imaginima

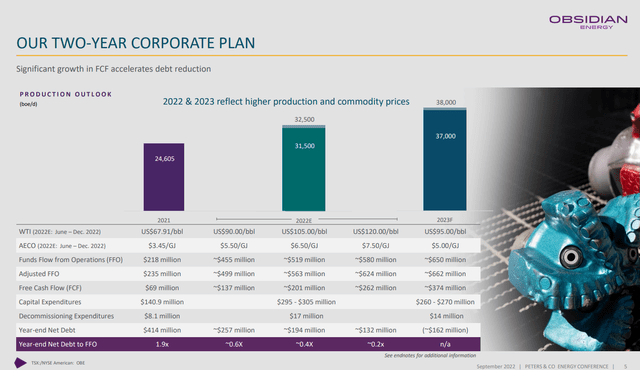

Burdened by excess debt, Obsidian Energy Ltd. (NYSE:OBE) has been in the doghouse for quite a while, although the shares have made a comeback in 2022 as the company steadily improves operating metrics and its balance sheet. Management sees 2022 cash flow of ~CAD$500 million based on US$90 WTI and AECO natural gas price of CAD$6.50 per gigajoule. Those projections are not far off my own estimates for 2022 as a whole even with softness in both commodity prices over the summer. For 2023, management sees improvements in cash flow and a cash balance by year end after a CAD$260-270 million capital budget with production rising to the 37,000 Boe/day range from about 31,500 for 2022.

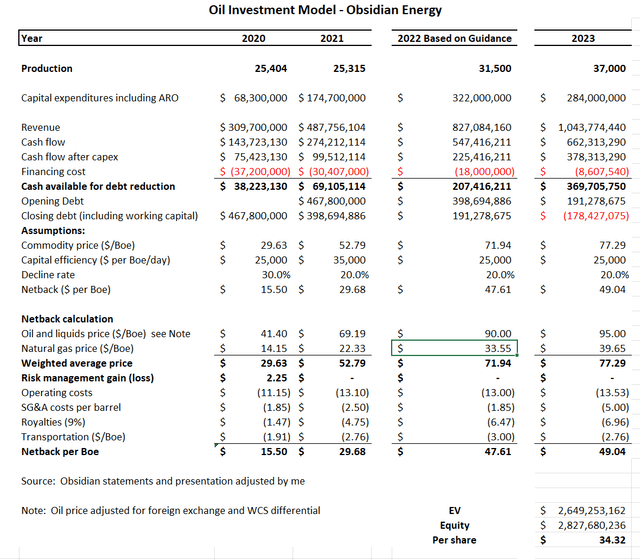

I have modeled Obsidian’s operations based on its published guidance adjusted for foreign exchange and WCS discount and see operations not only becoming debt-free by year end 2023, but also turning in cash flow modestly ahead of Obsidian’s guidance.

OBE Model (OBE website, Blair analysis)

Actual results will vary based on commodity prices realized and Obsidian’s ability to offset cost inflation. While commodity prices remain the largest risk, the heavy lifting done in the past few years positions Obsidian as a lower risk entity with a clean balance sheet, excellent operating economics and the prospect of a bright future. Using a valuation multiple of 4 X EBITDA I see OBE shares as worth about CAD$34 in 2023 versus a current price of just over CAD$11 a share. I think that OBE stock (like many Canadian E&P stocks) is significantly undervalued and is now worth holding.

I expect energy names to be re-rated upwards by markets in 2023 as it becomes clear that they have lowered risk by cleaning up balance sheets, have developed a disciplined approach to production, and are focusing on returns to shareholders rather than bragging rights at the Petroleum Club in Calgary.

The recent OPEC decision to cut output by 2 million barrels a day is a tailwind, but the prospect of higher rates and recession risks remain daunting and both energy commodity prices and trading prices of energy stocks can take a serious hit if a deep recession emerges. Having said that, little has been done that will add to oil & gas supplies and the recovery post-recession will face a prolonged shortage of fossil fuels making energy sector one of the most likely to lead a recovery.

I don’t hold OBE today but expect to add shares over the coming weeks.

Be the first to comment