franckreporter/iStock Unreleased via Getty Images

The Genius Next Door

Mario Monicelli (1915-2010) was an Italian film director and screenwriter, who became one of the masters of the so-called Comedy Italian Style. In 1975 he directed the film “Amici Miei,” (My Friends,) shot entirely in and around Florence, which was followed a few years later by a second episode, in which one of the characters at one point says, “What is genius? It is imagination, intuition, decision-making and speed of execution.”

Yes, what is genius? The question obviously does not refer to absolute geniuses, such as Leonardo da Vinci, Isaac Newton, or Albert Einstein, whose intellect was evidently beyond any parameters traceable to everyday life. Rather, it refers to our everyday experience. How often do we hear that an idea or solution is genius, when it would be more appropriate to simply call it clever, brilliant, intelligent, or maybe innovative. But why do we use the word “genius” instead?

To say that a person has a genius for business is sometimes not excessive, when it would suffice to speak of predisposition, aptitude, inclination, perhaps vocation? What, then, is genius?

Personally, I have a definition that, while not belittling supreme minds, avoids trivializing its meaning as is often the case in recurrent usage. In my opinion, a genius is that person who is confronted with a problem universally accepted as inescapable or unsolvable, embraces a broader view with his or her own mind, and offers a solution that disrupts the universally accepted way of thinking up to that point.

After that bold step, there can be no going back to thinking or acting as before. It can happen in a wide variety of fields. Most importantly, it happens thanks to normal people like the next-door neighbor. A few examples to make the idea clear.

Fosbury Flop…

Harry Beck was a British draughtsman. In 1931 he created the first schematic map of the London Underground. It was a revolutionary solution and has been adopted in tram and railway maps around the world ever since.

Rinus Michels was a Dutch player, considered the father of total soccer. He became coach of the “Orange” national team and astounded the world in 1974 with a playing formula that forever revolutionized the sport, giving birth to modern soccer.

Beck and Michels each created irreversible turning points in their own fields. There was no going back. They were geniuses next door.

Dick Fosbury was the high jumper who won the gold medal at the Mexico City Olympics in 1968. He is credited with the technical innovation that bears his name, the Fosbury Flop, and which has been the standard of the high jump ever since.

When I was a young high jumper competing, at the sports start centers in the early 1970s, they taught the “ventral overrun technique” (or “straddle style”) in Italy. During one competition I came third, jumping 4.75 feet, but a peer of mine won by jumping 5.25 feet with the Fosbury Flop. He was the only one to jump that way, and he won.

Although I was a teenager at the time, I never learned this technique well. I understood its potential, and once used it to jump “an astounding” 5 feet, but it was never workable for me. I continued to jump using the ventral overrun technique, but always at lower heights. A few years later I started playing volleyball, and the high jump bar was abandoned forever.

…and Investments

My personal solo challenge against the bar turned into a team challenge against a live opponent, with a ball, a referee, and the audience on the sidelines. After many years, I am back to measuring myself alone against the bar, but this time it is the bar of my own limitations, emotions, expectations, knowledge, and ignorance in the financial field.

I have set goals for myself but have always tried to impose the discipline of not expecting too much from the market and luck, to curb greed, and to respect the boundaries of my investment expertise (however limited it may be). I have decided to be content and never set the bar too high to jump. A realistic bar height provides more areas I avoid. One of those areas is cryptocurrencies, in whatever form they take. The events of these days confirm that perhaps I was not wrong.

Not being close to the Master Buffett’s skills, I am content to invest in CEFs and ETFs, which represent leaps of several feet for me. “I don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.” – Warren Buffett. I can’t expect much more using the ventral overriding technique. I’m not off chasing the next hot title or the next big opportunity hoping to strike it rich, but I try to set aside capital gains and dividends one at a time, slowly, like an ant…

All in all, the year 2022 has already been a success because my portfolio has managed to stay afloat. This happened in part thanks to the securities purchased at a discount in the spring of 2020, and in part thanks to the strength of the dollar against the euro, which in my case manages to offset the loss in nominal value of many securities. Plus, there are the dividends (or distributions,) which are continuing to flow in and will be partly reinvested.

In fact, I have stopped purchasing some of the titles whose positions I would like to complete (ETO, EVT, HTD, PDT, RQI, and UTF) because the price is higher than my load price, and I do not like to average upward.

Another consideration is that the exchange rate is still relatively high. This means that if I buy now and the dollar’s value goes down further, I will incur significant capital losses (when calculated in euros.) Let’s say I would prefer to wait for a further decline in the dollar before investing in some smaller, or recently opened positions such as JEPQ (JPMorgan Nasdaq Equity Premium Income), an ETF suggested to me by a kind reader of my last article, Philipsonh.

I bought a few shares of JEPQ to introduce it into the portfolio and follow it more closely. I prefer to tread lightly before exposing myself to double-digit returns, hoping that the strategy adopted by this fund will be as successful as that of its elder brother, JEPI.

My Overall Portfolio

As you may know, my investments are divided into three different portfolios: Cupolone, my primary CEF portfolio, Giotto, my ETF portfolio, and Masaccio, my tactical portfolio.

They are presented in the following tables in order to show the weight that each security has on the whole of all three portfolios, and the income each offers.

Cupolone Income Portfolio (named after Brunelleschi’s Florentine dome) is my strategic, primary investment portfolio consisting of the following sixteen CEFs:

- BlackRock Science and Technology Trust (BST)

- Calamos Dynamic Convertible and Income (CCD)

- Calamos Global Total Return (CGO)

- Eaton Vance Enhanced Equity Income II (EOS)

- Eaton Vance Tax-Adv. Global Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Income (EVT)

- Guggenheim Strategic Opp (GOF)

- John Hancock Tax-Adv. Dividend Income (HTD)

- PIMCO Corporate & Income Strategy (PCN)

- PIMCO Dynamic Income (PDI)

- John Hancock Premium Dividend (PDT)

- PIMCO Corporate & Income Opportunities (PTY)

- Cohen & Steers Quality Income Realty (RQI)

- Special Opportunities Fund (SPE)

- Cohen & Steers Infrastructure (UTF)

- Reaves Utility Income Fund (UTG)

Giotto Income Portfolio (named after the fourteenth-century Florentine painter and architect) includes the following five ETFs that adopt a covered-call strategy:

- JPMorgan Equity Premium Income (JEPI)

- JPMorgan Nasdaq Equity Premium Income (JEPQ)

- Global X NASDAQ 100 Covered Call (QYLD)

- Global X Russell 2000 Covered Call (RYLD)

- Global X S&P 500 Covered Call (XYLD)

Masaccio Income Portfolio (named in honor of the Florentine painter who initiated the Renaissance) is a small “tactical” portfolio that contains these five titles:

- Ares Capital (ARCC)

- Crescent Capital (CCAP)

- Royce Value Trust (RVT)

- Credit Suisse Crude Oil Shares Covered Call ETN (USOI)

- XAI Octagon FR & Alt Income Term Trust (XFLT)

There are 26 titles in total (including the recent purchase of JEPQ.) They all offer monthly distribution with the exception of ARCC, CCAP, and RVT, which have quarterly dividends (or distributions.)

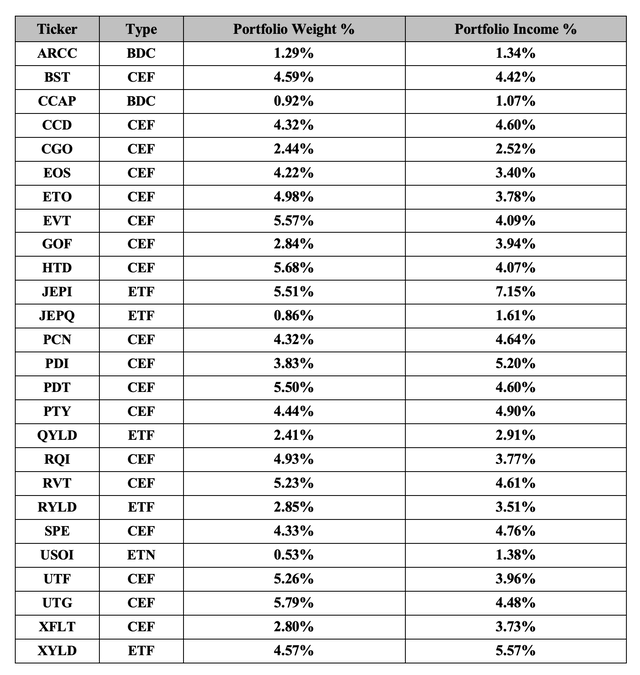

Weights and Income (Author)

Note: The weight of each security is shown based on the current market price. Yield is shown based on the last announced distribution.

As you can see, the largest positions are those of CEFs in the Cupolone Portfolio, with plans to increase some of them, joined by JEPI, RVT and XYLD.

The others are all gradually decreasing positions, down to ARCC, CCAP, JEPQ, and USOI, which are the “Cinderellas” of the group. In the case of ARCC it is my intention to increase the position, even though the individual stocks are not tax efficient for an Italian. But again, I will try to wait for a more favorable euro-dollar exchange rate before buying it.

Current return of the entire portfolio: 9.5%.

Bottom Line

Overall, my portfolio picture is fairly stable. Volatility has reduced in the markets, and the only major news on the horizon at the moment is the expected December rate hike, which is probably already discounted into the markets.

The Volatility Index (VIX) is around 21 at the moment, indicating flat calm. We will see what happens between now and the end of the year. I don’t like predictions. No one ever gets it right anyway, not in finance or in who will win the Soccer World Cup. Italy is not participating because we decided to get eliminated first.

Usually the lull in the markets does not last, but for a dividend investor the lull would be the ideal environment: a steady flow of money in the absence of thoughts, worries, upheavals, and decisions to be made on the spur of the moment. Yet it would be enough not to look at newspapers and financial news, to live peacefully. But this is not easy and blessed are those who can do it.

Everyone has their own way of dealing with the markets. The most important thing is that their strategy works. Everyone has their comfort zone, their bars to jump. For me they are CEFs and ETFs, bought mostly during market sell-offs and held until the next market highs, when the cycle starts over, and I will probably lighten my positions again. In the meantime I enjoy the dividends, keep a generous cash reserve aside and live quietly.

It works for me and, as James Bond says in the final scene of Diamonds Are Forever, “I’ll be the judge of that.”

Be the first to comment