Drew Angerer

Intro & Thesis

Palantir Technologies Inc. (NYSE:PLTR) has >191K followers here on Seeking Alpha, most of whom I assume are quite bullish on this stock. Investor demand for confirmation has created a large supply of analysis materials here (in the last 30 days, 9 of 12 analysts are bullish or strongly bullish).

Last year, I wrote my first bearish article on Palantir. Since then, I have never deviated from my thesis that: 1) the company is overvalued and 2) the business model will not allow it to quickly turn to profitability despite a 30% increase in sales.

| # of article | PLTR | S&P 500 index |

| 1 | -69.93% | -13.02% |

| 2 | -70.92% | -16.02% |

| 3 | -73.72% | -18.74% |

| 4 | -37.23% | -10.22% |

| 5 | -23.97% | -9.59% |

| 6 | -24.54% | -9.07% |

| 7 | -9.70% | 1.59% |

| Average | -44.29% | -10.72% |

Source: Author’s calculation, based on my Seeking Alpha articles

After the company’s latest Q3 2022 results came out on November 7th, we saw 11 new SA articles, and only one, from SA’s Albert Lin, was bearish.

Today, after the dust has settled a bit, I would like to share with you again the results of my updated Sum-Of-The-Parts valuation model that I developed 5 articles ago. I also want to speculate on what assumptions make the PLTR estimate attractive to bulls today and why it realistically makes no sense.

Sum-Of-The-Parts Valuation Table For Palantir Stock

To begin with, I would like to give some explanations about this model and its root assumptions.

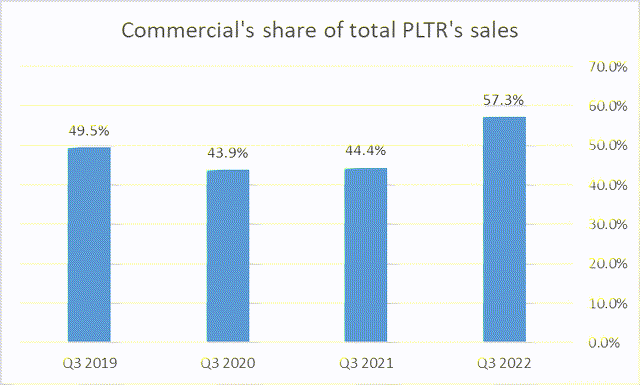

Today, we clearly see the transition of the enterprise from the Government segment to the Commercial segment. The volume of new contracts with large, non-military companies is increasing, and the old contracts are finally starting to be reflected in the revenues of the last quarters, making Palantir’s transition more and more evident.

Author’s calculations, based on PLTR’s filings

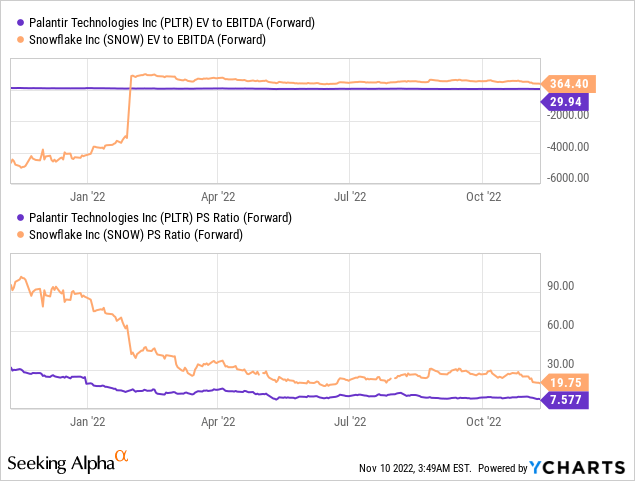

But should the Government segment, with a 43% revenue share, be written off now? It seems like many bulls believe it should – this would partially explain the company’s high valuation and possibly even lead to a comparative undervaluation. If you do not look deeper into the question, PLTR’s multiples resemble a value company compared to Snowflake Inc. (SNOW).

However, in my opinion, the transition described above: 1) will not happen soon; and 2) will not be complete, as Palantir is primarily a provider of data intelligence tools for the U.S. Army. That’s why we cannot just take PLTR multipliers and samples from expensive SaaS companies to draw a definitive conclusion. We should also look at the government segment and look for suitable analogs there for comparison.

Palantir is quite a suitable company to build a SOTP model – it has only 2 business segments. For large conglomerates, it takes several hours to create such a complex model (and this applies only to the data preparation process) – at least that’s how it was with 3M Company (MMM) and the model my friend Oakoff Investments created in August 2021.

But we cannot just take multiples of companies from 2 industries, take a weighted average based on the shares of each segment, and apply the implied value to what we see with Palantir. First, PLTR would immediately be shown to be overvalued, and we could end the whole conversation. Second, such a conclusion does not take into account the prospects of the companies – which is the most important thing when valuing anything in this way.

So I came up with the idea of looking at the growth of the companies in the last quarter and listing the corresponding forwarding valuation multiples in a separate column. Another question – which multiples to take for comparison?

I focus on revenue growth – that’s apparently what Alex Karp, the CEO of Palantir, also focuses on when he talks about the company’s GROWTH prospects every single quarter (he also talks of contract growth a lot, but not every single company reports of its contracts in detail). So, revenue growth is a suitable benchmark to compare all companies under approximately the same conditions.

Against the actual sales growth rates in the last reporting quarter, I set the forward price-to-sales multiplier, i.e., how “many” of next year’s annual sales are needed to offset today’s market capitalization.

Then we figure out “how much” of P/S make up 1% of the average growth of each of the segments, and then we multiply it by the weight (from revenue structure) to then get a P/S multiple that is fair for the company based on the average multiples of the peers at the average growth rate of the peer group. We then find the difference between the resulting value and what the company actually has – a positive (negative) difference indicates the extent of undervaluation (overvaluation).

Here’s what I ended up with:

| Government = | 42.68% | |

| Company name | P/S (FWD) | Sales growth, last quarter, YoY |

| Booz Allen Hamilton (BAH) | 1.59 | 9.16% |

| Science Applications International Corp. (SAIC) | 0.801 | -0.27% |

| Leidos Holdings (LDOS) | 1.023 | 3.59% |

| Average | 1.138 | 4.16% |

| Commercial = | 57.32% | |

| Company name | P/S (FWD) | Sales growth, last quarter, YoY |

| Tyler Technologies (TYL) | 6.561 | 2.90% |

| Verint Systems Inc. (VRNT) | 2.382 | 3.86% |

| Splunk Inc. (SPLK) | 3.453 | 31.86% |

| Cognizant Technology Solutions Corp. (CTSH) | 1.436 | 2.38% |

| Alteryx (AYX) | 3.464 | 74.66% |

| Snowflake | 19.75 | 82.68% |

| Average | 6.17 | 33.06% |

| Gov’s P/S per 1% sales growth | 27.36 | |

| Com’s P/S per 1% sales growth | 18.68 | |

| Palantir’s Gov growth, 3Q, YoY | 25.69% | |

| Palantir’s Com growth, 3Q, YoY | 17.24% | |

| implied PLTR’s FWD P/S | 4.85 | |

| vs. current P/S (FWD) | -36.06% |

Source: Author’s calculations, based on SA data.

Palantir turned out to be overvalued by 36.06% (despite the 12% decline following the report), considering what can be bought in the market at about the same growth rate.

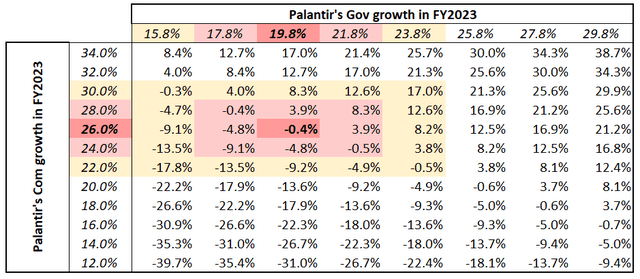

However, there is a little nuance here – my model is very sensitive to the growth rate we allow it. If we assume that the companies from the Government segment grew by 1% rather than 4.16%, then my SOTP model will indicate an 89% underestimate of PLTR. That is, every fraction of a percent has a strong meaning here, and that is a major flaw in my calculations, which I admit.

This is due to the rather large differences in the growth of companies within the Government segment. The number of companies in the sample also has a strong influence. The statistical range for 3 companies of about 9.43% with a mean of 4.16% is quite large and inefficient. So, I had a question – how can this model be improved so that it is no longer so sensitive?

The first option is to add 3-4 more companies to our sample (as in the case of the Commercial segment). I decided to add the following names that are relevant to this industry and fit the description of their business processes:

- CACI International (CACI);

- L3Harris Technologies (LHX);

- HEICO Corporation (HEI);

- Curtiss-Wright Corporation (CW).

As a result, PLTR’s undervaluation dropped from 36% to just 14.04% – more than a twofold drop. Good news for PLTR investors? Yes, but only if we assume the other companies in the sample are, on average, rightly valued.

The second option is to drop quarterly revenue growth as a benchmark, since fluctuations in 1 quarter are not representative of the quality of a long-term investment. Let us try to replace it with sales estimates for 1 year into the future (based on Seeking Alpha’s earnings estimates tables). What do we get?

13 analysts forecast Palantir’s revenue growth (total) of 23.34% in FY2023, and I expect we will see a skew in commercial revenue growth with the recent contracts – I expect that segment to grow 26% YoY. Then, taking into account the new companies that have been added to our sample, Palantir’s government revenue should grow by 19.77%, showing an average of 23.34%. And only now, under all these assumptions, do we see that PLTR is roughly fairly valued by the market at its current price:

Author’s calculations, sensitivity table of the SOTP model

So Is PLTR Finally Fairly Valued Now?

Yes, Palantir is fairly valued if you accept my assumptions above and are willing to focus only on revenue growth. Personally, I’m not ready to look only at revenue, so for me, PLTR is far from its fair value right now.

As long-term investors, we need to clearly distinguish between a quality company and a quality stock. In the case of PLTR, we often see comparisons to mega tech stocks like Amazon (AMZN), Apple (AAPL), or Microsoft (MSFT). These are indeed companies that have proven that turning a market cap from a few hundred million into trillions with the help of rapid operational growth is possible. I do not think anyone will argue that Microsoft is not a high quality and well-growing company. But how has this correlated with stock price performance in the past? Has the stock price always tracked how fast the company’s revenue has grown? Absolutely not!

From 1999 to 2016, MSFT stock gained only 7.2%, while the company’s revenue grew almost fivefold! Over the same time period, the market’s total return (SPX) was 117.5% in case you were wondering.

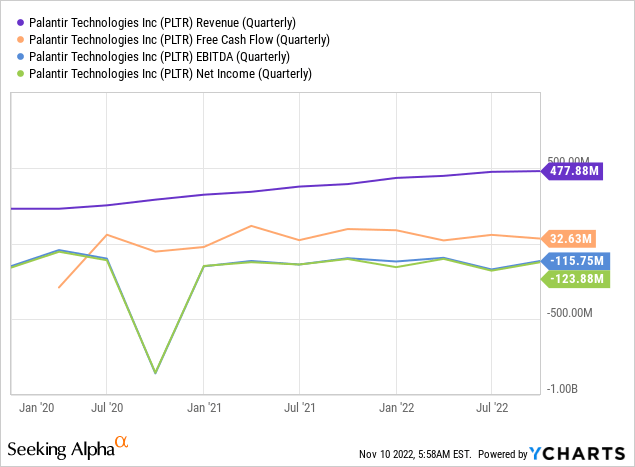

Yes, Palantir is showing a rapid reduction in share-based compensation (“SBC”) expenses, but they still represent a fairly large portion of costs (it’s like 29% of sales, albeit non-cash). This will inevitably impact the number of shares outstanding in the future.

Revenue growth is good. But it’s bad when this is the only thing your favorite company can boast about:

In the current macro situation and amid slowing business growth, I do not see the point in buying PLTR when it costs you 150x forward net earnings. It’s still just too crazy even for a young man like myself.

Therefore, I reiterate my sell rating on Palantir Technologies Inc. stock and do not recommend anyone buy it at current prices.

Thanks for reading!

![Twitter [@FundamentEdge]](https://static.seekingalpha.com/uploads/2022/11/10/49513514-1668077546346302.jpg)

Be the first to comment