roman_slavik/iStock via Getty Images

It sure seems like I have had to replace a lot of companies this year. STORE Capital (STOR) is the latest company to go away, following the announcement that GIC and Blue Owl’s Oak Street are acquiring the company. They joined Preferred Apartment (APTS) and Computer Services (OTCQX:CSVI) as companies I’ve lost to acquisitions this year.

Additionally, I made two other sales this year. I sold Annaly Capital (NLY), in March as part of a regular portfolio review. And as I shared last month, I was called out of about half of my Apple (AAPL) shares at the end of August.

The bright side of all this selling is that I was sitting on a lot of cash as the market made new lows for the year. Last month I covered my initial replacement of the income lost from the Apple sale, this month, I will cover what I am replacing STORE capital with, in addition to my regular monthly report.

Of course, as a dividend growth investor, I mostly ignore the fluctuations in the market. I sleep soundly, knowing my income is growing no matter what the market is doing. In fact, I get more excited on down days because I can scour my watch lists for bargains to buy.

My Process

The past thirteen years of dividend growth investing have been a learning curve. Along the way, I have made mistakes, falling into high yield over dividend growth, chasing low-quality dividend growth, and becoming over-concentrated in particular sectors or industries. None of these have threatened my goals, and the learning experiences have strengthened my portfolio today.

Today, my goals are clear, and investing criteria are defined. While my goals have mostly stayed the same for quite some time, my investing guidelines are occasionally tweaked. The latest change was last year when, on rare occasions, I started selling covered calls against significantly overvalued positions. I buy companies with the intent to hold them forever.

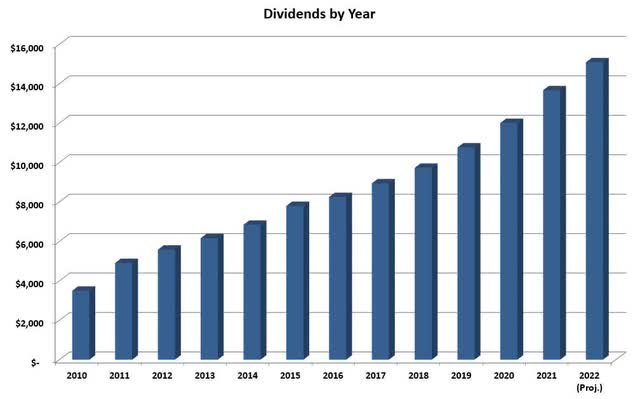

The portfolio goals are simple: Grow the income by 10% annually with dividends reinvested and 7% annually without reinvesting. Using the rule of 72 as a guide, this goal allows the income to double approximately every seven years while I am reinvesting and every ten years once I begin withdrawing the dividends. The table below shows the steady progress of income growth.

I use guidelines to achieve my goals rather than rules. Rules imply something hard and fast, whereas guidelines are flexible but give a general direction to follow. I keep these simple, as I have found that complexity adds time without any real benefit.

- Invest in companies from the Champions and Contenders list with at least 15 years of dividend growth.

- Look for companies with a 3% starting yield and the potential to maintain a 7% dividend growth for decades. This is integral as it’s impossible to continue growing income at 7% without reinvesting unless companies raise distributions by at least that amount.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this usually means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not. I want companies to grow the dividend with earnings, not by increasing the payout ratio.

- Unless it is well-diversified across industries, no single sector should account for more than 20% of the income. I was burned by this in 2016 when several energy companies cut dividends.

Again, these are just guidelines and are flexible to accommodate what makes sense to achieve my overall goals. I have a few other items I follow, but I don’t see them as integral to my investing. Instead, these tend to be more personal preferences. They include things like avoiding foreign companies because I don’t like accounting for the taxes and FX rates causing fluctuating dividends.

How Is 2022 Shaping Up?

This year has been a fantastic one for dividend growth, and the current projection is an income increase of 13.1%, for a total of $15,452. And I still have a lot of dividends to reinvest and raises to see; of course, it’s getting late enough a lot of these will take effect in 2023. One thing to remember about this portfolio is that all the dividend growth is from increases and reinvestment of dividends, as this portfolio has been closed to new capital since 2016.

While the portfolio goals are entirely income-based, many readers are interested in total returns. To be clear, I don’t care about total returns; all that matters is that the income grows by 10% annually. However, for information purposes, the portfolio is down 16.5% year-to-date, still handily beating the S&P 500, which is down over 24%.

September’s Dividend Increases

Starting with September, the end of the year is always a flurry of increases. Many of the raises are from some of my most significant positions. This September didn’t bring any large surprises (or disappointment). Everything was in line with my expectations, although there was one surprise announcement. Below I outline the increases for the month.

Philip Morris (PM)

PM delivered an uninspiring 1.6% dividend raise. This failed to meet my already muted expectations of 3-4%. The PM raise is important as the company is the third largest income producer in the portfolio at about 8% of the income. I’m not expecting much more of a raise next year unless the dollar weakens significantly. Fortunately, this was the lone disappointment for the month.

Texas Instruments (TXN)

The raise of 7.8% by TXN was in line with my expectations for the year. Additionally, they authorized an additional $15B buyback, which currently represents almost 10% of the company. TXN is a very shareholder-friendly company and a cornerstone of my portfolio.

Microsoft (MSFT)

Microsoft’s dividend raises are becoming as predictable as Johnson & Johnson (JNJ). Counting on a 10% raise is becoming the norm, and this year was no different. Microsoft is the second largest position in this portfolio, and I will add more if we can bring back the valuations we saw in the early 2010s.

Lockheed Martin (LMT)

At the last minute, LMT announced a $0.20 per quarter raise. This is the same raise they have given since 2018, equating to a 7.1% increase. Next year could be the year they bump it up, 30 cents, anyone?

Honeywell (HON)

At the end of the month, Honeywell announced a 5.1% increase, in line with my expectations. Honeywell is a tiny position in the portfolio as the markets have overvalued industrials for quite some time.

Starbucks (SBUX)

Starbucks announced an 8.2% raise near the end of the month. I love to see these healthy raises! However, I am concerned with the company’s seemingly “all-in” strategy in China. They can’t just move to another country like a manufacturer can if any of the looming geopolitical risks manifest themselves.

Ladder Capital (LADR)

Surprise dividend raises are the best! Ladder Capital surprised with its second dividend raise of the year. They announced a 4.5% raise to go along with the 10% raise earlier this year. While they have yet to reach their pre-pandemic payout, I don’t expect any raises from my high yield positions. Any raises here are welcome!

October’s Expected Raises

This month will bring fewer announcements than September, but they are significant. The three expected increases are all fast-growing dividends and play an essential role in reaching my goals. Additionally, October has been the traditional month for Phillips 66 (PSX) to raise the distribution, although they have already increased once this year. Is a second raise in order?

Blackstone (BX)

Blackstone is a bit of an anomaly in this portfolio, as it pays a variable dividend. Year to date, every quarter versus the year ago quarter has averaged a 63% increase! I expect the 4th quarter to be in this range as well, putting the 4th quarter dividend at $1.77 vs. $1.09 a year earlier. Total 2023 payout for Blackstone projects out a $5.81 vs. $3.57 in 2022. Blackstone is the second largest holding in this portfolio.

AbbVie (ABBV)

A couple of companies on this list sometimes announce the raise in October and sometimes in November, and AbbVie is one of these. AbbVie became part of the portfolio through the spin from Abbot labs in 2013. AbbVie is the fourth largest holding in the portfolio and accounts for just under 6% of the income.

While the 5-year dividend growth stands at 17%, it has slowed. I expect to see this year’s raise in the 7-9% range but could be even lower in anticipation of leaner years ahead.

A. O. Smith Corporation (AOS)

As a small cap, AOS doesn’t get the attention it deserves. With 28 years of dividend growth, they still maintain a 5-year dividend growth rate of 17%. The last two raises have been closer to 8%, which is where I anticipate this year’s raise, even in light of the slowing economy. AOS maintains a consistent payout in the 30% range and has been a fantastic holding since adding during the flash crash.

Visa (V)

For my annual spreadsheet projections, I cap dividend growth at 7%, except for one company, Visa. The company has a 5-year dividend growth rate of 17%, which was matched with last year’s increase. I’m looking for 10% this year, but we could see up to 15%. Visa was added in 2014 and is the 9th largest holding, although it only accounts for about 1% of the income. Visa is one company I expect to fuel dividend growth well into the future.

Sales In September

I rarely make sales. This year has been an anomaly as Preferred Apartments was acquired (and soon to be STOR capital). Additionally, I sold Annaly Capital on a portfolio review, and I was called out of some Apple at the end of August. I opened the Apple calls on overvaluation. No additional sales were made in September.

What Am I Doing With STORE Capital?

Ordinarily, I sell a company on an acquisition announcement. This is to lock in the gains as sometimes sales fall through and the price falls back down. In this case, I decided to hold until the dividend. Now that the date has passed, I am continuing to hold, as I would like to see the price a little closer to the sale price before selling. Worst case, I will be okay with the sale falling through as I am an income-oriented investor.

However, I have already replaced the company with cash on hand. STOR was/is a high-yield company in the portfolio and a micro-position. As it was the second REIT lost this year to acquisitions, I decided to embrace this trend. When Blackstone dropped below $85, I added to my position to replace the upcoming lost income from STOR. If all the little REITS are getting acquired, I might as well own the acquirer. (I know BX isn’t the one purchasing STOR.)

Regular Purchases

In addition to adding to my Blackstone position, I also continued adding BlackRock (BLK), CME Group (CME), Intercontinental Exchange (ICE), and Fortune Brands Home & Security (FBHS). These were replacements for the Apple shares I lost at the end of August. I added enough to replace the lost income but mostly still hold the cash from the sale.

Below is the summary of my regular reinvestments (share price is average):

- 1 share of Best Buy (BBY) @ $64.82

- 3 shares of Home Depot (HD) @ $272.95

- 2 shares of Medtronic (MDT) @ $86.65

- 4 shares of Prudential (PRU) @ $91.54

- 1 share of Visa (V) @ $189.86

What Else Am I Looking At?

Since this is a closed portfolio, I can only buy some things that look interesting. I use this section to cover what I purchase and consider in my other portfolios. The other portfolios have different goals and rules but are also dividend growth portfolios.

I was lucky enough to have sold a lot of weaker positions early in the year and raised cash again during July’s rally. But I’m not quite putting this cash to work in earnest. We will likely see a capitulation event in the next six months, but I’m still buying bargains just in case we don’t. I have been adding small amounts to various stocks and buying a small quantity of Schwab U.S. Dividend Equity ETF (SCHD) each down day.

I am a buyer now that Texas Instruments (TXN) and Broadcom (AVGO) are making new lows for the year. Especially in light of TXN’s recent raise and AVGO’s upcoming one. I want to see TXN’s yield top 3.5% to really get on board.

I’m still watching retailers. It amazes me that most have not hit new lows for the year in light of all the negative news. I’ve nibbled on some BBY as it’s one of the few making new lows, but these all have plenty of room to drop.

There is a lot of value to be had in banks. Insurance companies as well, to a lesser degree. I’ve added to my US Bancorp (USB) position, but many bargains are available.

Industrials are still stubbornly expensive. I have a few positions like Snap-On (SNA) that I would like to add to, but only at the right price. Industrials could be one of those sectors that was just too high going into the bear market to reach the best bargain prices. The same can be said for many chemical companies.

Some asset managers, like T. Rowe Price (TROW) and Blackrock, are at historically good yields. However, these will continue to fall with the market, and their earnings forecasts will continue to drop.

Finally, I’m paying attention to the tech space, non-dividend and dividend-paying companies alike. Visa offering above an 0.8% yield is historically high, although Mastercard (MA) hasn’t reached abnormally high yields. I want to buy Google (GOOGL), but I am holding out for $75. Just as we have seen ten years of multiple expansion in tech, we might see ten years of contraction. Anchoring to all-time highs could be a disastrous mistake right now.

Final Thoughts

Even though the better prices I expected in September materialized, I’m still cautious about making significant moves. I’m being greedy, expecting better buys. There is some risk in this, as buying a great dividend growth company at an above-average yield is always a good time to buy. However, I don’t think we will see a flash crash type rebound.

Looking back at the GFC, it felt like the market rebounded strongly off the March 2009 low. However, today we know we had a few years of good bargains. Not as great as the absolute bottom, but better than almost anything in the last five years. Of course, we may learn that the previous five years were an anomaly.

Either way, it’s a good time to be a dividend growth investor. Having converted to an income-oriented approach following the GFC, I wasn’t sure what to expect during the next bear market. I can confidently say that I sleep well, knowing my income is growing. I scarcely look at my portfolio balances as I scan for stocks that are down big to see if it’s time to add more.

Be the first to comment