Joanne K Hall/iStock via Getty Images

It’s been exactly five months since I “pounded the proverbial table” on Mueller Water Products, Inc. (NYSE:MWA) and in that time the shares have lost about 1.76% against a gain of about 3% for the S&P 500. The company has reported earnings since then, so I think it’s time to review the name again. I want to try to determine whether or not it’s worth holding the shares, buying more, or taking my lumps and moving on. I’m going to make this determination by looking at the aforementioned financials, and by looking at the valuations. Additionally, I was exercised on the short puts that I wrote earlier, so that demands commentary also.

It’s “thesis statement” time again, dear reader. I realise it’s the weirdly timed American Thanksgiving today, so you may be distracted by thoughts of breaking bread and having calm civil conversations with friends and family around the dinner table tonight. In order to help in this effort, I’m going to offer the “gist” of my thinking, so you can get back to basting the cranberries or whatever else people do in preparation for this holiday. I think Mueller Water Products has had a reasonably good year, though I’m worried about the uptick in SG&A expenses. The company remains profitable, and the dividend remains well covered in my view. Additionally, the capital structure is rock solid in my estimation. For that reason, I’m hanging on to my 1,400 shares. That written, I won’t be adding to the position, as I have enough exposure to this company. If you’re just joining the party, though, I’d recommend starting to build a position here, and would recommend adding to it slowly over the coming months. Fully 1,000 of my shares were acquired after they were “put” to me recently, so I’m obviously a fan of selling put options. The problem is that the current yield on these is so low that it just makes more sense to buy the shares in my view. There you have my thinking in broad strokes. You can read on from here, or you can get back to watching the New Zealand-India cricket match, or doing a marathon chicken dance or whatever else you people get up to this time of year. Whatever you do, I hope you enjoy it. Happy Thanksgiving.

Financial Snapshot

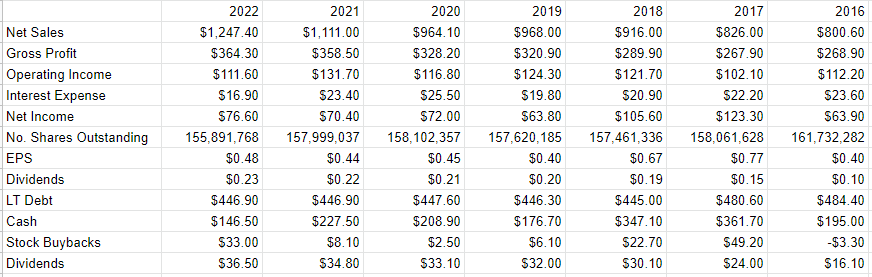

The most recent financial year was generally good, in my view, but there were a few points of concern. Revenue and net income each rose nicely relative to 2021, up fully 12.25% and 8.8% respectively. The problem is that gross profit barely budged, and operating income was down fully 15.25% relative to the same period a year ago. The problem was that SG&A increased about 9.1% or $19.9 million. It may be the case that this is a “new normal” for SG&A expenses, or it may be a “blip.” A similar picture emerges if we compare the most recent period to the pre-pandemic era. Revenue and net income in 2022 were about 29% and 20% higher than they were in 2019, while operating income is about 10.2% lower.

In the final analysis, though, none of this bothers me very much as the company remains profitable enough to give a great deal of cover to the dividend. Additionally, the capital structure is quite strong. Cash represents about 33% of long term debt, and the $450 million of notes that represent about 54% of total liabilities don’t come due until 2029, so I would suggest that there’s limited risk here. With a payout ratio of just under 50%, and a balance sheet as strong as this, investors have time on their hands in my view. I’d be happy to buy more of this stock at the right price.

Mueller Water Products Financials (Mueller Water Products investor relations)

The Stock

My regulars know that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits, and the stock is a speculative instrument that gets traded around based on long term expectations about the business. Given that the financial statement valuation of the business is “backward looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two. The tension is highlighted by the fact that the business is about the vital task of transmitting, distributing, and measuring water, while the stock is buffeted by a host of factors having nothing to do with that. One of the things that affects the performance of a given stock, for example, is the crowd’s ever changing views about the desirability of “stocks” as an asset class. There’s no way to prove this definitively, as it’s an obvious counterfactual, but a reasonable argument could be made to suggest that the loss I’ve suffered on this stock would have been much worse if the demand for stocks hadn’t improved since I bought the shares.

So this is why I consider the stock as a thing distinct from the business. The stock’s often a poor proxy for what’s going on at the company, and I think it’s possible to profitably exploit this disconnect. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. What I want to see in this regard is a stock that the crowd is somewhat pessimistic about that goes on to exceed expectations. When the crowd is pessimistic, the shares are cheap, which is why I try to buy only cheap stocks.

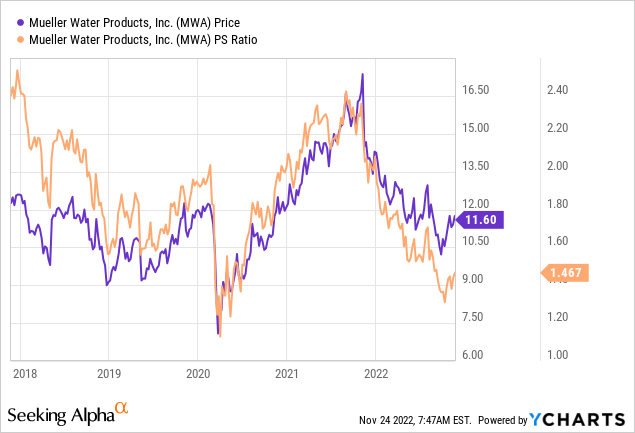

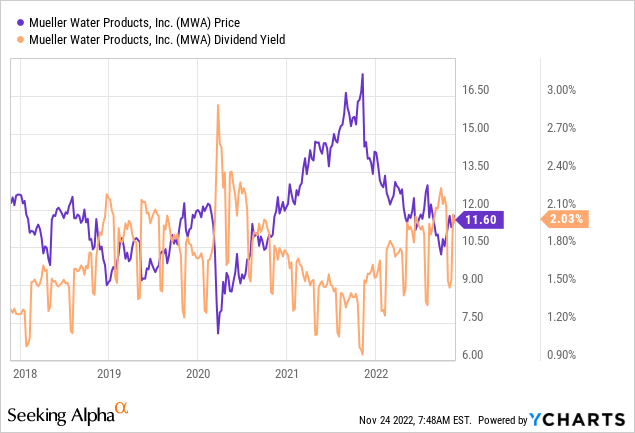

In my previous piece, in case you’ve forgotten, I got excited when the shares were trading at a price to sales ratio of about 1.59, and the dividend yield was 1.93%. Fast forward to the present and the shares are now about 7.5% cheaper on that basis, per the following:

At the same time, the dividend yield is about 3.7% higher than it was when I last reviewed the name, per the following:

Given the above, and given my view that the recent financial results were reasonable, the shares seem even more compelling to me.

In order to validate (or refute) this view, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Applying this approach to Mueller at the moment suggests the market is assuming that this company will grow at a rate of about 3.5%. I consider this to be fairly optimistic, actually. That written, I’m comfortable holding my shares as I’m comfortable with the size and sustainability of the current dividend. So, if you’re just joining us, I think it’s worth taking a nibble on this company by buying ⅓ of a position, and I would recommend adding to the position opportunistically over the next few months. For my part, I won’t be adding to my 1,400-share position, though, as my position’s already built in my view.

Options Update

You may recall that I sold 10 of the August Mueller Water puts with a strike of $12.50 for $.55 each. In addition to buying 400 shares at $11.95 each, I was exercised on these puts, so I’m now the proud owner of 1,400 shares of Mueller Water at an average price of $11.95. Given that I think this is “enough” exposure for me, I’m not going to sell any more puts on the name, and nor will I write calls against the shares, as I think there’s greater upside over the next year.

If you’re just joining the party, I’m afraid that there’s not really much opportunity from selling puts at the moment.

For example, the February Mueller Water Products puts with a strike of $10 is bid at $.10. On the one hand, that 1% yield for three months of “work”, is not terrible, given that these are about 10% out of the money, but there are greener pastures elsewhere in my view. For that reason, I can’t recommend selling puts at the moment, unless the shares drop significantly in price from current levels.

Be the first to comment