Maartje van Caspel/E+ via Getty Images

The job report on October 7 will be a big one for markets, as it will be the last report before the November 2 FOMC meeting. It will also be a critical report because following the weaker-than-expected ISM manufacturing data, the market started to float the idea of another potential Fed pivot coming. If strong, the job report could once again crush that idea.

Given the forecast of 260,000 new jobs in September and an unemployment rate of 3.7%, there is a solid chance the data comes in hotter than expected. That would come as a big shock to equity markets.

ISM Data Points To Rebounding Job Market

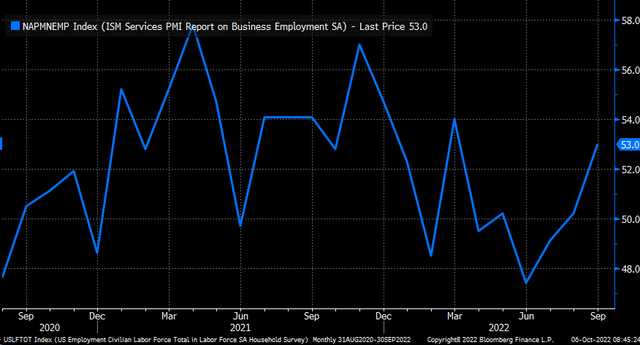

The ISM services data on October 5 showed a solid improvement in services hiring in September and is in a three-month uptrend. The index increased to 53 in September from 50.2 in August and 47.4 in June, a steady improvement.

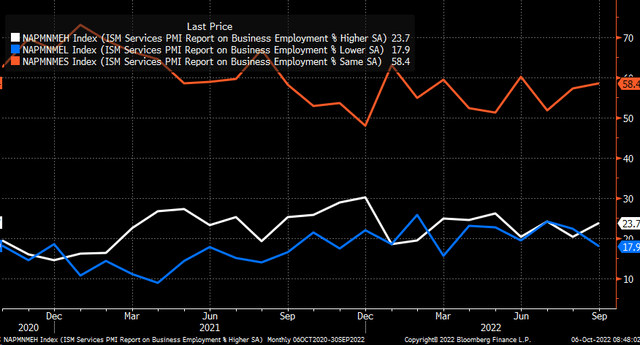

Additionally, the survey showed that 23.7% of the firms hired more workers, 17.9% hired fewer, and 58.4% hired the same-an improvement in the overall hiring trends in September for the services sector and an improvement versus August.

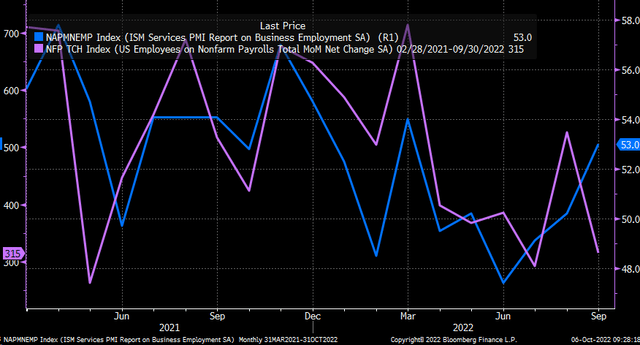

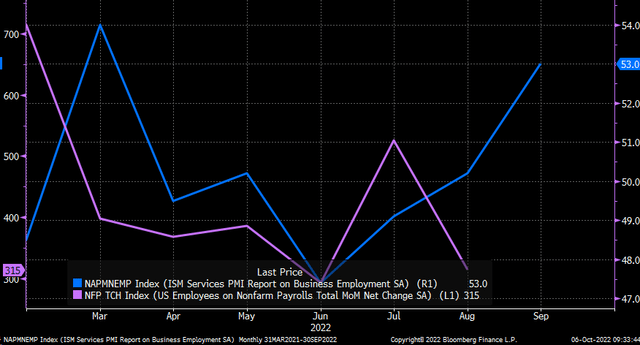

Historically, the ISM employment survey has a solid relationship with changes in the non-farm payroll report. The timing of ISM service data is not perfect, but it tends to lead the BLS jobs data by around one month. While the services index doesn’t tell us the amount of the BLS job report’s potential gains or losses, it can tell us if the BLS job report is likely to be higher or lower than the previous month.

Again, this is not perfect, and there are some outliers. But generally speaking, when the ISM services data increases versus the previous month, the vast majority of the time, non-farm payroll rises, and vice versa.

However, more recently, there has been a bit of a shift, with no monthly lag. Given that over the past three months, the ISM employment index has risen, it’s putting good odds on the BLS data coming higher than last month’s reading of 315,000.

It would be a massive beat and unexpected if that were to happen. It would kill the dovish pivot hopes and cause the market to think about the potential for the Fed funds rate needing to go higher than 4.6%.

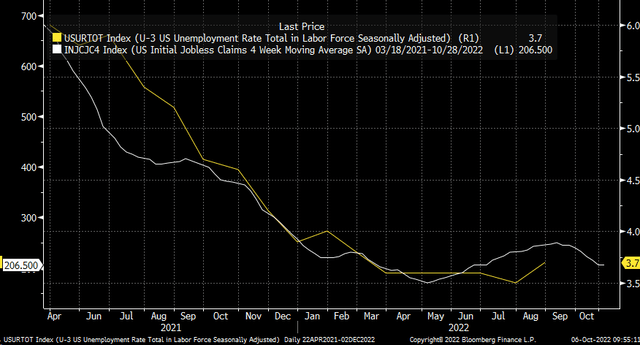

Jobless Claims

Additionally, we have seen the four-week average of initial jobless claims fall since peaking at the end of July. Historically, the unemployment rate tends to follow this trend, with the four-week average having about a 35-day lead time, and given that claims peak in July, it seems possible that the unemployment rate may fall in September and come in below the 3.7% forecast.

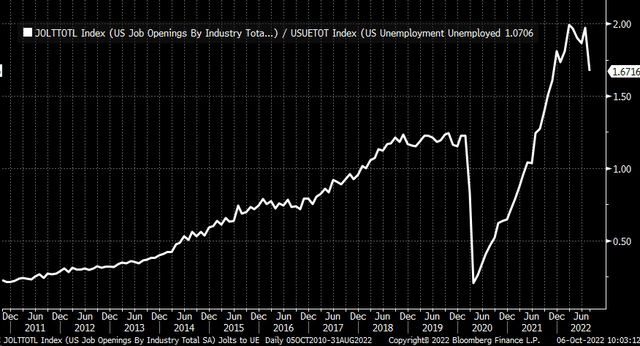

Again, the Fed has been looking for the unemployment rate to rise to cool the pace of inflation and that higher wage pressure would ease. The market thought this might be happening, given the JOLTS data the other day, which measures the number of job openings. The JOLTS data fell to roughly 10 million openings from around 11 million last month. It could be a very early sign that perhaps some of those tight labor conditions are starting to ease. But at the same time, there are still 1.7 times more job openings than the number of unemployed people. That number had been steady, around 1.2 through 2018 and the beginning of 2020.

Based on the number of unemployed workers in August, of 6.04 million, the number of Job openings would need to fall to around 7.2 million from its current 10.0 million. That would suggest the Fed still has a lot more work to do to lower those job openings in line with pre-pandemic levels.

Whether tomorrow’s data is good or bad, the Fed still has a lot of work to do. It will only tell us if the Fed is heading in the right direction. However, many recent data points suggest the job market is still very healthy and has shown few if any, signs of slowing down. If the BLS report shows something similar, it will kill, yet again, any hopes for another dovish pivot by the Fed, and the market would probably give back much of this week’s gains pretty quickly.

Be the first to comment