6381380/iStock Editorial via Getty Images

My regulars may have picked up on the fact that I’m reviewing my rail investments at the moment. In case you missed it, I’m reviewing my rail investments at the moment. Last month I finally bought CSX Corporation (NASDAQ:CSX), and in that time the shares are up about 13.8% against a gain of 7.4%. While that’s great on some level, it’s also a pain. I was responding to one of the comments on my Union Pacific article yesterday to a person who expressed a very common, and very reasonable view, namely that railroads are “never sell, buy and forget” type investments. People can sleep at night with these, and they can ignore the ups and downs in the stock price because railroads aren’t going away anytime soon. That’s a very legitimate view that probably promotes mental health far better than my perspective. I gotta be me, though, and my view is that I sleep at night when I know I don’t own assets that are overpriced. I want to only ever own assets that are relatively cheap because they represent less downside risk. In my view, railroads are great, trains are very cool (I used to have a large “N” scale railroad in my house), but they’re not worth an excessive price because nothing is.

So, in response to this tiresome rise in price, I’ve got to return to this company and decide whether or not it makes sense to buy more, hold, or sell my position. I’m going to make this determination by looking at the most recent traffic data, and comparing that to the stock price.

Let’s face it. There are more fun things to be doing on the weekend than reading the ramblings of someone like me. There are friends to visit, family to reconnect with, movie-lectures to be watched etc. etc. etc. Add to that the fact that I am an inveterate braggart and sitting through an entire article can be quite the chore. In order to soften this blow somewhat, I provide all of you people with a thesis statement paragraph near the beginning of each of my articles. You’re welcome. Obviously not all heroes wear capes. I’ll be selling my CSX shares today, but will remain short the (very profitable) puts I wrote earlier this year. The reason for this is that I don’t like the combination of slowing business and richer valuation. I admit that the shares have been more expensive in the past, and that they may continue to rise in price from here. In my experience, though, it makes sense to thank “Mr. Market” for the 13.8% (!) monthly gain, but to leave before this party gets too bubbly.

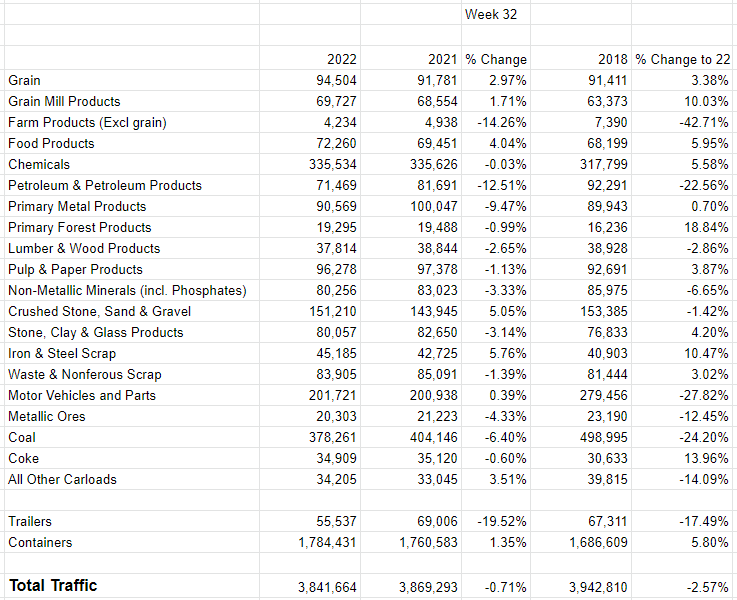

Traffic Update for Week 32

Railroads make money by hauling stuff around. I know that that’s about as insightful a comment as “water is wet”, but I think it’s helpful to remind ourselves of the blindingly obvious sometimes. Given the centrality of traffic flows in the life of a railroad, I think it’s worthwhile thinking about how it’s going.

I’ve produced a table below for your enjoyment and edification where I compare the first 32 weeks of 2022 to both 2021 and 2018. I bring in 2018 because, as you may recall, there was a global pandemic recently that massively impacted the global economy. For that reason, any comparison to the period affected by the pandemic would be unhelpful, so I want to compare traffic today to the pre-pandemic era.

In my view, things are relatively soft at the moment. Not “disastrous”, and not “flaccid”, but relatively soft. Specifically, as of week 32, total traffic on the CSX network is down about .71% relative to the same period a year ago. Trailers, farm products (ex-grain), and petroleum were standouts on the downside here, down 19.5%, 14.26%, and 12.5% respectively. This is mildly troubling, especially since 2021 was hardly a banner year for the firm.

Also, when compared to the same period in 2018, traffic is even softer, down 2.5% in 2022 relative to the earlier period. There was relative softness in the culprits listed above, and also motor vehicles and parts (down 27.8%), coal (down 24%), and “all other carloads” (down 14%).

In case you’re worried that I’m ignoring 2019, I should also point out that traffic is basically identical in 2022 than it was in 2019 (up by .23%). The point is the same, though. I’ll buy more of this if the stock is reasonably priced now relative to what it was priced at previously, when traffic was either similar or stronger.

Lastly, none of this is the end of the world, but I think it’s interesting for two reasons. First, railroad traffic gives us some insight into the health of the goods economy in North America. According to what I’m reading from this data, the economy is still weaker than it was just prior to the pandemic. Second, it’s obvious that traffic patterns move in cycles, but I’d want to see the shares reflect this slowdown before I got excited about buying more.

CSX Corp. Traffic Trends (CSX Corp. investor relations)

The Stock

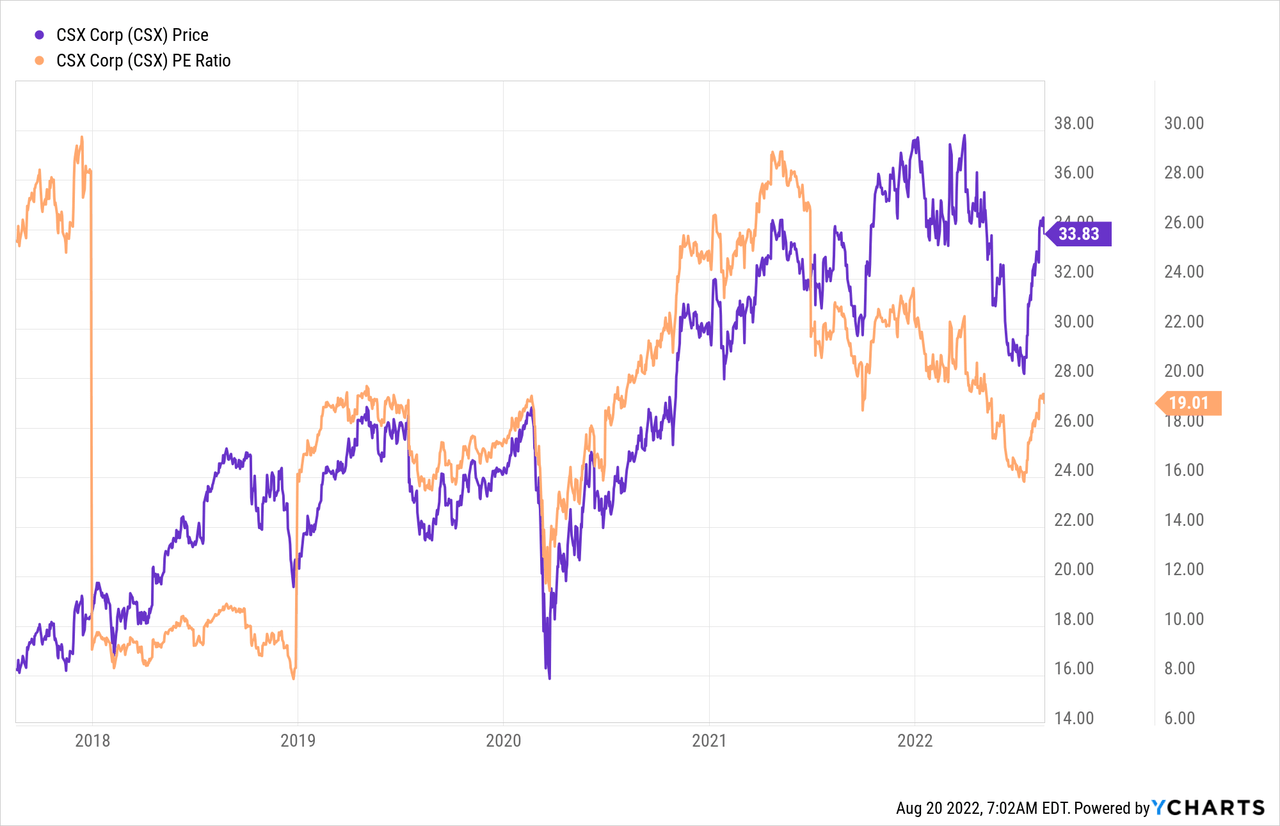

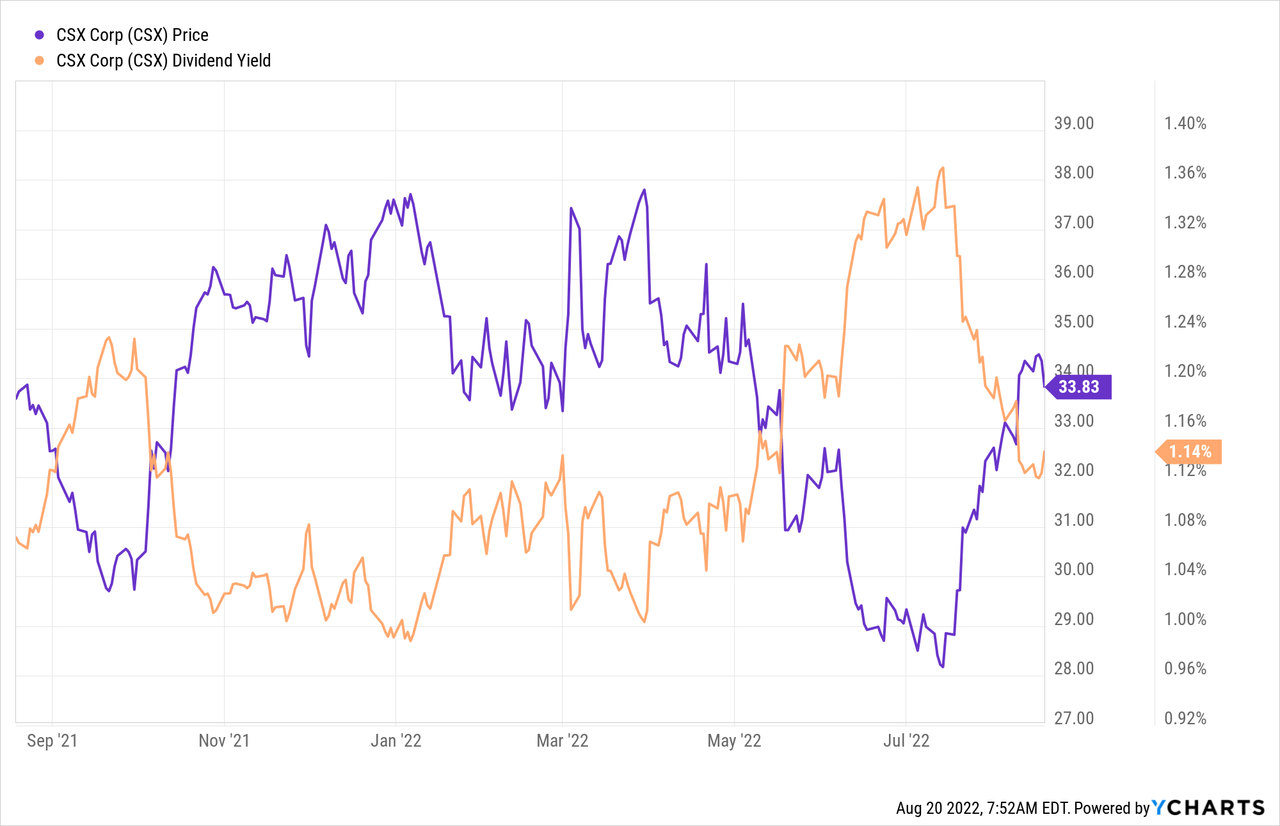

Given the above, I’d want to see the stock trading at a relative discount to the pre-pandemic period, when traffic was much more robust. While the shares are admittedly cheaper than they were in 2021, they’re still much more pricey now than they were when traffic was much more robust in the 2018-2019 periods, per the following:

Source: YCharts

Source: YCharts

I may be anchoring on my prior buy, but the shares are now about 15% more expensive than they were a month ago when I got excited about this name. Only one short month ago, the shares were trading at a PE of 16.5 and the dividend yield was about 1.3%. I’ll admit that the shares may have been “too cheap” back then, but I don’t think a 15% uptick in valuations is warranted here. Additionally, if I bought more shares at current prices, I’d collect 11% less income. Given the above, and given my growing risk aversion, I’m taking my chips off the table. I’ll thank “Mr. Market” for his very generous 1 month return, but I’m leaving the party before it gets out of hand.

Options Update

Just in case you happen to have misplaced your “Almanac of Doyle’s Trades”, I’ll remind you that I sold 10 January 2023 CSX puts with a strike of $27.50 for an average price of $1.54 each. This brought my total earned from selling puts over the years to $18.34 per share. This demonstrates the power of short put options, and allows me to suggest that, maybe, there are more ways to generate income than by buying dividends.

Alright, moving past that not so subtle “humble brag”, I want to revisit this trade. At the time that I sold my first batch of five of these, they were about 21% out of the money, and had a year of time value. They’re now about 18.6% out of the money and have only about five months of time value to go. They’re currently priced at $.45-$.60, so I think the trade has worked out rather well. To drive the point home, the puts are slightly less deeply out of the money, but because of the slow march of time, their price has collapsed. Assuming nothing significant changes over the next five months, I’ll re-enter this trade at the end of January and sell some more puts on this wonderful business. I’m quite comfortable owning it, obviously, but will only ever own it at a price that is attractive, and I’ll sell it when the shares become too richly priced.

Conclusion

So, I’m out. I acknowledge that the shares aren’t as egregiously expensive as they were when I actively avoided the name back in January of this year, and they may continue to rise in price from here. The shares have been at least this stretched in the past, and may become even more so in future. I’ll roll up a chair and watch from the sidelines, though, as my risk tripwires have just been triggered. I may miss out on some future upside from here, but as my first boss on Bay Street (Canada’s deeply insecure younger brother to Wall Street) once said to me “bulls make money, bears make money, pigs get slaughtered.” In my view, waiting to get out before the absolute top would be a mistake.

Be the first to comment