Justin Sullivan

Elevator Pitch

I rate Advanced Micro Devices, Inc.’s (NASDAQ:AMD) shares as a Buy. I assessed AMD’s valuations and touched on topics like market share gains and the Xilinx deal in my prior update for the stock published on January 31, 2022. Furthermore, I turn my attention to AMD’s share price recovery prospects in this current article.

In my view, AMD’s stock can rebound to $100, implying a +30% capital appreciation potential. The stock’s current valuations are inexpensive, and the company’s shares should be able to re-rate in the times to come, when the market is willing to focus on AMD’s long-term potential rather than short-term headwinds. This justifies my Buy rating for AMD.

Why Has AMD Stock Been Dropping?

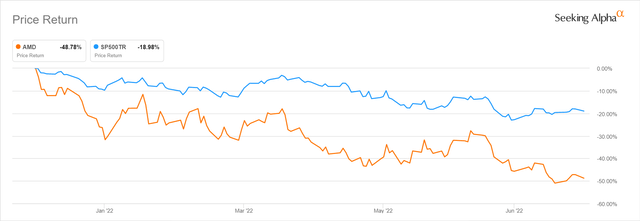

AMD stock dropped by -48.8% this year thus far, which stands in stark contrast to the S&P 500’s less severe -19.0% pullback year-to-date.

AMD’s 2022 Year-to-date Stock Price Chart

The key reason for AMD’s underperformance is clear, if one looks at the potential downside to the company’s future revenue in a scenario where there is a big drop in consumer spending.

In its FY 2021 10-K filing, AMD noted that “a large portion of our Computing and Graphics revenue is focused on the consumer desktop PC and notebook segments.” The Computing and Graphics business contributed 57% of AMD’s top line for fiscal 2021. Separately, AMD also highlighted in its 10-K that it is “the market share leader in semi-custom game console products” which is part of its other Enterprise, Embedded and Semi-Custom business.

In the current environment where workers are returning to offices and a recession is looming, consumers’ demand for PCs and consoles is very likely to be weak and this points to slower growth for AMD in the foreseeable future. Therefore, it isn’t a surprise that AMD’s shares have traded much lower than compared to the beginning of the year.

Can Advanced Micro Devices Rebound To $100 Again?

Investors considering a potential investment in Advanced Micro Devices will be looking at $100 as a key price point.

AMD’s last done share price was $76.95 as of July 11, 2022, so the shares will offer a substantial upside of approximately +30% from current levels if AMD’s stock price rebound to $100. Notably, AMD was trading above $100 just a month ago, with its shares closing at $101.90 on June 8, 2022.

I think that AMD’s shares can return to the $100 level in the future based on two key factors. The first key factor is valuations, which I will focus on in this section; the second key factor is the future growth potential of the company in terms of market share gains for the server processor segment that I will discuss in the next section.

AMD’s current consensus forward next twelve months’ normalized P/E multiple of 17.8 times is way lower than the stock’s three-year and five-year average forward P/E multiples of 41.0 times and 42.0 times, respectively, as per S&P Capital IQ. A $100 price target translates into a relatively reasonable 23.1 times forward P/E for AMD, which still seems undemanding.

AMD Stock Key Metrics

In my previous January 31, 2022, article for AMD, I mentioned that “AMD is well-positioned to realize market share gains in the server processor market.” My views are validated by a recent survey conducted by JPMorgan (JPM).

According to a June 23, 2022, JPM research report (not publicly available), a survey of 142 CIOs (Chief Information Officers) indicated that approximately 40% and 25%-30% of “respondents” planned “using AMD-based servers in cloud compute” and “on-premise enterprise”, respectively. In the same JPM report, it is highlighted that AMD boasted an estimated 17%-18% share of the server processor market as of March 31, 2022.

In summary, the metrics disclosed as part of JPM’s recent CIO survey suggest that AMD has lots of room to grow in the server processor market. This is aligned with the long-term outlook for AMD, as discussed in the subsequent section.

Is AMD Stock’s Long-Term Outlook Bright?

AMD stock’s long-term outlook is bright based on the takeaways from the company’s 2022 Analyst Day.

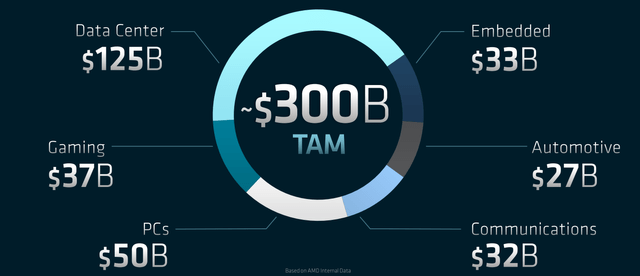

On June 9, 2022, Advanced Micro Devices hosted its Financial Analyst Day, and it guided for a revenue CAGR of around +20%, a 57% gross margin, a mid-30% operating margin to be achieved in the next three to four years, and a 2025 TAM (Total Addressable Market) of $300 billion. This is slightly below the market consensus. The Wall Street analysts forecast that AMD’s FY 2022-2025 top line CAGR will be +17.4% (adjusted for AMD’s pro forma revenue of $20.1 billion adjusted for the Xilinx acquisition), and expect the company to achieve gross profit and operating profit margins of 55.5% and 33.8%, respectively in fiscal 2025.

In my opinion, I see AMD beating the market’s long-term expectations and delivering on its own financial guidance.

Share gains in the server processor market will be a key driver of AMD’s revenue growth in the long run. In terms of profitability, a more favorable sales mix going forward with an increase in revenue contribution from the higher-margin Xilinx and the data center businesses, should lead to margin expansion for the company in the long term.

It is also noteworthy how much AMD’s TAM estimate has grown in the past two years. Previously, AMD had estimated its TAM to be $79 billion at its prior Analyst Day in March 2020. Moving forward, it has forecasted at the recent June 2022 Analyst Day that its TAM will grow by +280% to $300 billion in 2025. AMD’s pro forma revenue of $20.1 billion adjusted for the Xilinx acquisition is only about 7% of its $300 billion TAM, suggesting that there is a long growth runway ahead for the company.

Breakdown Of AMD’s 2025 TAM Estimate

AMD’s June 2022 Analyst Day Presentation

In a nutshell, AMD’s long-term prospects are great. As such, it is a matter of “when” rather than “if”, with regard to the potential of AMD’s shares rebounding to $100.

Is AMD Stock A Buy, Sell, or Hold?

AMD stock is a Buy. For investors who are able to look beyond the company’s near-term challenges relating to weak consumer spending and focus on its bright long-term outlook, AMD’s current valuations offer an attractive entry point. This supports my Buy rating for the stock.

Be the first to comment