Morsa Images

Zoom (NASDAQ:ZM) is probably the biggest poster child for fallen stars of the pandemic. This remote video conferencing giant was once one of the hottest trades on Wall Street. Then, as the pandemic era matured and Zoom started slowing down from growth rates that once exceeded 100% y/y, investors shied away from the decelerating company and compressed down its valuation multiples.

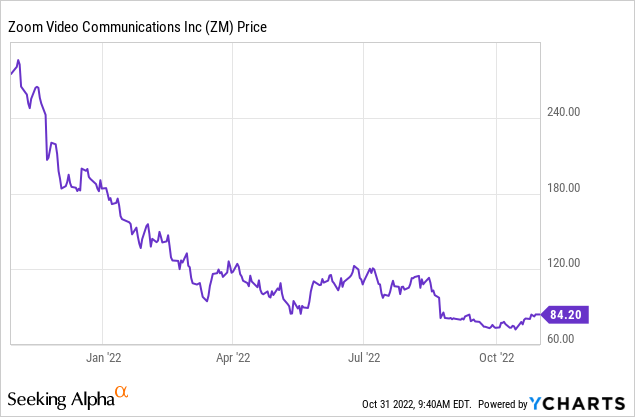

Year to date, shares of Zoom have lost 55% of their value, and over the past year, the stock is down nearly 70%. And yes, while there was certainly a lot of unwinding of undue valuation in that loss, I think Zoom’s descent has gone way too far and investors have now oversold this company. The negative sentiment and momentum on Zoom now far outweighs its true fundamentals.

I have been actively buying Zoom on its recent downside and believe the company has found a bottom. I am very bullish on the name and think there is substantial rebound upside over the next twelve-month timeframe.

Here is what I consider to be the key bullish drivers for Zoom:

- Zoom may not be growing as quickly as during the pandemic days, but its technology is incredibly sticky. The post-pandemic era has shown us that remote or hybrid work is here to stay. Web conferencing has not dwindled post-pandemic even as we return to the office. Once installed, Zoom becomes a mission-critical part of company operations and is very difficult to rip out.

- A plan for everyone. Zoom is applicable to the tiniest startups to the largest Fortune 100 companies. It is a truly horizontal software company with use cases for every industry at every size.

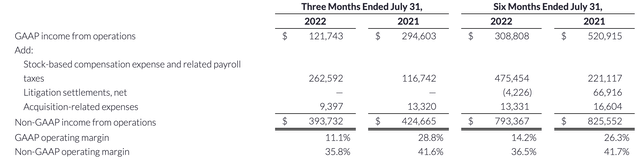

- Rich margin profile and inclusion in the “Rule of 40” club. Zoom has not shrunk since the pandemic; while it may no longer be growing like a weed the company has still managed to maintain its scale. And with that scale comes immense profitability; its mid-30s pro forma operating margins are among the best in the software industry. An overlooked fact is that Zoom is part of the “Rule of 40” club (a revenue plus pro forma operating margin profile in excess of 40) which very few software companies ever attain.

- Immense cash reserves. Zoom has more than $5 billion of cash on its books with no debt. The company has not yet tapped into a tried-and-true software growth playbook of expanding through M&A, but it certainly has the firepower to (and now, with multiples in the tech sector at multi-year lows, it may be quite an opportune moment to start).

The biggest draw to Zoom right now, of course, is its valuation. At current share prices near just $84, Zoom trades at a market cap of $25.03 billion. After we net off the $5.50 billion of cash on the company’s most recent balance sheet, Zoom’s resulting enterprise value is $19.53 billion.

Meanwhile, Wall Street analysts have a consensus revenue target of $4.80 billion for Zoom in FY24 (the fiscal year ending in January 2024), which represents 9.3% y/y growth over the midpoint of Zoom’s FY23 revenue guidance of $4.385-$4.395 billion (+7% y/y). Next year’s revenue is expected to accelerate, primarily on receding FX headwinds.

Against this estimate, Zoom trades at just 4.1x EV/FY24 revenue – a sharp decline from when Zoom at one point commanded revenue multiples in excess of 20x. Yes, of course Zoom was overvalued at the time and its growth was also much richer; but we also can’t overlook the company’s expanding bottom line and its enviable position to capture significant economies of scale.

The bottom line here: Zoom is far from a washed-up stock. Once investors shift their focus from growth to profitability (which is already happening in this risk-off market environment), there’s quite a bit of upside potential for Zoom. Stay long here and use the dip as a buying opportunity.

Q2 download

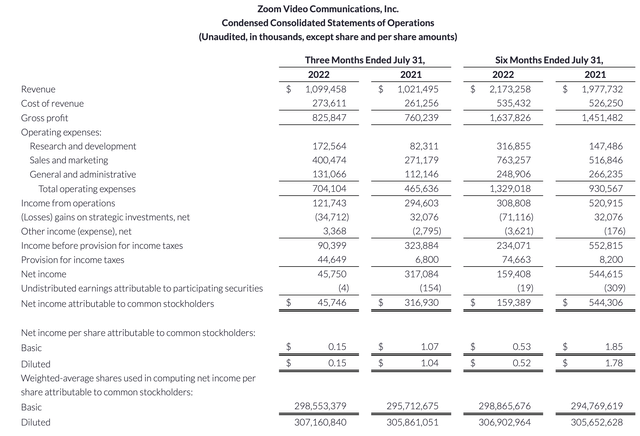

Let’s now discuss Zoom’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Zoom Q2 results (Zoom Q2 earnings release)

Zoom’s revenue grew 8% y/y to $1.10 billion, slightly missing Wall Street’s expectations of $1.12 billion (+9% y/y), with the company’s deceleration from 12% y/y growth in Q1 driven primarily by FX headwinds from the strengthening dollar. We have to acknowledge here that this weakness is industry-wide and certainly not company-specific.

Here’s some commentary from CFO Kelly Steckelberg on the drivers for the revenue miss this quarter, made during her prepared remarks on the Q2 earnings call:

A stronger U.S. dollar, which had an impact of approximately $8 million, weaker new online sales, and to a lesser extent, back-end linearity in the quarter, were the biggest factors contributing to the miss.

We recognize that the revenue results are disappointing and below our expectations as we navigate the current environment. It should be noted that while our online business saw lower new subscriptions, renewals and online continued to improve. And as we just discussed, we have launched a number of initiatives to drive new online subscriptions around local pricing, packaging and free-to-paid conversion.”

Underneath all of this, however, Zoom’s enterprise business still saw incredible growth. Revenue grew 27% y/y and now represents more than half of total revenue at 54%, up eight points from 46% in the year-ago quarter. As more of Zoom’s revenue centers on large enterprises and educational institutions (the company signed a huge expansion deal with UCLA this quarter, for example), Zoom’s revenue “stickiness” will continue to improve. Total enterprise customers are up 18% y/y to 204k. Note as well that net revenue expansion is at 120%, indicating that the average upsell for a Zoom customer is at 20% – a great indicator of Zoom’s “land and expand” potential within large enterprises.

Zoom’s shift toward having more of its revenue derived from enterprises has made it more susceptible to enterprise buying patterns, which is backend-loaded toward the end of the quarter. While this means less revenue recognition in any given quarter, it also means that Zoom will exit quarters with higher deferred revenue. On the whole, I think the richer enterprise revenue mix is a positive business driver.

On the profitability side, Zoom’s pro forma gross margins improved 270bps y/y to 78.9%, driven by economies of scale on its public cloud usage. The company now expects full-year gross margins (which it does not explicitly guide to) to be higher than its prior view.

Pro forma operating margins in the quarter stood at 35.8%, down roughly six points y/y, driven by both sales capacity expansion as Zoom tries to recharge its enterprise growth as well as the same opex/wage inflation that is hitting companies across the board.

Zoom margins (Zoom Q2 earnings release)

Still, we note that Zoom’s 36% pro forma operating margins plus 8% growth still lands the company comfortably in the “Rule of 40” zone. The company is still targeting a minimum operating margin of 33%, and I have confidence in its ability to grow profit dollars once macro headwinds subside.

Key takeaways

Don’t overlook Zoom as it slides. Double-digit enterprise growth, a fantastic and sticky technology platform, and a rich margin profile are all reasons to maintain confidence on this name. Buy the dip here.

Be the first to comment