Khanchit Khirisutchalual

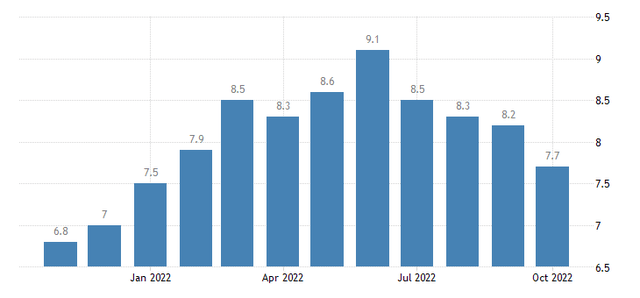

It was bullish misses across the board on the October CPI report released this morning. The year-on-year headline rate of 7.7% was less than the +7.9% economists were expecting. The month-on-month figure was just 0.4% vs. a consensus estimate of +0.6%.

At the core level, CPI was just +6.3% from a year ago while the monthly figure was higher by 0.3%. Average hourly earnings are still deeply in the red after inflation at -2.8% as workers, particularly those on the high end of the income spectrum see their wages failing to keep pace with the rise in consumer prices.

CPI Cooler Than Expected

There are now clear signs that headline CPI peaked with a 9.1% print back in June. This is what the Fed wants to see, but we still need a few more weaker inflation figures to give Chair Powell and the rest of the FOMC reason to pivot.

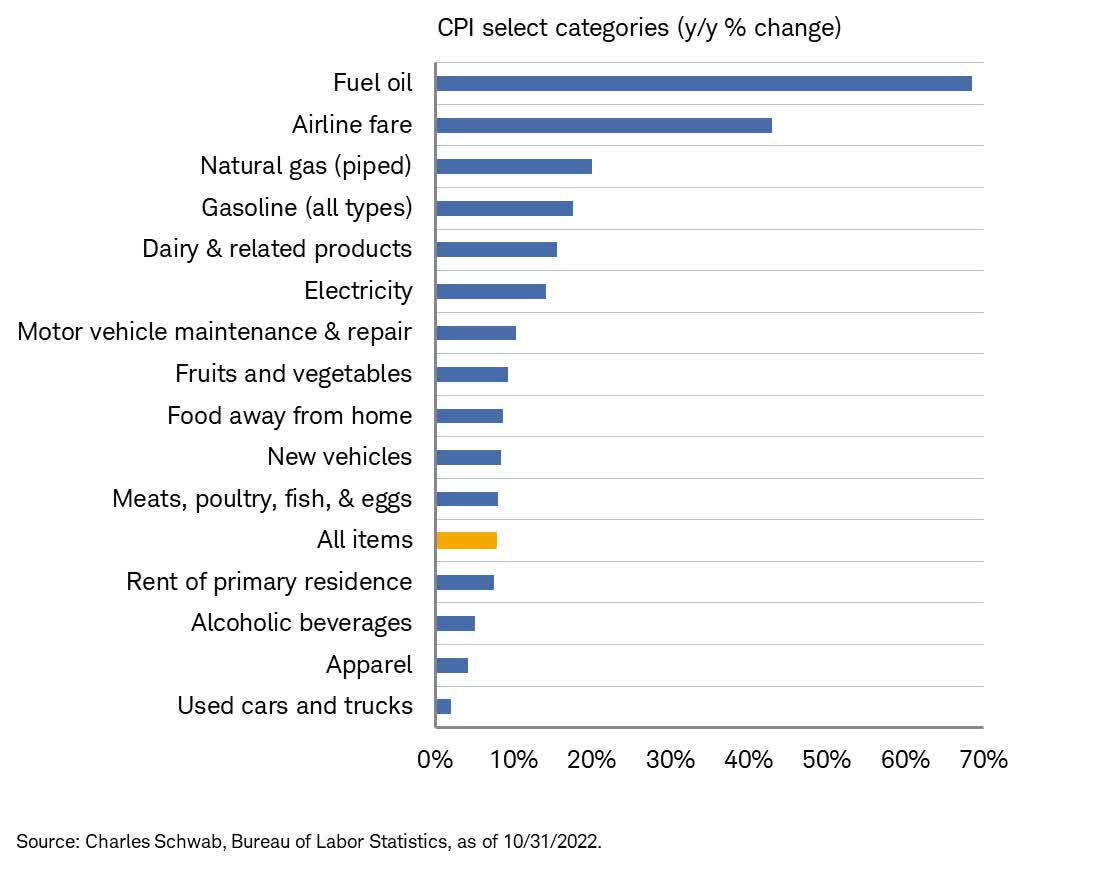

CPI By Category

Liz Ann Sonders

4 Consecutive Headline CPI Drops

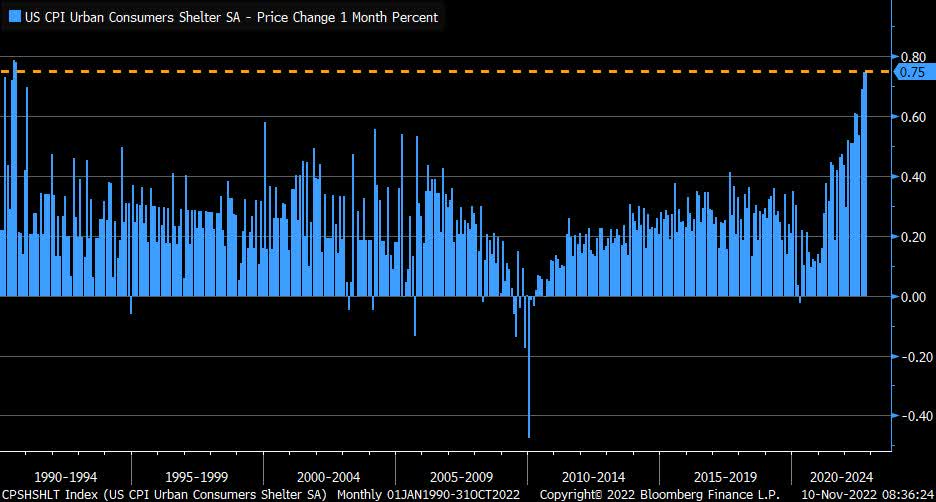

Shelter Prices, a Lagged Metric, Jump by the Highest Amount Since 1990

Liz Ann Sonders

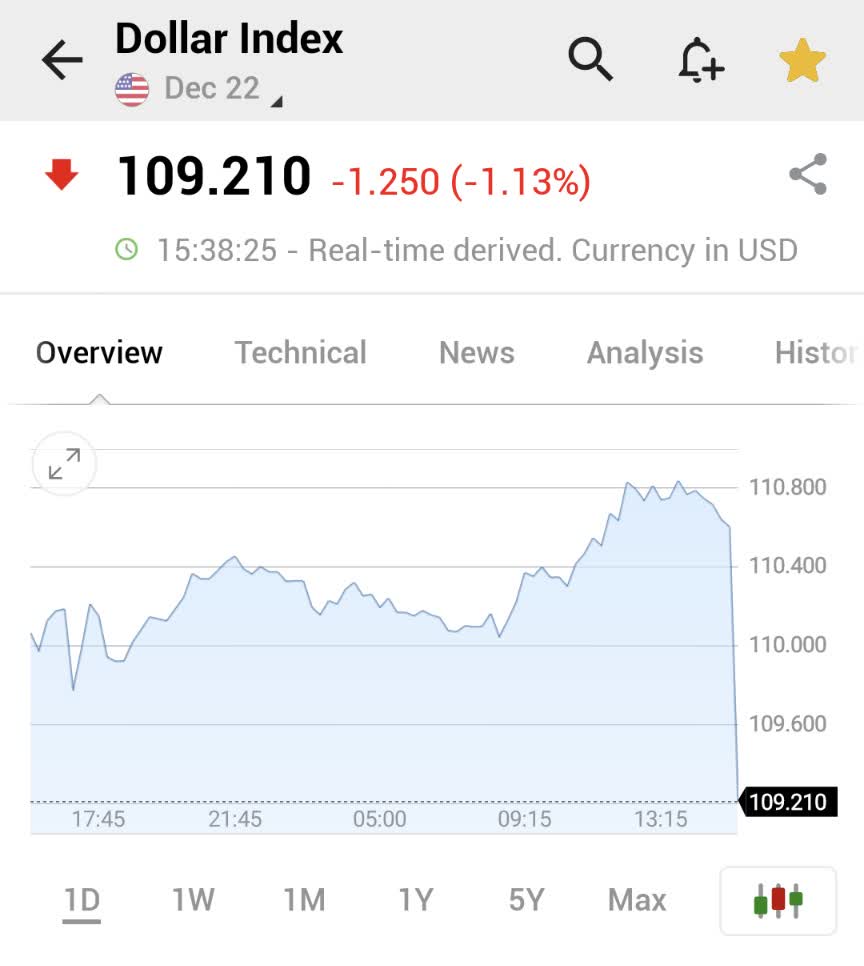

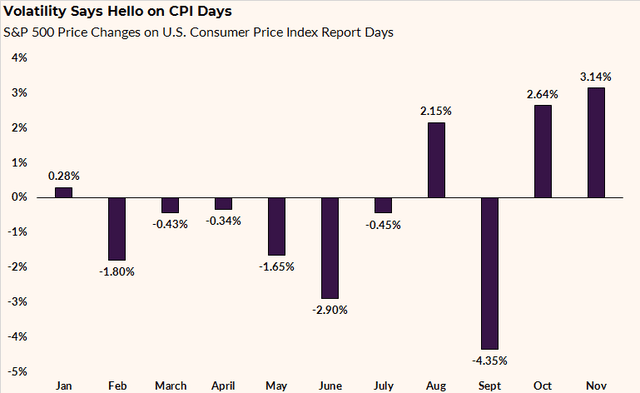

Stocks rose big immediately after the data hit the tape, and interest rates plunged. The U.S. dollar, meanwhile, also took a big leg lower as a risk-on trade ensued.

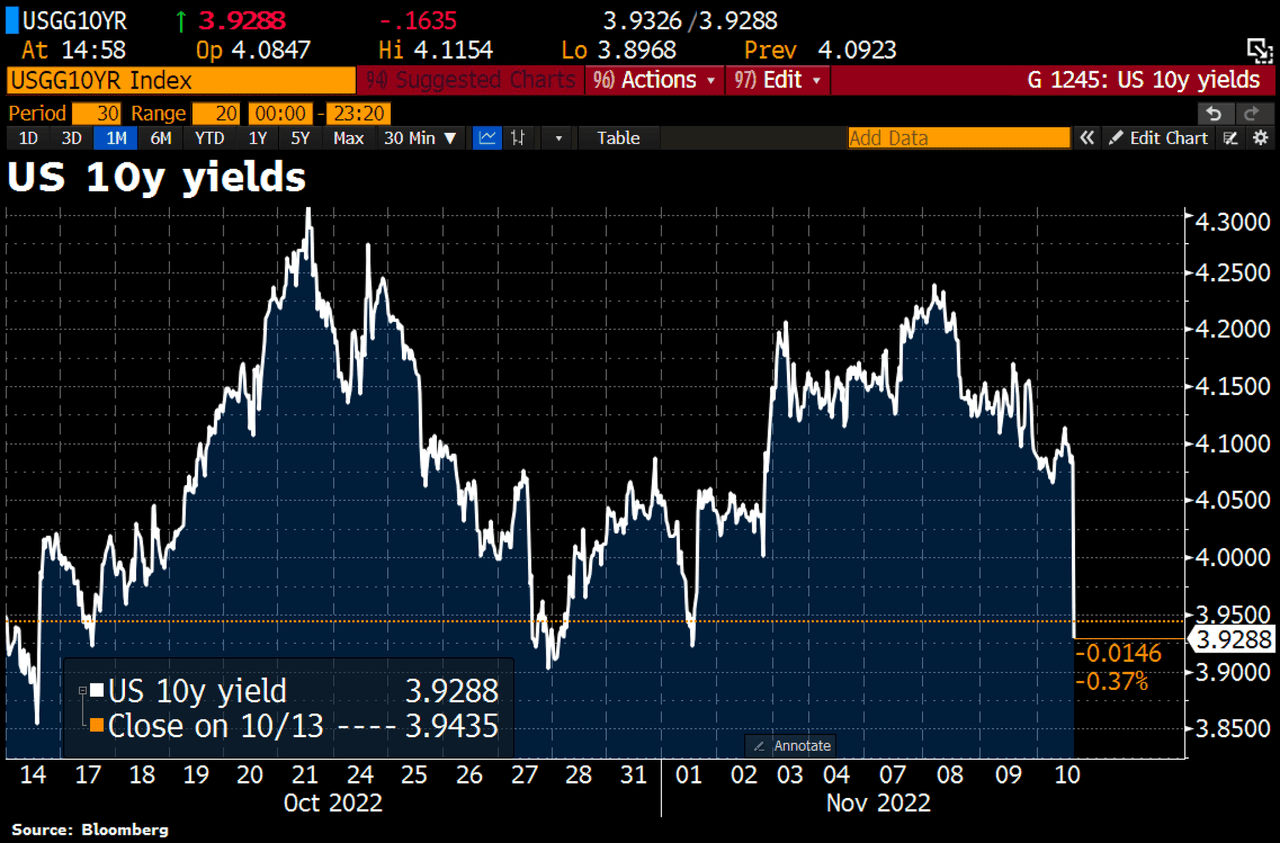

With the big upside move in equities this morning, stocks have now rallied sharply in three of the past four CPI report reactions. Perhaps the inflation scare is turning into hope and optimism. The S&P 500 rose about 3.4% while the 10-year rate dipped to 3.92%. The euro rose to near a fresh two-month high above $1.01 after 9 am EST. Bitcoin caught a bid, jumping above $17,000.

S&P 500 Rallies Post-CPI for the 3rd Time in the Last 4

10-Year Yield Plunges Post-CPI

Holger Zschaepitz

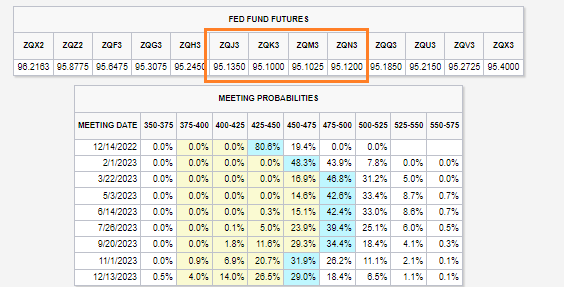

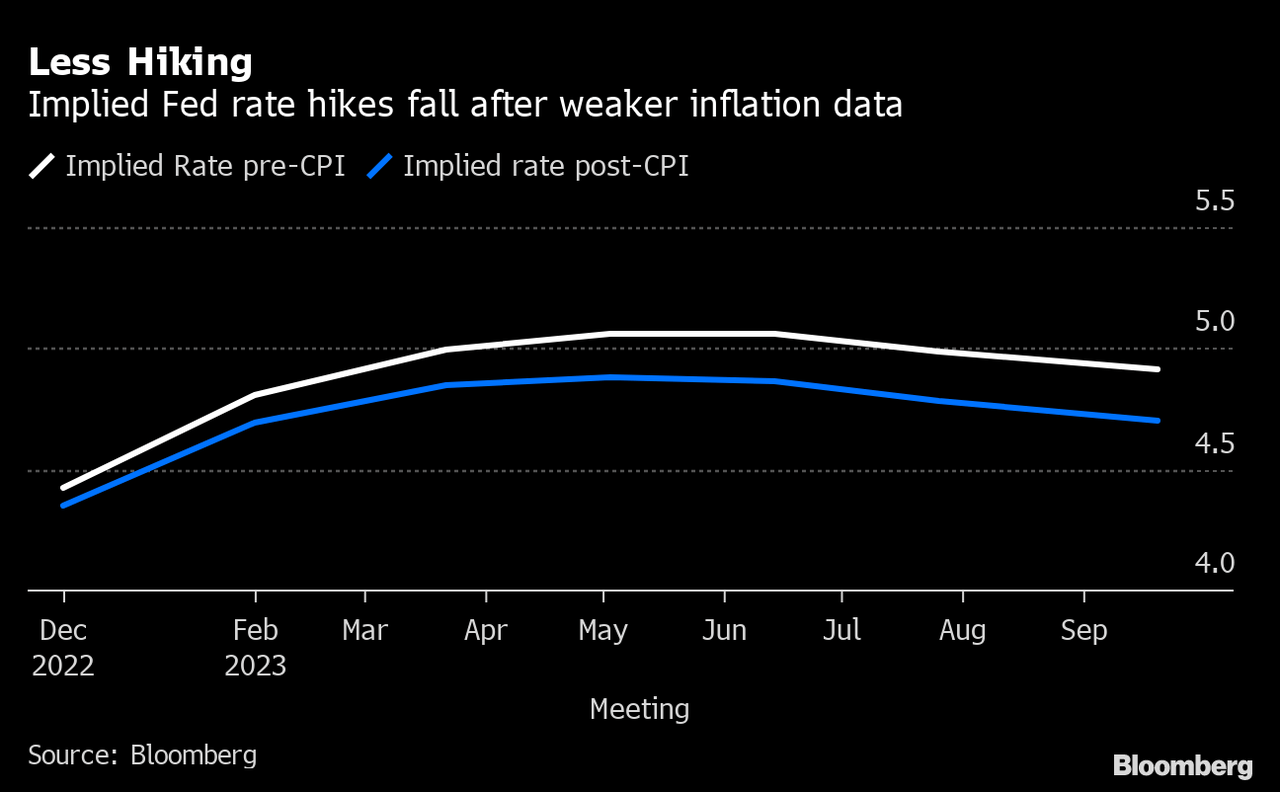

The Fed’s policy rate is now seen peaking below 5%. That’s a significant drop from a peak near 5.2% in the past week. Moreover, the chance of a 75-basis-point December hike is nearly off the table as traders discount an 80% chance of a half-point increase, halting a string of four straight major hikes. The Wall Street Journal’s Fed Whisperer, Nick Timiraos, tweeted that a 50-basis-point hike is now likely in less than five weeks.

Fed Fund Futures Drop Hard Post-CPI, Terminal Rate Seen Under 5%

CME Group

Fed Fund Futures Curve Pre- and Post-CPI

Bloomberg

Dollar Dump

Investing.com

The positive reaction – a steep rise in S&P 500 futures and a drop in Treasury yields – should help bring about a rebound in U.S. mega-cap growth stocks that have suffered greatly from surging Treasury yields in 2022.

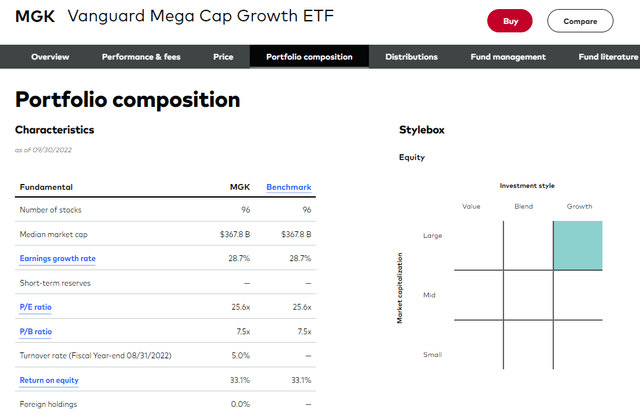

The Vanguard Mega Cap Growth ETF (NYSEARCA:MGK) tracks the performance of the CRSP US Mega Cap Growth Index, employing a passively managed, full-replication approach, according to Vanguard. The fund is a very effective way to get low-cost and liquid exposure to the large-cap growth upper-right portion of the Morningstar style box at just 0.07% in annual expenses. The 30-day median bid/ask spread is just two basis points despite the average daily volume being just 408,000, per Vanguard. You will not get much yield from MGK as it pays out 0.65%, so placing this fund in a taxable account could be a savvy move.

On valuation, MGK trades at a high 25.6 P/E ratio but features a high return on equity of 33.1%. MGK is 27% invested in Consumer Discretionary and a whopping 50% in the Information Technology sector. Apple (AAPL) is 16% of the ETF while Microsoft (MSFT) is 13%.

MGK: Expensive But High Growth, Exposed to Rate Moves

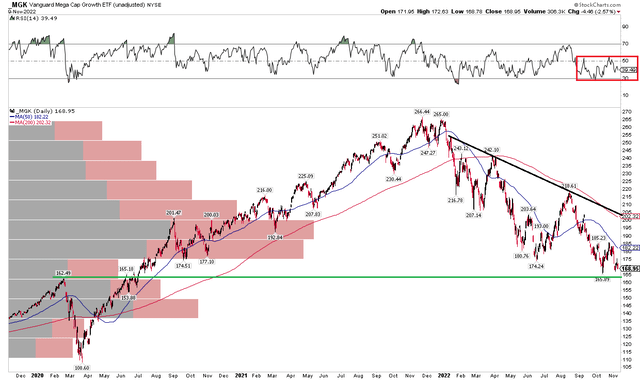

In the pre-market, MGK was indicated higher by 4% to nearly $177. I see support in the $162 to $166 range – notice that the pre-COVID high of $162 has not been breached, and there’s a decent amount of demand for shares there as measured by the volume-by-price indicator on the left. Still, the bulls have their work cut out for them. The long-term 200-day moving average is on the decline and is near a downtrend resistance line near $200. I would like to see that area get broken to the upside along with a turn higher in RSI before we can deem signs of a bottom taking hold.

MGK: Shares Holding Support, Upside Resistance

The Bottom Line

Following a much-better-than-expected CPI report Thursday morning, stocks rose sharply. Mega cap growth stands to benefit from the big tick down in Treasury rates as the niche is highly rated sensitive. MGK is a hold for now – a break below $162 would be bearish while a climb above $200 would help cement a decent low.

Be the first to comment