jetcityimage

It’s been a rough year thus far for the restaurant industry group, with the AdvisorShares Restaurant ETF (EATZ) sliding 24%, matching the market’s year-to-date decline, despite significantly underperforming the market in H2 2021 with a (-) 5% return. The hardest hit names have been in the casual dining space, where margins have taken a major step down, impacted by commodity/wage inflation, and less interest in dining out due to pinched discretionary budgets.

Among the quick-service space, we’ve seen relative performance for most names, and Jack in the Box (NASDAQ:JACK) has been one name that’s held up well vs. the group. This can be partially attributed to its acquisition of Del Taco, which significantly increased its restaurant base and sales, and a growing development pipeline in the Jack in the Box system. At ~11.3x FY2023 earnings estimates, the stock has become quite reasonably valued, but with a difficult macro backdrop for the industry, I don’t see any rush to rush in and buy just yet.

Jack in the Box (Company Presentation)

Q3 Results

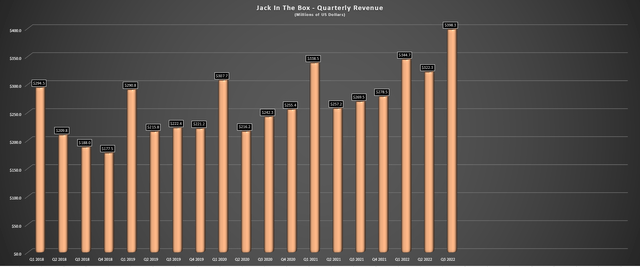

Jack in the Box released its fiscal Q3 results last month, reporting quarterly revenue of $398.3 million, a record figure representing 48% growth on a year-over-year basis. This sharp increase in sales was driven by adding ~500 restaurants with the company’s recently closed Del Taco acquisition (~$580 million) and high single-digit menu pricing, which partially offset traffic declines industry-wide. Jack in the Box reported system-wide sales of 1.4% on a brand-by-brand basis, with a 2-year stacked same-store sales growth of 9.6%, a somewhat disappointing figure given the relatively high pricing in the period. Meanwhile, Del Taco enjoyed a slightly higher growth rate of 10.6% (2-year stacked same-store sales), with positive same-store sales in fiscal Q3.

Jack in the Box – Quarterly Revenue (Company Filings, Author’s Chart)

The company noted that Del Taco’s strength was helped by its 20 under $2 menu, providing clear value to customers even in lower-income categories when discretionary budgets have taken a hit. Meanwhile, Jack in the Box’s Rewards program (Jack Pack) continues to grow with over 2 million members, digital sales were up sharply in the period, and its Tacos and Ultimate Cheeseburger/Sourdough Jack were also strong contributors in the period. Unfortunately, while menu innovation appeared to help, as did menu pricing north of 9.0%, the industry-wide traffic trends were not favorable and could remain pressured with another 8.0%+ inflation reading in August.

While the team appears confident in boosting margins through new restaurant processes, equipment, and technology (including automation) and can lean into this given its larger scale, margin performance was disappointing as well in fiscal Q3. At Jack in the Box, restaurant-level margins sunk to 15.8%, impacted by commodity inflation of 16.8% and wage inflation of 13.2%, with food & packaging and labor costs each up 360 basis points year-over-year. The weaker performance led to the company taking down its margin outlook from 17.0% to 16.0% for the year, despite relatively high pricing of more than 9.0%. At Del Taco, margins were stronger but also slipped over 300 basis points despite even higher ~11% pricing.

Not surprisingly, the lower restaurant margins impacted earnings per share [EPS] and adjusted EBITDA in the period, with operating earnings per share down 16% to $1.38, while adjusted EBITDA slid to $73.2 million vs. $79.0 million. This has set Jack in the Box up for a decline in annual EPS year-over-year, which is not the case for peers like Restaurant Brands International (QSR), McDonald’s (MCD), and Wingstop (WING), which have a much higher proportion of their system franchised after the Del Taco acquisition led to a significant decline in the company’s franchise/company-owned restaurant ratio (83% vs. 93%).

So, what’s the good news?

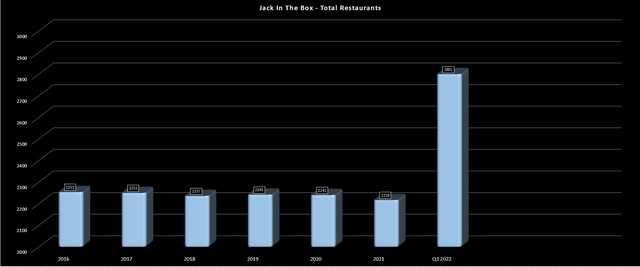

While this was a tough quarter for Jack in the Box, Del Taco did outperform the fast-food industry for most of fiscal Q3; the company appears confident that it can claw back some lost margins, staffing levels have improved, and its development pipeline is quite strong. The latter point is evidenced by the fact that Jack in the Box has approved more sites in the past six months than it has in the previous three years, with a path to 3,000+ restaurants across both brands with 220 restaurants in development. It’s possible we could see an acceleration in unit growth given recent actions taken related to royalty fees, with those franchisees signing at least three franchise agreements by March 2023.

Under this new multi-unit incentive program, royalty fees would be 1% for Year 1, 2% for Year 2, 3% for Year 3, and 4% for Year 4, before increasing to 5% over the remainder of the agreement. This could translate to savings of up to $180,000 over the first five years, allowing for a much quicker payback. This is an attractive proposition for prospective franchisees in the quick-service restaurant space and could lead to existing franchisees increasing their development plans. Finally, while it could take a few years, Jack in the Box plans to reduce its company-owned restaurant base at Del Taco, aiming to get closer to previous franchised/company-owned mix pre-acquisition levels, where it’s currently below its larger peers.

Jack in the Box – Total Restaurants (Total Restaurants)

To summarize, fiscal Q3 was a satisfactory quarter for Jack in the Box. However, its growing development pipeline was offset by margin weakness and the bill recently signed by California Governor Gavin Newson, AB 257. This bill would increase the power of fast-food workers in California and authorize the creation of a Fast Food Council, which would be comprised of representatives from labor and management to set minimum stands for wages, and security, among other things. The worst case would be that the minimum for fast-food workers could increase to over $20.00 an hour quite quickly, with the council able to bump up wages by the lesser of 3.5% or the increase in the CPI for every year thereafter.

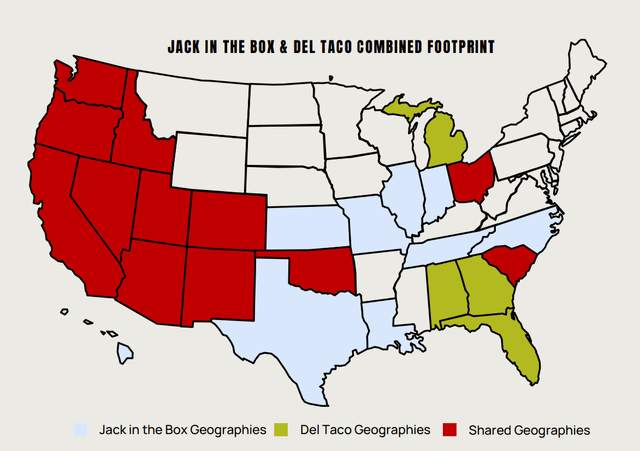

Jack in the Box & Del Taco Footprint (Company Presentation)

The latter is a negative development for a company with a California-heavy presence like Jack in the Box, especially after the Del Taco acquisition, which added over 300 restaurants in the state. The most recent development is that a newly proposed referendum is looking to block this legislation, which would make sense given that many restaurants in the state have already struggled with above-average minimum wage levels vs. national levels and are pinched further due to labor tightness/commodity inflation. So, if not blocked, this would be a very negative development for California-heavy brands like Jack in the Box and Chipotle (CMG).

Earnings Trend & Valuation

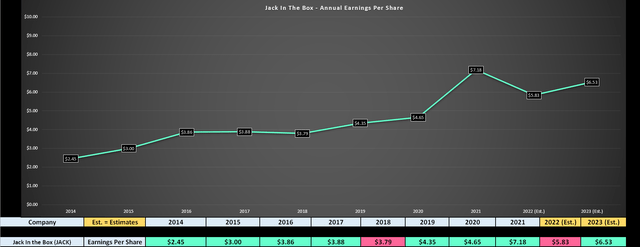

Moving to Jack in the Box’s earnings trend, we can see that the company has seen strong growth in annual EPS over the past several years, increasing annual earnings per share from $2.45 in FY2014 to $7.18 in FY2021. However, earnings are forecasted to decline 18% this year despite the significant growth in units from the acquisition, impacted by higher interest expense and weaker franchise/restaurant margins.

Some investors might be encouraged by the fact that annual EPS is expected to bounce back from $5.83 in FY2022 to $6.53 in FY2023. While this is positive, we are seeing a massive deceleration in the compound annual EPS growth rate. In fact, in the FY2014 to FY2021 period, Jack in the Box’s compound annual EPS growth rate came in at an incredible 16.6% but will fall to just 11.5% based on FY2023 estimates. While JACK may beat these estimates, I would argue that there’s a higher probability of a miss if commodity inflation doesn’t improve combined with weaker traffic trends, even if the company is more resistant than its casual dining peers due to its lower average check.

Jack in the Box – Earnings Trend (YCharts, Author’s Chart, FactSet)

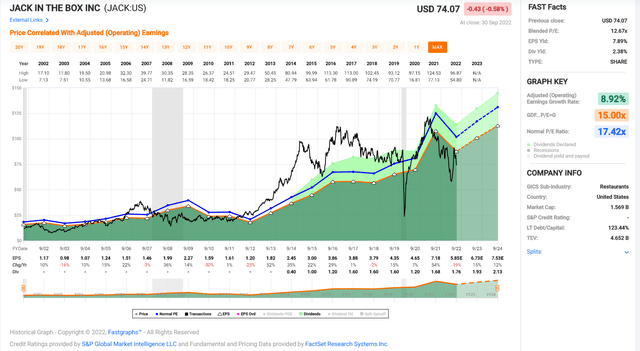

At a share price of $74.00, one could argue that the declining earnings in FY2022 are already priced into the stock, given that it’s trading at ~11.3x next year’s earnings estimates. While I would tend to agree, it’s not clear whether the potential impact from the FAST Act is priced into the stock, and with a lower growth rate, it’s hard for JACK to justify its historical earnings multiple of ~17.4. So, based on what I believe to be a more conservative multiple of 14, I see a fair value for the stock of $91.40, offering just a 24% upside from current levels.

Jack in the Box – Historical Earnings Multiple (FAST Graphs)

Generally, I prefer a minimum 35% discount to fair value to justify entering new positions in small-cap names, and this would require a pullback below $59.40. So, while Jack in the Box is very reasonably valued, I don’t see enough of a margin of safety just yet, especially given that we are in a cyclical bear market for the major market averages.

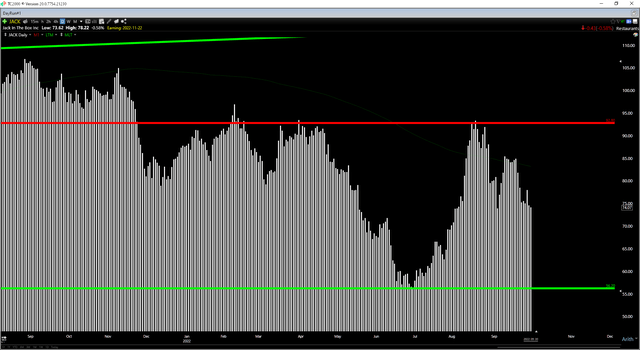

Technical Picture

Finally, the technical picture reinforces the view that JACK is not in a low-risk buy zone. This is because the stock is currently near the middle of its support/resistance range of $56.20 to $92.80, and in bear markets, it makes the most sense to buy as close to support as possible, not near the middle of the range. This would require a dip below $60.00 at a bare minimum for JACK. At these levels, the dividend yield would be more attractive and the stock would be within 6% of a strong support area at $56.20.

In addition, since August, JACK is now making lower highs, a negative development, suggesting it’s no longer seeing relative strength vs. the overall market. So, if I did want to go long the stock from a value standpoint, I would be waiting for a pullback below $60.00 to start a new position.

Summary

Jack in the Box has had a transformational year after it acquired Del Taco and has seen a meaningful improvement in its development pipeline. Plus, while the macro backdrop is challenging (lower discretionary budgets for consumers), JACK is more resistant as a quick-service name to the pullback in demand. That said, JACK is trading near the middle of its support/resistance range, and while cheap, I continue to see better value elsewhere in the market. Hence, I don’t see any reason to rush in and buy the stock above $74.00. For investors looking for value, I see Capri Holdings (CPRI) as the better bet, trading at ~5.6x FY2023 earnings estimates.

Be the first to comment