Ekaterina79/iStock via Getty Images

Thesis

Ally Financial Inc. (NYSE:ALLY) has continued to underperform the SPDR S&P 500 ETF (SPY) over the past month since we initiated our Hold rating. The lender has been battered by macro headwinds, and higher provisions for credit losses as the post-pandemic credit trends normalized further. Furthermore, the ongoing headwinds seen in the used car market have also buffeted investors’ confidence in ALLY, as the used car value index is down MoM as of mid-August.

However, we also noted that ALLY could have staged its medium-term bottom in late July after its Q2 earnings release. Given the battering seen in ALLY since its October 2021 highs (down 44% to its July lows), we are confident of its July bottom, as its valuation is also attractive.

Therefore, we revise our rating on ALLY from Hold to Buy.

The Battering In ALLY Is Justified

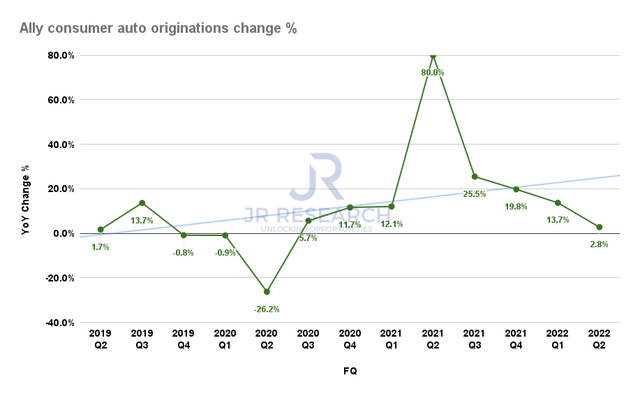

ALLY consumer auto originations change % (Company filings)

Ally reported consumer auto originations of $13.3B in FQ2, as it notched another record high of originations, despite a weak auto market in Q2. Therefore, it demonstrated that the company’s auto originations trend remains robust, even though it has normalized further.

As seen above, originations increased by just 2.8% YoY in Q2, down from Q1’s 13.7%. It’s another quarter of below-trend growth as Ally laps highly challenging comps from 2021. Furthermore, the Manheim Index suggests another weak month as of mid-August, as it fell to 211.6, down a further 2% MoM from July. Therefore, we expect the headwinds in the auto market to continue impacting the growth cadence in Ally’s auto originations in the near term as economic headwinds intensify. CEO Jeff Brown accentuated:

Our ability to generate strong consumer originations shows the scale of our auto business and depth of application flow. Supply chain challenges continue and demand remains robust, resulting in low levels of inventory and, therefore, support for used vehicle values. Broadly speaking, macro uncertainty and market volatility are elevated. [These] unique challenges are likely to continue in the quarters ahead. (Ally FQ2’22 earnings call)

But, Things Should Improve For Ally From Here

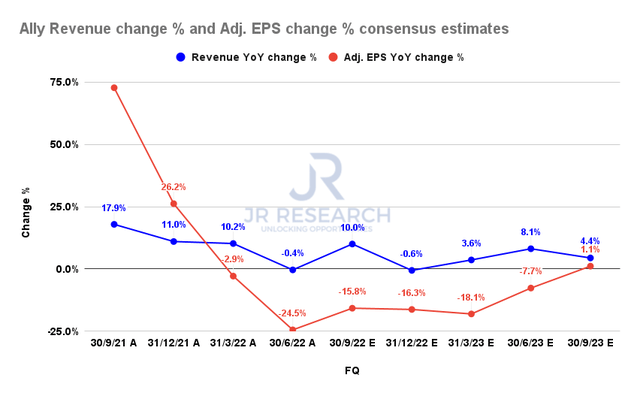

Ally revenue change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Ally’s underlying metrics should improve from here. Notably, we should see Ally’s adjusted EPS growth to have bottomed out in FQ2, as it recorded a provision of credit losses of $304M in Q2, up significantly from Q1’s $167M.

In addition, management guided it has not observed a material deterioration in credit trends within a normalization framework. Hence, if macros improve further moving forward, we are confident that it could help lift Ally’s earnings from its nadir.

Furthermore, management also guided that it’s expanding its yields in several verticals beyond auto financing, which should undergird its earnings recovery. CFO Jenn LaClair articulated:

We see a lot of opportunities to continue to see yield expansion. We are growing our unsecured portfolios, Ally Lending, Credit Card. We see really robust originated yields in the low-teens for Ally Lending and the upper teens for credit card, and we’re growing those very quickly and see a path kind of at $4 billion to $6 billion in those portfolios. Corporate Finance continues to grow. We hit a high watermark at $8.5 billion in HFI this quarter, continuing to see a clear path to about $10 billion and yields expanding from there. (Ally earnings)

ALLY’s Valuations Are Attractive

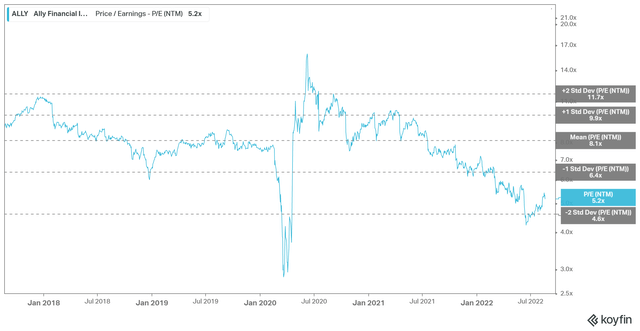

ALLY NTM P/E valuation trend (koyfin)

ALLY last traded at an NTM normalized P/E of 5.04x. At its July lows, its valuation reached levels more than two standard deviations below its 5Y mean. While it has recovered from its July lows, we believe ALLY’s valuation remains attractive, as its EPS growth is estimated to improve through FY23. Therefore, we are confident that we have likely seen the lows in its medium-term valuation in July.

Is ALLY Stock A Buy, Sell, Or Hold?

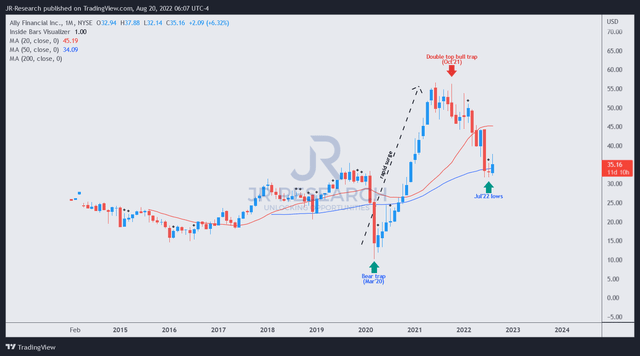

ALLY price chart (monthly) (TradingView)

As seen above, ALLY’s price action has been consolidating robustly since its lows in June and July. With July’s long-term bottoming process, we postulate that the battering from its October highs seems complete.

Therefore, ALLY’s price action is constructive, which augurs well with its attraction valuation, as discussed earlier.

Accordingly, we revise our rating on ALLY from Hold to Buy.

Be the first to comment