imaginima/E+ via Getty Images

If you can keep your head when all about you Are losing theirs and blaming it on you;

If you can trust yourself when all men doubt you, But make allowance for their doubting too:

If you can wait and not be tired by waiting, Or, being lied about, don’t deal in lies, Or being hated don’t give way to hating, And yet don’t look too good, nor talk too wise;

“If,” by Rudyard Kipling.

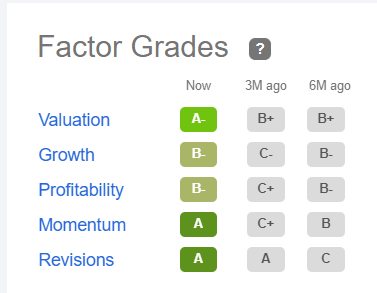

Bear markets, inflation, rising rates, recession, war, climate disasters, cryptocurrency scandals, and other fear-inspiring macro events dominate the discussion this holiday season. Yet, as an investor looking for opportunities for capital growth, there are reasons to be optimistic. For example, the rate of inflation is starting to decrease. In fact, according to Statista the rate of inflation has declined from a monthly high of 9.1% in June of this year down to 7.1% in November.

Bearish sentiment is on the rise and has been for 37 straight weeks, according to this recent article from Bespoke Investment Group. The market sentiment continues to be far more bearish than bullish, which may be a contrarian signal to investors looking for a reversal in the trend.

If you can dream – and not make dreams your master; If you can think – and not make thoughts your aim, If you can meet with Triumph and Disaster And treat those two impostors just the same. If you can bear to hear the truth you’ve spoken Twisted by knaves to make a trap for fools, Or watch the things you gave your life to, broken, And stoop and build ’em up with worn-out tools;

In this treatise, I will offer some ideas for growth-oriented investors to put on their Christmas wish list this year, to take advantage of the market recovery that I expect will occur in 2023. Without further ado, let’s get started. Following the Christmas theme, I will suggest a stock for each letter of the word starting with C.

Microsoft

C = Clearfield, Inc. (CLFD)

Clearfield is based in Minneapolis, MN and is committed to “enabling the lifestyle that better broadband provides.” Also known as the Fiber to Anywhere company, CLFD designs, manufactures, and distributes fiber optic connectivity and management solutions to enable rapid and cost-effective fiber-fed deployments. From the company website:

Based on the patented Clearview Cassette, our unique single-architected, modular fiber management platform is designed to lower the cost of broadband deployment and maintenance while enabling our customers to scale their operations as their subscriber revenues increase.

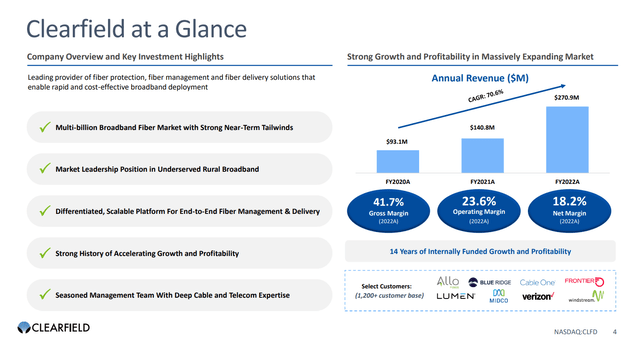

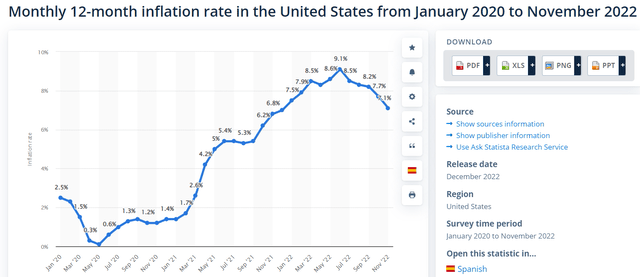

CLFD offers strong growth and profitability in a rapidly expanding market. From the company’s December 2022 investor presentation, the growth prospects are clearly illustrated in this overview slide.

December 2022 investor presentation (Clearfield )

For additional perspective, the estimated target market in the US for FTTH (fiber to the home) is expected to surpass $12.5B. The 5G market is expected to surpass $200B by 2030 and over $100B in US subsidies are anticipated to become available starting in 2023 for expanded broadband deployment across the US. The current CLFD product suite is well suited for 5G deployments as community broadband is the backbone for 5G and CLFD is the market leader with its end-to-end fiber delivery solutions.

The financial picture for CLFD is strong and growing as shown in the chart of quarterly revenues.

The price of CLFD got a little bit ahead of itself, rising 27% a day after reporting Q3 earnings on November 17 that included 110% YOY revenue growth. In the past 6 months, the stock price has escalated by more than 87%, however, it has recently dropped back below $100 after hitting an all-time high of $134.90. On December 7 the company announced a stock offering of 1.2M shares at a price of $100 that resulted in the price drop. As of the market close on 12/16/22 the stock was trading at a price of $99.07, representing a forward P/E of about 22, according to SA.

Microsoft

H = Hub Group, Inc. (HUBG)

Since the company’s inception in 1971, Hub Group, Inc. has aimed to deliver innovative, value-driven supply chain solutions including transportation and logistics. I last wrote about HUBG in July of this year where I discussed the 6 key tenets of their strategy including:

- Provide better customer service

- Drive organic growth

- Diversify service offerings

- Deepen customer value

- Advance technology strategy

- A culture of service, integrity, and innovation.

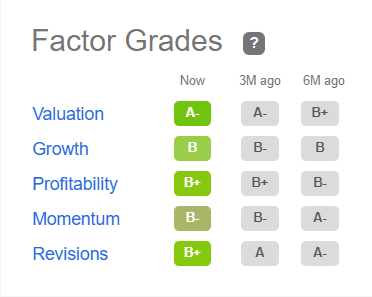

HUBG has a market cap of about $2.7B and trades at a market price of $80.87 as of 12/16/22, representing a forward P/E of less than 8. The stock has Buy ratings from Seeking Alpha authors and Wall Street analysts and is rated a Strong Buy according to SA quant rating factors.

In fact, HUBG is currently ranked #1 in the air freight and logistics sector, ahead of FedEx, UPS, and other well-known freight and logistics companies.

Seeking Alpha

Third quarter earnings highlights included the following results as summarized in the October 27 press release:

- Revenue growth of 26% to $1.4 billion, with increases across all lines of business

- Operating income increased 97% to $118 million (8.7% of revenue) driven by favorable pricing, yield management and operating efficiency

- Diluted earnings per share (EPS) of $2.61, up 104% as compared to prior year

- Expanded our consolidation and fulfillment solutions offering through the acquisition of TAGG Logistics in August

- Completed existing $135 million share repurchase authorization, and announced new $200 million authorization

- Updated 2022 outlook, with expected revenue of approximately $5.5 billion and diluted EPS of $10.40-$10.60.

Although a slowdown in the economy is expected to occur in Q4 and possibly into the first quarter of 2023, the company leadership believes that they are well positioned to withstand any slowdown that may occur. As explained on the earnings call, company CEO David Yeager responded to the question by saying:

We actually have seen a slowdown probably the last six or seven weeks on new opportunities that come across our desk. So I think that either a combination of the financing markets or economic conditions are probably leading to a little bit of a slowdown. But frankly, we’ve had much more success on outbounds on companies that we get to know and spend time with and make sure they’re a good cultural fit and really have been able to have success in doing acquisitions on kind of bilateral negotiations with sellers.

So, I think there is going to be a slowdown. I think private equity probably is going to pull back from their interest in the sector for some period of time. But we don’t think that’s going to impact our ability to continue to grow through acquisition.

Microsoft

R = RCM Technologies, Inc. (RCMT)

RCMT was founded in 1971 and is based in Pennsauken, New Jersey. The company provides business and technology solutions in the United States, Canada, Puerto Rico, and Serbia. It operates through three segments: Engineering, Specialty Health Care, and Life Sciences and Information Technology.

RCM services some of the largest national and international companies in North America as well as a lengthy roster of Fortune 1000 and mid-sized businesses in such industries as Aerospace/Defense, Energy, Financial Services, Life Sciences, Manufacturing & Distribution, the Public Sector and Technology.

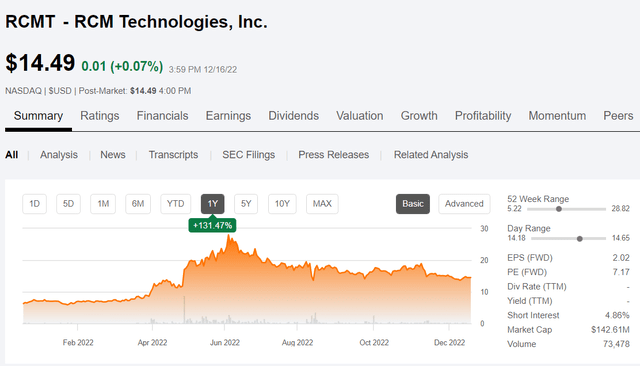

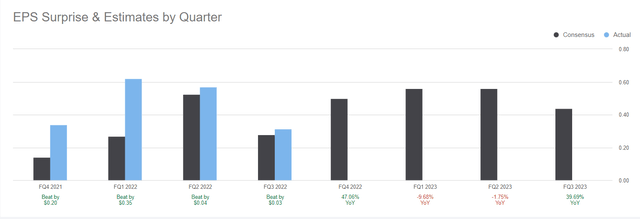

RCMT is a micro-cap stock with a market cap of about $140M. The share price has appreciated by more than 130% in the past year and is still trading at a low forward P/E of only 7.17 according to SA.

Revenues have been growing and earnings have exceeded estimates over the past 4 quarters. Estimates for 2023 indicate that revenues are likely to continue growing despite the potential slowdown in the economy. One of the impacts of that slowdown that has a positive effect on the future growth potential of RCMT is the lack of talent in the healthcare field as explained on the Q3 earnings call by company Chairman, Bradley Vizi:

The bottom line, the U.S. health sector is facing a substantial talent shortfall with several studies estimating that by 2025, there may be a supply-demand imbalance of 200,000 to 450,000 nurses. We have the expertise to help close this gap for our clients as it will require a combination of innovation and robust execution that comes from decades of service that committed to this end market.

From the company’s Q3 press release dated November 9:

RCM Technologies reported revenue of $214.5 million for the thirty-nine weeks ended October 1, 2022 (the current period), an increase of 54.3% compared to $139.0 million for the thirty-nine weeks ended October 2, 2021 (the comparable prior-year period). Gross profit was $62.5 million for the current period, a 76.8% increase compared to $35.3 million for the comparable prior-year period. The Company experienced GAAP operating income of $22.0 million for the current period compared to $7.0 million for the comparable prior-year period. The Company experienced GAAP net income of $16.1 million, or $1.52 per diluted share, for the current period compared to $5.0 million, or $0.43 per diluted share, for the comparable prior-year period. The Company experienced adjusted EBITDA of $22.5 million for the current period compared to $5.8 million for the comparable prior-year period.

Company CFO, Kevin Miller summed up the quarter and the outlook going forward:

“We continue to deliver on EBITDA-driven growth initiatives, with third-quarter and year-to-date adjusted EBITDA growing by 162% and 290%, respectively, over the prior year. Also, our strong balance sheet affords us strategic optionality to act opportunistically and drive continued value creation.”

RCMT is firing on all cylinders and providing much needed experienced staffing and consulting services in a variety of high growth industries including engineering and IT in addition to healthcare. RCMT just might take off in 2023 with potential for 80%+ upside in the share price according to Wall St analysts who have an average price target of $26.50.

If you can make one heap of all your winnings And risk it on one turn of pitch-and-toss, And lose, and start again at your beginnings, And never breathe a word about your loss: If you can force your heart and nerve and sinew To serve your turn long after they are gone, And so hold on when there is nothing in you Except the Will which says to them: “Hold on!”

Microsoft

I = iRobot Corporation (IRBT)

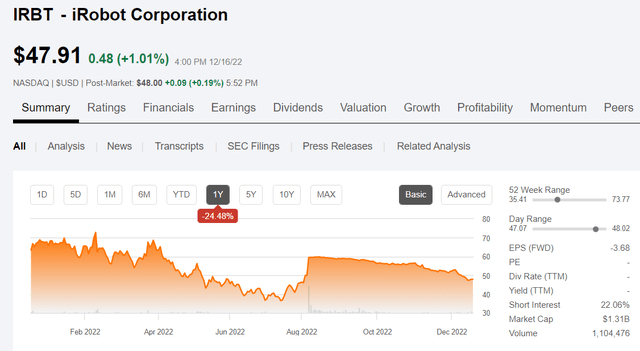

This pick is a merger arbitrage play on the pending takeover bid from Amazon. The company, iRobot, is best known for its robotic vacuum Roomba, and other floor and automated home cleaning devices.

On August 5, 2022, Amazon announced its intention to acquire IRBT for $61 per share, or $1.7B in an all-cash deal.

Commenting on the deal, Dave Limp, SVP of Amazon Devices, said:

“Over many years, the iRobot team has proven its ability to reinvent how people clean with products that are incredibly practical and inventive. Customers love iRobot products—and I’m excited to work with the iRobot team to invent in ways that make customers’ lives easier and more enjoyable.”

After the announcement, the IRBT stock price jumped to near $60 in anticipation of the deal closing mid-2023. However, in September the FTC made a 2nd request for information related to the merger and the stock took another leg down. On November 8, the company reported disappointing results for Q3, including huge misses on earnings and revenues and increasing inventories as a result of softening demand in the quarter. The deal spread has now increased considerably to the point where investors can realize a substantial profit as the stock is trading below the price when the deal was announced.

At the current market price of about $48, the deal spread is $13, representing roughly 27% upside profit potential if the deal closes as expected. The likelihood that the merger is approved is high so the risk of losing money on the deal is relatively low, however, there could be an unexpected hurdle or delay that could prevent the deal from closing in 2023.

In a recent article from another SA author that suggests IRBT is a compelling Buy due to the widening deal spread, some of the concerns that regulators may have in approving the deal are explained.

Given Amazon’s history of self-preferencing, regulators will be looking closely to see how the merger will affect competition in the robotic vacuum market. I’ve mentioned the possibility of including iRobot as part of Prime subscription, regulators will want to see if such a possibility is an unfair advantage that iRobot gets as a result of the merger. They will also be looking to see if Amazon can use its position as an e-commerce behemoth to disadvantage competing products on its platform. Regulators could challenge the merger if they feel they can prove Amazon will disadvantage competitors if it merges with iRobot. Unfortunately for the latter, not only has Amazon engaged in self-preferencing practices, it is also criticizing laws that attempt to reign in those practices.

Microsoft

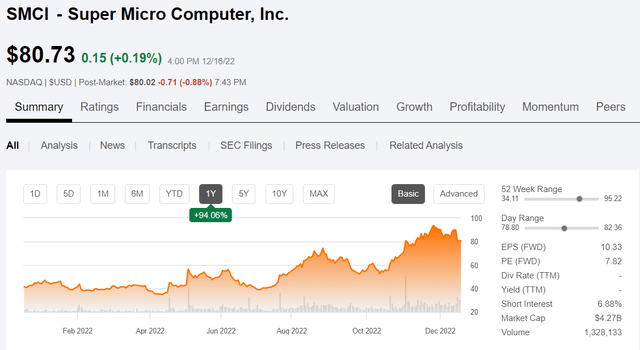

S = Super Micro Computer Inc. (SMCI)

Despite the lackluster performance of the technology sector in 2022, SMCI has delivered excellent results and its stock performance has demonstrated strong confidence in its ability to continue that momentum into 2023, trading at a forward P/E of less than 8. The market price has increased by more than 90% in the past year, and by more than 260% in the past 5 years.

Supermicro was founded in 1993 by Charles Liang, who is now CEO and Chairman of the Board. From the company’s website:

Supermicro is a global technology leader committed to delivering first to market innovation for Enterprise, Cloud, AI, and 5G Telco/Edge IT Infrastructure. We are transforming into a Total IT Solutions provider with environmentally-friendly and energy-saving server, AI, storage, IoT, and switch systems, software, and services while delivering advanced high-volume motherboard, power, and chassis products.

A recent article from Danil Sereda explains why this stock is poised to outperform in 2023. In that article, the author estimates a fair value of nearly $105, representing an upside of about 30% from the current price of around $80.

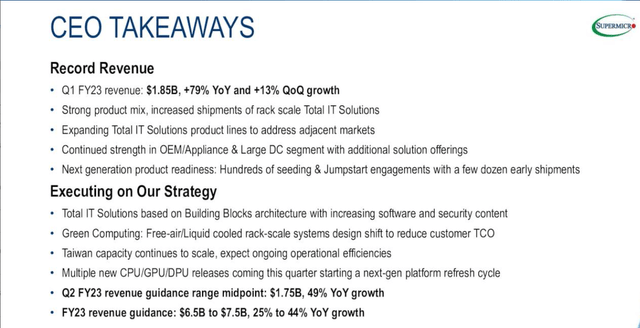

From the company’s Q1 FY23 (third quarter 2022) earnings presentation, SMCI anticipates 49% YOY revenue growth in its Q2 FY23 (Q4 calendar year 2022) with total FY23 revenues of $6.5B to $7.5B. The CEO takeaways from the recent earnings report are summarized on this slide from the presentation.

Supermicro earnings presentation

The company generated record cash flow in the quarter of $314M resulting in $238M cash on hand with total debt down to $250M, reduced by $347M in the quarter. Margins have been increasing each quarter as well, with non-GAAP gross margins increasing from 13.4% in Q1 FY22 to 18.8% in Q1 FY23 due to price discipline, higher factory efficiency, and lower freight costs.

In his comments on the latest earnings report, CEO Liang summed up the future prospects for SMCI:

“Looking ahead, I anticipate fiscal year 2024 revenue may reach the range of $8 billion to $10 billion considering the current economic headwind may last for many quarters. As we continue to gain IT market share with the best rack-scale Plug-and-Play IT Total Solutions, I believe we will soon become a $20 billion revenue company. Our business model has been optimized, our engineering teams are fully ready, and our worldwide campus production capacity and efficiency are now second to none.”

Microsoft

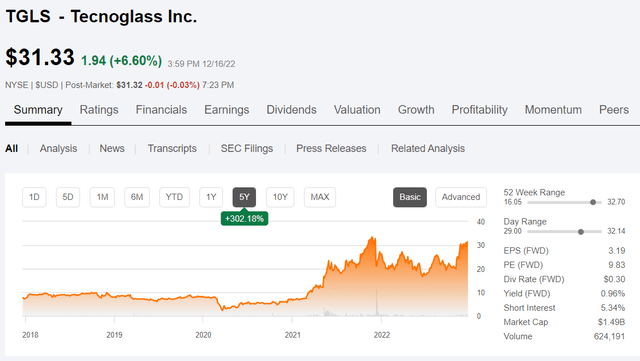

T = Tecnoglass Inc. (TGLS)

Tecnoglass is a vertically integrated manufacturer of low-cost, high-quality glass products. From the SA company profile:

Tecnoglass Inc., through its subsidiaries, designs, produces, markets, and installs architectural systems for the commercial and residential construction industries in Colombia, the United States, Panama, and internationally. The company was founded in 1984 and is headquartered in Barranquilla, Colombia.

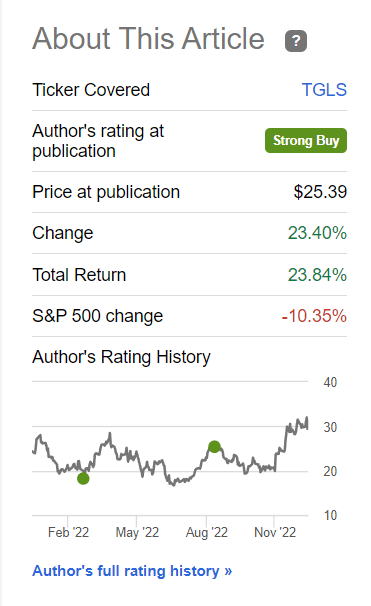

I last wrote about TGLS in August of this year when I stated that the prospects for growth look encouraging despite inflationary headwinds and a slowing economy. Since that time, the stock price has increased by more than 23% while the broader market has declined by more than -10%.

Seeking Alpha

In Q3 2022 the company reported record revenues of $201.8 million, up 53% YOY with record gross margin of 52.2%. Record net income of $46.9 million represents $.98 per diluted share. Adjusted EBITDA more than doubled YOY to $78.5 million, or 38.9% of total revenues. Backlog expanded by 21% to a record $696.9 million. The company CEO, Jose Manuel Dias summarized the outstanding performance of TGLS over the past several years in his comments.

“The structural enhancements in our business, our diversified revenue mix, and our prudent working capital management have helped us generate 11 straight quarters of exceptional cash flow. Based on the Board’s confidence in our strategy and cash generation, we are pleased to announce today the authorization of a new $50 million share repurchase program as an additional avenue to build value in our Company. As we move forward, we believe our structural advantages and highly profitable growth strategy will allow us to continue generating exceptional cash flow as we look to deliver value for our shareholders.”

The 5-year chart for TGLS illustrates how well they have performed with over 300% growth in the share price, yet still trading at a forward P/E of less than 10.

For the full year 2022 outlook TGLS raised guidance, which helped to propel the share price to near 52-week highs.

“…..We continue to expect full year gross margin to be in the mid-to-high 40% range, demonstrating strong operating leverage on our structural advantages, vertically integrated operations and high-return capex initiatives. We look forward to delivering a fifth straight year of record Adjusted EBITDA, representing year-on-year organic growth of 72% at the midpoint, and exceptional cash flow,” said CFO Santiago Giraldo.

Microsoft

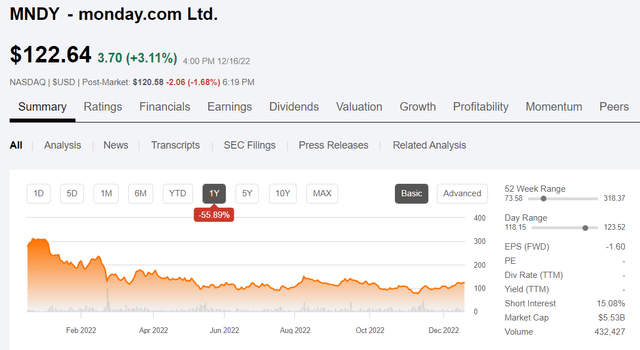

M = monday.com Ltd. (MNDY)

Named #10 of the top 10 most overweight stocks according to BofA global quant strategy team, monday.com is a growing software company based in Israel. The company profile from SA describes them this way:

monday.com Ltd., together with its subsidiaries, develops software applications in the United States, Europe, the Middle East, Africa, and internationally. It provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools. The company also offers product solutions for marketing, CRM, project management, software development, and other fields; and business development, presale, and customer success services. The company was formerly known as DaPulse Labs Ltd. and changed its name to monday.com Ltd. in November 2017. monday.com Ltd. was incorporated in 2012 and is headquartered in Tel Aviv-Yafo, Israel.

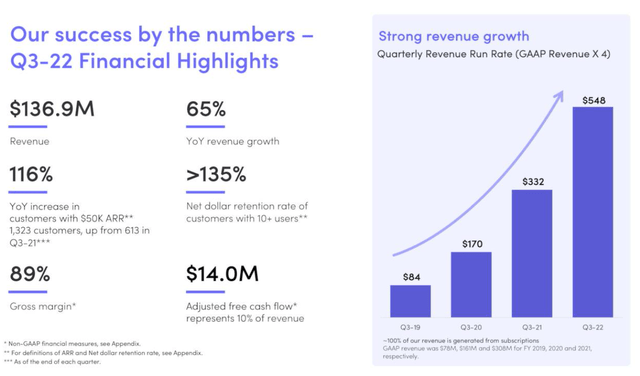

In November 2021, MNDY reached an all-time high price of over $400. Since that time, the stock has retreated along with the broader market while growing revenues by nearly 65% YOY in Q322.

The primary software application from MNDY is Work OS. The Work OS suite of solutions is winning customers and growing in adoption due to its flexible and adaptable architecture, the use of customizable no-code building blocks, a single platform to run all work processes, and the ability to create a single, unified workspace.

On November 14 the company reported Q3 earnings and provided a Q4 outlook. Highlights from the press release include:

Third quarter revenue of $136.9 million grew 65% year over year (68% FX-adjusted)

Number of Customers with more than $50k ARR grew 116% year over year

Number of paying accounts from new monday Work OS products has surpassed 3,000

For the fourth quarter of the fiscal year 2022, monday.com currently expects:

- Total revenue of $140 million to $142 million, representing year-over-year growth of 47% to 49%.

- Non-GAAP operating loss of $22 million to $20 million and negative operating margin of 15% to 14%.

The following slide from the earnings presentation illustrates the financial highlights from the Q3 report.

The company has been growing revenues every quarter since Q1 2019, while reducing annual expenses as a percentage of revenues each year. Annual adjusted free cash flow turned positive in FY 21. There are some risks to consider and some potential headwinds that could slow the growth in 2023, however, as co-CEO Roy Mann explained on the earnings call, they feel well prepared to deal with those risks:

We currently see two primary headwinds. First, we continue to see pockets of stress in our customer base, in particular in Europe with some indication of softness spreading to other regions. Second, since we have a large presence of business outside the U.S., the strong U.S. dollar has negatively impacted reported results and represents an FX headwind to revenue growth. Despite these uncertainties, new customer demand remains solid and acquisition efficiency improved in Q3. While others are pulling back, we continue to see opportunities and invest for growth and gain market share. With our in-house business intelligence tools, BigBrain we track every marketing campaign in detail allowing us to easily adapt to changes in the business environment.

Microsoft

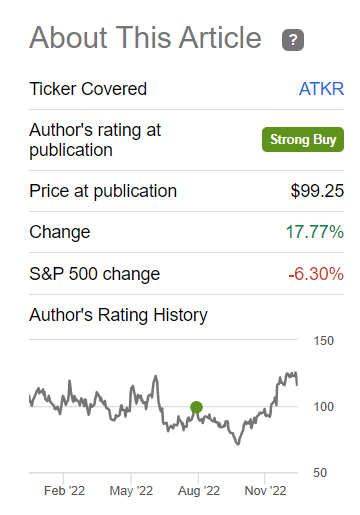

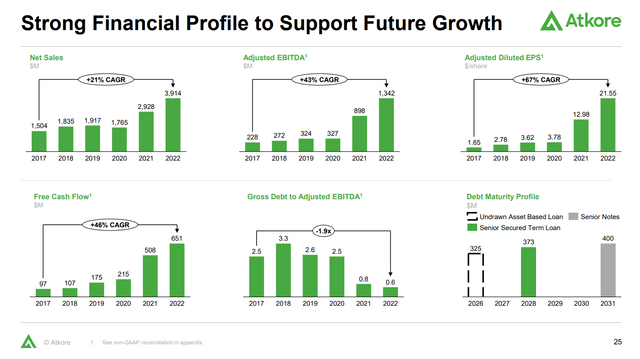

A = Atkore Inc. (ATKR)

Atkore is an industrial company that specializes in electrical and infrastructure equipment and components. Atkore was founded in 1959 with headquarters in Harvey, IL. The company includes multiple brands from acquiring other companies, including six acquisitions in FY 2022. I last wrote about ATKR in August when I rated the stock a Strong Buy at a price of $99.

Seeking Alpha

On November 18, ATKR reported Q4 FY22 earnings including record full year net sales and net income.

- Net income per diluted share increased to $20.30 from $12.19 in prior year; Adjusted net income per diluted share increased to $21.55 from $12.98 in prior year

- Net income increased by $325.6 million versus prior year to $913.4 million; Adjusted EBITDA increased to $1,341.8 million from $897.5 million in prior year

- Net cash provided by operating activities of $786.8 million; Free Cash Flow of $651.1 million

In addition, the Board increased the current share repurchase authorization from $800M to $1.3B and extended the duration until November 2025. The full year 2023 adjusted EBITDA outlook was estimated at $850M to $950M.

The President and CEO Bill Waltz summarized Q3 results and the outlook for 2023:

During fiscal 2022, we deployed over $950 million in capital towards investments in our operations, six acquisitions and $500 million in share repurchases. Our fiscal 2022 performance builds on the journey we’ve taken over the years to transform our business and create a stronger platform for long-term success.” As anticipated, the strong pricing environment experienced in recent years is expected to normalize in fiscal 2023, which will impact our top- and bottom-line performance through the year. However, we expect to continue to generate strong cash flow, and our capital allocation strategy remains focused on investing in both organic and inorganic opportunities while still returning capital to shareholders.

From the Q4 investor presentation, ATKR presents a strong financial performance profile.

ATKR is well positioned for future growth, although the outlook for 2023 is for flat to -10% in net sales due to deteriorating economic conditions. Nonetheless, the estimate for adjusted EPS is $13.10 to $14.90. Assuming the mid-range of $14 and using an earnings multiple of 12x, a conservative price target for 2023 would be $168. The stock currently trades for about $117 as of 12/6/22 so there is roughly 40% upside to ATKR based on those estimates.

Microsoft

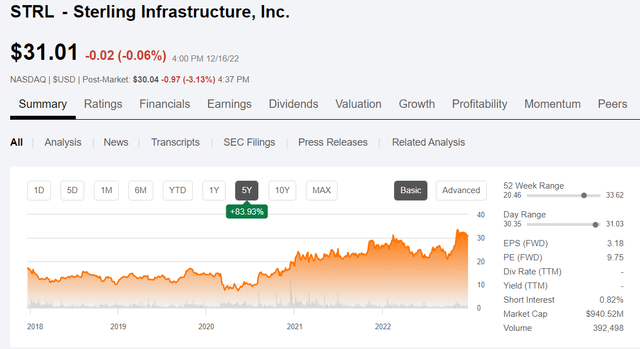

S = Sterling Infrastructure, Inc. (STRL)

Sterling Infrastructure closes out our Christmas wish list picks for 2022. As witnessed by some of the other picks described above like CLFD, ATKR, and TGLS, the Bipartisan Infrastructure deal passed by Congress in 2021 has created some opportunities in broadband investment, roads and bridges, clean water, electric utility grid improvements, and renewable energy development. That momentum and additional spending on infrastructure projects in 2023 is a positive tailwind for STRL.

Based on the SA company profile, Sterling should benefit significantly from this enhanced federal spending emphasis on infrastructure projects:

Sterling Infrastructure, Inc. engages in the transportation, e-infrastructure, and building solutions primarily in the Southern United States, the Northeastern and Mid-Atlantic United States, the Rocky Mountain states, California, and Hawaii. It undertakes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, light rail, water, wastewater, and storm drainage systems for the departments of transportation in various states, regional transit authorities, airport authorities, port authorities, water authorities and railroads.

Sterling was founded in 1955 and is based in Woodlands, TX. They are an industry leader in E-Infrastructure solutions, Building Solutions, and Transportation Solutions including heavy civil engineering and construction. They have a broad spectrum of end customers including Government agencies, Fortune 100 companies, and Top National Builders.

The stock price performance in the past year has included a price return of about 17% and nearly 84% price appreciation in the past 5 years. With a forward P/E of less than 10 and growing revenues, the stock offers a good value for growth investors.

On October 31, STRL reported Q322 earnings that resulted in revenues of $556.9M representing 20% YOY revenue growth. Net income was $29.5M which works out to $0.97 per diluted share, an increase of 40% and 35% respectively compared to Q321. Other highlights from the earnings report included:

- EBITDA of $60.2 million, an increase of 50% compared to the third quarter of 2021

- Cash flows from operations was $96.1 million and $130.6 million for the third quarter and nine months ended September 30, 2022, respectively

- Cash and Cash Equivalents totaled $146.5 million at September 30, 2022

- Backlog at September 30, 2022 was $1.67 billion, an increase of 12% over December 31, 2021

- Combined backlog at September 30, 2022 was $1.90 billion, an increase of 25% over December 31, 2021.

As explained by CEO Joe Cutillo, the slowdown in the housing market negatively impacted the Building Solutions division, however, the company’s strengths in other areas made up for the shortfall.

“Our company’s gross profit increased $24.2 million to $82.0 million, with gross margin increasing 220 basis points to 14.7% from the prior year period. Our strong results were driven by revenue growth from E-Infrastructure Solutions which benefited from organic growth and the acquisition of Petillo in late 2021, and improved margins from Transportation and Building Solutions. Building Solutions’ revenue decreased quarter over quarter, as home ownership became less affordable due to increasing interest rates and inflation. Despite the Building Solutions revenue headwinds, our continued focus on execution of our strategic objectives once again enabled us to generate our record results.

Our backlog and combined backlog levels were at all-time highs, primarily as a result of the new large site development projects in E-Infrastructure Solutions and increased bid activity in Transportation Solutions. As a result of our strong third quarter, we are adjusting our full year 2022 guidance. The mid-point of this adjusted guidance improves our net income by 53%, our revenue by 21% and our EPS by 47% over 2021”

One definition of Sterling is the description of something of very high quality, as in sterling silver. Sterling Infrastructure is a high-quality growth company being offered to investors at a value price. The SA quant factor grades back this up with high grades in nearly every category.

Seeking Alpha

That pretty much wraps up my 2022 Christmas growth investors wish list. I will close by adding a bow, taking the final verse from If to end this litany. If you stayed with me this long, I appreciate your attentive nature and I wish you all the best including a happy, healthy, and prosperous new year!

If you can talk with crowds and keep your virtue, Or walk with Kings – nor lose the common touch, If neither foes nor loving friends can hurt you, If all men count with you, but none too much: If you can fill the unforgiving minute With sixty seconds’ worth of distance run, Yours is the Earth and everything that’s in it, And – which is more – you’ll be a Man, my son!

Be the first to comment