Metkalova

Published on the Value Lab 9/7/22

Mowi (OTCPK:MHGVY) (OTCPK:MNHVF) was our pick for the grain crisis, where substitute foods to downstream grain products would pick up in price. That might have been the case, but for now greater forces are influencing the price of salmon to Mowi’s benefit. With inflation resistance becoming more clear in the business model and the reopening shifting margin back into services where salmon’s bread is most thickly buttered, the direction looks good for Mowi despite overall macroeconomic headwinds, of which COVID-19 is the worst we’ve seen for the industry. At the current multiple, it could be an interesting investment, but with lower multiple opportunities out there for greater margin of safety, we give it a pass.

Discussing Q1

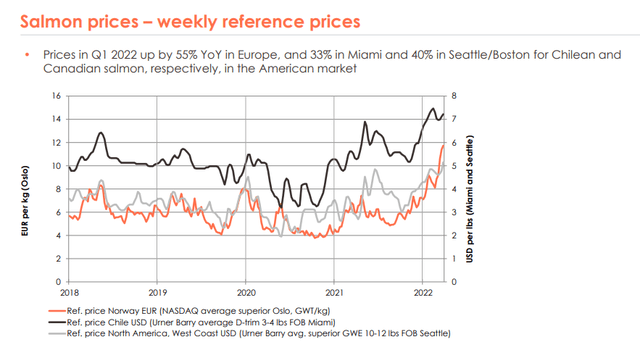

The Q1 featured some interesting dynamics that should be parsed. The first is that volumes fell across the board. This reflected broader industry trends where biomass entering the quarter from Q4 2021 was lower than normal. In fact, supply in the salmon industry contracted globally by 7% due to zealous slaughtering in Q4 2021, meaning lower volumes but also substantially higher prices to boost EBIT. Higher prices came about from the meaningful contraction in supply, but might have also been helped by our thesis on salmon in connection with grain.

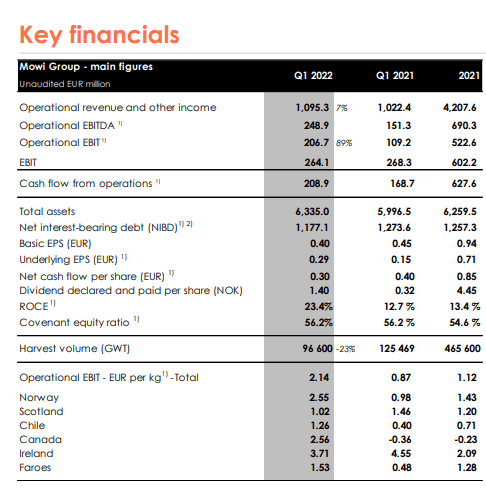

Financials Mowi (Q1 2022 Pres)

Despite the loss of scale, the company dealt with minimal inflation from Q1 2021 levels, where commodities were yet to rise. Cost per kg of fish rose from 4.6 to 4.8 EUR which is only 5%, given that general inflation has been more than that even on the most generous inflation accounting. Meanwhile, prices have risen by about 40-60% depending on the market.

Price Evolution Salmon (Q1 2022 Pres)

All segments except for Scotland managed to capture the improved price dynamics, with even the Canada division, subject to turnaround efforts, posting a very healthy profit this quarter. The low point in biomass also meant a low point in the feed business. When biomass recovers, feed should also recover, and this vertical integration should help offset inflation happening in feed industry and protect unit economics.

Mowi Outlook

Our outlook for Mowi remains good. The grain situation is a support to prices, and as a consequence of war is unlikely to resolved quickly. While biomass will recover and there should be some downward pressure on prices as the year goes on, reopening constitutes an important skew of spending back from goods to services, where the service industry was an important high margin channel for salmon that went relatively offline for some years with intermittent lockdowns and restrictions on mobility. While the macroeconomic environment is a headwind for all industries, including food service, the COVID-19 lockdowns are the worst we’ve seen for salmon markets, and a recession is unlikely to draw EBITDA down quite so far again as long as lockdowns don’t become reinstituted. Moreover, in the inflationary environment we have as the status quo, Mowi continues to meaningfully outpace its costs, offering inflation resistance if monetary authorities change course with rate hikes.

Currently, the company trades at a 10x multiple, reflecting expectation of price reversal and general economic woe. Its normalized multiple as of FY 2020 would have been around 20x on current market cap and halved EBITDA reflecting the depressed 2020 environment. With ROICs in the industry being exceptionally high, and the barriers to entry and supply situation within salmon being rather high as well, such a multiple makes sense. Given the EBITDA is unlikely to fall to 2020 levels again due to the reopening which should offset some of the macroeconomic headwinds, a normalised multiple around 16x is most likely on current market cap. This appears to be fair given the value from the assets, but with other opportunities existing that are more secure in terms of fundamentals, not being exposed directly to commodity prices while also being much cheaper, we elect to allocate money elsewhere for now. If we were to pick something within the seafood industry, we’d go perhaps with Austevoll Seafood (OTCPK:ASTVF) on pelagic offsets and the lower multiple or even better with Aker BioMarine which offers a more unique value proposition and benefits from greater barriers to entry and upside.

Be the first to comment