Dilok Klaisataporn

The Vanguard High Dividend Yield ETF (NYSEARCA:VYM) has a well-earned reputation as a solid core holding for conservative exposure to the stock market with an ultra-low expense ratio and high liquidity typical of Vanguard ETFs. In this article, I will examine VYM’s benchmark index and yield metrics along with its recent performance to see how ideal it may or may not be for the macro environment going forward.

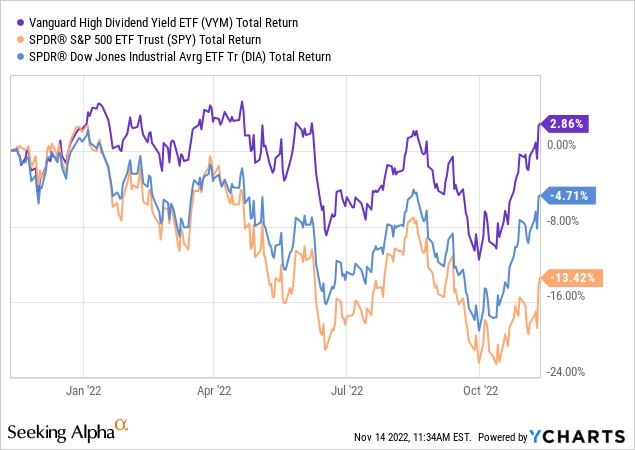

As we can see above, VYM has held up very well this year against the S&P 500 and has even outperformed the Dow. It’s no secret that I’m not going to issue a “strong sell” recommendation for what is essentially the bluest of blue-chip dividend ETFs with the lowest expense ratio. However, I think we will see that better long-term dividend-focused returns might be found elsewhere now that inflation is receding but interest rates are forecasted to remain elevated for quite some time.

What The Index Reveals

As a first step, I always like to look at the benchmark index for any ETF I’m evaluating, mostly to see if there are any unexpected surprises under the hood. Many investors tend to assume that highly diversified core ETFs all pull from the same set of stocks, and they rarely look into the methodology behind the indexes those ETFs track. Some even assume that the ETF provider itself is hand-picking stocks or creating their own index rules for each ETF, when in reality most indexes are created and administered by outside companies such as S&P Global (SPGI), FTSE Russell (a subsidiary of London Stock Exchange Group), and MSCI (MSCI) and then licensed to ETF providers like Vanguard and iShares.

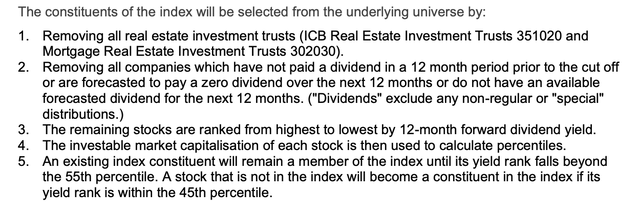

VYM tracks the FTSE All-World High Dividend Yield Index, which is comprised of a subset of the highest-yielding large and mid-cap stocks from the FTSE All-World Index. Here we can see the basic rules set by FTSE:

FTSE All-World High Dividend Yield Index Rules (FTSE Russell)

Methodologies can quickly become confusing and convoluted, but for the purposes of evaluating VYM we can extrapolate the following important points:

1) VYM is not limited to US stocks

2) It excludes small cap stocks and REITs entirely

3) It has no dividend growth requirement

4) It only requires that companies have paid a dividend over the past 12 months (to calculate current yield) and are forecasted to pay a dividend in the next 12 months (to calculate forward yield)

5) After separating out the highest-yielding stocks, it ranks and weights them based on a combination of highest yield and largest market cap.

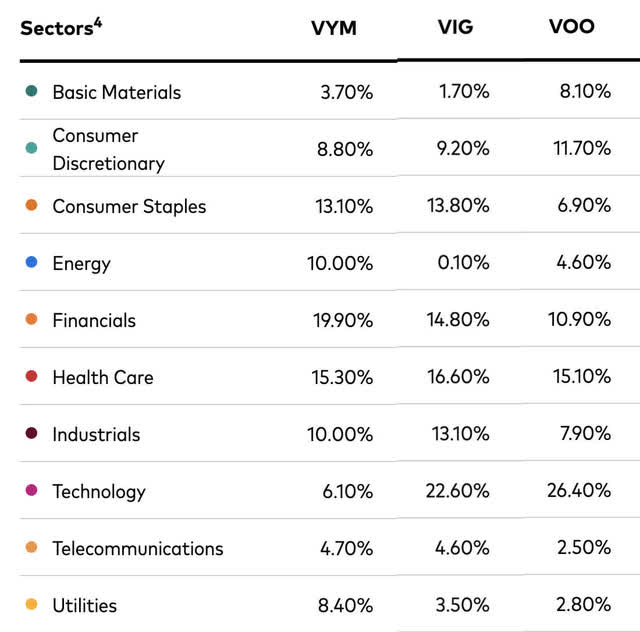

As we can see from its sector weightings below, VYM is fairly defensive with significant exposure to financials, consumer staples, and health care, and very little exposure to tech stocks. However, perhaps its most notable differences Vanguard’s dividend growth (VIG) and S&P 500 (VOO) alternatives are VYM’s much higher exposure to energy, utility, and basic materials stocks, which can be expected when an index prioritises yield and removes dividend growth from the equation.

While I like the additional utilities exposure as I see the sector as slightly undervalued now, energy and materials could come under pressure as inflation recedes and commodity prices normalise. Gas and oil producers have been operating at historically high levels to capitalise on high prices and to help alleviate Europe’s energy shortage due to Russia, but this might lead to a supply glut and rapid price drops should the Ukraine war end sooner than expected. Although combined they comprise less than 15% of VYM’s holdings, I worry that this energy and materials exposure could be a drag on VYM’s returns if we see a sustained market recovery.

Lastly we should consider the index’s and VYM’s diversification. Currently holding 443 stocks with a top weighting of around 3%, VYM is highly diversified to the point that any one individual component is not going to have a major influence on the ETF’s overall performance. This diversification along with the size and value tilt inherent in its index methodology above help to keep VYM’s volatility relative to the overall market quite low at 0.85 beta over the past 5 years. It also makes analysing VYM a bit simpler, since we are mainly investing in the movement of an index and don’t need to worry as much about the prospects of its top few holdings, unlike the Dow Jones (DIA) where the top 10 holdings make up over 50% of the index, or even the S&P 500 (SPY) whose top 5 holdings make up nearly 20%, whereas VYM’s top 10 holdings only make up ~23% of its index.

Dividend Analysis

Similar to my recent analysis of DGRO, now let’s look at the most important part of a dividend ETF: the dividends! At a 2.92% yield, Critics will rightly point out that VYM’s yield is on the low side for a “high dividend yield” ETF, although this is largely due to the incredible outperformance of energy stocks since the COVID crash in 2020, which have likewise helped VYM to outperform the market this year.

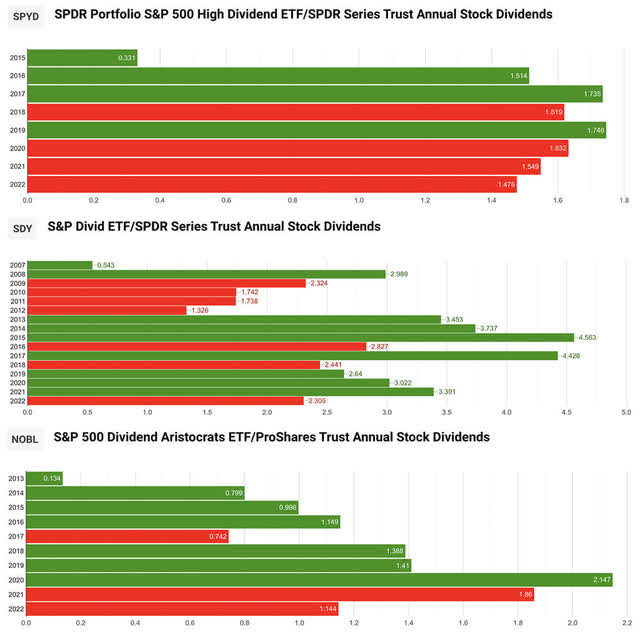

On the plus side, despite not having a dividend growth requirement for its holdings, VYM has done a much better job than most of its peers at maintaining a growing dividend. I find dividend history to be a great indicator of ETF quality, since it is can be very difficult to maintain a reliable income stream with riskier high-yield holdings that are more prone to cuts and special dividends than the average stock. We can see this is true by looking at the dividend history of several of VYM’s smaller peers, SPYD, SDY, and NOBL:

Dividend ETF History (dividendinvestor.com)

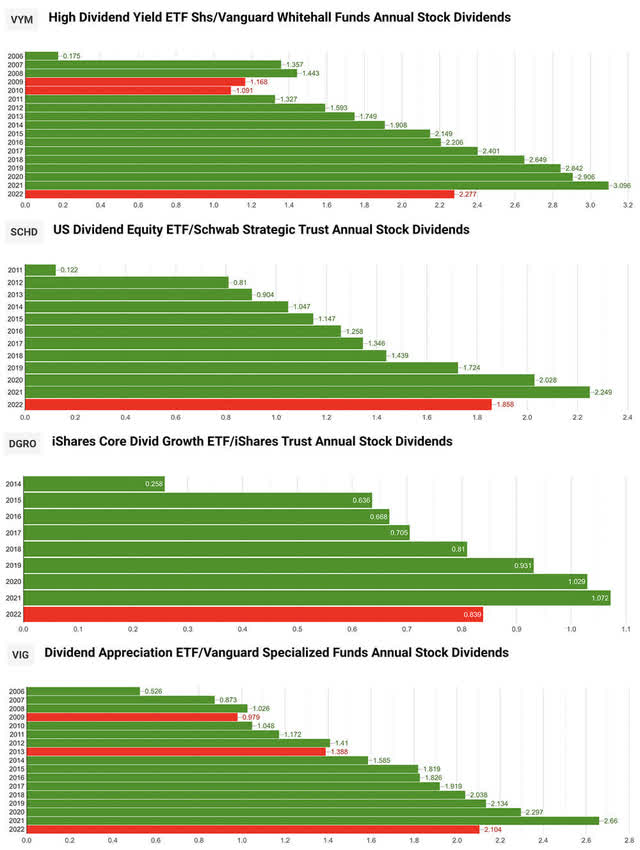

Unsurprisingly, NOBL (a Dividend Aristocrats ETF) has decent performance in this regard given that some of its dividend dips are likely due to lumpy or special dividends. But VYM’s closer analogues SPYD and SDY are downright mediocre and inconsistent for core high-yield ETFs, especially compared to VYM and its much stronger competitors SCHD, DGRO, and VIG:

VYM Peer Dividend History (dividendinvestor.com)

I view these four ETFS – VYM, SCHD, DGRO, and VIG as best-in-class, and I think investors looking for a core broad-market, dividend-focused ETF would do well to start their search with these.

For what I view as a defensive value ETF, VYM has done a great job of delivering consistent dividends, although its dividend growth is lower than the S&P 500 and significantly lower than the other three:

| VYM | VIG | SCHD | DGRO | |

| Current Dividend Yield | 2.92% | 1.88% | 3.22% | 2.24% |

| 3-Year Dividend CAGR | 4.71% | 10.83% | 14.20% | 8.30% |

| 5-Year Dividend CAGR | 5.81% | 8.08% | 12.10% | 11.40% |

| 10-Year Dividend CAGR | 8.10% | 8.74% | 16.20% | N/A |

There’s no need to colourise the above chart because SCHD wins in every column. Needless to say, for both yield and dividend growth, SCHD is an all-star ETF and I would recommend it over VYM for both income and growth. However, although it has similarly high financials exposure, SCHD is much more aggressively weighted with heavy exposure to tech, very little to energy and utilities, and it is also much less diversified at only 103 holdings.

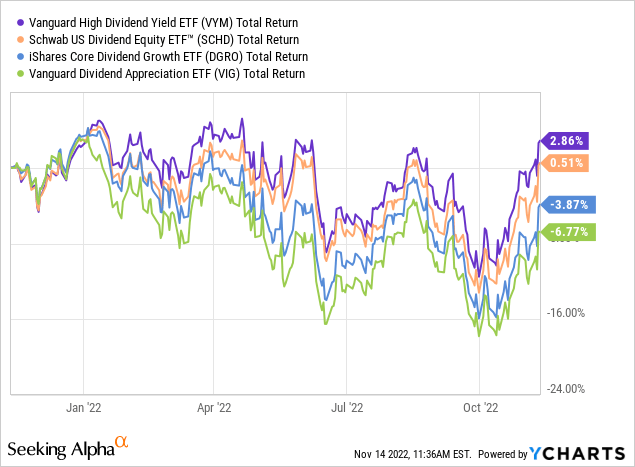

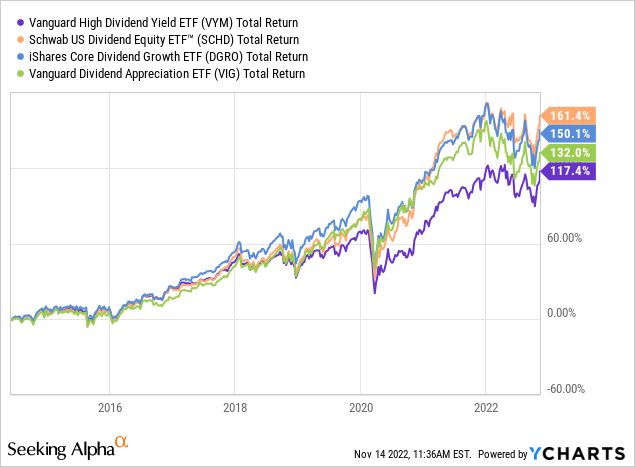

If we continue to see inflation receding and a possible Fed pivot in the coming months, SCHD will likely be a much better bet on a turnaround. But much is still uncertain, and either way VYM remains a solid option for conservative investors, and its mutual fund VHYAX may be your only high-yield option depending on where you hold your assets. Indeed, VYM has outperformed SCHD, DGRO, and VIG in total return over the past year, although it has underperformed them over the long term:

Conclusion

I rate VYM a hold at present due to its high energy and materials exposure, average yield, and low dividend growth compared to an alternative like SCHD, which has a higher yield, superior dividend growth, and more exposure to the downtrodden technology sector, which should drive higher returns if the market continues to rebound.

With that said, VYM is still a great option for investors who are looking for more diversification, prefer more of a value tilt in their core holdings, and want continued protection against high inflation until a hawkish Fed finally relents.

Be the first to comment