Bilanol

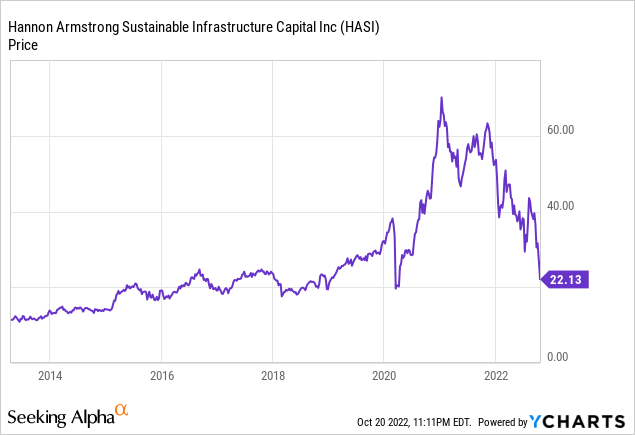

Animal spirits are an often-overlooked part of what drives short-term investment returns. These describe the instincts and emotions that influence and guide human behaviour. The current investment climate is dire as once euphoric investor sentiment just over a year ago has morphed into dread and fear with the Fed sapping liquidity in the stock market through a series of consecutive interest rate hikes. In this new investment environment, fearful animal spirits have come to dominate what was once an almost insatiable market appetite for climate economy companies like Hannon Armstrong (NYSE:HASI).

Hence, Hannon Armstrong now looks to be going through the most protracted period of decline in its history as a public company. Against this, momentum-driven bears have understandably seized on the new animal spirits to become relevant. So what does this all mean for Hannon Armstrong’s shareholders? The short-term outlook is negative with common shares likely to fall below $20. However, the longer-term outlook remains incredibly strong, likely exposing the current malaise as a generational buying opportunity for one of the foremost climate economy companies on the US stock market.

Climate Solutions Continue To Drive A Covered Dividend And Earnings Growth

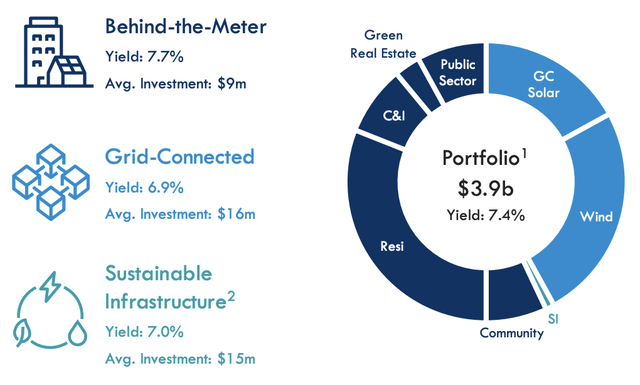

Hannon Armstrong last reported earnings for its fiscal 2022 second quarter. This saw revenue come at $62.8 million, a 6.6% year-over-year increase and a $3.62 million beat on consensus estimates. The relatively low single-digit growth came on the back of a decline in year-over-year investments made during the period to $340 million from $509 million. This still saw the company’s portfolio grow to reach $3.9 billion, a 30% increase from the year-ago quarter.

Hannon Armstrong

Distributable EPS of $0.60, was $0.10 ahead of consensus estimates and increased from $0.57 in the year-ago quarter. This came on the back of interest income of $33.4 million, a 33.6% increase from its year-ago quarter and a 10.6% sequential increase.

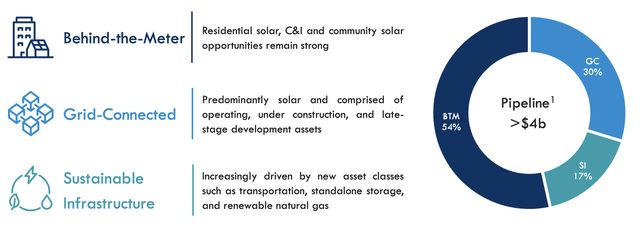

Hannon Armstrong’s pipeline grew to reach $3.9 billion with Behind-the-Meter constituting 54%, Grid-Connected at 30%, and Sustainable Infrastructure at 17%.

Hannon Armstrong

The company also received its inaugural credit rating from Moody’s of BAA3. This is investment grade and sets the background for enhanced access to cheaper credit just as the climate economy is about to experience accelerated growth through the Inflation Reduction Act. The IRA represents a step change for the industry, with $370 billion to $800 billion likely to be spent over the next decade by the US government towards solutions that bring the US closer to its emissions reduction goals. Subsidies will be provided to solar, wind, and utility-scale battery storage systems through uncapped tax credits. The government will award credits as long as a project meets the terms so there will be no upper ceiling, no budget, and no restrictions.

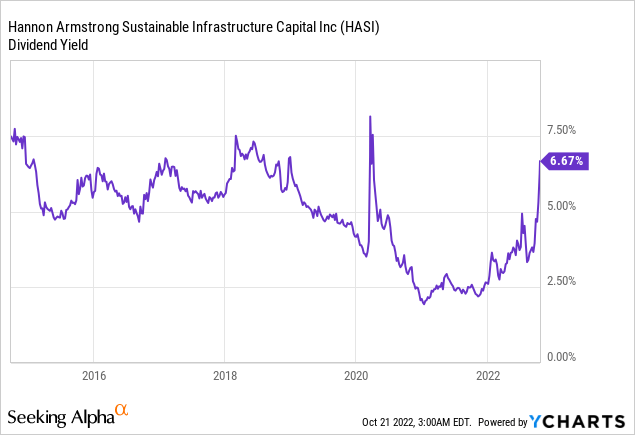

It will come to be one of the single most defining legislation for the climate economy in a generation and sets Hannon Armstrong up for years of strong growth as its total addressable market rapidly expands. At its core, the IRA intends to induce a decade of unencumbered growth for the climate economy. The current quarterly dividend of $0.375 per share was more than covered by earnings. When annualized this provides a yield of 6.8%.

The company’s dividend yield is now reaching new highs, but when looked at over a longer-term time frame it is clear that there was a level of overvaluation with Hannon Armstrong’s previous valuation. We could see this yield get driven higher in the interim, assuming the quarterly payout is constant, with continued stock market headwinds maintaining selling pressure on the stock.

Investing In Climate Solutions

Hannon Armstrong wants to generate risk-adjusted returns for its shareholders by providing capital to companies in the energy efficiency, renewable energy and sustainable infrastructure markets. To accomplish this, the company has created a diversified portfolio of investments that generate long-term, recurring and predictable cash flows. The current downward momentum is much a result of the inflation and hawkish Fed-driven collapse of the capital markets than it is reflective of broader concerns with the company’s execution.

Momentum is currently on the side of the bears and will likely remain that way for a while. Indeed, the current mantra is not to fight the Fed and the bears are reflecting exactly that. But Hannon Armstrong remains a great company and ESG darling. The current collapse is a short-term blimp in what remains an attractive long-term growth story. Animal spirits ebb and flow when viewed over time, the current ebb is to the downside. With the IRA, a covered dividend yield, and rising EPS, Hannon Armstrong will return to a strong performer in the near future. I have taken the current downturn to add to my position but there will likely be more opportunities ahead.

Be the first to comment