RomanNerud/iStock via Getty Images

Dear readers/followers,

I’ve covered Schneider Electric (OTCPK:SBGSF) once before, and a few times on our private community, iREIT on Alpha. Schneider Electric (OTCPK:SBGSY) is older than most current European nations in their current configurations. The company was founded, with more or less its current name, in 1836 by two brothers and began working in steel and armament and other industrial concerns. Tradition is one thing the company has in spades – and you certainly needn’t worry all that much about this company going anywhere.

Since my article on the company, Schneider has underperformed the S&P 500, there are reasons for this. However, to me, there are many reasons why you can expect Schneider, one of the world’s premier energy solutions businesses, to deliver mid and long-term alpha.

Let’s look once more at Schneider Electric

Revisiting Schneider Electric

As I mentioned in my first piece, Schneider is a business that consists only of two divisions. These divisions are Energy Management and Industrial Automation. That is what the company does. Despite the names and segments, Schneider still serves the same segments, and also focuses on the same global megatrends that are currently ruling the markets – namely electrification in the lower/medium voltage segments, and automation.

The company is one of the better-rated industrials on the entire planet, with an A- from S&P. Like Siemens (OTCPK:SIEGY), this is an extremely well-leveraged company with a high credit rating.

The company’s main end markets and customers are found in both the non-residential and residential construction markets, electrical markets, energy infrastructures, data centers, and industrial markets. This is a TAM of over $250B on an annual basis, and it’s growing. it’s also the reason why Schneider has been suffering somewhat in the last few months – because the infrastructure market isn’t as clear-cut or as forecastable as it was in the early portion of the year.

Schneider is also tiered to expand its exposure to emerging markets, which has a higher need for new electrification than established geographies in the west have (where much of the work is retrofitting/renovation). Schneider, unlike some of its peers, is an early-stage CapEx company that, unlike some engineering companies, benefits from the early cycle projects.

This means that Schneider actually suffers in financial drawdowns, but is also quick to recover as markets start to recover – much like it did in the financial crisis around 10 years back. Volatility is a bit inherent to this business model, and that’s why the company has taken steps to stabilize its cycles, which includes a higher degree of service contracts, product integration services and other incomes that are less tied to the ups and downs of the market.

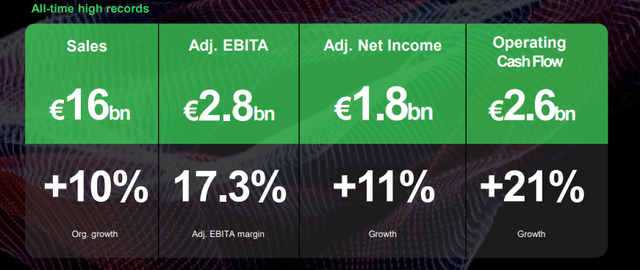

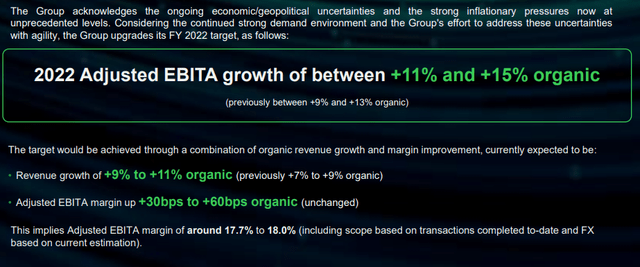

Half-year results are what we have here – and those are solid. Despite ongoing issues and inflation pressures, the company managed a 20%+ adjusted EBITDA margin in energy management and group revenues of over €16B company-wide, which is a 10% YoY growth.

Schneider Electric IR (Schneider Electric IR)

The company’s strategy is based on sustainable, digitized electrification with efficiency while trying to maintain inflation protection. The recent portfolio and client wins confirm the company’s continued appeal…

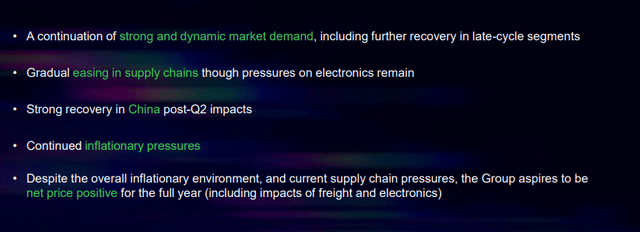

Schneider Electric IR (Schneider Electric IR)

… and the business is at the forefront of building-wide digitization and sustainable electrification, cutting carbon emissions and energy spending, and reducing total energy spending by as much as 50%. Schneider is also active in things like Data Centers and cybersecurity/cyberinfrastructure. The company is currently managing supply chain issues as well as it can, using its strategic supplier relationships, and redeveloping products, but the company still believes the electronics supply market to remain constrained until 2023.

Financial results for the half-year were really solid, with the one exception of FCF, impacted by the need for working capital. Energy management and FX were the two primary contributors to the revenue growth of almost €2.5B in a single half-year YoY, but every segment contributed to the growth.

Capital allocation priorities are on track – Schneider M&A’ed EvConnect and Autogrid, both bolt-ons completed in July, while divesting almost €1.1B worth of non-core assets out of the €2B planned. This included disposal of Eurotherm, Transformer plants in Eastern Europe and Turkey. This disposition is ongoing.

The company also bought back over 1.7M shares, with a total of 7.6M shares repurchased at an average of €105/share – and not even half of the planned share buyback program is done as of yet.

The company remains very conservative leveraged, below 1.5x, and payments of dividends are on track. The company currently yields over 2.54%, which is impressive for this company, all things considered.

On a high level, it’s energy management that is 85% of the company’s sales revenues. Industrial automation currently makes up no more than 15% as of the latest annual numbers.

This makes sense when you look at what the company has been doing, and that it’s still shifting to its new segments. The company targets its continued value proposition in the EM business segment, which frankly is better than Siemens and most of its competitors due to its end-to-end nature.

The company continues to consolidate an extremely fragmented market for global energy, and viewing the company historically, it’s gone through three clear phases. The first phase between 2003-2013/14 was building up its portfolio of products with large M&A’s in automation and energy management, with the subsequent years trying to effectively integrate all of these moving parts into a sort of global powerhouse in the sector. The latest M&A, Aveva, added more digital/software offerings to the sales mix, and the OSIsoft M&A has taken this yet another step in the right direction.

These moves are continuing as of this latest quarter. It’s not the highest yielder, but it’s an absolutely solid French giant with plenty of safety. On a high level, and as mentioned, Schneider is a play on shifting its business model from being a pure-play equipment manufacturer and supplier to being a solutions provider.

Schneider now has a solid track record of not only executing M&As but successfully integrating the businesses as well. The Aveva M&A is a recent positive example of a very positive and accreditive addition to the company.

I continue to be positive about the company as of this latest quarter, and this flows through to the valuation for the business in the following manner.

Schneider Electric Valuation

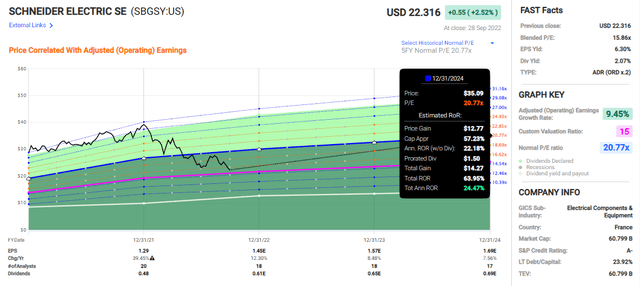

The company’s valuation is not a difficult one to look at, not even for the company’s ADR. The current ADR P/E multiple is around 15.8x but typically trades closer to 20x. This is a higher premium than some of its peers command, and its peers also yield more – but there is still an impressive upside to the company.

At a 15x P/E, the company has an upside of no less than 24% annually to a 20x forward P/E or a total RoR of around 60% overall.

Schneider Electric IR (F.A.S.T Graphs)

I use a number of EU industrials as peers, including aforementioned Siemens, ABB (ABB), Atlas Copco (OTCPK:ATLKY), Sandvik (OTCPK:SDVKY) and others. This comes to an average P/E of around 20X, and average EV/EBITDA of 13X, and a P/B of 3X as well as an average yield of just north of 2.8%.

Schneider is now undervalued in all of these apart from yield – and these comparisons are still valid. I still apply a 10-15% premium to Schneider based on what I would consider to be a solid core of manufacturing, sales, and software/service.

When coming out the other side, Schneider is more than 20% undervalued on EV/EBITDA, P/E, and even more, closer to 30% on book value as of this article. For NAV, we use EBIT multiples for the 2 segments at ranges of 15-17X and the listed value for Aveva Group. Aveva is over 50% owned by Schneider. This gives us a NAV range based on a net treasury share count of 556M of €138-€149/share. I would still weight NAV toward the higher end of this calculation, reflecting the strength of its segments at a higher as opposed to a lower multiple.

For S&P global, we have 21 analysts following the native ticker SU, which calls the company to trade between €100 for the low and a high of €210/share. The average target for Schneider is around €153.6, which comes to a current undervaluation of around 32.6%.

Putting these things together, I give the company a conservative price target of €146/share, which now implies a double-digit upside for the company. This is, again still considering the company’s commodity exposures, the ramp-up of the software/service advantages when considering its over 15-year legacy and M&A time, and other things that might weigh on valuation for some time.

However, at €146 conservatively, Schneider is now a solid, high-conviction “BUY” for me – and this is my thesis update.

Thesis

My thesis on Schneider is as follows:

- Schneider is one of the leading, global energy solution companies. It’s a 186-year-old dividend payer with one of the strongest records in all of Europe. With solid fundamentals and a great upside, this company is a must-own in a conservative portfolio at the right valuation.

- I consider the company at the “right” valuation at this time, with a double-digit upside and a yield above 2.5%.

- I consider Schneider Electric a solid “BUY” with an upside of up to 60% in a 3-year basis.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment