ChuckSchugPhotography/iStock Unreleased via Getty Images

Introduction

One of my first series of articles on Seeking Alpha was a coverage of the agriculture, farming, and construction machinery manufacturers. For those interested in catching up with my research, I wrote about CNH Industrial (NYSE:CNHI), then about John Deere (DE), AGCO Corporation (AGCO) and Caterpillar (CAT).

I plan on keeping my research updated as this is one of the industries I have more interest in. It is now time to share some thoughts on NYSE:AGCO and CNHI as they both reported earnings that somewhat go in different directions.

Summary of previous research

When I first wrote about CNHI, I highlighted how the spinoff of Iveco Group was the right move to separate the Off-Highway machinery unit from the On-Highway unit. CNHI is not the name only for the first one. This demerger has a great impact for the company as it spun off the low margin business. Now CNHI is a more profitable company that is second only to Deere. CNHI’s revenues come for about 80% from agriculture machinery, and for the remaining 20% from construction machinery. The former is highly profitable, the latter needs to improve as it has low single digit margins. Overall, the company was the only major manufacturer in the industry to increase its margins during Q1 2022, whereas both Deere and AGCO suffered from inflationary pressure and labor cost without being able to offset it completely.

I outlined how in a market where demand was pent-up the main driver of orders and sales was availability. This is the perfect environment for companies that are trying to close the gap with the market leader. In fact, as demand increases, more competitors benefit from pricing power. When demand is low, only a well established leader with huge brand value can keep pricing up and still make high margins. In this industry, Deere is the clear leader. However, in the past months, the environment benefited more CNHI as it managed to raise margins unlike Deere and AGCO.

Just to recap some quick numbers. In the first part of this year, we saw CNHI’s operating margin reached 11%, AGCO’s was 7.6%. Surprisingly, Deere saw a major downfall in its margins with 8.8%, very low compared to its historical range between 16-20%. In any case, I rated both AGCO and CNHI as two buys, stating that I was (and still am) personally invested in CNHI as I think there is more upside. AGCO seemed to be a very interesting play as it has ample room to grow its North America business, where margins are traditionally higher and it is highly focused on precision agriculture, which will be of ever-increasing importance in the next decade. Furthermore, I like AGCO’s dividend policy that in the past years has paid a growing quarterly dividend with a low yield (0.9%) and a low payout ratio (9%) that, in the past two years, have been joined by a special dividend of more than $4.00 which brought the total yield in the very interesting range of 4-5%.

At the end of June I then wrote a second article on AGCO after it was downgraded by Morgan Stanley’s to “Equal Weight” assessing the risk of a recession. I argued that, while it may be true that we are heading into a recession that will slow down the economy, the company had its order book already covered for the whole year with orders already covering the first part of 2023. Thus, it would enter into a recession with the singular situation of benefiting from strong orders at high prices and a possible deflation in raw materials, thus making it able to post very convincing results while keeping the company busy for at least 3 quarters. I wondered whether we could see many manufacturing companies weather through a small recession without almost noticing it thanks to the pent-up demand created by supply chain constraints. This could be a theme for comments from the readers of this article. I will surely take part in the conversation with anyone who wills to share his/her thoughts.

AGCO and CNHI after 1H 2022 results

Let’s get to the new part: both AGCO and CNHI just posted their results for the quarter and for the first six months of 2022. I was particularly curious to see two main data: margins and orders.

AGCO

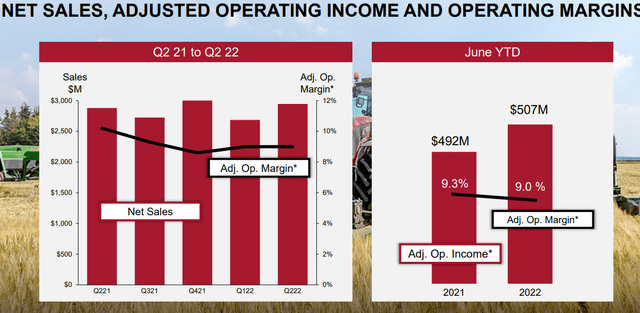

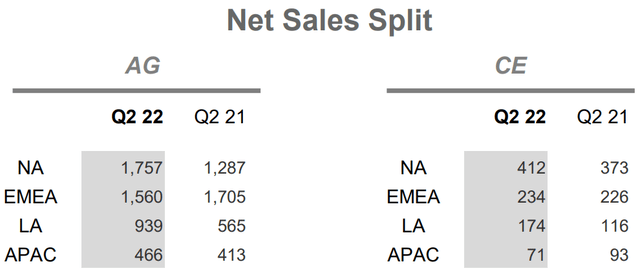

In its earnings report, AGCO reported net sales of the quarter of $2.9 billion, up 2.3% YoY. For the first six months net sales reached $5.6 billion, up 7.1% YoY. However, both gross margin and operating margin decreased, as the first one for the quarter was 23.4% (-60 bps) and the second one 8.9% (-120 bps). This led to decreasing diluted EPS: $2.37 in Q2 vs. $3.73 last year and $4.40 in the first six months vs. $5.71 last year. As we can see from the slide below, there is a slight downward trend that the company needs to address. The company also suffered from a cyberattack in May that had a negative impact on production that was down 8% compared to last year. However, AGCO expects full year production to be up 5-7% vs. 2021.

AGCO Q2 2022 Results Presentation

These results shed some shadow on one of AGCO’s strengths: the special dividend. In fact, in the first six months, the company has paid, including the special dividend, $4.92 a share, more than its EPS. Last year, the dividends paid during the first six months totaled $4.33, well covered by the EPS $5.71.

This makes me think that investors should probably expect a special dividend that should be lower than the $4.50 paid this year. However, investors should also know that AGCO currently has a very interesting free cash flow yield of 7.49% which received a B+ from Seeking Alpha’s Quant Ratings. This yield is the basis to forecast how far a company can go in paying a sustainable dividend. Depending on how the second half of the year – a period where historically revenues are higher compared to the first half – will go, I would still expect a special dividend to be paid in 2023 that could be around $4.00, which would still give a total yield of 4.6%.

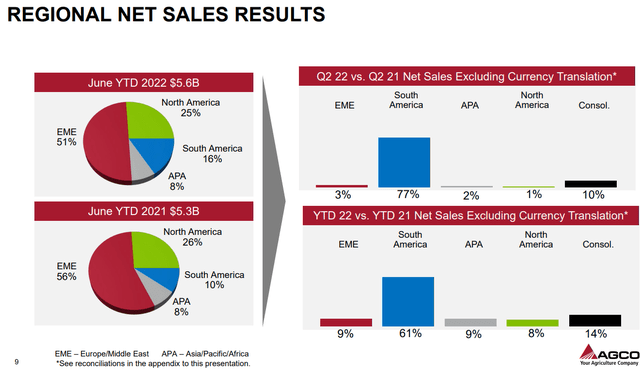

One of the main factors to watch about AGCO is how it is penetrating the North American market and what percentage of the company total sales come from here. As we can see from the regional net sales breakdown, the company reduced a bit its reliance on Europe and the Middle East, which now accounts for 51% of net sales instead of 56% last year. However, the real market that saw a huge increase is not North America, but South America.

AGCO Q2 2022 Results Presentation

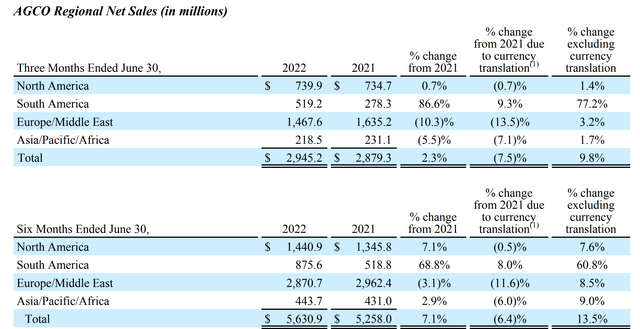

South America is really supporting AGCO as net sales increased 86.6% YoY reaching, as shown in table below, $519.2 million in Q2 vs. $278.3 million in 2021. Over the first six months, South America improved 68.8% YoY. In the meantime, North America performed better in Q1 2022 vs. Q1 2021, while in the most recent quarter the results were basically flat YoY. Factoring in inflation, the performance in North America is actually inferior compared to last year. Europe is taking a hit, too and this could be a major problem for the company as it is still heavily linked to this market.

AGCO Q2 Earnings Release

The operating margin in South America is high and for the first six months it averaged 15% vs. 7.5% in 2021. In North America it was just 7.3% vs. 13.3% in 2021, while in Europe it reached the double digits at 11.3% almost flat compared to the 11.7% in 2021.

Why do I think margins are so important for these companies? The answer is simple: margins have a direct impact on earnings. If they are low and earnings are thus eroded, the multiples the stock trades at jump up and this puts investors before the problem of accepting or not higher multiples. If the multiples go too high and are not justified anymore, the stock may see some downward pressure.

How is the company planning to focus on high margin growth? Eric Hansotia, the company’s CEO, addressed this issue by pointing out a threefold strategy he intends to take. During the earnings call he explained that the company is planning on taking the Fendt brand global. So far, the brand is strong in Europe and AGCO plans on increasing its sales in North and South America as this brand is perceived as a premium one. There are already some improvements that can be seen:

Our Fendt branded sales in the first half of 2022 have increased over 20% compared to the first half of 2021. And we expect these growth rates to improve in the second half based on our current production plan. Our Fendt and Challenger sales in north and south America are expected to double in 2022 as compared to 2020. Our ambitious target is to double them again over the next five to seven years.

The second focus to grow margins is precision agriculture. AGCO has a precision planting business, which has become one of the fastest growing ag-tech companies in the world, and a business called Fuse, which provides OEM solutions for its equipment. In other words, it provides options like telemetry guidance, field mapping, and other capabilities that make the machines smarter and more productive for the farmer.

The third high margin focus area is the global parts and service business, which, as we know, is becoming more and more valuable for every industrial company as it is a sort of subscription revenue the company can rely on.

We also have to keep in mind that the company still has a very strong order book and that it is actually accepting orders in Brazil only for the next three months, in order to control pricing and fight off inflation.

CNHI

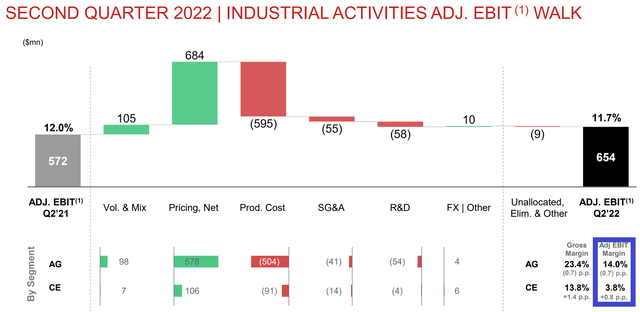

CNHI had a strong quarter. Net sales for agriculture reached $4.7 billion, a 22% increase YoY. The operating margin was $663 million, which equals to 14%. The construction unit is approaching the $1 billion revenue per quarter and totaled a $891 million, an increase of 12% YoY. The margin here is still low at 3.8%, and CNHI definitely needs to bump this up to, at least, high single digits.

Below, I wanted to share the slide that shows the EBIT walk from last year to this year. In the slide, we can also see it divided by segment: agriculture and construction. In blue, I highlighted the final margin for each segment.

What I like about this chart is that the company was able to offset completely the production cost by pricing. In fact, CNHI declared that it raised prices by 13% without damaging its order book. I think this confirms my initial hypothesis that when demand is high and supply can’t keep up with it, the second largest player in the industry has an advantage over the leader and over the other competitors. In fact, while the market leader is the player that most experiences and has demand, when this grows and the market leader can’t keep up with it in reasonable times, then it is likely that a part of this demand turns to the second player, giving it the opportunity to raise prices and catch up with the leader. AGCO, which is at the moment the third player, has not been yet able to offset completely inflationary pressure.

CNHI Q2 Results Presentation

CNHI’s sales are also more evenly balanced between Europe and North America which gives the company greater stability without exposing it as much as AGCO to the possible difficult winter the old continent may face due to the Ukraine invasion and high energy prices. As we can see below, while net sales in Europe did decrease YoY, it wasn’t only South America that helped the company make up for the loss, but North America, too, unlike for AGCO, played a major role for the company.

CNHI Q2 Results Presentation

Farmer income outlook

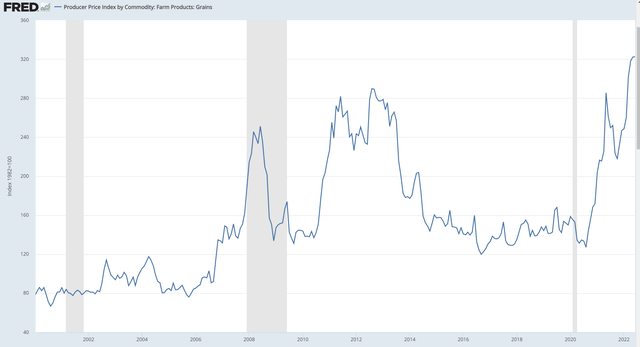

Now, both AGCO and CNHI do depend on farmer income and, more in general, on how things are going and are perceived by farmers. The Farmer Sentiment Index is at 97,2 points, pretty much where it was during the first months of the pandemic and very far from the peak of 180 a year ago.

However, although crop prices have declined a bit, they still remain high and should support the income of farmers with the advantage that these prices are high enough to offset inflationary pressure. As shown from the graph below, we are indeed in very high territory. True, in case a real recession unfolds, these prices could drop significantly. But, in case of milder recessions, such as the one in the early 2000s, this scenario may not take place. With the last jobs report showing a strong labor market, I am inclined to think that we will go through a mild GDP contraction that should not have the impact the Great Financial Crisis had. Thus, I have a positive outlook overall and I do believe the company will find a healthy economic environment for its business in the next years.

FRED St. Louis

Scott Wine, CNHI’s CEO, during the earnings call, addressed the situation with his view:

During the second quarter, farmers sentiment deteriorated as increased pressure on the cost and availability of fertilizer and other inputs met an easing of soft commodity prices. The Ag cycle nonetheless still appears to have legs as our order backlog for new equipment continues to grow.

So, at the moment, even though sentiment is down, we know that order books are full and that, actually, both AGCO and CNHI are restricting the order windows in order to consider future costs. In a certain way, both companies are playing a strategy of controlled volumes and I think this trend can continue longer than we expect, as both will see the benefit of having a little more demand than supply. Only a major economic downturn or the choice of one manufacturer to play aggressively on volumes by lowering prices could, at the moment, change this situation drastically. However, this latter option is not possible today due to the supply chain bottle necks that we know of.

Valuation

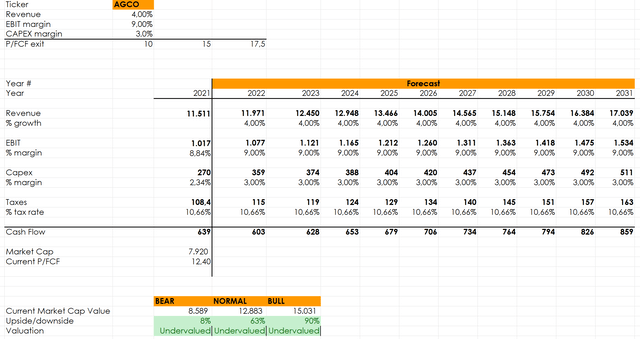

AGCO

Now, even though I have highlighted some difficulties the company is facing, the valuation remains very interesting. I have rated twice AGCO as a buy and I still rate it as such. In fact, in my discounted cash flow model by plugging in last year’s results and forecasting an overall 4% revenue growth rate that I think is reasonable in the next decade, as we will see a major shift from traditional agriculture to precision and autonomous agriculture, I have a very interesting result. I chose three possible P/FCF exit multiples and even with a 10 I get that the company is slightly undervalued. This leave me with enough margin of safety to believe there is some real upside over the long term for the company.

Author with data from Seeking Alpha

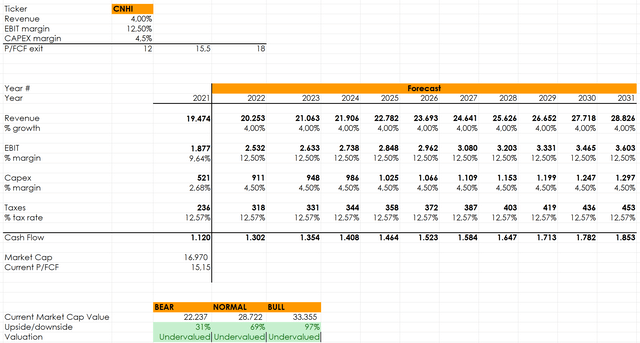

CNHI

CNHI’s discounted cash flow model gives me similar results. Even though CNHI is growing faster than AGCO, I decided to compare them giving both of them a 4% revenue growth estimate over the next decade. However, CNHI, though it has a higher capex than AGCO, has higher margins that are actually improving. This makes the company trade at slightly higher multiples than AGCO. This is why I chose a 12 P/FCF exit in case of a bear scenario, and 18 as the bull scenario multiple. As we can see, I get that CNHI has slightly more interesting upsides both in the normal and the bull scenario while it seems to provide a larger margin of safety, compared to AGCO, in case of a bear scenario. This is why, at the moment, I have a position in CNHI while I still haven’t opened one in AGCO:

Author, with data from CNHI Annual Report

Conclusion

The agriculture machinery industry may indeed suffer from cyclical swings and may take a hit in case of a recession. However, there are important mega trends that over the long term support a bull thesis on the industry as a whole. At the moment, I see both AGCO and CNHI trading at interesting valuations and I do believe both can be satisfying buys. However, I do prefer a little bit more CNHI due to its higher margins and its geographical diversification.

Be the first to comment