Marko Geber/DigitalVision via Getty Images

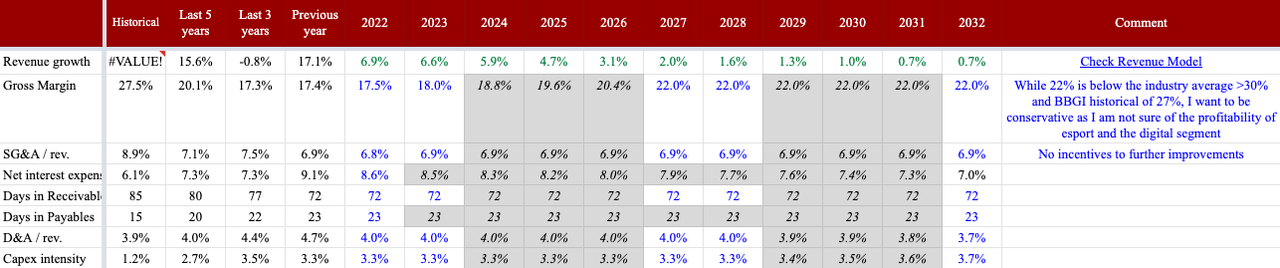

Since my last article, Beasley Broadcast Group (NASDAQ:BBGI) stock price is down 33.5% while the S&P is down 16.7%. I think this is an unjustified drop as there is no company-specific or industry-specific bad news. In fact, Q1 earnings showed strong top-line growth with slightly worse margins due to inflation and more marketing expenses.

Seeking Alpha

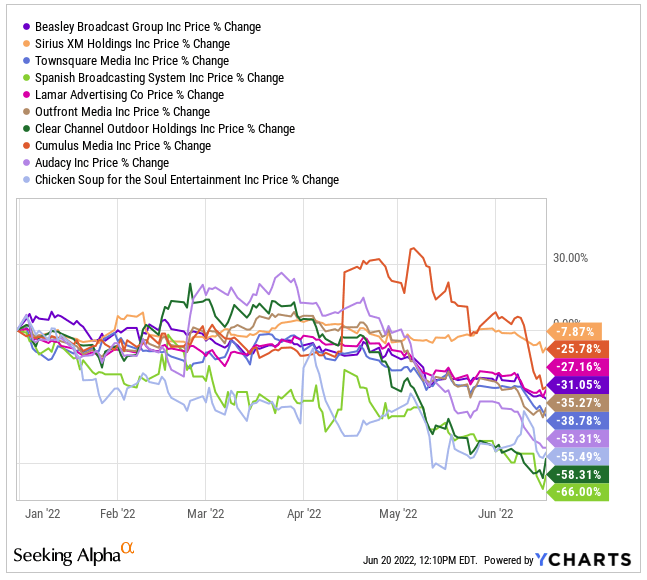

However, as radio broadcasting is a higher-beta industry, it is more sensitive to market swings. In fact, BBGI’s drop is in the middle area of the industry performance, Sirius XM (SIRI) just dropped 5.2% while Spanish Broadcasting System (OTCPK:SBSAA) dropped a whopping 57.6% in the same period.

Ycharts

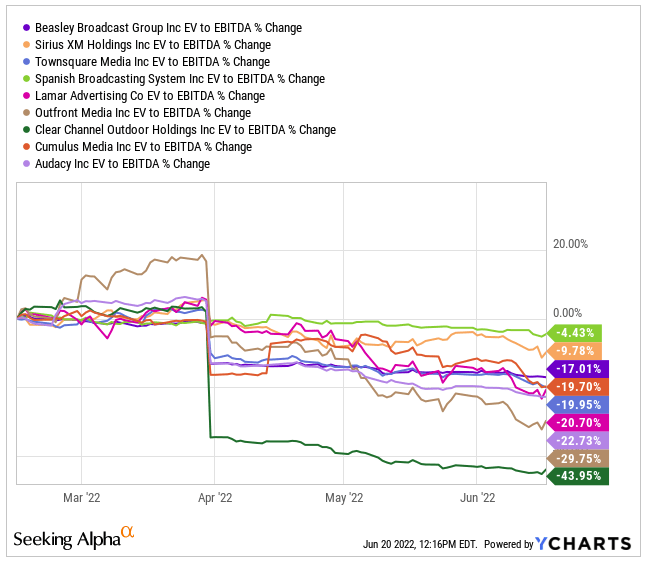

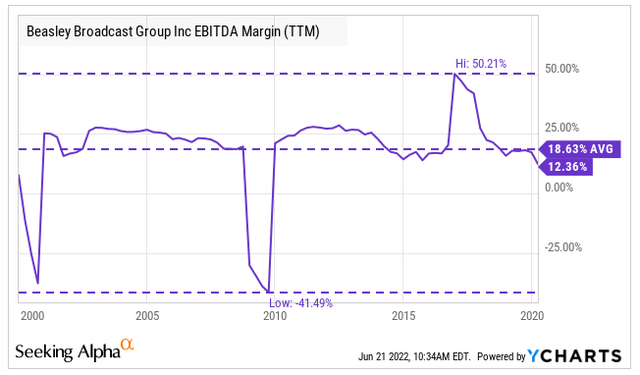

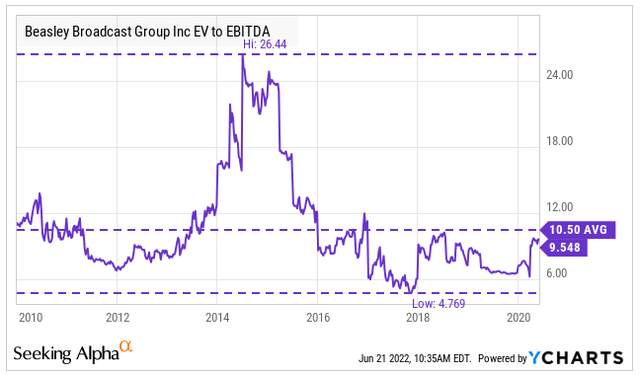

While a portion of the drop is attributed to tighter margins due to inflation, most of the loss in the stock price of these companies is due to a re-rating of its multiples.

Ycharts

Good Q1 top-line results

On May 9, BBGI reported Q1 results. Overall, the results were good. Revenues increased 15.6% to 55.7M USD. Revenues for both segments increased, commercial advertising and digital revenues increased by 13.5% and 35% respectively. The driver for this growth is the recovery in the commercial advertising market as we are exiting the pandemic. The growth in unique visitors of the digital platforms has been outstanding, since 2019, unique visitors have doubled leading to a 35% digital revenue growth. The digital segment continued its strong growth pace and now represents 16.4% of total revenues, compared to 11.9% last year.

Gross margin decreased from 10.9% to 10.6%. The margin compression was driven by the commercial marketing segment where margins compressed by 260bps to 14.1%. The material improvement in the digital segment was not enough to offset these headwinds. The digital segment gross margin improved from -25.9% to -7.5%. The extra costs were due to wage increases, increased talent fees, sports rights fees and more marketing.

The opportunity in the digital segment

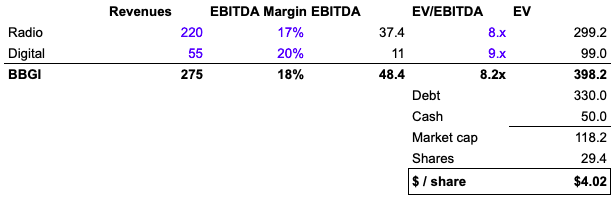

This segment is still unprofitable, but that gap may be closed very soon as we witnessed an improvement in gross margin from -25.9% to -7.5% in this quarter. I think this segment could add 99M USD in value to shareholders in the medium term. BBGI’s objective is to generate 20% of its revenues from this segment which would translate to roughly 55M USD. Assuming an EBITDA margin of 20% and a multiple of 9x, this segment could be worth 99M USD.

While BBGI is close to hitting the 20% target (currently the segment represents 16.4% of revenues), BBGI is still unprofitable in this segment and that is the big question here. Thus, it is critical we track the segment performance in the coming quarters and reassess.

If the digital segment could be worth $3.40 per share (99M USD EV), why would the stock be trading at $1.31?

The reason for that is threefold. First, BBGI has a significant net debt burden of 280M USD, more than seven times its market cap. Secondly, there is uncertainty about the digital segment so a heavy discount on this segment is applied. Thirdly, note everyone believes in the return of radio in this age and time of podcasts and streaming.

Author estimates

As you can see above, the $4 per share target embeds a couple of conservative assumptions that work as a margin of safety. For radio, I am assuming revenues to almost return to 2019 levels of 224M USD. Also, I assume a steady-state EBITDA margin of 17% for the segment, 160bps lower than the historical margin.

Finally, for the radio segment, the valuation implies an 8x multiple while the historical multiple is closer to 10.5x.

As per the digital segment, a 20% EBITDA margin is conservative and could easily be as high as 50% but I think it is too early to assign a higher number. Also, the segment grew 51.6% in 2021 and 35% in Q1 2022, such growth deserves a higher multiple than 9x.

Valuation

My target price remains $4 per share while I see more potential upside depending on the profitability of the digital business. I expect management to continue its revenue diversification through its digital channel, expanding its audience and improving margins as the digital segment becomes more relevant.

Author estimates

Also, as explained in my previous article, I would not be surprised if BBGI deploys some of its cash in buying digital assets. I have not incorporated that assumption into my model.

Risks

BBGI is highly levered at 9x EBITDA. While it has 50M USD in cash, that cash could be consumed quickly by the interest burden (25.8M USD paid in the last 12 months), a potential acquisition in the digital space or an acceleration in the cash burn either due to inflation or the digital segment.

Conclusion

BBGI stock price is continuing its multi-year drop. While the initial drop was due to the industry sentiment and management, I believe the latest drop is due to the macro environment as we witness the same drop within the industry.

However, I see better days ahead, as the economy opens up and people restart commuting to the office, commercial advertisements will pick up. As per the digital segment, unique visitors and revenues are pacing as expected and I expect BBGI to hit its target pretty soon, the only question remaining would be the profitability of the segment.

At the current stock price of $1.31, in my opinion the risk is limited while there exists a potential for investors to triple their investment.

Be the first to comment