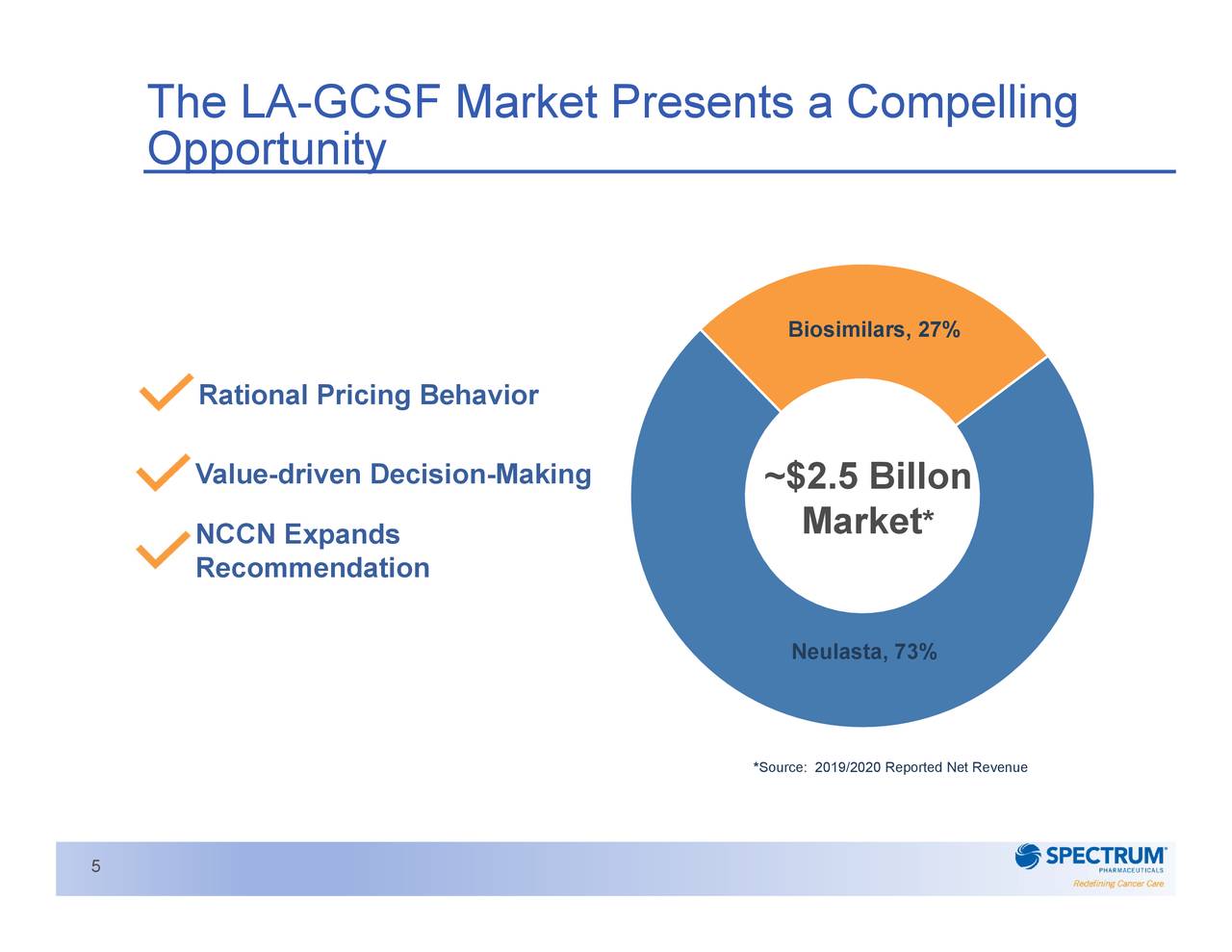

The FDA completed re-inspection of the manufacturing facility for ROLONTIS in August. Chemo-induced neutropenia impacts just over one million individuals in the United States. ROLONTIS would be the first drug in its class approved for this indication since Neulasta got the green light from the FDA in 2002.

March Company Presentation

March Company Presentation

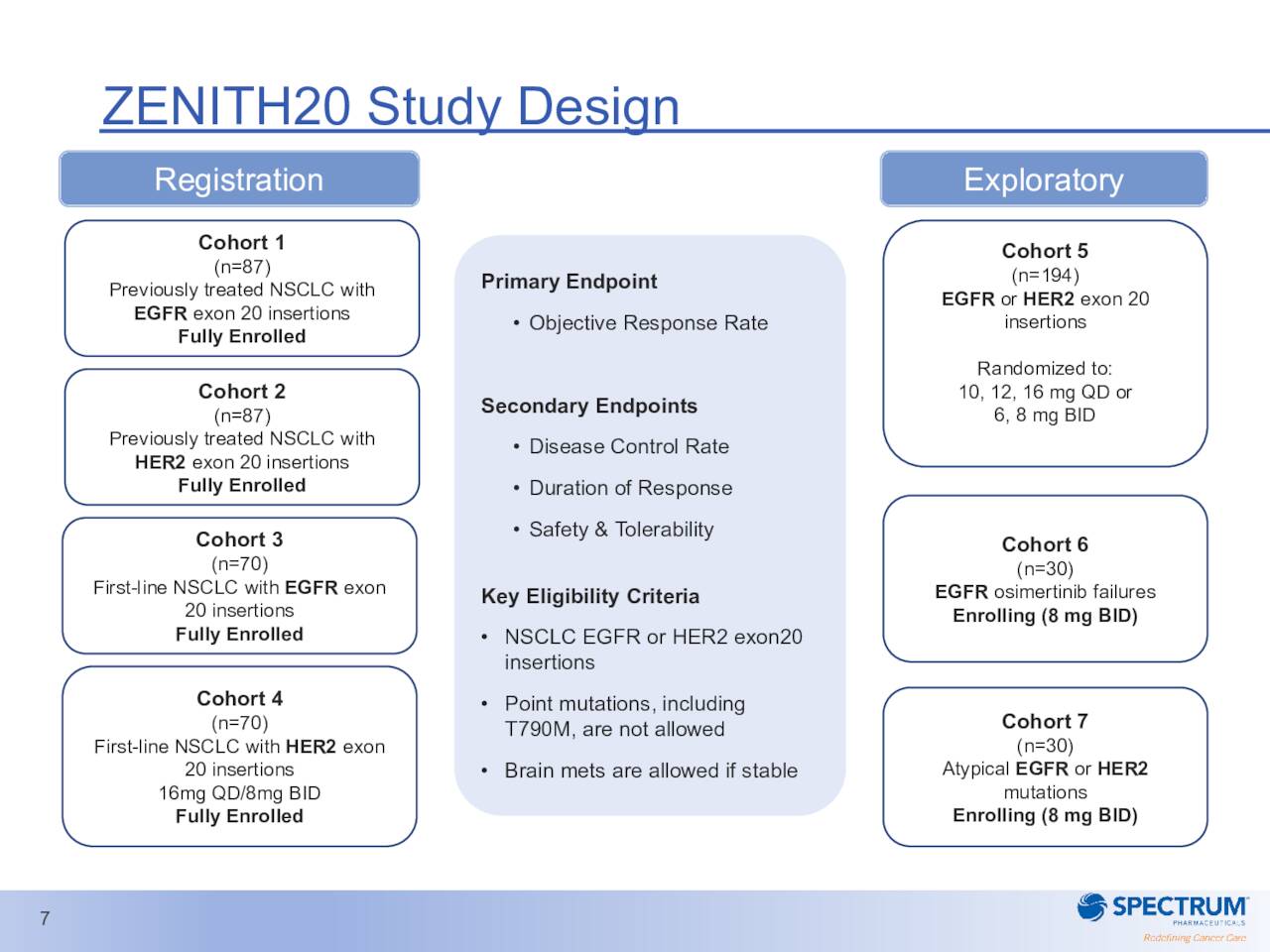

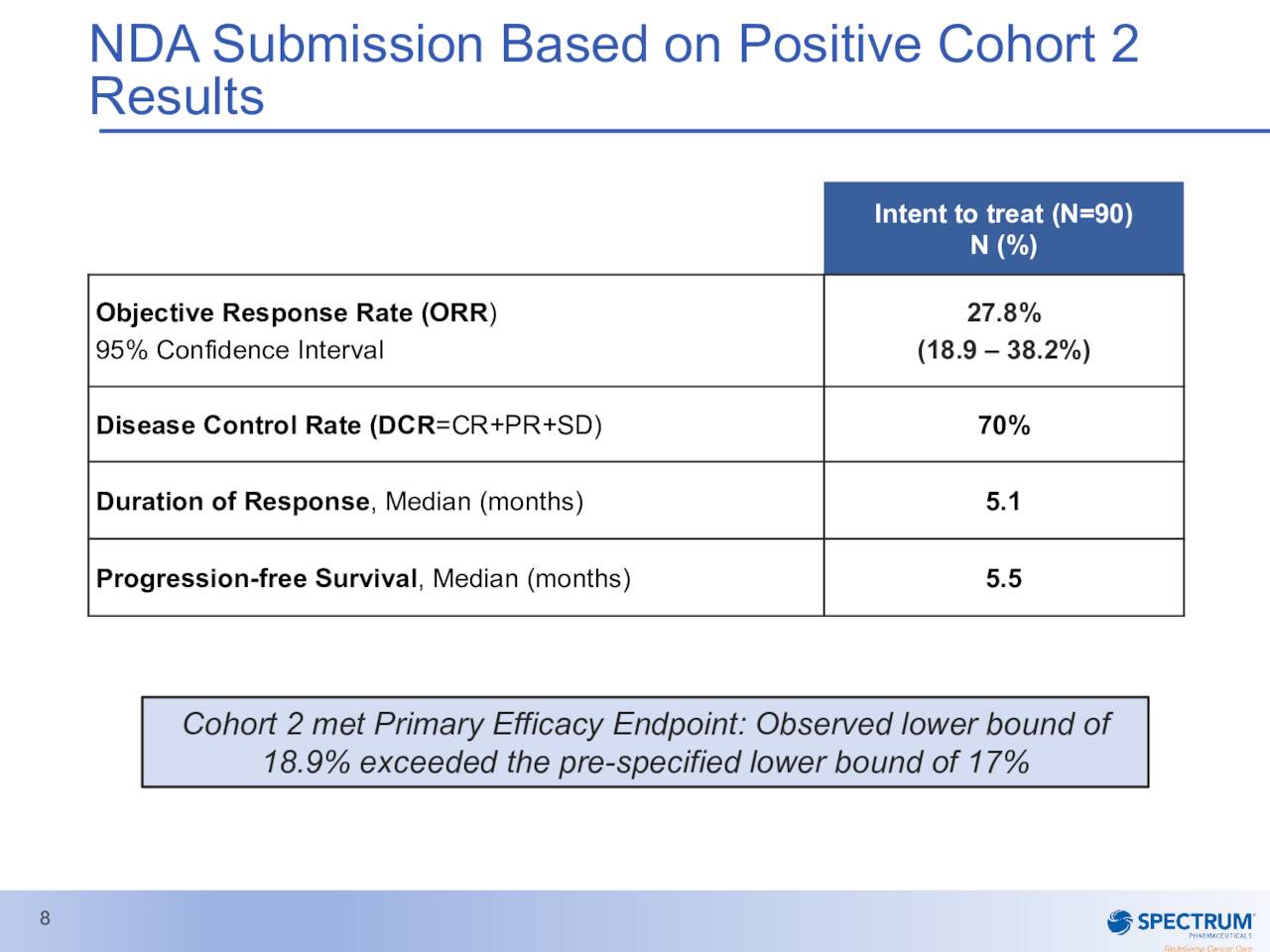

The approval path for poziotinib has been much smoother to this point. The compound is targeting patients with previously treated, locally advanced or metastatic non-small cell lung cancer, harboring HER2 exon 20 insertion mutations. This drug candidate is an orally administered, irreversible tyrosine kinase inhibitor targeting EGFR and HER2 with exon 20 insertion mutations.

Poziotinib has fast track designation and is on an accelerated approval pathway for this indication. The NDA was submitted some ago has a PDUFA date of November 24th of this year. It is important to note Poziotinib has a much smaller potential market than ROLONTIS and the company will have to demonstrate the compound has an overall risk benefit and clinical relevance based on its ‘ZENITH’ study to the FDA to garner approval. A randomized confirmatory trial is currently ongoing. A critical phase 2 trial in 2nd line NSCLC patients with EGFR exon 20 mutations around Poziotinib did not meet its primary endpoint of ORR in one of its cohorts early in 2020.

Analyst Commentary & Balance Sheet:

Since second quarter results posted, B. Riley Financial ($4 price target), H.C. Wainwright ($10 price target) and JMP Securities ($4 price target) have all reiterated Buy ratings on SPPI.

Several insiders have made myriad but small dispositions (Under $20,000 per transactions) of shares in 2022. There have been no insider purchases in the stock so far this year. A very small percentage of the overall float is currently held short. After recording a net loss of $29.0 million in the second quarter, the company had just less than $70 million of cash and marketable securities on its balance sheet.

Verdict:

The current analysis consensus sees sales of just $3 million in FY2022, but projects that to soar to approximately $100 million in FY2023.

The stock is not that expensive on a price to forward sales basis if one believes the company can achieve $100 million in projected sales in 2023. Given the events of the past year, an investor has more than enough cause to be at least skeptical. In addition, both ROLONTIS and Poziotinib are not wholly owned, but licensed from Hanmi. The company is also very likely to execute a substantial capital raise in the near future to fund the launch of hopefully two newly approved products. Therefore, it feels like discretion is the best part of valor here, until the company can produce a series of positive milestones over the next few quarters and once Spectrum’s funding needs have also been addressed.

“He who dares not offend cannot be honest.“― Thomas Paine

Be the first to comment