Sundry Photography

Beyond Meat’s (NASDAQ:BYND) management expected to return to strong growth in 2022 after a poor 2021, but this growth has not eventuated. The company now has a high cost basis and must now grow into these costs and / or cut costs, or likely risks running out of cash. Nationwide rollouts with QSRs would be the most viable growth option, but it is not clear if this will eventuate. If the company can reinvigorate growth, greater scale along with a normalization of supply chains will significantly improve margins, providing potential upside for the stock.

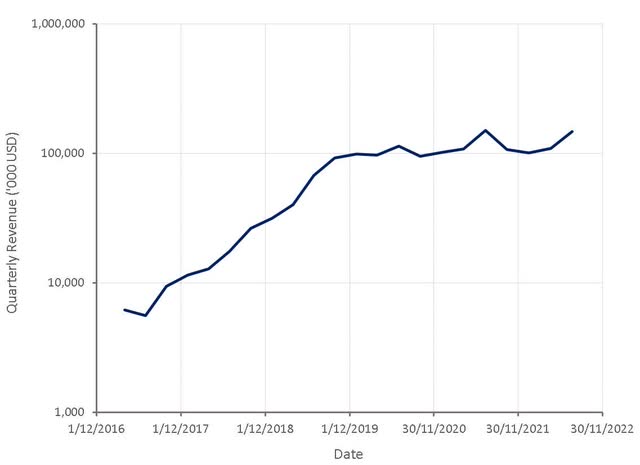

Figure 1: Beyond Meat Revenue (source: Created by author using data from Beyond Meat)

Competition

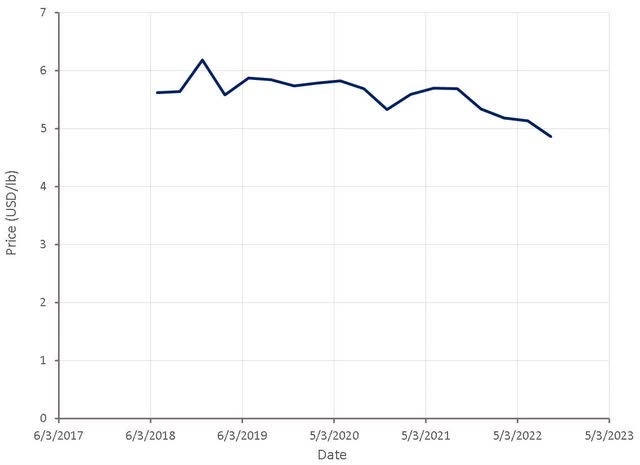

Retail competition in the US intensified in 2021, with new entrants attempting to gain market share through pricing. After strong growth in 2020, the size of the plant-based meat category did not increase in 2021, intensifying competition.

Beyond Meat continue to believe that their products are differentiated by quality and the ingredients they use (no soy, non-GMO). It is not clear that this is the case though, as Beyond Meat is losing market share, despite being forced to reduce prices. Data still shows that Beyond Meat is one of the category leaders, but it now appears likely that most products will end up being viewed as commodities by customers.

Figure 2: Beyond Meat Revenue per Pound of Product Sold (source: Created by author using data from Beyond Meat)

Product Innovation

Beyond Meat’s lack of product innovation, while R&D expenses have remained relatively high, is one of the most disappointing aspects of the company. Considering the breadth of the market opportunity, Beyond Meat’s product portfolio has remained overly focused on ground beef type products. This may be a case of other types of meat (pork, chicken, lamb, etc.) and non-processed meats being difficult to adequately mimic. Even where new products have been introduced, it is not clear that they have been able to drive significant sales growth.

Beyond Meat introduced chicken tenders derived from faba beans in 2021, although have been working on chicken products for a number of years. Beyond Meat also introduced jerky (Original, Hot & Spicy and Teriyaki) in 2022 through their JV with PepsiCo (PEP). This was a nationwide launch into 56,000 stores, which expanded to 80,000 stores in the first few months, and hence had high expectations. The product has not lived up to expectations though and this was one of the reasons that Beyond Meat lowered their full year guidance.

Beyond Meat Jerky has been a large margin headwind (5-10%) as Beyond Meat has been relying on expensive third-party manufacturing to rapidly scale-up production. Beyond Meat is currently consolidating operations with a manufacturing that utilizes more automated equipment, which is expected to lower manufacturing and transportation costs. This capacity was expected to come online in the third quarter of 2022. Beyond Meat also recently secured lower pricing for mung bean protein, which should help to alleviate cost pressures.

Beyond Meat is also developing steak slices, but it is unknown when a product will be widely distributed. Simulating the texture of unprocessed meat is crucial to expanding the addressable market of plant-based meats, making the success of this product important.

New product launches are generally a margin headwind as Beyond Meat utilizes higher-cost co-manufacturing partners, with lower throughput levels and other supply chain inefficiencies.

COGS

Beyond Meat’s gross margins have deteriorated significantly over the past 12 months due to a combination of rising costs and lower prices.

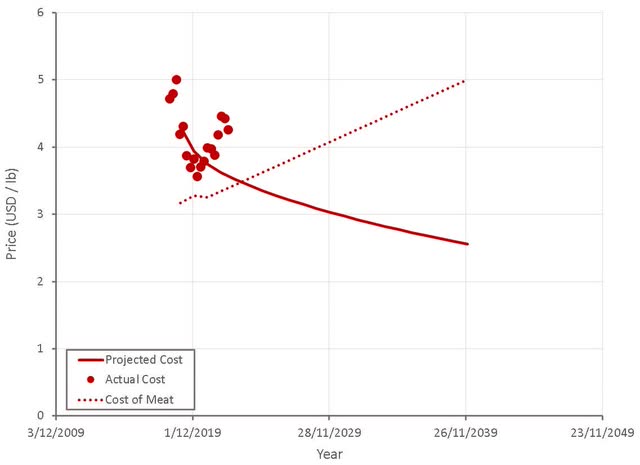

Figure 3: Beyond Meat COGS per Pound (source: Created by author using data from Beyond Meat)

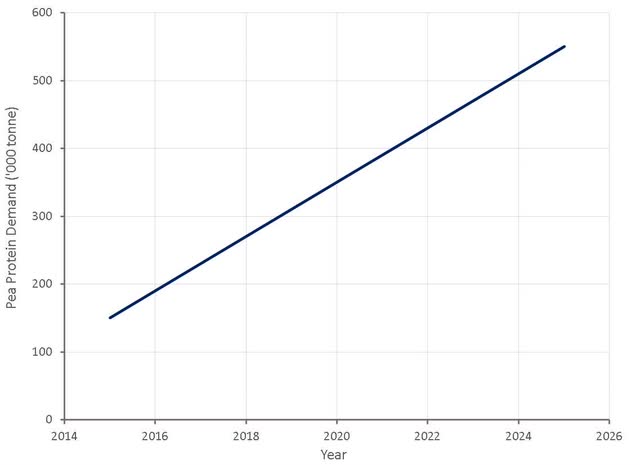

Protein from the yellow pea is one of the main ingredients in plant-based meats. The rapid expansion of the category has pressured supply and there is a lack of processing capacity to produce the protein powder extracted from the legume. Yellow pea prices surged by over 100% YoY in early 2021, contributing to Beyond Meat’s problems. Soya is the most abundant and lowest cost source of plant-based protein, but it is an allergen, is high in plant estrogen and is often genetically modified, leading to health concerns amongst some consumers.

Figure 4: Pea Protein Demand (source: Created by author using data from The Financial Times)

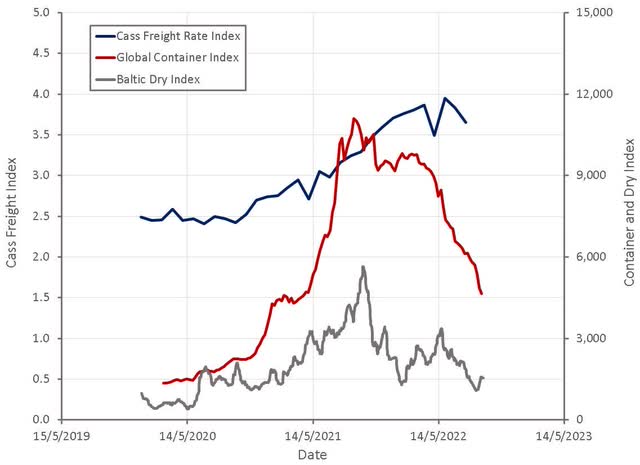

Supply chain issues are likely pressuring Beyond Meat in a number of areas, with management specifically calling out packaging, warehousing and transportation. Some of these issues are likely to resolve themselves over the next 6 months, but Beyond Meat’s problems go beyond just supply chain bottlenecks.

Figure 5: Illustrative Freight Indices (source: Created by author using data from Cass, Freightos and tradingeconomics)

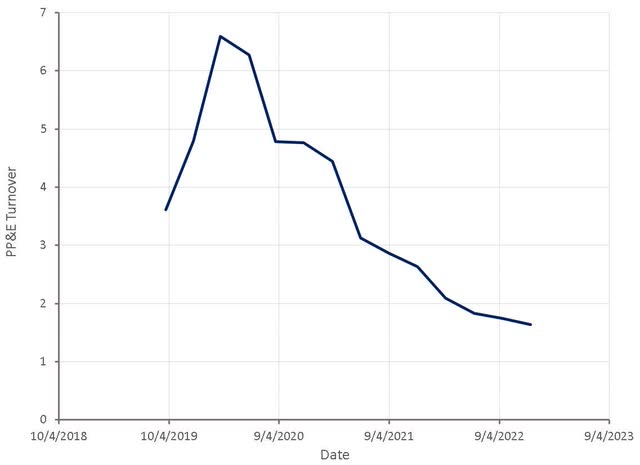

Beyond Meat has invested heavily with the expectation of new product launches and wider distribution through QSR partners. These investments include manufacturing facilities in China and the Netherlands. While greater scale and insourcing manufacturing should lower production costs, Beyond Meat has been left in the unenviable position of demand not meeting expectations, resulting in poor capacity utilization and higher costs. This can be seen from the revenue generated from Beyond Meat’s property, plant and equipment. While not all the increase in PP&E in recent years has been related to manufacturing, Beyond Meat is clearly not generating the revenue they expected when these investments were made.

Figure 6: Beyond Meat PP&E Turnover (source: Created by author using data from Beyond Meat)

Beyond Meat are engaging in initiatives to reduce costs, including:

- Procurement of raw ingredients

- Waste reduction

- Improved throughput

- Insourcing

- Improved logistics

- Packaging optimization

The timeline for these initiatives to begin benefitting the company’s financial statements is not clear though, and there is the risk that further price competition will offset COGS reductions.

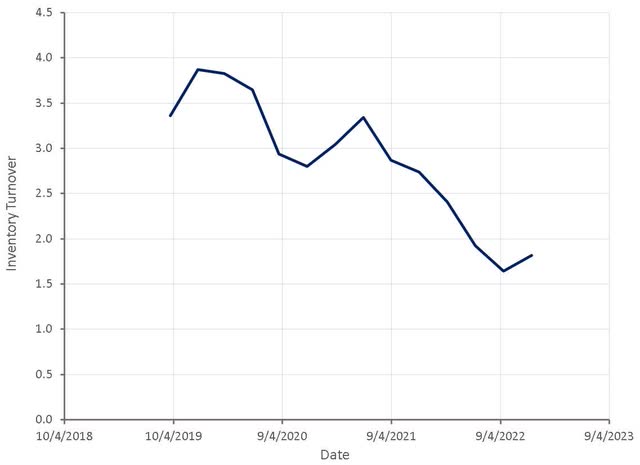

Inventory

Beyond Meat has also faced massive inventory issues over the past few years as demand has waxed and waned, and shifted between channels, which has caused increased costs due to warehousing, repackaging and write-offs. These problems should largely be in the rearview mirror, but Beyond Meat still has far more inventory than it should relative to sales. While this inventory could help Beyond Meat to conserve cash in coming quarters, there is also the risk that some of this inventory will be written-off, or liquidated at greatly reduced prices.

Figure 7: Beyond Meat Inventory Turnover (source: Created by author using data from Beyond Meat)

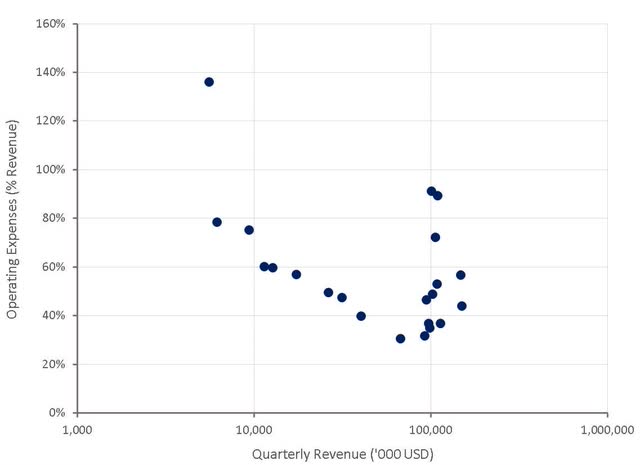

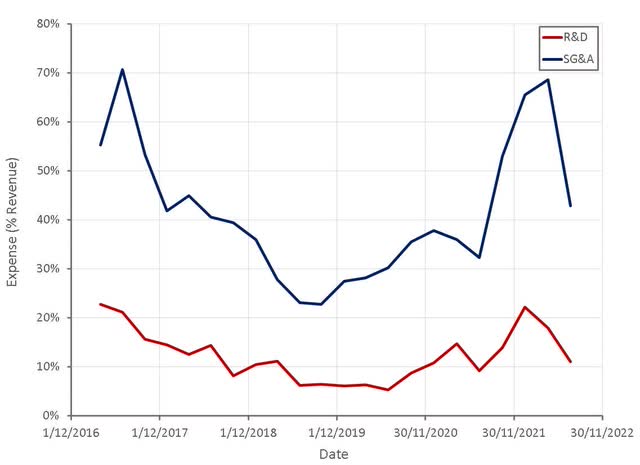

Operating Expenses

Beyond Meat’s problems extend beyond just their supply chain and manufacturing operations. The company’s operating expenses have continued to grow, despite revenue growth stalling. Even if Beyond Meat can get their COGS under control, the company will have to grow substantially, or greatly reduce operating expenses, before they can become profitable.

Figure 8: Beyond Meat Operating Expenses (source: Created by author using data from Beyond Meat)

Much of the increase in operating expenses falls under SG&A, although it is not really clear what the primary expenses are or how easily they can be cut.

Figure 9: Beyond Meat Operating Expenses (source: Created by author using data from Beyond Meat)

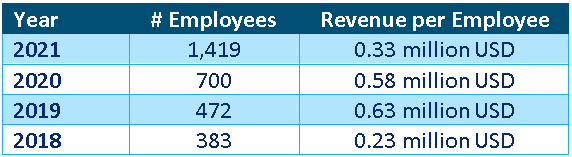

It seems likely that a large portion of the increase in operating expenses is related to employees, as Beyond Meat’s increase in headcount has greatly exceeded revenue growth in recent years. Despite recently laying off approximately 4% of their workforce, Beyond Meat’s CEO appears to be reluctant to cut headcount. This has been framed as a decision to position the company for growth when the macro environment improves.

Table 1: Beyond Meat Number of Employees (source: Created by author using data from Beyond Meat)

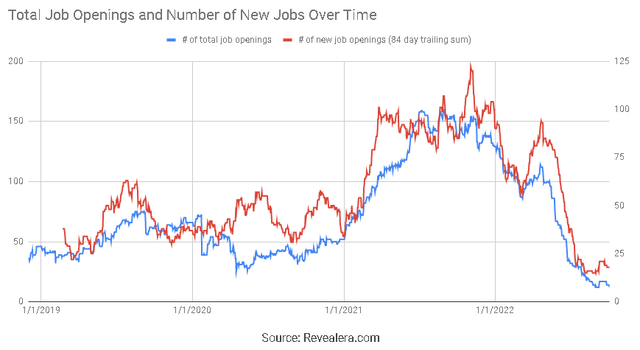

Hiring has slowed to a crawl, which at least indicates that operating expenses should not grow significantly from current levels.

Figure 10: Beyond Meat Hiring Trend (source: Revealera.com)

Distribution

Much of Beyond Meat’s current problems appear to stem from an inability to secure the distribution and hence sales that were hoped for.

Retail distribution has been increasing slowly, with gains internationally in countries like Canada, Germany, Australia, Austria and the UK. Within the US, Beyond Meat has continued to expand through retailers like Rite Aid (RAD), Albertsons (ACI), CVS (CVS), select Costco (COST) regions, Jewel-Osco, Kroger (KR), Shoprite, Sprouts, Target (TGT), Walmart (WMT) and Whole Foods Markets. These gains have been offset by a decline in velocity though, either due to consumers trading down as the result of inflationary pressures or competition.

Beyond Meat has also had some headwinds in the foodservice channel as some businesses have faced labor challenges. The bigger problem has been the failure to achieve widespread rollouts through their QSR partners. Beyond Meat had expected tests with companies like McDonald’s (MCD) and Yum! Brands (YUM) in 2021 to result in significant revenue growth in 2022, which has not occurred.

Over the past few years Beyond Meat has trialed a range of products, in a number of geographies, with QSRs like:

- McDonald’s

- Dunkin Donuts

- Pizza Hut

- KFC

- Panda Express

- A&W

Some of these trials have resulted in wider distribution, while the status of others is not clear. In some cases, Beyond Meat’s products have been dropped as partners rationalize their menus, like Dunkin Donuts. Management has been reluctant to comment in most cases, citing a desire to respect the privacy of partners. In the past, Beyond Meat’s products generally displayed a fairly impressive ability to drive incremental foot traffic to QSRs. As the novelty of plant-based meat wears off, the company may be finding it more difficult to achieve the performance necessary for its products to be added as permanent menu items.

Executive Turnover

In addition to the obvious issues, Beyond Meat has had increased executive turnover in recent months. The Chief Supply Officer left the company to pursue other opportunities after less than a year on the job. The role was subsequently left unfilled, with responsibilities being taken on by a vice president in manufacturing operations. The COO was also recently suspended after allegedly biting someone after an altercation at a football game. The COO was a former Tyson Foods (TSN) executive who had also been with Beyond Meat for less than a year. While it is easy to read too much into these types of events, it certainly doesn’t inspire confidence in the direction of the company or their ability to hire.

Conclusion

While cash burn is likely to come down significantly next year, the company has limited runway and must find a way to cut costs and / or increase revenue. Beyond Meat needs revenue growth to resolve their cost issues, but it is not clear where this growth will come from. Consumers are likely to continue facing inflationary pressures, which may keep them away from the plant-based meat category. Nationwide rollouts with QSRs like McDonald’s would be the most viable option, but it is not clear this is coming. Beyond Meat’s reluctance to cut headcount could be viewed optimistically as confidence that wider distribution is coming, but it is also possible that the CEO is just not ruthless enough.

Be the first to comment