Justin Sullivan

by Levi at StockWaves, produced with Avi Gilburt

Those who have been following what seems to be quite a bit of drama as of late are familiar with these headlines. It has been widely reported that Elon Musk is selling Tesla (NASDAQ:TSLA) shares so as to complete the acquisition of Twitter (TWTR) (see Reuters article here). What’s also somewhat ironic is that on the last earnings conference call a few weeks back, it’s becoming a possibility that the company may actually, for the first time in its history, buy back some of the shares on the open market (see WSJ article here).

In spite of all of the pushing and pulling in the stock over the last few months, has anything changed from a fundamental standpoint?

A Fundamental Recap

From what we’re seeing, there are no changes in the actual fundamentals of the company itself. If anything, with the potential of a share buyback, this may suggest that the company is confident in its free cash flow and sees the shares as a bargain.

In a recent discussion of the fundamentals for TSLA, Lyn Alden offered these comments:

“Tesla is one of the hardest stocks to analyze fundamentally because it trades a lot more so on sentiment than even other stocks of its size. This is a stock that has ranged from a 1.5x price/sales multiple to a 30x price/sales multiple over the past few years. Although it is cut in half from its 2021 highs in terms of its price/sales multiple, I continue to be concerned about Tesla’s valuation as primarily a hardware company.”

“One of the bull cases for Tesla historically is to argue that it’s more of a software company than a hardware company. However, in terms of the various operational risks and profit margin profiles they have, they clearly fit more in the hardware category. For example, this is the gross margin of two example software companies vs two examples hardware/’car’ companies.”

Now, please note Lyn’s conclusion and one of the main benefits of our synergistic methodology in StockWaves:

“So, I generally leave Tesla purely for the technical analysts to work with, because it’s a stock that has such wild valuation fluctuations, that fundamentals are a distant second in terms of analysis compared to sentiment and narratives.”

The Prior Setup

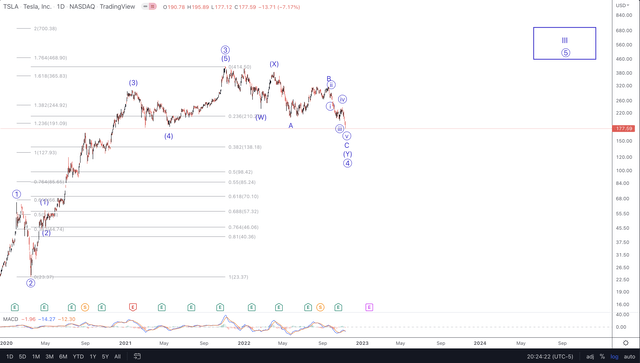

Back on Sept. 27, we published “Tesla: Catch Me If You Can.” The main takeaway from the piece was that the stock price needed to hold support in a fourth wave pullback and then make a higher high. Note the commentary near the conclusion of the article:

“We see TSLA as needing a higher high in the near term, perhaps near the $340 level. In the bullish case, that would complete wave 5 of the parenthesis wave ‘1’ up. Thereafter, a pullback in parentheses wave ‘2’ would be underway and would typically retrace 38% to 62% of the larger wave ‘1’.”

“The highest probability entry point would be once that larger wave ‘2’ finds its low and starts back up in what would be a third wave to new highs.”

The stock instead broke support at the $260 level and this told us that it would at least retest the recent lows at $210 or even lower.

Where Do We Find Ourselves Now?

For those who follow our methodology, you will know that we view the markets as fluid, dynamic and non-linear in nature. This means that at any point in time there are various possibilities that can take shape. However, what this does not mean that we present all of these possibilities and then whichever comes to fruition we proclaim ourselves as correct.

We view the markets from a probabilistic standpoint. A basic stance would be that when the market moves up in a 5 wave structure and back down in a 3 wave structure that holds the prior low or higher, that usually proves to be a buying opportunity.

It’s at that point that we find ourselves with TSLA. We’re looking for a 5 wave advance to start from the $165-$175 area. Can TSLA move lower than that? Of course it can. But note what we are currently seeing in the near term structure of price.

So, should price strike this zone and then move up in 5 waves from there, a 3 wave corrective pullback would be a swing long buying opportunity with stops at that recent low.

What’s The Current Context?

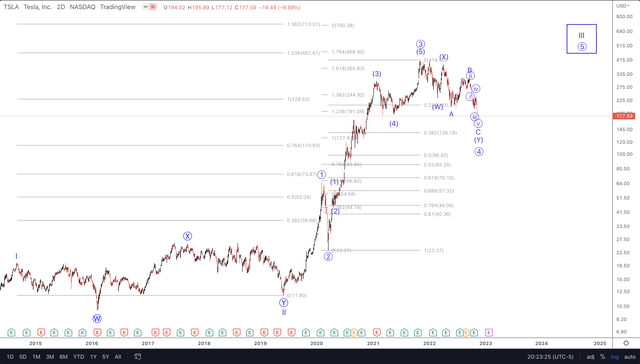

Elliott Wave theory, when correctly applied, is one of the only methodologies we know of that will provide context to any market at any given point in time. Where do we see TSLA at the moment? This is in a Primary fourth wave pullback that once complete, may indeed lead to new highs in the stock.

Risks and Conclusion

It’s plausible to conclude that TSLA is actually in a deeper fourth wave correction that could take it to the $128 – $138 area. While we don’t see a probable setup for that scenario at the moment, it’s possible. However, since we deal in probabilities, we mention it but are not projecting that at this time.

If we do not see a 5 wave move up from this $175 price target zone, then we will look for another high-probability setup in the near future.

What’s Truly Moving This Stock?

We might even ask, what truly moves the markets? As humans, we love a narrative. Tell us a story, forge a narrative to explain what is happening at any moment in time. It’s this craving for a framework around market movements that requires regular feeding on news, stories, narratives and the like. A narrative makes us feel like we are in control of our environment.

It’s the narrative that seems to somehow provide reason to market movements. However, the markets are anything but reasonable. They’re a mass of emotions driven hither and thither by the whims of the crowd.

We have some fascinating research in the Education section of ElliottWaveTrader.net. Avi Gilburt has gathered a wealth of scientific studies discussing what truly moves the markets. This is an excerpt from an article that asked the question, “Does Man Truly Have Free Will?”:

“Based upon much recent research, it seems that, as a society, we are moved by our limbic system, which controls the impulsive actions of living creatures (including the ‘herding’ impulse), and which will, subconsciously, often override the neocortex of our brain, which controls our reason. As Eric Hoffer aptly noted, ‘When people are free to do as they please, they usually imitate each other.’ Therefore, as a society, we seem to be hard-wired so as to move in a unified direction.

However, it has also been proven that the extent of this effect will vary on an individual basis. Therefore, as individuals within the overall society, we are not necessarily completely bound by the decisions made by society at large, so we are then able to make choices which can, to some extent, protect us from the mistakes repeated by the masses throughout history. This, my friends, is probably the most powerful tool available to Elliotticians in our time. It is our ability to understand the overall trend of the masses, which potentially gives us the opportunity to act in contravention to the negative, harmful trends. This assists us in maximizing our individual ‘free will.'”

How We Can Use This Information

To boil this all down to actionable intelligence, we’re looking for TSLA to make a significant low in the $165-$175 area. From there, to create a high-probability setup, we want to see an initial 5 wave structure up, then a corrective 3 wave structure down that holds that low struck or higher. That will provide us with a swing long entry point with a specifically defined risk vs reward.

I would like to take this opportunity to remind you that we provide our perspective by ranking probabilistic market movements based upon the structure of the market price action. And if we maintain a certain primary perspective as to how the market will move next, and the market breaks that pattern, it clearly tells us that we were wrong in our initial assessment. But here’s the most important part of the analysis: We also provide you with an alternative perspective at the same time we provide you with our primary expectation, and let you know when to adopt that alternative perspective before it happens.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

Be the first to comment