StevanZZ/iStock via Getty Images

The Closest of the Distant Islands

Facing the Tuscan coast, halfway between Italy and Corsica, is the Tuscan Archipelago, a handful of small islands set in the Tyrrhenian Sea. It’s a popular, year-round destination known for its gentle climate, lush nature, enchanting sea and beautiful seabed, all accompanied by superb cuisine and excellent wine (which never hurts).

The main and largest island is Elba, which a happy advertisement a few years ago called “the Closest of the Distant Islands.” It is a small paradise of villages and harbors overlooking a cobalt blue sea, to which a couple of centuries ago history assigned the onerous task of hosting for a few months the irrepressible genius of Napoleon Bonaparte.

Having arrived in exile on the island in May 1814, after abdicating following the Treaty of Fontainebleau, the French emperor remained there for ten months as ruler of the Principality of Elba Island until he decided to return to France in February 1815. The people of Elba never saw him again, but two hundred years later his memory is still alive in local traditions, where Napoleon’s charm has left indelible traces.

Last week, I was between Capoliveri and Porto Azzurro, on the south coast of Elba, for a few relaxing days at the end of summer, in the company of my wife and a wonderful book by Morgan Housel, The Psychology of Money. In it, I found Napoleon’s definition of a military genius: a person “who can do the average thing when everyone else around him is losing his mind.” His observation can apply to conduct during challenging times in many fields, including money management.

Doing the Average Thing?

A few months ago, I wrote an article titled “Long-Term Investing – Simple, But Not Easy.” I told the story of a neighbor of mine, Irene, who was struggling with managing her savings. I suggested three simple moves to her: identify quality tickers, buy them at the lowest possible price, and keep them for the long term.

Easier said than done, especially in times like these, when on certain days it seems as if the world might come crashing down on us. In moments of general panic, or when selling is raging in the stock markets, “doing the average thing when everyone else around us is losing his mind” is a thing of extreme difficulty. There are two options: stay put and wait for the storm to pass; or, if one has cash, increase one’s positions by taking advantage of selloffs. Any other move, such as selling at a loss hoping to buy back at even lower prices, is usually a loser.

To have liquidity, or a dry gunpowder reserve, for future opportunities, you have to either set some cash aside as part of routine portfolio management or sell when the market rises, forgoing possible further gains. Mind you, I am not suggesting timing the market, but simply lightening one’s positions when the market updates the highs, knowing that sooner or later midnight will strike and the bandwagon will become a pumpkin again.

Holding Dry Gunpowder

As Morgan Housel says in his book:

No one wants to hold cash during a bull market. They want to own assets that go up a lot. You look and feel conservative holding cash during a bull market, because you become acutely aware of how much return you’re giving up by not owning the good stuff. Say cash earns 1% and stocks return 10% a year. That 9% gap will gnaw at you every day.

But if that cash prevents you from having to sell your stocks during a bear market, the actual return you earned on that cash is not 1% a year–it could be many multiples of that, because preventing one desperate, ill-timed stock sale can do more for your lifetime returns than picking dozens of big-time winners.”

I personally have been doing, saying and writing this many times: when the market reaches new highs, I lighten my positions. When things go well, people don’t worry about the downside, but I do. And while I have regularly been accused, in often outraged comments, of timing the market, such is not the case. It is simply the realization that in the world of closed-end funds (“CEFs”), where Total Return is predominantly made up of the distributions offered by each fund, and when the price bell calls us for the last round, we all return to the starting blocks.

Because returning to the starting blocks can have a painful outcome, I never reinvest the proceeds of distributions in the same securities that generated them, because doing so would average up their load prices. Rather, I invest the proceeds in other securities while keeping some cash aside, probably even to excess, for intervening when market prices become close to my load prices. Then, I can increase my positions without averaging too much upward.

Squaring the Circle

It seems clear that the secret to a successful outcome lies in studying and looking for those CEFs whose starting blocks are positioned just a little further each time than the start of the previous run, that is, funds whose Total Returns consist of both distribution and growth in asset value, so as to increase the initial capital invested.

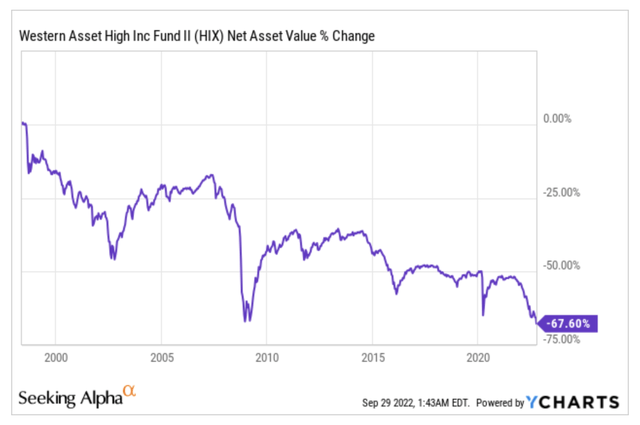

I have been repeating it in my articles… although I too don’t always practice it, unfortunately. But when I see a NAV performance like the following CEF (and it is a CEF that I also owned, in my “early days”), I wonder what prospects it can offer an investor. Will this fund ever be able to create value, given that its NAV has lost over 67% since launch?

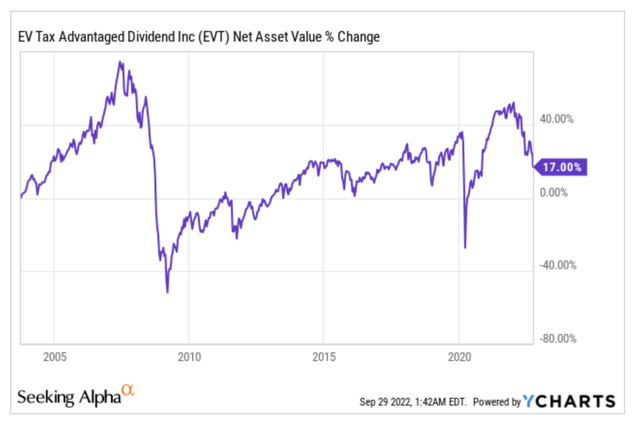

What I, on the other hand, seek and want, is shown in this example:

In addition to a substantial distribution paid out over many years, the Eaton Vance Tax-Advantaged Dividend Income Fund (EVT) fund has also increased the value of its assets, thus allowing the invested capital to grow (at least nominally). And this despite the ups and downs since its launch as well as during the current bear market.

Dividends plus capital growth: that’s squaring the circle!

Keep It Simple, Sweetheart

About a year ago, I developed a personal “rule of thumb,” which in its first (simplest) formulation called out as a first step to select CEFs with a positive NAV since inception. Even today, in this complicated market phase, I remain of the opinion that NAV performance is the first, reliable indicator of the quality and management of a CEF. And only after that should parameters such as discount/premium, leverage and distribution be considered.

What am I going to do with a 12.78 percent distribution (as in the case of HIX) when the NAV has been falling steadily for twenty years? In light of this, is it vital that the stock can be bought at a discount of 5.93% or that it has a leverage of 32.73% to boost returns?

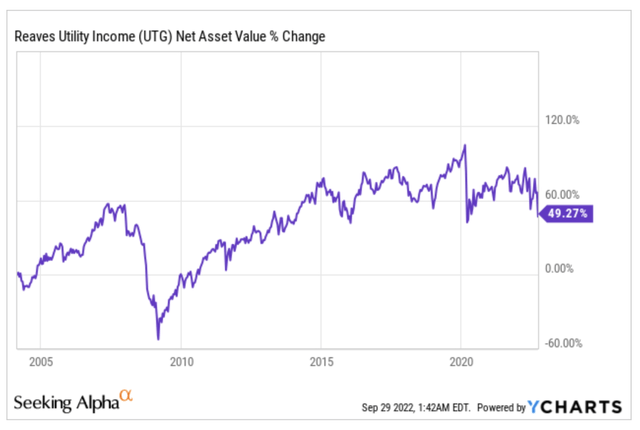

I personally prefer titles like EVT, which yields “only” 9.04% (still at a discount of 2.00% and a leverage of 21.56%) but shows a growth chart, albeit troubled. Or Reaves Utility Income Fund (UTG), up almost 50% since inception but with a distribution of 7.94%, and buyable around parity with leverage of 18.69%.

Bulking Up My Cupolone Income Portfolio

As you know, the Cupolone Income Portfolio (named after Brunelleschi’s Florentine dome) is my strategic, primary investment portfolio. It contains the following sixteen CEFs.

- BlackRock Science And Technology Trust (BST)

- Calamos Dynamic Convertible and Income (CCD)

- Calamos Global Total Return (CGO)

- Eaton Vance Enhanced Equity Income II (EOS)

- Eaton Vance Tax-Adv. Global Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Income (EVT)

- Guggenheim Strategic Opp (GOF)

- John Hancock Tax-Adv. Dividend Income (HTD)

- Pimco Corporate & Income Strategy (PCN)

- Pimco Dynamic Income (PDI)

- John Hancock Premium Dividend (PDT)

- Pimco Corporate & Income Opportunity (PTY)

- Cohen & Steers Quality Income Realty (RQI)

- Special Opportunities Fund (SPE)

- Cohen & Steers Infrastructure (UTF)

- Reaves Utility Income Fund (UTG)

I pointed out in my last article the weaknesses I see in my overall portfolio (also including the Giotto and Masaccio portfolios), so I refer back to that one for further discussion. As George Soros once said, “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

As for Cupolone, eleven of the CEFs in it (ETO, EVT, GOF, HTD, PCN, PDI, PDT, PTY, RQI, UTF, UTG) were purchased in the spring of 2020, during the Covid crisis, and then lightened during 2021 as the market went up, with the liquidity implications I alluded to earlier.

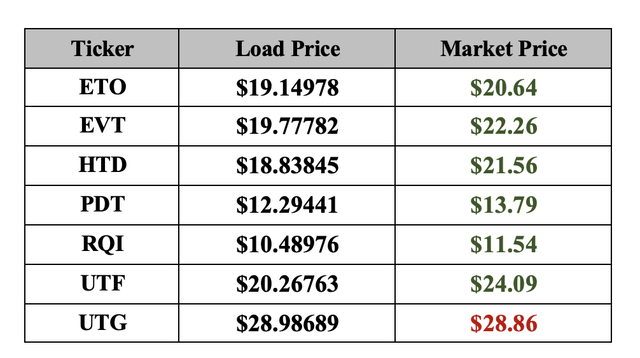

For the purpose of restoring my initial Cupolone positions in the current market, I exclude the four fixed-income funds, namely GOF, PCN, PDI, and PTY, for which I have no intention of increasing positions despite the fact that their prices have fallen far below my load ones. However, the other seven CEFs have also fallen to the point where they are very close to my load prices.

Now, it is true that I do not like to mediate upward. This is especially true in a rising market because I do not like to follow the trend. In the current case, however, as the market has gone down a lot, I find it convenient to reinvest the cash set aside to rebuild my initial positions at profitable prices, thus entirely benefitting from the substantial gains realized during 2021.

The current situation is illustrated below. Of course, nothing precludes the market going down further, but the price at which I could buy them back today already seems affordable. I never make investment decisions based on macro forecasts such as how high inflation will rise or whether there will be a recession, so I recently began to move starting with UTG, the only one that currently trades below my load price. All data as of September, 29.

As we know, the markets have been changing their tune for a few months now amid inflation, winds of war and rate hikes. Despite this, as of today as many as six of these seven CEFs still show NAV in positive territory since launch, while the only loss-making fund is RQI.

No one knows how long this situation may last, but the fact that ETO, EVT, HTD, PDT, UTF, and UTG show positive NAVs to date since launch is a value add that causes me to confidently buy back the shares of these funds that were sold at significant gains during 2021.

Time is a Gentleman

Once the initial positions are rebuilt, it will be a matter of waiting for the tide to rise, and hoping that the horizon is not as bleak as it is being painted. On the lighter side, I once heard that Mr. Market anticipated nine of the last six recessions…

In Italy, we say that time is a gentleman, and he will give us the answers if we have the patience to wait for them. In the meantime, the distributions provided by my CEFs will ease the wait, hopefully without excessive cuts, although I fear that will be inevitable sooner or later, given current yields.

I don’t know if my approach is the “average thing” that Napoleon referred to. He was a military genius, and even the Battle of Waterloo would have seen him victorious if chance had not had a hand in it. Slowed by mud from the heavy rains of the previous days, the French army was taken by storm with the unexpected arrival of general Gerhard von Blücher’s 117,000 Prussian soldiers on the battlefield at dusk. And there was nothing the Empereur could do.

But that is another story.

On a Side Note…

As of September 27, 2022 Credit Suisse AG implemented 1-for-20 reverse splits of its Credit Suisse X-Links Gold Shares Covered Call ETN (GLDI), Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO) and Credit Suisse X-Links Crude Oil Shares Covered Call ETN (USOI). All in all, I am glad I sold my holdings in these three ETNs at the end of August because these types of transactions are always suspect, usually being made after a security has shed substantial value, and do not bode well.

Be the first to comment