alvarez

Author’s note: This article was released to CEF/ETF Income Laboratory members as part of the CEF Weekly Round up on October 18, 2022. Please check the latest data before investing.

HYT rights offering results

The results of BlackRock Corporate High Yield Fund’s (HYT) rights offering are in! To recap, this was a transferable 1-for-5 offering with a subscription formula being the higher of 90% of NAV or 95% of the market price of the fund, as defined by the average closing price in the final five days of the offering. The ex-rights date for the offering was September 19, 2022, and the sponsor will bear all of the costs of the offering. We discussed the rights offering when it was initially announced in a previous CEF Weekly Roundup (public link) and then again last week when it was due to expire in another Weekly Roundup.

From the press release:

NEW YORK–(BUSINESS WIRE)–BlackRock Corporate High Yield Fund, Inc. (NYSE: HYT) (the “Fund”) today announced the successful completion of its transferable rights offer (“the Offer”). The Offer commenced on September 20, 2022, and expired on October 13, 2022.

The Offer entitled rights holders to subscribe for up to an aggregate of 24,463,440 shares of the Fund’s common stock, par value of $0.10 per share (“Common Share”). The final subscription price of $8.23 per Common Share was determined based upon the formula equal to 90% of the Fund’s net asset value per share of Common Shares at the close of trading on the NYSE on the expiration date. The Common Shares subscribed for will be issued promptly after completion and receipt of all shareholder payments.

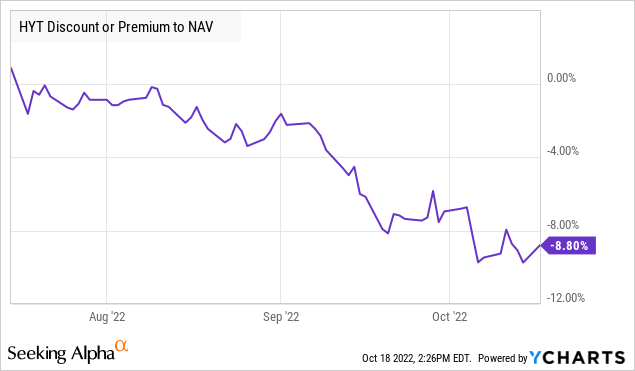

As we had predicted, HYT’s discount gradually moved towards the -10% discount floor for the offering as the expiry date approached. This meant two things: (1) that the benefit from subscribing became diminished, (2) the rights became less valuable. This is why we recommend investors who do not intend to take part in the rights offering to sell their rights as soon as they receive them on the open market.

YCharts

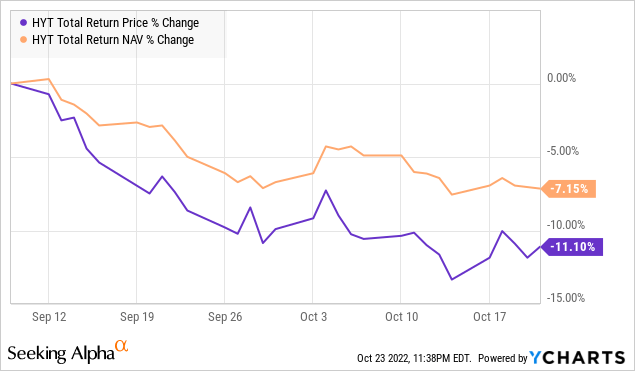

Additionally, the “sell and rebuy” strategy that we recommend for our members who do not intend to take part in the rights offering would have been a successful one again (tax issues not considered), although the difference between price and NAV this time was not stark (about 4 percentage points) as the fund was already at a mild discount when the offering was announced.

The press release announced that 20.3 million new shares will be issued, giving proceeds to the fund of approximately $168 million. The new shares were issued at $8.23, which was 90% of the NAV of the fund at expiry, i.e. the discount floor. Compared to the closing share price of $8.31 on expiry day, investors who subscribed received a slim -0.96% discount to the market price.

A quick back-of-the-envelope calculation indicates that the offering was moderately undersubscribed, with around 83% of rightsholders subscribing. Undersubscription was expected, given the slim advantage to subscribing over not subscribing. Together with the fact that this was a 1-for-5 offering, the dilution is also expected to be diminished too, with a corresponding NAV/share hit of -$0.10 or -1.0%. The fund’s outstanding share count will increase by +16.6% as a result of the offering.

Going forward

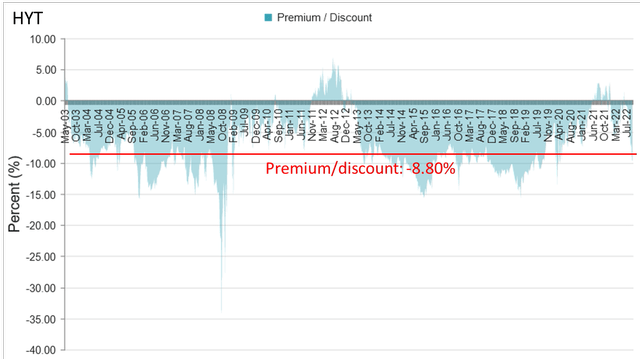

HYT is a fairly solid high-yield bond fund that ranks in the upper half of funds across longer time frames (per CEFdata). Its current -8.80% discount (-2.2 z-score) compares favorably with its 1, 3 and 5-year average discounts of -2.23%, -3.47% and -6.51% respectively. However, do note that HYT’s discount has been wider in the past, and with other high-yield CEFs being more attractively valued (e.g., portfolio positions FTHY at a -13.44% discount and HYB at a -15.01% discount), I’d be looking elsewhere first.

For a more comprehensive fundamental review of HYT, see Dividend Seeker’s (a member of the CEF/ETF Income Laboratory team) article on HYT here: Tempting Valuation Right Now.

Don’t know what to do about CEF corporate actions?

Closed-end fund corporate actions such as rights offerings and tender offers present both significant opportunities and risks. We cover these regularly for members of CEF/ETF Income Laboratory, allowing them to profit or avoid losses.

Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial!

Be the first to comment