Galeanu Mihai

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 14th, 2022.

BlackRock Enhanced Global Dividend Trust (NYSE:BOE) runs a portfolio of mostly large-cap holdings. To set the fund apart, the fund focuses a majority of its portfolio on investments outside the U.S. It also utilizes an options writing strategy that can lead to some downside protection but, even more importantly, help cover the distribution to shareholders. The fund is also relatively diversified. There is no massive overweight in tech here.

In 2022, things have been rather bleak due to sticky inflation. That sticky inflation is causing the Fed to be aggressive on interest rate hikes. At the same time, the hikes aren’t expected to stop until a recession is hit. How deep and how long that recession is, is still unknown. The way that BOE is managed can be beneficial in keeping losses relatively smaller. That’s what we have seen YTD. The monthly distribution can be welcomed in generating cash every single month to deploy elsewhere or cover investors’ expenses.

The Basics

- 1-Year Z-score: -0.39

- Discount: -11.48%

- Distribution Yield: 7.66%

- Expense Ratio: 1.07%

- Leverage: N/A

- Managed Assets: $697 million

- Structure: Perpetual

BOE has an investment objective to “provide current income and current gains, with a secondary objective of long-term capital appreciation.”

The fund intends to achieve this through the following:

“investing in at least 80% of its net assets in dividend-paying equity securities and at least 40% of its assets outside of the U.S. The Fund may invest in securities of companies of any market capitalization but intends to invest primarily in securities of large-capitalization companies. The Fund generally intends to write covered put and call options with respect to approximately 30% to 45% of its total assets. However, the percentage may vary from time to time with market conditions.”

They focus on writing options on individual stocks in its portfolio. The fund last reported that the portfolio was 43% overwritten at the end of October. That is on the higher end of its 30 to 45% target. That could suggest they are more defensive at this time. Having more of a portfolio overwritten could suggest that they don’t foresee these positions being called away.

So far, that has been the right call for 2022. That also means that when the market recovers, the covered call-writing strategy could lead to lagging performance if it is a rapid recovery. That’s one of the big negatives of employing capital in such a strategy.

The fund doesn’t employ any leverage, and that can be a positive for the fund. That is one less worry that an investor needs to consider. When rates rise, leveraged funds can be negatively impacted by amplified lower results and higher interest expenses.

Performance – Better NAV Performance, Lagging Share Price

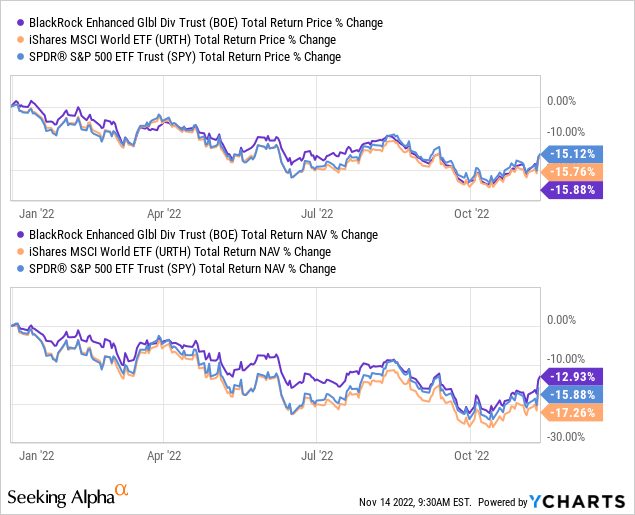

One of the key things to look for in closed-end funds are discounts and premiums. The first sign that a fund is getting more attractive comes when the total returns of the fund are lower or further negative than the total NAV returns. That’s what we have with BOE.

I’ve also included YTD performance in the chart below comparing iShares MSCI World ETF (URTH) and the S&P 500 ETF (SPY). That gives us some context of how BOE is performing, relatively speaking. URTH invests globally but carries less global exposure relative to BOE.

As mentioned previously, the results of BOE have shown relatively smaller losses on a total NAV return basis. The NAV return is what the actual underlying portfolio is doing. The share price return is how investors are pricing the fund.

YCharts

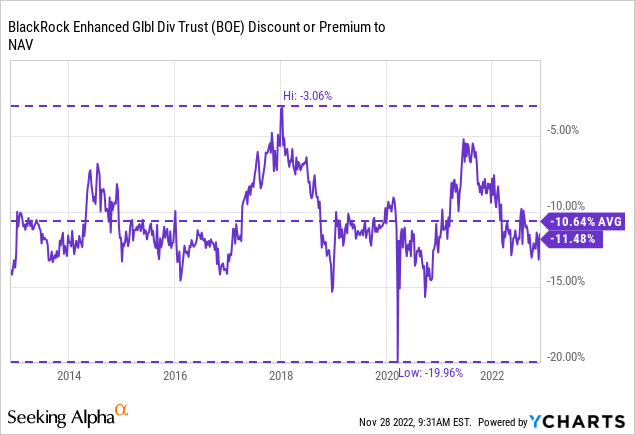

When we see that share price lagging NAV returns, we know a discount is opening up. In this case, since our previous coverage, the discount moved just a tad wider than it was earlier this year.

This isn’t all that unexpected because we were covering this fund in August. That’s when we were getting our summer rally in 2022. Since then, the overall market (and BOE) has moved lower. Generally, when volatility picks up, discounts start widening out. That’s exactly what we saw with BOE.

Over the longer term, the fund is trading below its decade-long average. That indicates that it’s a reasonable time to initiate a position. With the overall market lower, that potentially adds to its attractiveness too.

In our prior coverage, I also highlighted the fact that U.S. and international stocks have taken turns in outperformance. The fact remains that global stocks continue to remain relatively more attractive due to better valuations. While Russia’s invasion of Ukraine continues to destabilize that region of the world, it can take longer to play out. I’ve never been one to try to time the market, though, instead taking a diversified approach to investing in what is attractive at a given time and allowing time for that to play out.

Distribution – Discounts Leads To Other Positive

Another reason that a discount can be so important in a CEF is that it also positively impacts shareholders’ distribution yield. The larger the discount, the higher the distribution yield is relative to the NAV yield. That can be beneficial because investors can buy today and receive a 7.66% rate. At the same time, the NAV distribution rate comes to just 6.78%.

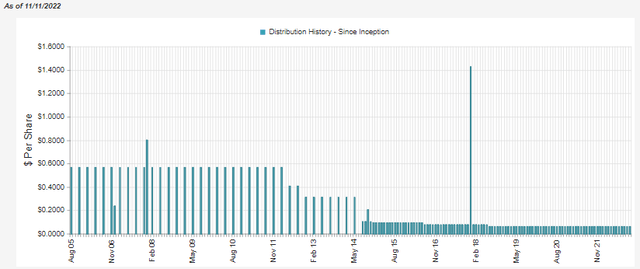

Due to lagging performance in the international market over the last decade, the distribution has been trimmed several times. A cut is always possible in a bear market too. If we head lower, that would definitely be something I expect. On the other hand, for now, I believe that a less than 7% distribution rate on an NAV basis is sustainable.

In the past, I’ve also highlighted how that one extremely large special distribution could have also helped result in the regular distribution cut that followed around a year later. To summarize, the special distribution meant that over 9% of the fund’s assets were paid out all in one shot. Therefore, the earnings potential of the fund following that payout was diminished.

BOE Distribution History (CEFConnect)

To help provide coverage of the capital gains that it requires to pay out its current distribution, that’s where option writing can come into play.

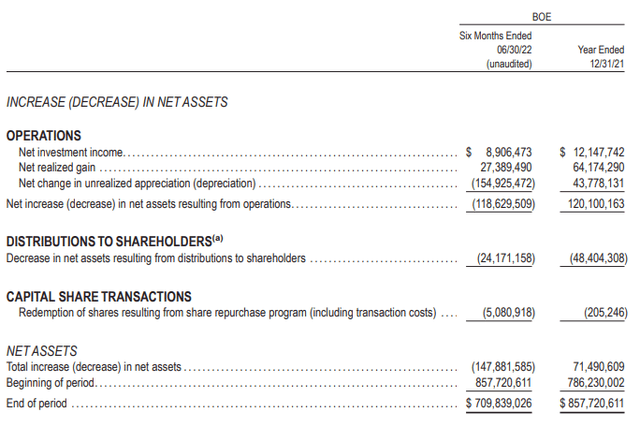

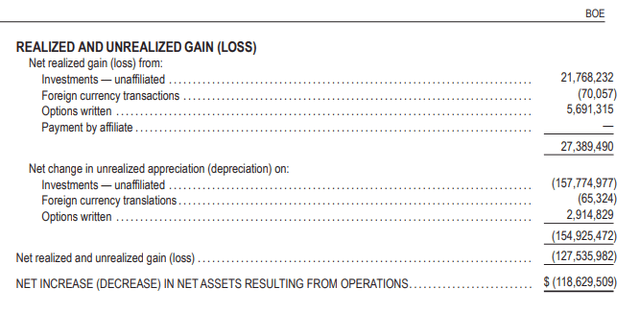

In its last semi-annual report, we can see that net investment income and realized gains were more than enough to pay the distribution to shareholders. Unrealized gains were quite immense, so we can’t ignore that. Certainly, that’s not something that would be sustainable forever.

BOE Semi-Annual Report (BlackRock)

In a market such as 2022, one might be curious about where these gains could be coming from. Well, the largest portion was unrealized gains built into the fund from prior years. The other portion was a significant contribution from their options writing strategy. That generated nearly $5.7 million. That’s a source of capital gains that can be quite consistent. The overall market volatility could have helped juice up the premiums even.

The realized gains generated by the options writing strategy and the NII of the portfolio still weren’t enough to entirely cover the distribution. However, it significantly reduced the shortfall of what is required.

BOE Realized/Unrealized Appreciation/Depreciation (BlackRock)

BOE’s Portfolio

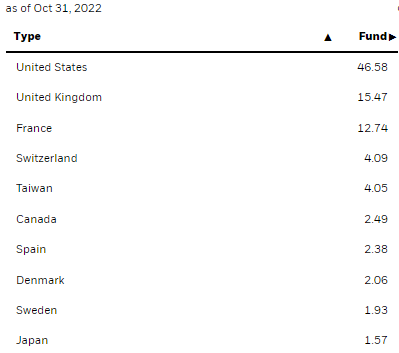

Nearly 97% of the portfolio is invested in large-cap companies. Most of these companies can be found in the U.S., but at less than 47% in the U.S., this fund carries a significant exposure to global operations. Most of the other country’s exposure in the fund is between the U.K. and France. Both carry a significant amount but, perhaps more importantly, are less impacted by the Russian invasion compared to Eastern European countries. BOE has no top exposure to these Eastern European countries in the top allocations.

BOE Geographic Exposure (BlackRock)

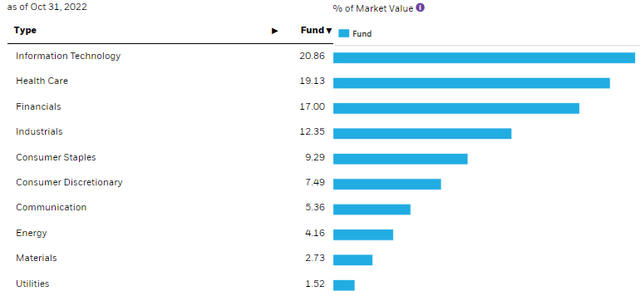

One other component that I find favorable in BOE is that the fund isn’t heavily invested in tech. It is the largest allocation, but we also have healthcare, financials and industrials, all at quite significant weightings. Overall, no sector commands an overwhelmingly dominant portion of the portfolio. SPY, on the other hand, still carries a rather significant weighting in tech. It has been reduced this year as it has been a poor-performing area of the market.

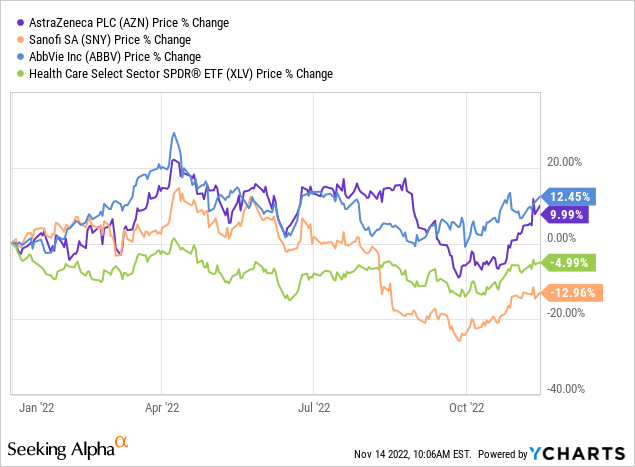

This is mirrored in the fund’s top ten holdings. Microsoft (MSFT) is in a top position, but we don’t see all the other mega-cap tech names that we often see in other diversified CEFs. Instead, we have quite a few healthcare-related names show up. Those include AstraZeneca (AZN), Sanofi (SNY) and AbbVie (ABBV).

This is another reason the fund has performed better than the broader markets. Healthcare has performed much better this year on a relative basis. However, SNY has been the laggard. This happened in August, with SNY hitting a 52-week low. It appears the cause for the sell-off was an analyst downgrade and recalled heartburn drug news leading to lawsuits. They use ranitidine in their generic heartburn medicine, which has now been linked to cancer at the levels they used.

YCharts

AZN and ABBV, on the other hand, have been star performers on a YTD basis. ABBV’s move is interesting considering going into 2023; we have the Humira patent cliff where biosimilars will be hitting the market in the U.S. We’ve already seen the declines it can cause globally in their sales. Here’s from their Q3 results.

Internationally, Humira net revenues were $603 million, a decrease of 25.9 percent on a reported basis, or 16.8 percent on an operational basis, due to biosimilar competition.

That being said, they’ve also made moves to lower their reliance on Humira, which seems to be paying off significantly. Investors seem less nervous about the patent cliff the closer we get. Yet, as I’m a shareholder, it seems that’s all investors could talk about for years.

Conclusion

BOE’s portfolio is down with the rest of the market. Due to the broader sector diversification and options writing strategy, the declines have been a bit smaller. The fund’s discount has also opened up. Therefore, I continue to feel comfortable putting capital to work in BOE.

Be the first to comment