bancha singchai/iStock via Getty Images

Investment Thesis

Preformed Line Products Company (NASDAQ:PLPC) focuses on manufacturing systems and products employed in constructing and further maintaining ground-mounted and underground networks for various industries. The company recently announced the acquisition of Delta Conectores, which I believe can boost its growth by increasing its competitive power and dominance in the industry. The company is also experiencing strong demand from the telecommunication and energy sectors.

About PLPC

PLPC manufactures and designs products & systems used in constructing & maintaining overhead, ground-mounted, and underground networks for various industries such as information (data communication), telecommunication, energy, cable operators, and many other industries. The company’s product line includes products that support, connect, protect, terminate and secure cables & wires. It also provides solar hardware systems and mounting hardware used in various solar applications. PLPC’s customer base includes financial institutions, governmental agencies, communication companies, value-added resellers, public & private energy utilities, cable operators, and contractors & subcontractors. Its product portfolio is mainly classified into three segments: Energy Products, Communications Products, and Special Industries Products. The Energy Products are mainly used for securing, terminating, and protecting fiber communication cables & power conductors and also controlling cable dynamics. Energy products contribute 61% to the company’s total revenue. Communication Products consist of protective closures, which protect fixed-line communication networks from moisture and environmental hazards. It also includes wire products supplied to the communication industry, which helps them to support, protect, and terminate fiber optic cables and copper wires. Communication Products generate 30% of the company’s total revenue. The Special Industries Product includes fiber optic cable markers, pole line hardware, resale products, underground connectors, tree guards, cable markers, guy markers, and other urethane products. The Special Industries Product earns approximately 9% of the company’s total revenue.

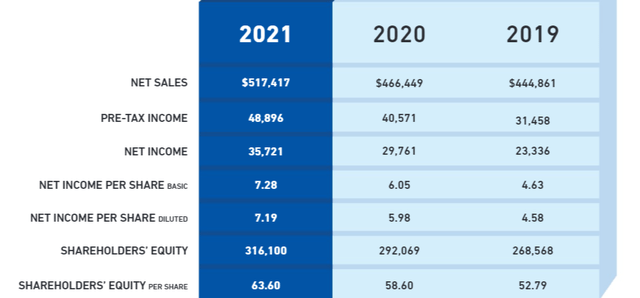

Year-wise Income Statement (Annual Report of PLPC)

Acquisition of Delta Conectores

The company operates in a highly competitive industry. After observing the competitive landscape, we can see that the company faces competition from domestic and international competitors. These competitors compete on the basis of price, performance, product offerings, and service. This intense competition is mainly due to rapid growth in the Electric power utility industry. The industry is already huge and expected to grow dramatically in this decade. Identifying this potential opportunity and observing the competitive scenario, the company has recently announced the acquisition of Delta Conectores. It is a Mexico-based company that develops and produces accessory hardware for high-voltage AC systems and substation connector systems. I believe this acquisition can act as a primary catalyst to boost the company’s growth as it expands PLPC’s current substation product offerings, which might give it a competitive edge in the market. Delta is considered a market leader in Mexico and can bring a high level of design expertise which can significantly help the company enhance its manufacturing, operational and technical capabilities. PLPC also acquired Maxxweld Conectores Electricos in the previous year, which is a designer and manufacturer of substation connector systems and accessory hardware for AC systems. I believe covering and capturing these major markets of South & North America, increasing product offerings, high levels of expertise, and increased technical & manufacturing capabilities can help the company to compete and create its dominance in the industry which might result in significant market share growth.

Financials

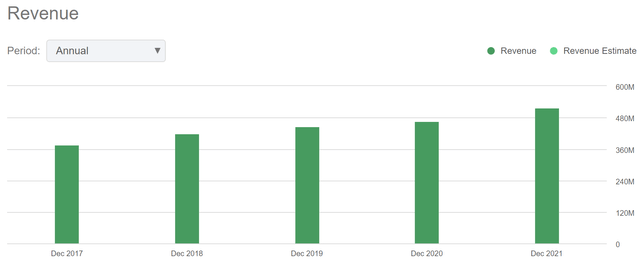

As we can see in the above chart, the company has maintained stable revenue growth in the last five years. The revenue has grown from $378.21 million in FY2017 to $517.42 million in FY2021 resulting in a solid 5-year CAGR of 6.47%. The company is experiencing strong growth in the current year. Recently, PLPC has reported solid third-quarter results. The company has reported a revenue of $165.40 million which is 22.2% YoY compared to $135.40 million. This revenue growth was mainly driven communication product portfolio. It has reported a gross margin of 35.24%, an expansion of 335 basis points compared to the third quarter of FY2021. In the third quarter, PLPC’s operating profit increased by 32.8% compared to the same period of the last year. The company’s EPS has grown from $2.15 in FY2017 to $2.36 in FY2021 resulting in 9.76% growth. This is all about the income statement. Now let’s discuss the balance sheet. The company has $30.9 million in cash & cash equivalents and $55.9 million in long-term debt. Compared to the last year’s same period, the long-term debt has increased by 39.7% YoY. The significant rising debt is driven by the multiple acquisitions in the last year.

I believe PLPC’s stable growth might continue in the coming years as the company is experiencing strong demand in the telecommunication & energy sector. The company has acquired Delta Conectores, which can help it create industry dominance. After considering all these factors, I estimate the company can achieve an EPS of $11.65 in FY2023.

What is the Main Risk Faced by PLPC?

Dependency on Energy & Telecommunication Industries

Most of PLPC’s past sales have come from the energy and telecommunications sectors. It is anticipated that these industries will continue to witness a concentration of revenue for the foreseeable future. Most of a customer’s capital expenditures for developing, renovating, maintaining, or upgrading their systems determine the demand for items in these industries. Several variables, such as general economic conditions, consumer access to financing, governmental regulation, demand for energy and cable services, energy pricing, and technological considerations, have an impact on PLPC’s sales and profitability. As a result, some clients may considerably cut back on or postpone their purchases or cease to exist altogether, which could negatively impact the PLPC’s operations, financial situation, and company.

Additionally, as the company adjusts its operations to reflect these changes and uncertainties in the company’s industries and customer demand, PLPC may incur exit-related costs and impairments of goodwill, definite and indefinite-lived intangible assets, property, fixtures, and equipment. These costs and impairments could significantly negatively impact the company’s operating results for the period in which they are incurred. The company faces an additional risk from consolidation since merged customers would rely on connections to sources other than the company. Additionally, consolidation can put more pressure on suppliers to reduce prices, such as the company. If the demand from energy & telecommunication industries drops, it can affect the financials of the PLPC in the coming years.

Valuation

PLPC has recently announced the acquisition of Delta Conectores, which I believe can boost the company’s growth by increasing overall competitiveness and industry dominance in the rapidly growing market. After considering all the above factors, I am estimating EPS of $11.65 for FY2023, giving the forward P/E ratio of 7.15x. After comparing the forward P/E ratio of 7.15x with the sector median of 12.53x, I think the company is undervalued. I believe the company might gain significant momentum and trade at the sector median due to the strong demand in the energy & telecommunication industries. After considering all these factors, I estimate the company might trade at a P/E ratio of 12.53x, giving the target price of $146, which is a 75.37% upside compared to the current share price of $83.25.

Conclusion

PLPC is a leading designer and manufacturer of products and systems used to construct underground networks of various industries. The company is heavily dependent on the energy & telecommunication industries. It has recently announced the acquisition of Delta Conectores, which I believe can drive the company’s growth by increasing its competitiveness. Also, this acquisition can increase PLPC’s dominance in the industry by capturing significant areas in North America. After comparing the forward P/E ratio of 7.15x with the sector median of 12.53x, I think the company is undervalued. After considering all the above factors, I assign a buy rating for PLPC.

Be the first to comment