Nastassia Samal/iStock via Getty Images

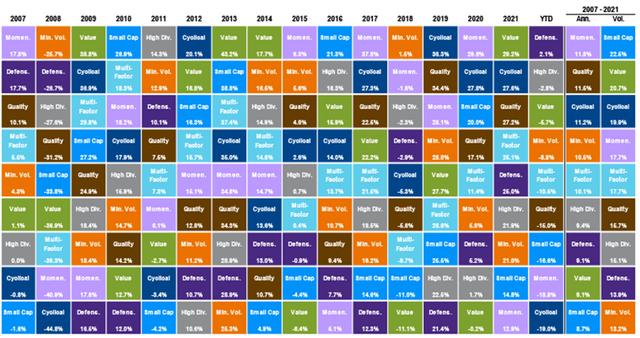

Factor investing was all the rage in the 2010s. What was coined “smart beta,” select overweights to niches of the stock market was seen as a way to earn outsized returns without taking on much more risk. Such factors included owning small caps, the value style, and even low-volatility stocks. There’s a so-called “factor zoo” of possible ways to augment your portfolio with satellite positions to complement the core.

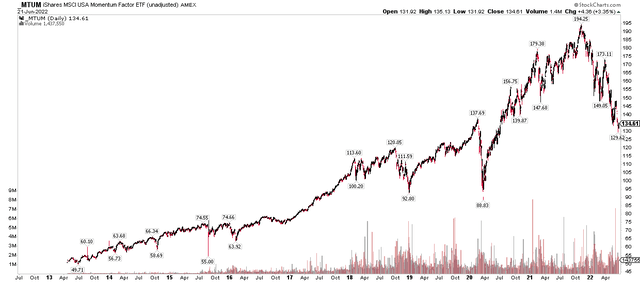

One factor became increasingly talked about as the market ran up from the stealth global bear market of late 2014 through early 2016: Momentum. The iShares MSCI USA Momentum Factor ETF (BATS:MTUM) launched in early 2013 and quickly gathered assets due to strong performance. Shares doubled by late 2017.

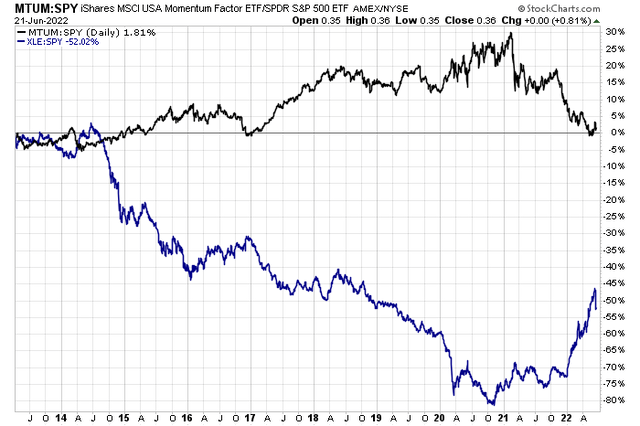

MTUM Since Inception: Major Pullback Continues

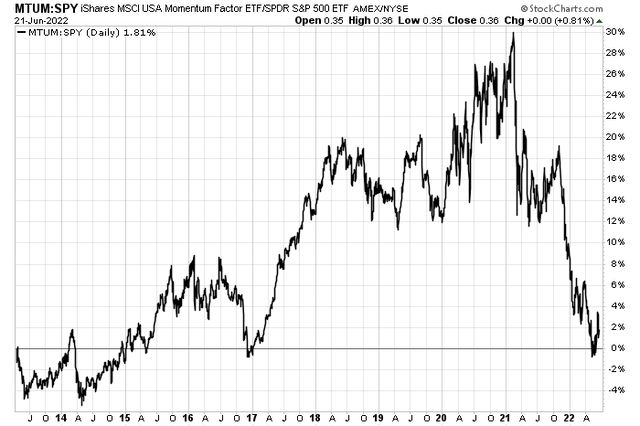

As with any equity factor, it’s the relative returns that matter. MTUM sputtered vs the S&P 500 SPDR Trust ETF (SPY) in its first two years, then dropped during the second half of 2016. Major alpha began shortly after that year’s election, however. Relative strength topped out at the speculative peak early last year. The last 16 months have been dreadful for this cap-weighted ETF. Virtually all its outperformance since inception has been wiped out. Factors have their time in the sun and the shade.

MTUM Vs SPY Since 2013: Benefitted From Mega-Cap Growth’s Rally Through Early Last Year

But what exactly is MTUM? Are there alternatives? Let’s see how “smart” this fund is. According to iShares, MTUM seeks to track the investment results of an index composed of U.S. large- and mid-capitalization stocks exhibiting relatively higher price momentum. So, you won’t ever have a ton of exposure to small-cap shares with this play. During periods of Russell 2000 (IWM) outperformance, expect MTUM to be lackluster vs., say, the Vanguard Momentum Factor ETF (VFMO).

By far the biggest momentum factor ETF at almost $10 billion in AUM, according to ETFdb (9x the next-largest), MTUM currently holds 124 positions, per iShares. It yields just 1%, but that yield will fluctuate big time based on what’s working in the market. When energy stocks and large blue chips lead the S&P 500, then MTUM’s dividend yield will be higher compared to when mega-cap growth TMT stocks charge higher. Likewise, the ETF’s P/E ratio and other valuation metrics will constantly ebb and flow with how the fund is constituted.

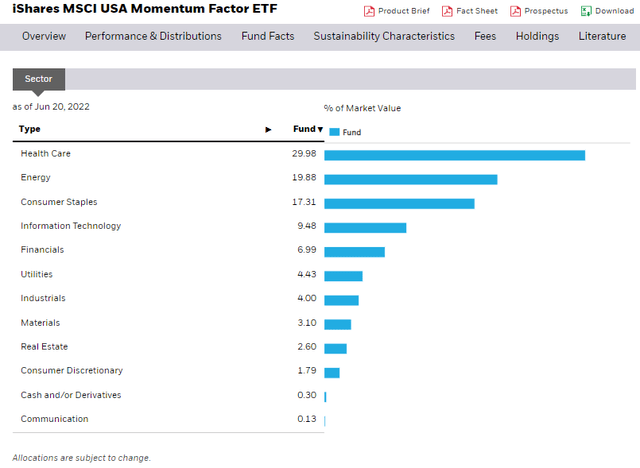

With transparent ETFs, we can get a nearly real-time look under the hood. MTUM’s biggest weight is the biggest energy stock in the SPX – Exxon Mobil (XOM). Shares of Apple (AAPL) are the second-largest holding. Both are each about 5% of the fund. Sector-wise, Healthcare dominates with a 30% weight while extreme underweights in its composition are seen in the Communications Services and Consumer Discretionary sectors.

MTUM Sector Bets: Health Care, Energy Overweight; Comm Services, Discretionary Underweight

You’ll also notice that Energy is a whopping 20% of MTUM. The sector is under 5% of the S&P 500. The fund rebalanced heavily into Energy and out of Tech and Discretionary at its May rebalance. It also rebalances in November. Each time the portfolio is updated, the financial media pays attention. In this case, Energy’s recent slide hindered performance. Moreover, the massive rally oil and gas stocks enjoyed from late 2021 through early June was largely missed out on by MTUM holders. For years, MTUM simply rode the backs of the big TMT horsemen while avoiding perpetually weak Energy stocks. That reversed late last year.

MTUM’s Relative Weakness Vs SPY Since Early 2021

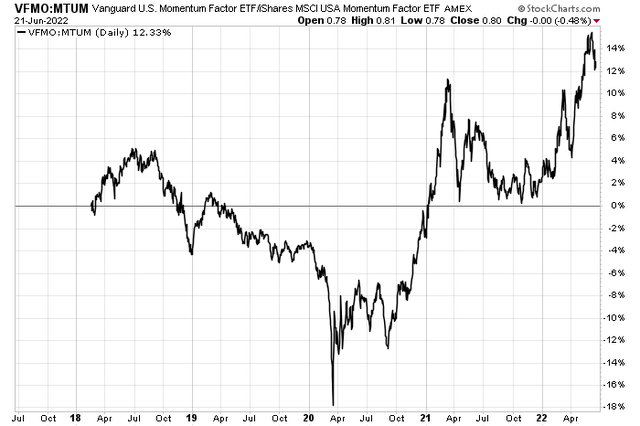

I would rather own VFMO since it rebalances more frequently, though at the discretion of its managers. Vanguard’s momentum fund also holds more stocks and effectively takes an equal-weight approach. Hence, the median market cap is much smaller than MTUM’s. For what it’s worth research firm Morningstar rates VFMO as a five-star gold ETF while MTUM is just a two-star bronze fund. There are other momentum ETFs out there, too.

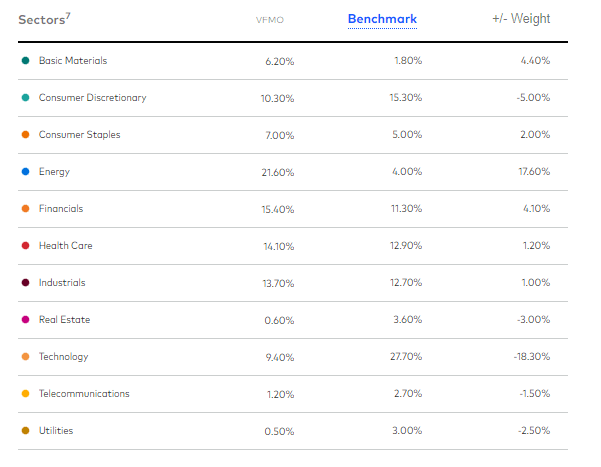

VFMO Sector Weights: Also Heavy In Energy, Light In Tech (But A Smaller-Cap Approach)

Vanguard Group

Since the March 2020 COVID Crash lows, VFMO has easily beaten MTUM. I assert that if the era of mega-caps domination is over, then VFMO is likely a better momentum play than MTUM. But with any factor strategy, it really only works over the very long run. Factors go through literally decades of relative weakness (just look at small caps’ relative slide since 2006).

Vanguard Momentum’s Alpha Vs. MTUM Since Early 2020

Factor Performance Quilts: Weak Momentum Returns This Year And Last

The Bottom Line

MTUM is a popular (or sometimes infamous) fund to play the momentum factor of the U.S. stock market. It goes through periods of over- and under-performance and usually features heavy large-cap exposure due to its construction. I favor VFMO due to its relatively diversified approach and more frequent rebalancing strategy.

Be the first to comment